India Aerial Work Platform Market Size, Share, Trends, and Forecast by Engine Type, Product Type, Application, and Region, 2025-2033

India Aerial Work Platform Market Overview:

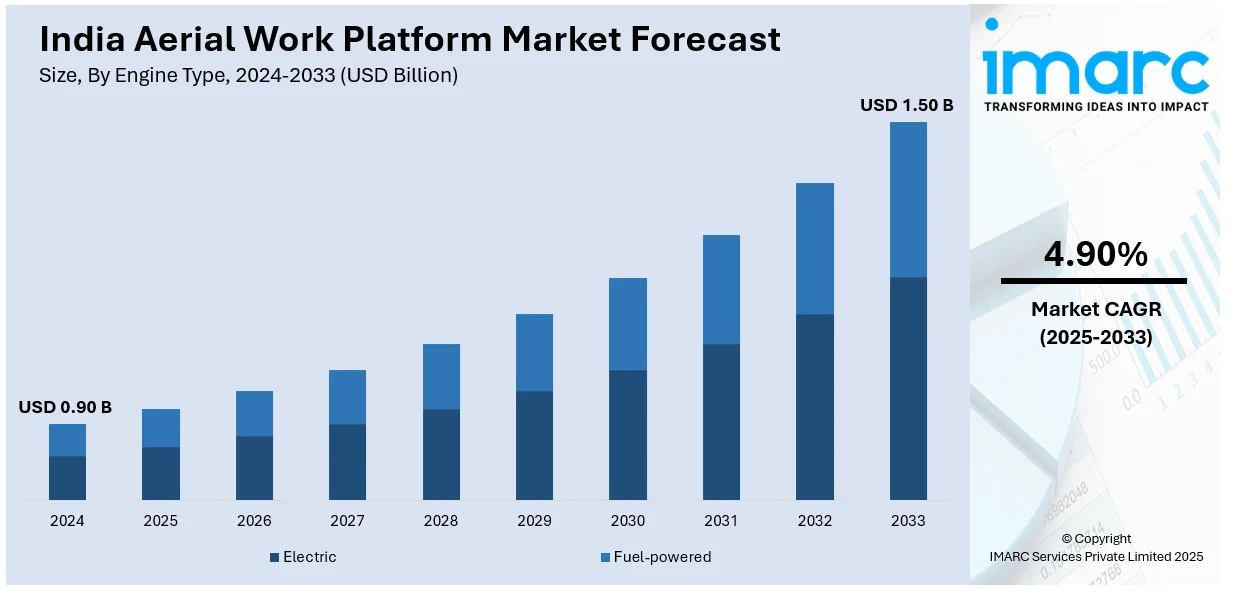

The India aerial work platform market size reached USD 0.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.50 Billion by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is expanding due to an increasing demand across sectors like construction, manufacturing, and infrastructure. The need for enhanced worker safety, efficient material handling, and improved productivity is driving market growth across the country. Additionally, technological advancements and government infrastructure projects further boost adoption, fostering market development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.90 Billion |

| Market Forecast in 2033 | USD 1.50 Billion |

| Market Growth Rate 2025-2033 | 4.90% |

India Aerial Work Platform Market Trends:

Rising Demand from Infrastructure and Construction Sectors

The growing infrastructure and real estate sectors in India are driving the demand for aerial work platforms (AWPs). For instance, in January 2025, as per industry reports, India's infrastructure production witnessed 4.6% annual growth, reflecting an upward trend in industrial expansion and development activities. AWPs are becoming indispensable for high-rise building, bridge maintenance, and industrial facility maintenance, supplanting conventional scaffolding techniques. The demand is especially high for scissor lifts and articulated boom lifts, which offer greater safety and maneuverability in urban development schemes. Private real estate developments, such as commercial complexes and high-rise buildings, are also driving the use of AWPs. Additionally, with rising labor safety rules, developers and contractors are focusing on minimizing workplace hazards by using equipment that reduces risks at the workplace. The growing requirement for high-altitude maintenance activity in airports, power plants, and telecommunication infrastructure is contributing to market expansion as well. Furthermore, with continued urban infrastructure investments, India's AWP market will grow steadily.

To get more information on this market, Request Sample

Shift Toward Electrification and Sustainable Solutions

India’s aerial work platform market is experiencing a shift toward electric and hybrid-powered models as businesses seek sustainable alternatives to diesel-powered equipment. Stricter emission regulations and rising fuel costs are pushing companies to adopt electric scissor lifts and battery-powered boom lifts, which offer lower operational costs and reduced environmental impact. For instance, as per industry reports, petrol prices in India have increased by 30% over the last 10 years. Warehousing and logistics companies, particularly in e-commerce and retail, are increasingly opting for electric AWPs for indoor operations, where emissions and noise levels must be minimized. Advancements in battery technology, such as longer operational hours and faster charging capabilities, are making electric AWPs more viable for large-scale industrial applications. Additionally, hybrid models that combine electric and diesel power sources are gaining traction, offering flexibility for both indoor and outdoor use. With sustainability becoming a key focus for businesses and government policies promoting green equipment, the demand for eco-friendly AWPs is expected to grow significantly in the coming years.

