India Aerospace Composites Market Size, Share, Trends and Forecast by Fiber Type, Resin Type, Aircraft Type, Application, Manufacturing Process, and Region, 2025-2033

Market Overview:

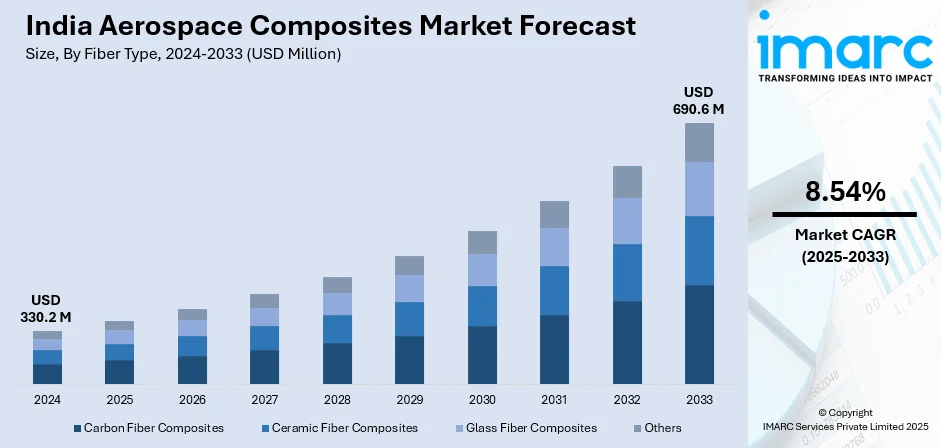

India aerospace composites market size reached USD 330.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 690.6 Million by 2033, exhibiting a growth rate (CAGR) of 8.54% during 2025-2033. The market growth is attributed to the expanding aviation industry, fuel-efficient aircraft development, and the increasing adoption of aerospace composites for primary structures such as wings and fuselages.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of fiber type, the market has been divided into carbon fiber composites, ceramic fiber composites, glass fiber composites, and others.

- On the basis of resin type, the market has been divided into epoxy, phenolic, polyester, polyimides, thermoplastics, ceramic and metal matrix, and others.

- On the basis of aircraft type, the market has been divided into commercial aircraft, business aviation, civil helicopters, military aircraft and helicopters, and others.

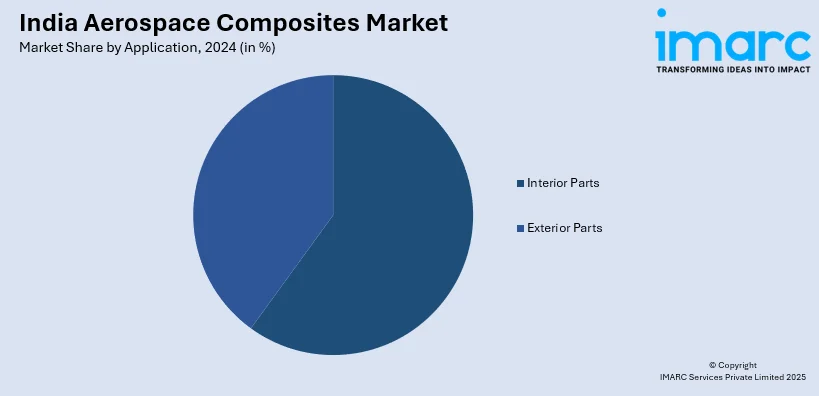

- On the basis of application, the market has been divided into interior parts and exterior parts.

- On the basis of manufacturing process, the market has been divided into AFP/ATL, layup, RTM/VARTM, filament winding, and others.

Market Size and Forecast:

- 2024 Market Size: USD 330.2 Million

- 2033 Projected Market Size: USD 690.6 Million

- CAGR (2025-2033): 8.54%

Aerospace composites refer to the amalgamation of two or more materials with distinct properties, employed to create a combination of characteristics that neither individual material could attain independently. Initially, these composites were limited to application in secondary structures like seats, rotor blades, and instrument enclosures for gliders, helicopters, fighter planes, passenger airlines, and space shuttles. However, in contemporary contexts, they are increasingly utilized in the manufacturing of primary structures such as wings and fuselages. This shift is attributed to their superior flexibility when compared to metallic counterparts.

