India Adult Diaper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

India Adult Diaper Market Summary:

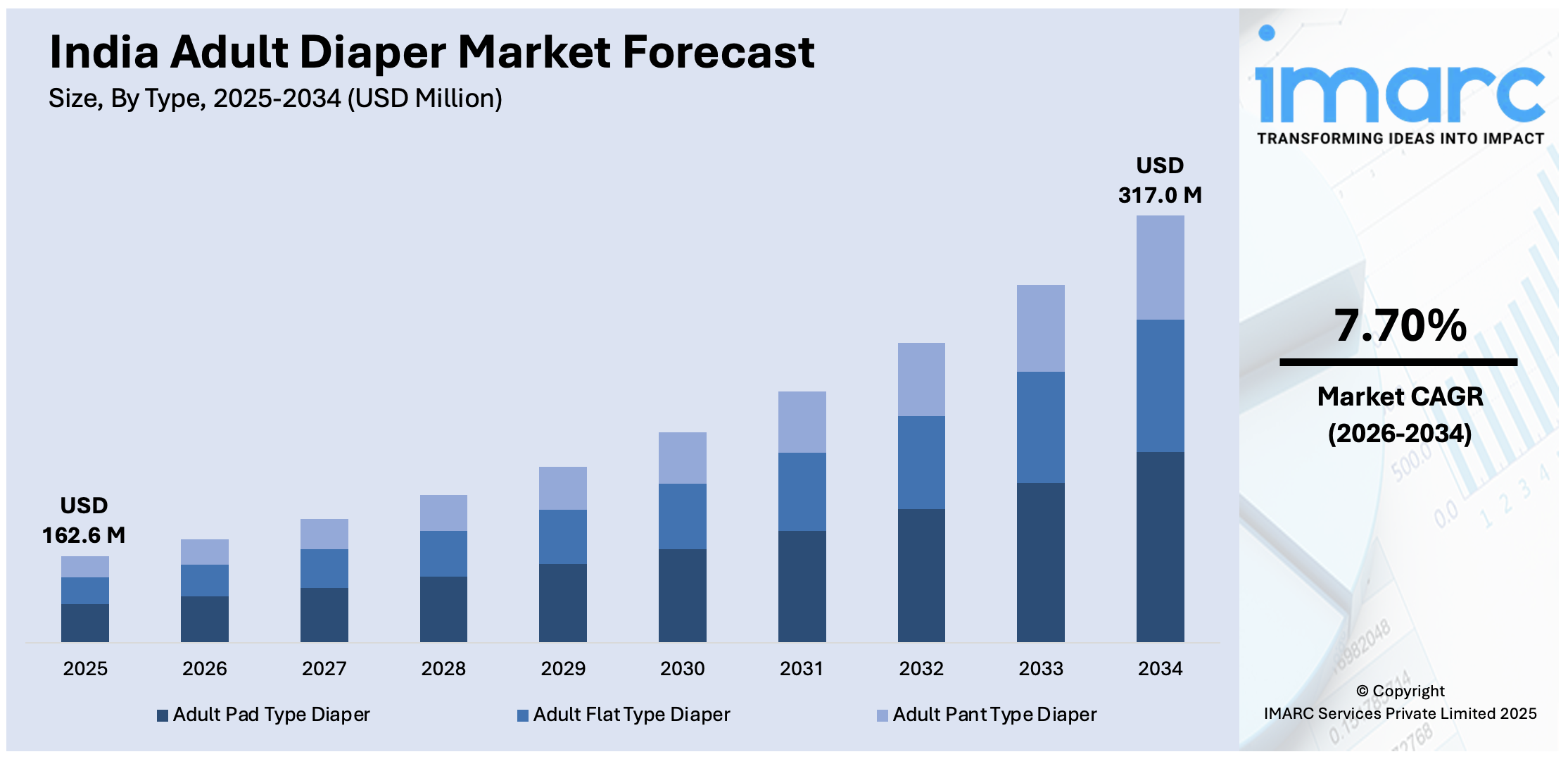

The India adult diaper market size was valued at USD 162.6 Million in 2025 and is projected to reach USD 317.0 Million by 2034, growing at a compound annual growth rate of 7.70% from 2026-2034.

The India adult diaper market is experiencing robust expansion driven by demographic shifts toward an aging population and increasing awareness about incontinence management solutions. Growing healthcare infrastructure, rising disposable incomes, and changing social attitudes toward personal hygiene products are accelerating adoption rates across urban and semi-urban regions. Enhanced product accessibility through expanding pharmacy networks and e-commerce platforms, combined with continuous innovations in comfort and absorbency technologies, are collectively establishing strong market momentum.

