India Aerogel Market Size, Share, Trends and Forecast by Material, Application, and Region, 2025-2033

India Aerogel Market Overview:

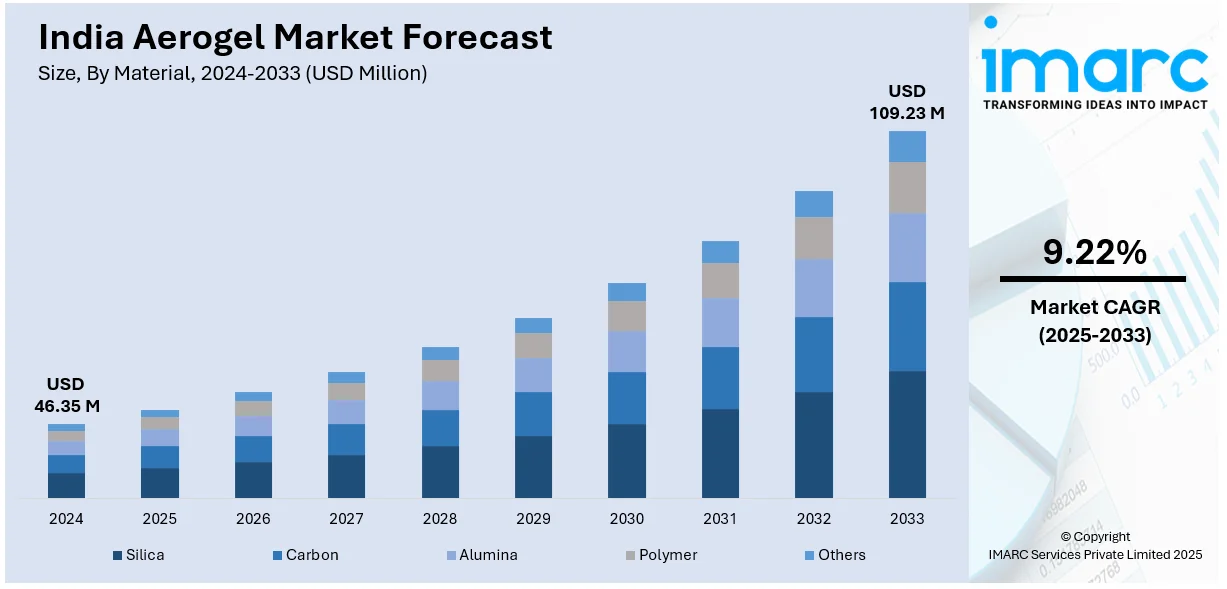

The India aerogel market size reached USD 46.35 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 109.23 Million by 2033, exhibiting a growth rate (CAGR) of 9.22% during 2025-2033. Sustainability concerns, stringent regulations, and corporate goals are driving the adoption of eco-friendly aerogels in India, while technological advancements, domestic production growth, and collaborations are enhancing innovation, reducing import dependency, and expanding applications across industries like construction, energy storage, and e-waste management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 46.35 Million |

| Market Forecast in 2033 | USD 109.23 Million |

| Market Growth Rate 2025-2033 | 9.22% |

India Aerogel Market Trends:

Growing Preferences for Eco-Friendly and Sustainable Materials

Sustainability concerns and stringent environmental regulations are driving the adoption of aerogels as eco-friendly materials across various industries in India. Aerogels, renowned for their recyclability, non-toxic nature, and superior thermal insulation efficiency, are gaining popularity for lowering energy usage and carbon output. Numerous firms are transitioning to environment-friendly building methods and incorporating low-emission materials to achieve their sustainability objectives. Furthermore, aerogels contribute substantially to industrial sustainability by improving energy efficiency and minimizing waste. Besides this, aerogels are emerging as an innovative solution in the field of e-waste management, offering a safer and more eco-friendly alternative for metal recovery. Their high surface area and customizable properties enable effective adsorption and separation of precious metals, minimizing the environmental impact of extraction. In December 2024, researchers from IISER Pune developed a hybrid aerogel that could extract up to 99% of gold from e-waste. The aerogel, treated with iron nitrate salts, offered a sustainable and efficient method for recycling valuable metals, reducing reliance on harmful mining practices. This innovation highlights the capacity of aerogels in circular economy applications by enabling the extraction of precious metals without the environmental harm associated with conventional mining. With corporate sustainability efforts coinciding with governmental policies that support green technologies, the need for innovative aerogel solutions is increasing. Such innovations illustrate how advanced materials can promote sustainable development and lessen environmental effects.

