India Advertising Video on Demand (AVOD) Market Size, Share, Trends and Forecast by Type, Content, and Region, 2026-2034

India Advertising Video on Demand (AVOD) Market Summary:

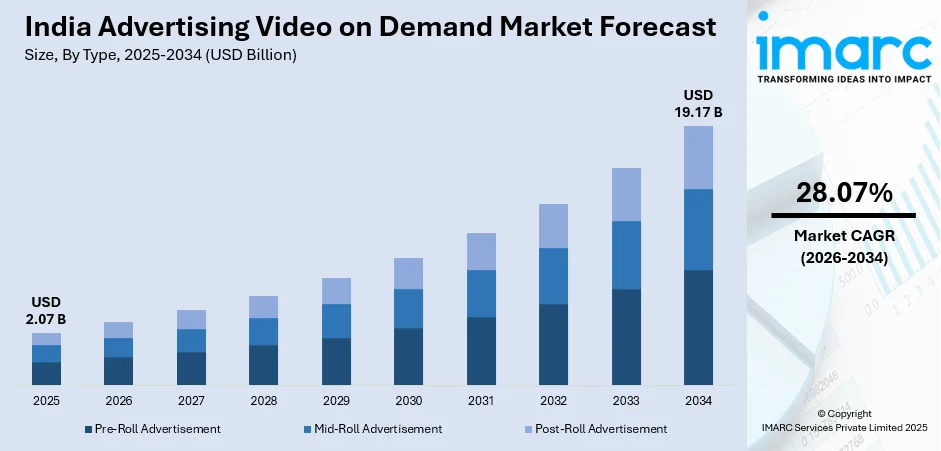

The India advertising video on demand (AVOD) market was valued at USD 2.07 Billion in 2025 and is projected to reach USD 19.17 Billion by 2034, growing at a compound annual growth rate of 28.07% during 2026-2034.

The market's exceptional growth trajectory is propelled by accelerating smartphone penetration coupled with expanding 5G network infrastructure, affordable data plans democratizing digital content access, and consumer preference for free ad-supported streaming over subscription-based models, alongside platforms' strategic focus on regional language programming catering to India's multicultural audience. These converging factors position India as one of the fastest-growing AVOD markets globally, attracting substantial investment from both domestic and international streaming platforms competing for India advertising video on demand (AVOD) market share.

Key Takeaways and Insights:

-

By Type: Pre-roll advertisement dominated with 35% share in 2025, capturing viewer attention at peak engagement moments immediately before content consumption when audiences demonstrate highest commitment and patience levels, resulting in superior completion rates and premium pricing from advertisers seeking maximum brand visibility.

-

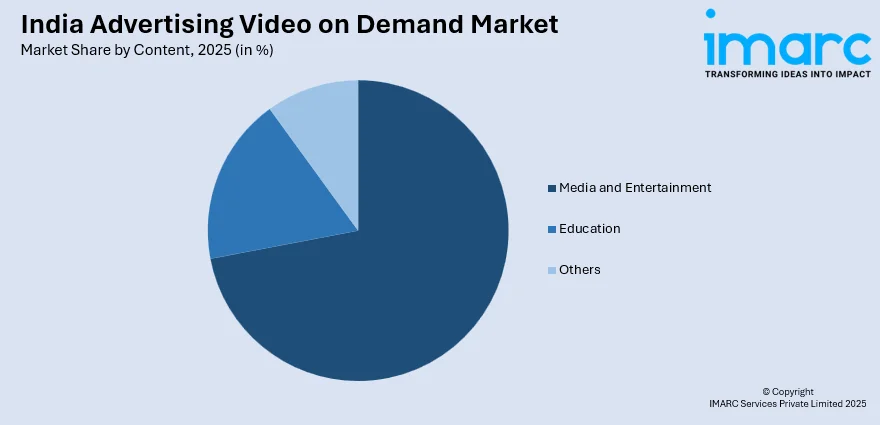

By Content: Media and entertainment led with 72% share in 2025, driven primarily by cricket's unparalleled viewership including IPL and ICC tournaments, Bollywood and regional cinema offerings, and original web series production, with sports content alone attracting the highest number of unique viewers across India's premium VOD platforms.