Key Takeaways and Insights:

- By Type: Adult pant type diaper dominates the market with a share of 49% in 2025, owing to its ease of use, comfortable fit resembling regular underwear, and enhanced discretion for active users. Growing preference among younger adults experiencing mild incontinence is driving segment expansion.

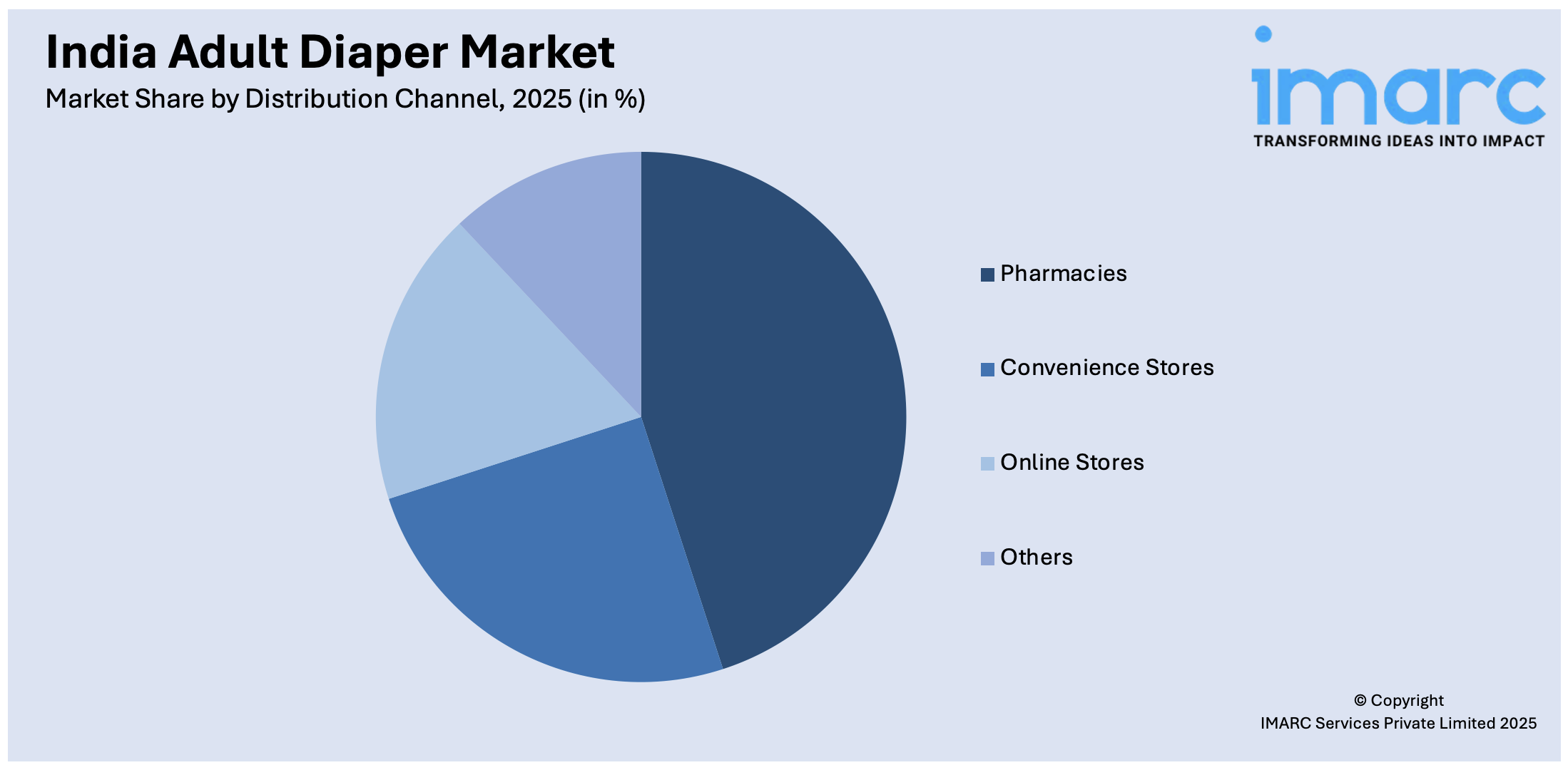

- By Distribution Channel: Pharmacies lead the market with a share of 35% in 2025. This dominance is driven by healthcare-related trust associations that reduce purchasing discomfort, superior product assortment depth, and availability of professional guidance from pharmacists on appropriate product selection.