India Aerial Work Platform Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on engine type, product type, and application.

Engine Type Insights:

- Electric

- Fuel-powered

The report has provided a detailed breakup and analysis of the market based on the engine type. This includes electric and fuel-powered.

Product Type Insights:

- Boom Lifts

- Scissor Lifts

- Truck/Crawler Mounted Lifts

- Push Around Aerial Work Platforms

- Spider Lifts

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes boom lifts, scissor lifts, truck/crawler mounted lifts, push around aerial work platforms, spider lifts, and others.

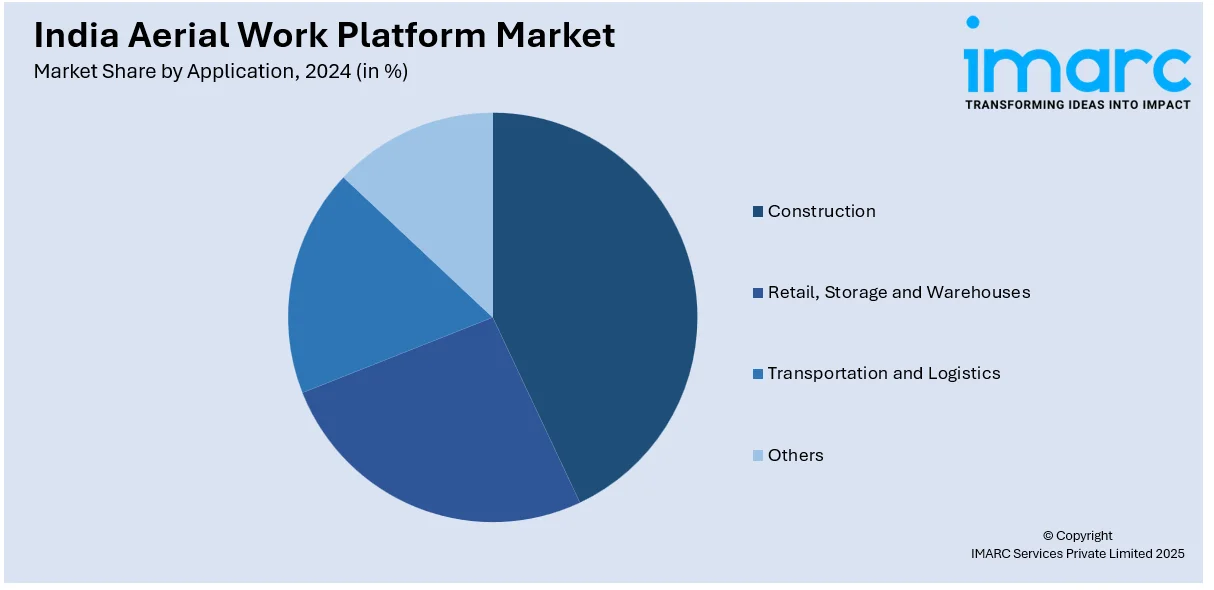

Application Insights:

- Construction

- Retail, Storage and Warehouses

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes construction, retail, storage and warehouses, transportation and logistics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aerial Work Platform Market News:

- In August 2024, JCB announced the launch of its first diesel Telescopic Boom Platform, the T65D, in Goa. This platform prioritizes safety, reliability, and efficiency, making it suitable for construction, oil, gas, and airport operations. This launch strengthens India's expanding market and enhances global export opportunities.

- In December 2024, TIL announced the launch of the Snorkel A62JRT articulating boom lift at Bauma ConExpo India 2024, marking its entry into the aerial work platform segment. It offers a spacious platform, precision controls, and stability, making it well-suited for Indian terrains and enhancing efficiency and versatility across various industrial applications.

India Aerial Work Platform Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Engine Types Covered | Electric, Fuel-powered |

| Product Types Covered | Boom Lifts, Scissor Lifts, Truck/Crawler Mounted Lifts, Push Around Aerial Work Platforms, Spider Lifts, Others |

| Applications Covered | Construction, Retail, Storage and Warehouses, Transportation and Logistics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India aerial work platform market performed so far and how will it perform in the coming years?

- What is the breakup of the India aerial work platform market on the basis of engine type?

- What is the breakup of the India aerial work platform market on the basis of product type?

- What is the breakup of the India aerial work platform market on the basis of application?

- What is the breakup of the India aerial work platform market on the basis of region?

- What are the various stages in the value chain of the India aerial work platform market?

- What are the key driving factors and challenges in the India aerial work platform market?

- What is the structure of the India aerial work platform market and who are the key players?

- What is the degree of competition in the India aerial work platform market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aerial work platform market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aerial work platform market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aerial work platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)