-

Key Players: The market exhibits intense competition between YouTube's dominant 92% online video share, JioHotstar's merged 500 million user base with cricket rights, and Amazon's dual-platform strategy through Prime Video and MX Player, while regional specialists like SonyLIV, Zee5, and Pluto TV differentiate through language-specific content targeting linguistic diversity.

To get more information on this market, Request Sample

The Indian AVOD ecosystem has undergone transformative evolution with platforms embracing hybrid monetization strategies combining free ad-supported content with premium subscription tiers to maximize market penetration. The convergence of widespread internet connectivity, surging smartphone adoption, and competitive telecommunications pricing has democratized access to high-quality streaming content across urban, semi-urban, and rural geographies. Regional content production has emerged as a critical differentiator, with platforms investing heavily in Tamil, Telugu, Kannada, Bengali, and Marathi language programming to capture India's linguistically diverse audience segments. In February 2025, JioStar launched JioHotstar by merging JioCinema and Disney+ Hotstar platforms, creating India's largest unified streaming service featuring 300,000 hours of content and a combined user base exceeding 500 million users, fundamentally reshaping the competitive landscape. The market demonstrates exceptional resilience and growth momentum driven by evolving consumer viewing habits, technological infrastructure expansion, and innovative advertising formats delivering superior targeting capabilities compared to traditional broadcast media.

India Advertising Video on Demand (AVOD) Market Trends:

Programmatic Advertising Revolutionizing Ad Targeting and Monetization

Programmatic advertising technology is fundamentally transforming India's AVOD landscape by automating the buying and selling of advertising inventory through sophisticated algorithms and real-time bidding mechanisms. This technological advancement enables advertisers to target specific demographic cohorts, behavioral segments, and geographic clusters with unprecedented precision, significantly improving campaign return on investment while reducing wastage. AVOD platforms leverage extensive first-party viewing data, device specifications, and consumption patterns to deliver contextually relevant advertisements that align with viewer preferences and content categories. The scalability and efficiency gains from programmatic systems allow platforms to maximize revenue per impression while maintaining competitive cost structures. In January 2025, Aarki Inc. established Aarki Labs in Bangalore specifically focused on developing AI-powered mobile advertising solutions using deep neural networks, aiming to enhance user acquisition strategies and improve in-app marketing efficiencies across India's rapidly expanding digital advertising ecosystem.

Regional Language Content Proliferation Driving Audience Expansion

Regional content has emerged as the cornerstone growth strategy for AVOD platforms seeking to capture India's multicultural and multilingual audience base spanning 22 official languages and numerous dialects. Platforms are investing substantially in producing and licensing content in Tamil, Telugu, Kannada, Bengali, Marathi, Malayalam, and other regional languages to address authentic cultural representation demand from diverse linguistic communities across different states. This localization strategy enables platforms to penetrate Tier 2 and Tier 3 cities where regional language preference dominates entertainment consumption patterns, significantly expanding addressable market potential beyond English and Hindi-speaking metropolitan audiences. Regional content demonstrates higher engagement metrics and viewer loyalty as audiences gravitate toward culturally familiar narratives, characters, and storytelling formats. ZEE5 experienced a 25 percent increase in viewer engagement during the 2024-2025 period, driven primarily by family-friendly and regional content offerings, with Tier II and III cities accounting for approximately 40 percent of total viewership, particularly for Tamil, Telugu, Kannada, and Bangla language programming distributed across the platform.

Hybrid Monetization Models Combining AVOD and SVOD Strategies

AVOD platforms are increasingly adopting hybrid business models that strategically combine free ad-supported content with premium subscription tiers, offering consumers flexibility while diversifying revenue streams beyond advertising dependency. This freemium approach maximizes market reach by attracting price-sensitive audiences through zero-cost entry barriers while simultaneously monetizing premium-seeking viewers willing to pay for ad-free experiences, exclusive content libraries, or advanced features like offline downloads and higher resolution streaming. Hybrid models enable platforms to capture diverse consumer segments across different willingness-to-pay thresholds while maintaining sustainable unit economics. Major global streaming services recognize India's price-sensitive market dynamics and consumer preference for value-driven offerings, prompting strategic pivots toward advertising-supported tiers. In October 2024, Amazon Prime Video announced it would introduce advertisements in India starting 2025, targeting both free and paid subscribers with ad-supported content while maintaining an optional ad-free premium tier for additional subscription fees, marking Amazon's significant strategic shift from purely subscription-based to hybrid monetization model reflecting broader industry convergence toward AVOD integration.