- By Region: North India is the largest region with 30% share in 2025, driven by the concentration of healthcare facilities in metropolitan areas like Delhi and NCR, higher disposable incomes enabling premium product purchases, and greater awareness about incontinence management solutions.

- Key Players: Key players drive the India adult diaper market by expanding product portfolios, improving comfort and absorbency technologies, and strengthening nationwide distribution networks. Their marketing expenditures, affordability programs, and collaborations with healthcare professionals increase awareness and hasten acceptance. Some of the key players operating in the market include Kamal Health Care Pvt Ltd., Kangaroo Health Care, Nobel Hygiene Private Limited, Paramount Surgimed Ltd, Romsons Prime Pvt. Ltd, Tataria Hygiene, and Unicharm Corporation.

To get more information on this market Request Sample

The India adult diaper market is advancing as healthcare providers, manufacturers, and consumers embrace improved incontinence management solutions across the country. India's elderly population currently stands at approximately 153 Million individuals aged 60 and above and is projected to reach 347 Million by 2050, representing a significant demographic shift that underpins sustained market demand. Growing urbanization, changing family structures with increasing nuclear households, and rising healthcare awareness are collectively transforming consumer attitudes toward adult incontinence products. Manufacturers are responding with innovative product designs featuring enhanced absorbency, skin-friendly materials, and discreet profiles that appeal to active users. The expansion of organized retail pharmacy chains and e-commerce platforms is improving product accessibility across metropolitan, tier-two, and tier-three cities. Healthcare institutions including hospitals, nursing homes, and assisted living facilities are increasingly incorporating adult diapers into standard care protocols, further normalizing product usage and expanding the India adult diaper market share.

India Adult Diaper Market Trends:

Emergence of Slim and Discreet Product Designs

The market is witnessing a transformative shift toward ultra-thin, undergarment-like adult diaper designs that prioritize discretion and comfort. Manufacturers are developing sleeker products that provide an invisible fit under clothing while maintaining high absorbency levels. This trend responds to growing demand from younger adults experiencing mild incontinence due to lifestyle conditions, postpartum recovery, and chronic health issues, expanding the consumer base beyond traditional elderly users.

Digital Commerce Transformation and Online Retail Growth

E-commerce platforms are revolutionizing adult diaper distribution by offering convenient, private purchasing options that eliminate social discomfort associated with in-store buying. Online channels offer a wide range of products, reasonable pricing via subscription models, and doorstep delivery services that reach customers in far-off places. By increasing accessibility and lowering stigma through anonymous transactions, this digital change is propelling the growth of the adult diaper market in India.

Healthcare Integration and Institutional Adoption

Healthcare facilities are increasingly integrating adult diapers into standardized patient care protocols, driving institutional demand across hospitals, nursing homes, and rehabilitation centers. Medical professionals actively recommend incontinence products as essential components of comprehensive geriatric care and post-operative recovery management. This healthcare sector endorsement enhances product credibility, reduces usage stigma, and establishes adult diapers as medically necessary hygiene solutions. Growing collaborations between manufacturers and healthcare institutions further strengthen distribution channels while reinforcing clinical validation of incontinence management products.

Market Outlook 2026-2034:

The India adult diaper market outlook remains highly favorable, supported by compelling demographic dynamics, evolving consumer preferences, and expanding healthcare infrastructure across the nation. Rising awareness campaigns led by healthcare organizations and manufacturers are progressively destigmatizing incontinence management, encouraging broader product acceptance among diverse population segments. The market generated a revenue of USD 162.6 Million in 2025 and is projected to reach a revenue of USD 317.0 Million by 2034, growing at a compound annual growth rate of 7.70% from 2026-2034. Government initiatives expanding healthcare coverage to senior citizens, combined with private sector investments in domestic manufacturing capabilities, are establishing sustainable growth foundations. Technological innovations in product design, distribution channel expansion through organized retail and e-commerce, and increasing institutional procurement from healthcare facilities collectively strengthen the positive market trajectory.

India Adult Diaper Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Adult Pant Type Diaper | 49% |

| Distribution Channel | Pharmacies | 35% |

| Region | North India | 30% |

Type Insights:

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

Adult pant type diaper dominates with a market share of 49% of the total India adult diaper market in 2025.

