India Adventure Tourism Market Size, Share, Trends and Forecast by Type, Activity, Age Group, Sales Channel, and Region, 2025-2033

India Adventure Tourism Market Overview:

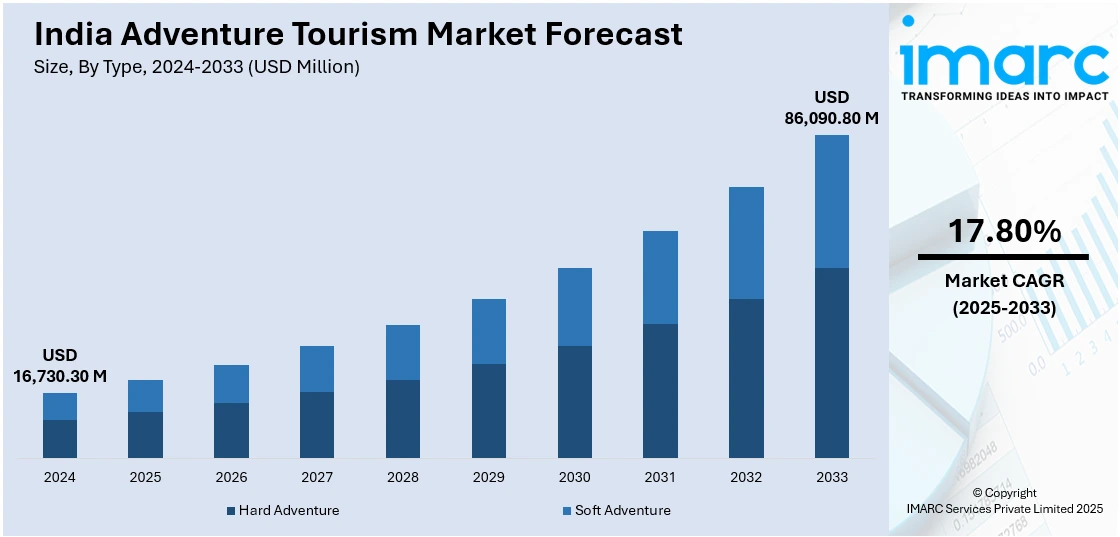

The India adventure tourism market size reached USD 16,730.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 86,090.80 Million by 2033, exhibiting a growth rate (CAGR) of 17.80% during 2025-2033. The increasing interest in offbeat travel, government support through schemes like Swadesh Darshan, growth in domestic and international backpackers, inflating disposable incomes, social media influence, and expanding adventure infrastructure including trekking routes, camping sites, and water sports facilities, are some of the factors augmenting the India adventure tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16,730.30 Million |

| Market Forecast in 2033 | USD 86,090.80 Million |

| Market Growth Rate 2025-2033 | 17.80% |

India Adventure Tourism Market Trends:

Government-Backed Infrastructure and Policy Push

The Indian government is actively promoting adventure tourism through policy incentives, infrastructure investments, and safety guidelines. The implementation of favorable initiatives for the development of integrated circuits with adventure tourism components, such as eco-parks, trekking routes, and camping grounds, is providing an impetus to India adventure tourism market growth. Additionally, states like Uttarakhand, Himachal Pradesh, and Sikkim are receiving targeted funds for adventure tourism infrastructure, including ropeways, helipads for rescue, and upgraded mountain trails. In addition to this, the National Strategy for Adventure Tourism introduced by the Ministry of Tourism outlines standardized safety protocols, skill development for guides, and registration systems for operators, which facilitates travelers and supports the expansion of the market. These interventions also enhance credibility and reduce risks, especially in high-altitude or water-based activities. Moreover, private investment in the tourism sector is growing steadily, supported by favorable government policies. Hospitality chains, travel-tech startups, and state authorities are actively collaborating to boost infrastructure and service offerings. According to industry reports, in order to attract foreign capital, the Government of India permits 100% Foreign Direct Investment (FDI) under the automatic route in the tourism and hospitality industry, subject to existing regulations. This also includes a 100% FDI allowance in tourism-related construction projects such as hotels, resorts, and recreational facilities, encouraging both domestic and international players to invest in adventure tourism development across the country. Apart from this, regulatory clarity and physical infrastructure, such as roads, sanitation, and digital connectivity, are making remote adventure destinations more accessible and market-ready, drawing domestic and international adventurers.