To get more information on this market, Request Sample

The aerospace composites market in India is witnessing a transformative shift as these advanced materials play an increasingly crucial role in the aviation and aerospace industry. Moreover, the landscape is evolving, and there is a notable expansion of their role to encompass primary structures like wings and fuselages. Additionally, this expansion is driven by the superior malleability of aerospace composites compared to their metallic counterparts, allowing for innovative design possibilities and contributing to overall weight reduction in aircraft. Besides this, the adoption of aerospace composites in India is influenced by their unique combination of strength, durability, and lightweight properties. Furthermore, as the aviation industry in India continues to grow, there is an increasing emphasis on fuel efficiency, performance optimization, and environmental sustainability. Apart from this, aerospace composites contribute significantly to these goals by enabling the manufacture of structurally sound yet lightweight components. The India aerospace composites market is poised for continued growth, driven by advancements in manufacturing technologies, increased investments in research and development, and a growing recognition of the benefits these materials bring to the aviation and aerospace sector. As aircraft design continues to evolve, the role of aerospace composites is set to become even more prominent in shaping the future of aerospace engineering in India. This, in turn, is anticipated to fuel the market growth in the coming years.

India Aerospace Composites Market Trends:

Growth Drivers of the India Aerospace Composites Market

The India aerospace composites market share continues to expand, driven by increasing domestic air travel demand and the growth of low-cost carriers, is significantly boosting the demand for lightweight composite materials. The establishment of aerospace manufacturing hubs and the entry of global OEMs into the Indian market are creating a robust ecosystem for composite material suppliers. Furthermore, digital twin technologies are being employed to simulate composite behavior under various stress conditions, enabling engineers to optimize designs before physical production. This digital transformation is particularly crucial as the India aerospace composites market analysis indicates a growing demand for more complex composite structures that require precise manufacturing capabilities. Government initiatives promoting indigenous manufacturing under the Make in India program and increased defense spending are creating substantial opportunities for local composite manufacturers. The push for fuel-efficient aircraft designs and stringent emission regulations are compelling aerospace manufacturers to adopt advanced composite materials that offer superior weight-to-strength ratios. Rising investments in research and development activities by both government institutions and private companies are accelerating technological innovations in composite manufacturing processes.

Opportunities in the India Aerospace Composites Market

The India aerospace composites market demand is poised for continued growth, driven by increased investments in research and development, advancements in manufacturing technologies, as well as a growing recognition of the benefits these materials bring to the aviation and aerospace sector. The increasing focus on unmanned aerial vehicles (UAVs) and space applications presents new market segments for specialized composite materials with unique property requirements. Export opportunities are expanding as Indian manufacturers develop capabilities to serve international aerospace supply chains, particularly in cost-sensitive markets. The maintenance, repair, and overhaul (MRO) sector is growing rapidly, creating demand for composite repair materials and technologies. Partnerships with global aerospace companies are opening avenues for technology transfer and joint development of advanced composite solutions. The emerging urban air mobility and electric aircraft segments offer potential for innovative lightweight composite applications that could revolutionize short-distance transportation. This, in turn, is anticipated to fuel the India aerospace composites market growth in the coming years.

Challenges in the India Aerospace Composites Market

High initial investment costs for advanced manufacturing equipment and technology acquisition pose significant barriers for small and medium-sized enterprises entering the composites market. Limited availability of skilled workforce with specialized knowledge in composite manufacturing processes and quality control systems hampers industry growth. Stringent certification requirements and lengthy approval processes for aerospace applications create time and cost challenges for manufacturers. Supply chain dependencies on imported raw materials and equipment make the industry vulnerable to global disruptions and price volatilities. Competition from established international players with superior technological capabilities and economies of scale presents ongoing challenges for domestic manufacturers.

Some of the Other Factors Contributing to the Market Include:

- Supply-Chain Shift & Western OEM Engagement: Global aerospace companies are increasingly looking to diversify their supply chains away from traditional manufacturing hubs, creating opportunities for Indian composite manufacturers to become preferred suppliers. Western Original Equipment Manufacturers (OEMs) are establishing partnerships with Indian companies to leverage cost advantages while maintaining quality standards.

- Policy-Driven Growth & Indigenization: Government policies promoting indigenous defense manufacturing and the Atmanirbhar Bharat initiative are driving investments in domestic composite manufacturing capabilities. These policies provide financial incentives and preferential procurement opportunities for locally manufactured aerospace composites.