Adult pant type diapers have gained significant market prominence due to their user-friendly pull-up design that closely resembles conventional underwear, offering enhanced dignity and ease of use for both ambulatory and semi-ambulatory individuals. The segment appeals particularly to active adults seeking discreet protection during daily activities without compromising mobility or comfort. In May 2025, Nobel Hygiene secured USD 20 Million investment from Neo Asset Management to expand distribution of its Friends brand, which commands over 40% share in the adult diaper category nationwide.

The pant type segment benefits from continuous product innovation focused on thinner profiles, improved absorbency cores, and breathable materials that enhance wearer comfort during extended use periods. Manufacturers are developing gender-specific variants acknowledging different anatomical requirements and incontinence patterns between male and female users. Growing consumer preference for products that enable active lifestyles while managing incontinence conditions effectively positions pant type diapers as the preferred choice among health-conscious consumers seeking reliable protection without sacrificing quality of life.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Pharmacies lead with a share of 35% of the total India adult diaper market in 2025.

Pharmacies maintain dominant market position through established trust associations with healthcare and medical products that significantly reduce purchasing hesitation among first-time adult diaper buyers. The channel benefits from professional pharmacist guidance enabling appropriate product selection based on individual incontinence severity, size requirements, and skin sensitivity considerations. Organized pharmacy chains are rapidly expanding their adult incontinence product offerings nationwide, strengthening distribution networks and improving consumer accessibility. The healthcare-oriented retail environment creates psychological comfort for customers seeking sensitive personal care products while ensuring consistent quality assurance.

Pharmacy distribution channels offer strategic advantages including consistent product availability, competitive pricing structures, and convenient locations within residential neighborhoods and commercial areas. The presence of healthcare professionals creates comfortable purchasing environments where consumers receive confidential consultations regarding product features and usage recommendations. Growing expansion of pharmacy retail chains into tier-two and tier-three cities is extending adult diaper accessibility beyond metropolitan markets, driving volume growth through enhanced geographic coverage and improved supply chain efficiency across underserved regions.

Regional Insights:

- North India

- West and Central India

- East India

- South India

North India exhibits a clear dominance with 30% share of the total India adult diaper market in 2025.

North India commands the largest regional share supported by substantial urban population concentration in Delhi NCR and surrounding metropolitan areas with advanced healthcare infrastructure. The region benefits from higher average disposable incomes enabling premium product adoption, extensive organized retail presence, and greater consumer awareness regarding incontinence management solutions. Strong pharmaceutical distribution networks and healthcare institution density facilitate consistent product availability across the region. Metropolitan centers feature well-established pharmacy chains, supermarket networks, and e-commerce delivery services that ensure convenient access to diverse adult diaper product ranges catering to varying consumer preferences and budgetary requirements.

The region's demographic profile includes significant elderly populations residing in urban households where family caregivers actively seek quality incontinence management products. Healthcare facilities across North India increasingly incorporate adult diapers into standard patient care protocols, generating sustained institutional demand from hospitals, nursing homes, and rehabilitation centers. Rising health awareness campaigns conducted by manufacturers and healthcare organizations have progressively destigmatized incontinence product usage, encouraging broader consumer acceptance. Expanding middle-class populations with evolving lifestyle expectations continue driving demand for premium hygiene solutions across the region.

Market Dynamics:

Growth Drivers:

Why is the India Adult Diaper Market Growing?

Rapidly Expanding Elderly Population and Demographic Transition

India's demographic landscape is undergoing a fundamental transformation characterized by accelerating population aging that directly amplifies demand for adult incontinence management products. The country's elderly population aged sixty years and above is expanding at approximately forty percent per decade, substantially outpacing overall population growth rates. This demographic shift creates sustained demand for adult diapers as aging individuals increasingly experience incontinence conditions requiring reliable hygiene solutions. According to the United Nations Population Fund India Ageing Report, India's elderly population is projected to make 20% of the population by 2050.

Rising Healthcare Awareness and Destigmatization of Incontinence

Transformative shifts in social perceptions and healthcare awareness are progressively normalizing adult diaper usage across Indian society, dismantling traditional stigma barriers that historically inhibited market penetration. Educational campaigns conducted by healthcare organizations and manufacturers are increasingly positioning incontinence management as an essential component of personal health maintenance rather than a source of embarrassment. This cultural evolution encourages individuals experiencing bladder control difficulties to seek appropriate solutions proactively rather than suffering in silence. Healthcare professionals now actively recommend adult diapers as medically necessary hygiene products during patient consultations, particularly for elderly individuals and those recovering from surgical procedures. The integration of incontinence management into comprehensive geriatric care protocols across hospitals, nursing homes, and home healthcare services establishes adult diapers as standard medical supplies, accelerating mainstream acceptance.