To get more information on this market, Request Sample

Technological Advancements and Domestic Production Capacity

Ongoing research and development (R&D) activities are playing a crucial role in making aerogels more affordable, efficient, and scalable for industrial applications. In India, the collaboration between domestic firms and international organizations is fueling innovation and the creation of aerogel products that cater to the specific needs of the local market. As technological advancements continue, manufacturing processes are becoming more streamlined, resulting in reduced production costs and higher performance materials. For instance, in September 2024, Armacell announced the opening of a new aerogel insulation plant in Pune, India, and the launch of its next-generation ArmaGel XG product line. The new aerogel blanket technology enhanced their existing product portfolio with improved thermal performance. This development strengthened Armacell’s commitment to providing sustainable, energy-efficient solutions in the industrial and energy sectors, addressing the growing demand for high-performance materials. With enhanced thermal management capabilities, the new product line is poised to meet the rising energy efficiency standards in sectors such as construction, transportation, and manufacturing. The opening of this plant further exemplifies how international collaborations and investments are fostering innovation in India's aerogel market, positioning the country as a key player in the global industry.

India Aerogel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on material and application.

Material Insights:

- Silica

- Carbon

- Alumina

- Polymer

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes silica, carbon, alumina, polymer, and others.

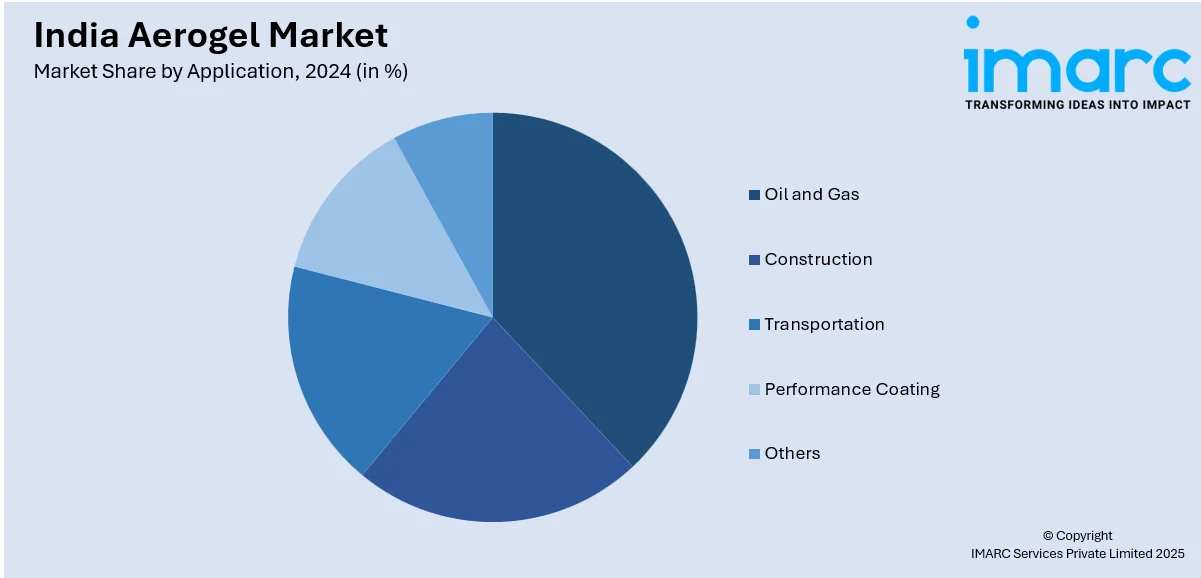

Application Insights:

- Oil and Gas

- Construction

- Transportation

- Performance Coating

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, construction, transportation, performance coating, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aerogel Market News:

- In February 2024, IN-SPACe facilitated the transfer of six ISRO technologies to private companies in India. These included a de-mating tool for connectors, solar cell adhesive, vibration sensor, and silica aerogel materials, with agreements signed between NewSpace India Ltd, IN-SPACe, and the companies involved. The aim was to promote private sector involvement in space technology development.

- In October 2023, researchers from IIT Madras and Tel Aviv University developed a graphene-modified silica aerogel that effectively removed trace pollutants from wastewater. The aerogel adsorbent could remove over 76% of pollutants in continuous flow conditions, offering a sustainable solution for large-scale water purification.

India Aerogel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Silica, Carbon, Alumina, Polymer, Others |

| Applications Covered | Oil and Gas, Construction, Transportation, Performance Coating, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aerogel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aerogel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aerogel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aerogel market in India was valued at USD 46.35 Million in 2024.

The aerogel market in India is projected to exhibit a (CAGR) of 9.22% during 2025-2033, reaching a value of USD 109.23 Million by 2033.

The India aerogel market is being driven by demand for insulation, building, and oil & gas applications. Its high thermal resistance, lightness, and energy-saving qualities are spurring demand. Increasing industrialization, increased emphasis on power conservation, and the increasing use of electronics, aerospace, and building insulation are driving market growth. Initiatives by governments supporting sustainable materials further support the usage of aerogels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)