- Defense & UAV Expansion: India's growing defense budget and increasing focus on unmanned systems are creating substantial demand for advanced composite materials that offer stealth capabilities and enhanced performance characteristics. The development of indigenous fighter aircraft programs further boosts this demand.

- Advanced Materials & R&D Innovation: Research institutions and companies are collaborating to develop next-generation composite materials, including ceramic matrix composites and nanocomposites, that can withstand extreme operating conditions. These innovations are opening new application areas and enhancing performance capabilities.

- Space and Startup Ecosystems: India's expanding space program and the emergence of private space companies are creating demand for specialized composite materials for satellite and launch vehicle applications. The startup ecosystem is fostering innovation in composite manufacturing technologies and applications.

India Aerospace Composites Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on fiber type, resin type, aircraft type, application, and manufacturing process.

Fiber Type Insights:

- Carbon Fiber Composites

- Ceramic Fiber Composites

- Glass Fiber Composites

- Others

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes carbon fiber composites, ceramic fiber composites, glass fiber composites, and others.

Resin Type Insights:

- Epoxy

- Phenolic

- Polyester

- Polyimides

- Thermoplastics

- Ceramic and Metal Matrix

- Others

A detailed breakup and analysis of the market based on the resin type have also been provided in the report. This includes epoxy, phenolic, polyester, polyimides, thermoplastics, ceramic and metal matrix, and others.

Aircraft Type Insights:

- Commercial Aircraft

- Business Aviation

- Civil Helicopters

- Military Aircraft and Helicopters

- Others

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes commercial aircraft, business aviation, civil helicopters, military aircraft and helicopters, and others.

Application Insights:

- Interior Parts

- Exterior Parts

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes interior parts and exterior parts.

Manufacturing Process Insights:

- AFP/ATL

- Layup

- RTM/VARTM

- Filament Winding

- Others

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes AFP/ATL, layup, RTM/VARTM, filament winding, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, Hindustan Aeronautics Limited (HAL) announced plans to deliver the first two Tejas Mark-1A jets to the Indian Air Force (IAF), pending successful completion of weapon trials. The jets are slated to undergo weapon firing tests for integration with advanced air-to-air missiles and radar systems. The delivery of these fighters is critical to HAL's aerospace production targets and aligns with India’s growing demand for indigenous aerospace composites to support the aviation and defense industries.

- In December 2024, Hindustan Aeronautics Limited (HAL) showcased its expertise in composite materials by highlighting their application in the Tejas Light Combat Aircraft (LCA). The use of composites in the Tejas LCA enhances the aircraft’s performance and stealth capabilities, marking significant progress in India's aerospace technology.

- In September 2024, Lockheed Martin and Tata Advanced Systems Limited (TASL) announced a strategic partnership to strengthen India’s aerospace sector, particularly focusing on the C-130J Super Hercules tactical airlifter program. The collaboration aims to establish a Maintenance, Repair, and Overhaul (MRO) facility in India and enhance the production of key components, including the use of advanced aerospace composites for airframe development.

- In January 2024, Air India inaugurated its first Airbus A350 aircraft at the Wings India 2024 event, marking a significant milestone in the airline's fleet modernization. The A350, featuring advanced fuel-efficient technology, is equipped with Rolls-Royce Trent XWB engines and boasts superior environmental performance with a reduced carbon footprint.

India Aerospace Composites Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Carbon Fiber Composites, Ceramic Fiber Composites, Glass Fiber Composites, Others |

| Resin Types Covered | Epoxy, Phenolic, Polyester, Polyimides, Thermoplastics, Ceramic and Metal Matrix, Others |

| Aircraft Types Covered | Commercial Aircraft, Business Aviation, Civil Helicopters, Military Aircraft and Helicopters, Others |

| Applications Covered | Interior Parts, Exterior Parts |

| Manufacturing Processes Covered | AFP/ATL, Layup, RTM/VARTM, Filament Winding, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aerospace composites market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aerospace composites market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aerospace composites industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India aerospace composites market was valued at USD 330.2 Million in 2024.

The India aerospace composites market is projected to exhibit a CAGR of 8.54% during 2025-2033, reaching USD 690.6 Million by 2033.

Key factors driving the market include the expanding aviation industry, demand for fuel-efficient aircraft, and the increasing adoption of aerospace composites in primary structures such as wings and fuselages. Technological advancements and government supporting policies also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)