Expanding Healthcare Infrastructure and Distribution Networks

Significant investments in the development of healthcare infrastructure throughout India are expanding adult diaper goods' distribution channels while also raising institutional demand from healthcare facilities. Product accessibility has significantly increased in both metropolitan centers and emerging markets in tier-two and tier-three cities due to the growth of organized retail pharmacy chains, supermarket networks, and e-commerce platforms. Adult diaper usage among patients seeking treatment outside of typical hospital settings is directly impacted by the quick growth of home healthcare services that provide nursing care, physical therapy, and chronic illness management. Stable demand foundations for long-term market growth are provided by expanding institutional procurement from palliative care units, rehabilitation facilities, and senior care facilities.

Market Restraints:

What Challenges the India Adult Diaper Market is Facing?

High Product Costs Limiting Adoption Among Price-Sensitive Consumers

The relatively elevated cost of adult diapers compared to traditional alternatives creates significant adoption barriers, particularly among lower-income households and rural populations with limited disposable incomes. Premium pricing influenced by imported raw materials, manufacturing costs, and distribution expenses restricts accessibility for budget-conscious consumers who comprise substantial market segments requiring affordable incontinence solutions.

Limited Rural Distribution and Awareness Gaps

Rural market penetration remains constrained by inadequate distribution infrastructure, limited retail presence, and persistent awareness deficits regarding adult diaper availability and benefits. Geographic dispersion challenges supply chain efficiency while sparse healthcare facilities reduce professional recommendations that drive product adoption. Educational initiatives reaching remote communities remain insufficient to overcome information barriers hindering rural market development.

Persistent Cultural Stigma Around Incontinence Management

Deep-rooted cultural attitudes associating adult diaper usage with dependency and diminished dignity continue inhibiting market acceptance among certain demographic segments despite ongoing destigmatization efforts. Social embarrassment surrounding incontinence discussions discourages open conversations about management solutions, delaying product adoption until conditions become severe. Overcoming entrenched perceptions requires sustained awareness campaigns addressing psychological barriers alongside product accessibility improvements.

Competitive Landscape:

There is fiercer rivalry in the adult diaper business in India between well-known local producers and foreign companies vying for consumers' increasing needs. Product innovation, pricing tactics, and the growth of distribution networks in urban and growing areas are ways that businesses are differentiating themselves. Manufacturers make significant investments in R&D to improve skin-friendly fabrics, comfort features, and absorbency technology. Strategic alliances with pharmacies, healthcare facilities, and online retailers improve market positioning and customer accessibility. While foreign newcomers offer worldwide product advances and brand recognition, domestic players take use of local production capabilities and distribution knowledge. Marketing campaigns are increasingly emphasizing destigmatization message, focusing on younger audiences, and establishing emotional bonds with caregivers who make decisions about what to buy.

Some of the key players include:

- Kamal Health Care Pvt Ltd.

- Kangaroo Health Care

- Nobel Hygiene Private Limited

- Paramount Surgimed Ltd

- Romsons Prime Pvt. Ltd

- Tataria Hygiene

- Unicharm Corporation

India Adult Diaper Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Adult Pad Type Diaper, Adult Flat Type Diaper, Adult Pant Type Diaper |

| Distribution Channels Covered | Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Kamal Health Care Pvt Ltd., Kangaroo Health Care, Nobel Hygiene Private Limited, Paramount Surgimed Ltd, Romsons Prime Pvt. Ltd, Tataria Hygiene, Unicharm Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India adult diaper market size was valued at USD 162.6 Million in 2025.

The India adult diaper market is expected to grow at a compound annual growth rate of 7.70% from 2026-2034 to reach USD 317.0 Million by 2034.

Adult pant type diaper dominated the market with a share of 49%, driven by user-friendly pull-up design, comfort comparable to regular underwear, and growing preference among active adults seeking discreet incontinence protection.

Key factors driving the India adult diaper market include rapidly expanding elderly population, rising healthcare awareness and destigmatization, expanding healthcare infrastructure, improved product accessibility through pharmacy and e-commerce channels, and technological product innovations.

Major challenges include high upfront product costs limiting adoption among price-sensitive consumers, limited distribution and awareness in rural areas, persistent cultural stigma around incontinence management, and dependence on imported raw materials affecting pricing stability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)