Market Outlook 2026-2034:

The India advertising video on demand (AVOD) market is positioned for exceptional expansion driven by accelerating digital infrastructure development, expanding 5G network coverage reaching smaller cities and rural areas, continued smartphone adoption penetration increases, and sustained advertiser migration from traditional television to programmatic digital video platforms offering superior targeting and measurement capabilities. The market generated a revenue of USD 2.07 Billion in 2025 and is projected to reach a revenue of USD 19.17 Billion by 2034, growing at a compound annual growth rate of 28.07% during 2026-2034. The competitive landscape will intensify as domestic and international platforms invest aggressively in regional content production, technological capabilities enhancement, and strategic partnerships with telecommunications operators and device manufacturers. Regulatory frameworks evolution including data privacy legislation implementation will shape advertising practices while platform consolidation through mergers and acquisitions creates larger integrated players with enhanced content libraries and distribution reach. Consumer behavior shifts toward on-demand viewing and increasing comfort with ad-supported free content consumption patterns will sustain robust AVOD audience growth, positioning India as a critical strategic market for global streaming platforms.

India Advertising Video on Demand (AVOD) Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Pre-Roll Advertisement | 35% |

| Content | Media and Entertainment | 72% |

Type Insights:

- Pre-roll Advertisement

- Mid-roll Advertisement

- Post-roll Advertisement

Pre-roll advertisement led the India AVOD market with a 35% share in 2025.

Pre-roll advertisements represent the most lucrative and strategically valuable ad placement format in India's AVOD ecosystem, capturing viewer attention at peak engagement moments immediately before desired content consumption begins. This premium positioning ensures maximum visibility as audiences demonstrate highest intent and patience levels before accessing selected entertainment, resulting in superior completion rates and brand recall metrics compared to alternative ad formats. Advertisers recognize pre-roll's effectiveness in delivering brand messages to committed, captive audiences who are less likely to abandon viewing during pre-content ad breaks. Leading brands including Tata, PepsiCo, and Hindustan Unilever have pioneered innovative pre-roll campaigns combining regional creative adaptations with data-driven targeting strategies, achieving measurable lifts in brand awareness and purchase consideration. Pre-roll advertising commands premium pricing from marketers seeking high-impact placement opportunities and consistently delivers strong return on advertising spend metrics. Globally, pre-roll is recognized as one of the fastest-growing advertisement position segments as advertisers increasingly allocate budgets toward formats demonstrating proven engagement effectiveness in capturing audience attention before content immersion begins.

Content Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Media and Entertainment

- Education

- Others

Media and entertainment dominated the India AVOD market with a 72% share in 2025.

Media and entertainment content represents the overwhelming majority of AVOD consumption in India, driven primarily by sports programming prominence (particularly cricket including Indian Premier League), Bollywood and regional cinema offerings, original web series productions, and television show streaming rights. Sports content emerges as the single most powerful audience magnet and subscription driver, with cricket tournaments generating unprecedented viewership numbers and advertising revenues. In the first half of 2024, sports content attracted the highest number of unique viewers across India's premium VOD platforms, with nine of the top 15 titles belonging to the sports genre. IPL 2024 and the ICC Men's T20 World Cup 2024 emerged as the top two sports properties, driving significant viewership spikes and advertising demand. India's premium VOD sector generated $1.04 billion in revenue during this period, representing 38 percent year-over-year growth, with local content and live sports representing the dominant programming categories across AVOD, freemium, and SVOD services. Bollywood and regional film libraries provide evergreen content attracting diverse demographic segments while original web series production investments by platforms create differentiated exclusive offerings driving platform loyalty and repeat viewership engagement.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits robust AVOD market development led by major metropolitan centers including Delhi NCR, Punjab, Haryana, Uttar Pradesh, and Rajasthan, benefiting from high smartphone penetration rates, advanced telecommunications infrastructure, and substantial youth demographic cohorts driving digital content consumption. The region demonstrates strong preference for Hindi language entertainment content alongside regional Punjabi programming, creating lucrative opportunities for platforms offering localized content libraries. Advertisers targeting North India's affluent urban consumers and expanding middle class populations in smaller cities leverage AVOD platforms for reaching audiences abandoning traditional television viewing in favor of on-demand streaming alternatives. The region's cricket enthusiasm drives exceptional sports content viewership during major tournaments, creating premium advertising inventory commanding elevated pricing.