To get more information on this market, Request Sample

Rise in Domestic Solo and Female Travelers

There is a visible rise in solo and female participation in adventure tourism in India. According to an industry report, the number of women traveling alone in India is drastically changing, with 40.7% of solo travelers being Gen Z women (18–25 years old). Urban women, particularly from metro cities like Bengaluru, Delhi, and Mumbai, are increasingly signing up for trekking, scuba diving, and motorcycle expeditions. Additionally, companies are tailoring group tours with safety-first policies, female guides, and curated itineraries for solo female travelers, which is positively impacting the India adventure tourism market outlook. Moreover, the availability of GPS-enabled wearables, emergency contact features, and women-only hostels or campsites is reducing safety concerns and increasing confidence. Additionally, the rise of all-women adventure communities on social medial platforms like Instagram and Facebook fosters peer motivation, shared travel experiences, and real-time support. In addition to this, many travelers are also combining adventure with wellness, seeking mindful escapes through forest hikes, high-altitude yoga, or cycling retreats. Besides this, the broader cultural shift in gender roles and the rise of financial independence among Indian women are catalyzing this trend. Also, domestic tourism policies in states like Kerala and Meghalaya are focusing on creating women-friendly tourism ecosystems, further accelerating market growth.

India Adventure Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, activity, age group, and sales channel.

Type Insights:

- Hard Adventure

- Soft Adventure

The report has provided a detailed breakup and analysis of the market based on the type. This includes hard adventure and soft adventure.

Activity Insights:

- Land-Based Activity

- Water-Based Activity

- Air-Based Activity

A detailed breakup and analysis of the market based on the activity have also been provided in the report. This includes land-based activity, water-based activity, and air-based activity.

Age Group Insights:

- Below 30 Years

- 30-41 Years

- 42-49 Years

- 50 Years and Above

The report has provided a detailed breakup and analysis of the market based on the age group. This includes below 30 years, 30-41 years, 42-49 years, and 50 years and above.

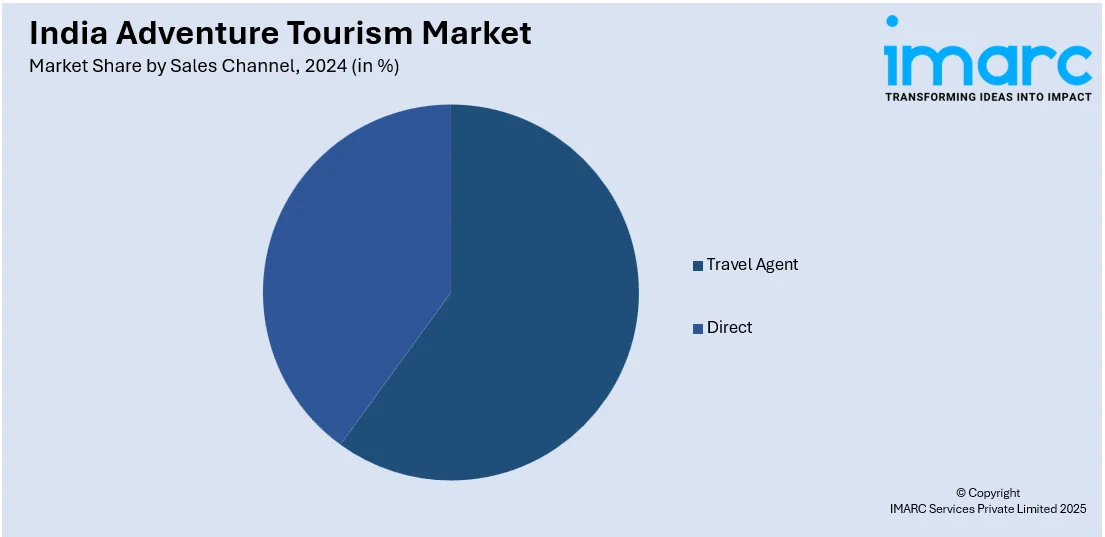

Sales Channel Insights:

- Travel Agent

- Direct

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes travel agent and direct.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Adventure Tourism Market News:

- On May 14, 2024, Intrepid Travel India introduced a new range of adventure travel packages tailored for Indian domestic travelers. The offerings focus on culturally immersive and sustainable experiences, covering destinations such as Ladakh, Kerala, and Sikkim. These packages are designed to help local communities and are in line with the rising need for responsible tourism.

- On March 12, 2025, Kerala Tourism announced the launch of a structured training program for youth in adventure tourism. The initiative, led by the State Responsible Tourism Mission in partnership with the Youth Welfare Board, aims to enhance employment opportunities by developing skilled adventure tourism professionals. The program includes technical training in trekking, water sports, paragliding, and rescue operations.

India Adventure Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hard Adventure, Soft Adventure |

| Activities Covered | Land-Based Activity, Water-Based Activity, Air-Based Activity |

| Age Groups Covered | Below 30 Years, 30-41 Years, 42-49 Years, 50 Years and Above |

| Sales Channels Covered | Travel Agent, Direct |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India adventure tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India adventure tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India adventure tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The adventure tourism market in India was valued at USD 16,730.30 Million in 2024.

The adventure tourism market in India is projected to exhibit a CAGR of 17.80% during 2025-2033, reaching a value of USD 86,090.80 Million by 2033.

Key factors driving the adventure tourism market in India include rising disposable incomes, increasing interest in unique travel experiences, improved infrastructure, government support, and social media influence. Additionally, India's diverse geography offers activities like trekking, river rafting, and paragliding, attracting both domestic and international adventure enthusiasts.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)