South India represents a fast-growing AVOD market segment propelled by surging demand for Tamil, Telugu, Kannada, and Malayalam language content across Karnataka, Andhra Pradesh, Telangana, Tamil Nadu, and Kerala. The region's consumers demonstrate strong cultural identity and preference for regional entertainment over Hindi and English content, motivating platforms to invest substantially in South Indian language productions and licensed content acquisitions. Regional film industries including Tamil and Telugu cinema command devoted fan bases driving strong streaming engagement while original web series productions in regional languages attract younger urban audiences. The region's higher smartphone penetration compared to national averages and strong economic fundamentals support accelerated AVOD adoption trajectories.

East India comprising West Bengal, Bihar, Odisha, Jharkhand, and northeastern states demonstrates expanding AVOD market penetration supported by improving 4G network coverage reaching smaller towns and rural areas previously underserved by reliable internet connectivity. The region shows particular strength in Bengali language content consumption while emerging interest in Hindi entertainment supplemented by regional productions. Growing smartphone affordability and data plan competitiveness enable wider population segments to access streaming content, expanding addressable market potential. Advertiser interest in East India focuses on capturing emerging consumer markets and building brand awareness in growing economies as disposable incomes rise and consumption patterns modernize.

West India anchored by Maharashtra (including Mumbai financial capital), Gujarat, and Goa demonstrates mature AVOD market characteristics with high per capita consumption, sophisticated viewer preferences spanning multiple content genres and languages, and premium advertiser demand targeting affluent urban populations. Mumbai's position as India's entertainment industry hub creates strong local content production ecosystem supporting platform content supply while the region's cosmopolitan demographics drive demand for diverse Hindi, Marathi, English, and international content offerings. Gujarat's substantial business community and rising affluence levels create attractive advertiser targets while the region's cricket enthusiasm maintains strong sports content engagement driving premium advertising opportunities.

Market Dynamics:

Growth Drivers:

Why is the India Advertising Video on Demand (AVOD) Market Growing?

Smartphone Adoption and 5G Network Expansion Accelerating Digital Video Consumption

India's exponential smartphone penetration coupled with aggressive 5G network infrastructure rollouts by leading telecommunications operators has fundamentally transformed digital content accessibility and consumption patterns across urban, semi-urban, and rural geographies. The convergence of affordable smartphone devices, competitive data pricing from operators, and high-speed network capabilities enables seamless high-definition video streaming experiences previously constrained by connectivity limitations. 5G technology deployment facilitates buffer-free streaming, supports multiple concurrent device connections within households, and enables bandwidth-intensive formats including 4K video resolution and interactive content applications. In 2024, 5G smartphone shipments reached approximately 80 percent of total smartphone shipments in India, with nearly 90 percent of all smartphone replacements in 2025 expected to be 5G-capable devices, reflecting rapid technology adoption at all price segments. India’s 5G user population is forecast to grow dramatically as per the IBEF, rising from about 290 million in 2024 to nearly 980 million by 2030, alongside an expected increase in average smartphone data consumption to around 62 GB per month. The availability of entry-level 5G smartphones priced below INR 15,000 democratizes access to premium streaming experiences for mass market consumers, directly fueling AVOD platform audience growth. Enhanced network performance reduces buffering frustrations and abandonment rates while supporting longer viewing sessions and higher content consumption volumes, increasing advertising inventory availability and revenue potential for AVOD platforms.

Cost-Effective Data Plans and Expanding Internet Accessibility

India's intensely competitive telecommunications sector has driven data prices to among the lowest globally, democratizing access to video streaming services across diverse socioeconomic segments and geographic regions. Aggressive pricing competition among major operators including Reliance Jio, Bharti Airtel, and Vodafone Idea has resulted in affordable unlimited data plans and prepaid packages enabling sustained video consumption without prohibitive cost barriers. Low data pricing particularly benefits price-sensitive consumers in Tier 2, Tier 3 cities and rural areas where entertainment budgets remain constrained, but smartphone adoption continues accelerating. The availability of low-cost smartphones in smaller cities and towns, combined with affordable 4G and emerging 5G data plans, has brought high-quality video content access to hundreds of millions of previously underserved consumers lacking reliable entertainment alternatives. India's internet user base stood at 751.5 million at the start of 2024, representing 54 percent population penetration, with internet access continuing to expand rapidly across both urban and rural geographies driven by government Digital India initiatives and private sector infrastructure investments. BharatNet program extending fiber connectivity to village panchayats and telecommunications tower densification in underserved regions progressively eliminates connectivity gaps limiting streaming adoption. Enhanced internet accessibility creates expanding addressable markets for AVOD platforms seeking advertising revenue through mass audience reach, while affordable connectivity costs remove economic barriers preventing consistent streaming engagement.

Consumer Preference Shift Toward Free Ad-Supported Content Over Subscription Models

Indian consumers demonstrate pronounced preference for ad-supported free content over paid subscription services, driven by inherent price sensitivity, limited disposable entertainment budgets, and abundant availability of quality AVOD offerings eliminating subscription necessity. This behavioral pattern reflects India's value-conscious consumer mindset prioritizing cost savings while accepting advertising exposure as reasonable exchange for free content access. The proliferation of compelling AVOD alternatives providing extensive content libraries without financial commitments fundamentally challenges subscription services struggling to justify pricing propositions. According to the Ormax OTT Audience Report 2024, India's AVOD segment experienced robust 21 percent year-over-year growth while the SVOD segment suffered a 2 percent numerical decline, highlighting stark divergence in adoption trajectories. The AVOD audience now constitutes 72.5 percent of India's total OTT viewership, with the overall streaming universe reaching 547.3 million users representing 38 percent penetration of India's population, up from 34 percent in 2023. This growth is entirely driven by AVOD expansion as subscription services stagnate around 150 million users. Consumer acceptance of advertising interruptions in exchange for zero-cost entertainment access creates sustainable business models for platforms monetizing through advertising revenues rather than subscription fees. The economic rationality of AVOD consumption particularly resonates in India where traditional television remains low-cost and data charges add to total content access costs, making paid streaming subscriptions difficult to justify for budget-conscious households when free alternatives deliver comparable content quality and variety.

Market Restraints:

What Challenges the India Advertising Video on Demand (AVOD) Market is Facing?

Balancing Advertising Load with User Experience Quality

AVOD platforms face the perpetual challenge of optimizing advertising frequency and placement without compromising viewer satisfaction and retention, as excessive ad interruptions, poorly targeted advertisements, or irrelevant commercial content drives audience frustration and platform abandonment. The fundamental tension between revenue maximization through increased ad inventory and user experience preservation requires sophisticated content delivery strategies, dynamic ad load management, and contextually appropriate placement timing ensuring relevancy while minimizing viewing disruption. Platforms must continuously calibrate ad frequency caps, test placement strategies, and monitor engagement metrics to identify optimal equilibrium points balancing monetization objectives against churn risk from over-commercialized experiences degrading entertainment value propositions.

Data Privacy Regulations and Compliance Requirements

Implementation of India's Digital Personal Data Protection (DPDP) Act 2023 imposes stringent requirements governing data collection practices, user consent mechanisms, data processing purposes, and targeted advertising methodologies, fundamentally reshaping operational compliance obligations for AVOD platforms. Regulatory frameworks mandate transparent data handling practices, explicit user permissions for tracking and profiling activities, and demonstrable purpose limitation governing information usage, substantially increasing compliance costs and operational complexity. Platforms must invest substantially in legal expertise, compliance infrastructure, consent management platforms, and revised data architecture ensuring adherence to evolving regulatory standards while maintaining advertising effectiveness depending on audience targeting precision. Non-compliance risks significant financial penalties, operational restrictions, enforcement actions, and erosion of advertiser confidence in platform measurement accuracy and targeting capabilities.

Intense Market Fragmentation and Platform Competition

India's AVOD market features approximately 57 OTT platforms competing simultaneously for audience attention, advertising budgets, and content licensing rights, creating severe market fragmentation diluting individual platform reach and complicating advertiser campaign planning across fragmented inventory. Platforms must differentiate through exclusive content acquisitions, original productions, technological innovation, superior user experiences, and strategic partnerships while competing against entrenched domestic players and well-funded global giants. YouTube commands 92 percent of India's total online video consumption, creating dominant competitive benchmark. JioHotstar's merged entity combining JioCinema and Disney+ Hotstar creates formidable competitor with 300,000 hours content library and 500 million user base commanding substantial advertising market share. Competition intensity pressures platform profitability margins, escalates content acquisition costs, and necessitates continuous innovation investments maintaining competitive positioning.

Competitive Landscape:

The India advertising video on demand (AVOD) market exhibits dynamic competitive intensity characterized by both established global streaming platforms and aggressive domestic players competing for audience share and advertising revenues. YouTube dominates overall online video consumption, representing the primary competitor across both user-generated content and professional media categories. JioHotstar emerged in February 2025 through JioStar's merger of JioCinema and Disney+ Hotstar, creating India's largest unified streaming platform, positioning it as the dominant premium AVOD competitor. Amazon strengthened market presence through multiple strategic initiatives including Prime Video's ad tier introduction and the MX Player acquisition merger creating Amazon MX Player offering free ad-supported content with shoppable video integration. International player Netflix, while primarily subscription-focused, increasingly acknowledges AVOD importance through selective market experiments. Domestic platforms including SonyLIV, Zee5, MX Player, and regional specialists like Aha and Hoichoi compete through differentiated content strategies and regional language specializations.

Recent Developments:

-

November 2024: Prasar Bharati launched WAVES, a comprehensive government-owned OTT platform, at the 55th International Film Festival of India in Panaji, Goa, offering free ad-supported video-on-demand, audio-on-demand, live TV and radio, gaming, e-books, e-magazines, and e-commerce services through a unified application. The platform provides access to extensive Doordarshan and Akashvani archives alongside contemporary programming spanning over 80 genres, with content available in 26 languages and interface support in 10 Indian languages including Hindi, Tamil, Telugu, Bengali, and Marathi. WAVES operates as an aggregator platform integrating third-party content from Lionsgate Play, Eros Now, and PTC Play while featuring distribution partnerships with Tata Play Binge, BSNL, Jio STB, and RailWire, positioning it as India's first comprehensive public broadcaster entry into the competitive AVOD streaming market with nationwide accessibility across mobile, smart TV, and streaming device platforms.

India Advertising Video on Demand (AVOD) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pre-Roll Advertisement, Mid-Roll Advertisement, Post-Roll Advertisement |

| Contents Covered | Media and Entertainment, Education, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India advertising video on demand (AVOD) market size was valued at USD 2.07 Billion in 2025.

The India advertising video on demand (AVOD) market is expected to grow at a compound annual growth rate of 28.07% from 2026-2034 to reach USD 19.17 Billion by 2034.

Pre-roll advertisement leads the India AVOD market with a 35% share in 2025, owing to its premium positioning capturing peak viewer attention immediately before content consumption begins, delivering superior engagement rates and brand recall compared to alternative ad formats.

Key growth drivers include accelerating smartphone adoption with 5G network expansion enabling seamless high-definition streaming, cost-effective data plans democratizing video access across socioeconomic segments, and pronounced consumer preference shift toward free ad-supported content over paid subscription models, with AVOD audience growing 21% year-over-year while subscription services stagnate, creating sustainable advertising-based monetization opportunities.

Major challenges include balancing advertising frequency with viewer satisfaction to prevent abandonment, navigating stringent data privacy regulations under DPDP Act 2023 requiring substantial compliance investments, and competing within a fragmented market featuring 57 OTT platforms alongside YouTube's 92% dominance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)