India Affective Computing Market Size, Share, Trends and Forecast by Technology, Components, End Use, and Region, 2025-2033

India Affective Computing Market Overview:

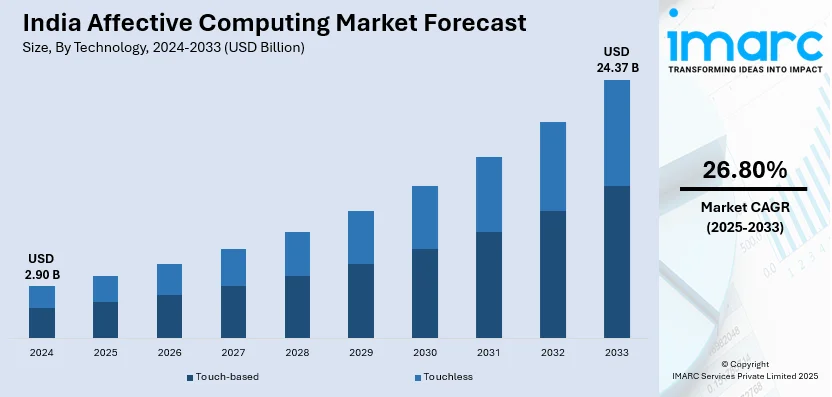

The India affective computing market size reached USD 2.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.37 Billion by 2033, exhibiting a growth rate (CAGR) of 26.80% during 2025-2033. The India affective computing market share is expanding, driven by the increasing adoption of machine learning (ML), which assists in enhancing emotion recognition capabilities, along with the growing applications in the healthcare sector where reliable tools are required to monitor stress levels, anxiety, and mood patterns.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.90 Billion |

| Market Forecast in 2033 | USD 24.37 Billion |

| Market Growth Rate 2025-2033 | 26.80% |

India Affective Computing Market Trends:

Increasing adoption of ML

The rising utilization of ML is impelling the India affective computing market growth. To refine the ability to recognize emotions, companies and healthcare providers are incorporating sophisticated algorithms. A deeper comprehension of human emotions is made possible with the help of ML models that aid in improving the precision of voice recognition, facial expression analysis, and physiological data interpretation. Affective computing solutions are employed to enhance patient care, personalize user interactions, and boost learning opportunities. In order to determine if a customer is satisfied or frustrated, call centers are using ML-based affective computing techniques to analyze speech patterns and voice tones, enabling agents to respond appropriately. Additionally, marketers are adopting these technologies to monitor user behavior and develop emotionally responsive targeted advertising. ML applications in affective computing technologies are growing, as businesses place a higher priority on emotional insights and tailored engagement. According to the IMARC Group, the India ML market size is set to show a growth rate (CAGR) of 35.44% during 2025-2033.

To get more information on this market, Request Sample

Growing applications in mental health and wellness

The rising applications in mental health and wellness are offering a favorable India affective computing market outlook. Healthcare professionals are using emotion-sensing technology to improve patient care. Affective computing techniques are being included in mental health apps, treatment platforms, and virtual counseling systems to detect emotional states utilizing facial recognition, voice analysis, and physiological data. These technologies aid therapists and healthcare professionals in monitoring stress levels, anxiety, and mood patterns, allowing more rapid interventions and individualized treatment approaches. In addition, wellness apps employ affective computing to provide guided meditation, relaxation exercises, and cognitive behavioral therapy based on real-time emotional indicators. The increased emphasis on preventative healthcare is motivating enterprises to adopt emotion-tracking technologies to enhance stress management and emotional well-being. Companies are also collaborating with mental health experts to improve affective computing solutions, ensuring refined accuracy in identifying emotional responses. Apart from this, government agencies are making efforts to offer assistance to people with mental illnesses, thereby propelling the market growth. For example, the Indian Economic Survey 2023-24 discussed in detail mental health, its importance, and its effects on policy recommendations. It was also highlighted that as of March 2024, under the National Tele Mental Health Programme, 53 Tele MANAS cells across 34 states/union territories (UTs) were established to aid in augmenting mental well-being for all age groups, with more than 1600 trained counselors speaking over 20 languages and over 8.07 lakh calls having been managed since October 2022.

India Affective Computing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, components, and end use.

Technology Insights:

- Touch-based

- Touchless

The report has provided a detailed breakup and analysis of the market based on the technologies. This includes touch-based and touchless.

Components Insights:

- Hardware

- Sensors

- Cameras

- Storage Devices and Processors

- Others

- Software

- Analytics Software

- Enterprise Software

- Facial Recognition

- Gesture Recognition

- Speech Recognition

A detailed breakup and analysis of the market based on the components have also been provided in the report. This includes hardware (sensors, cameras, storage devices and processors, and others) and software (analytics software, enterprise software, facial recognition, gesture recognition, and speech recognition).

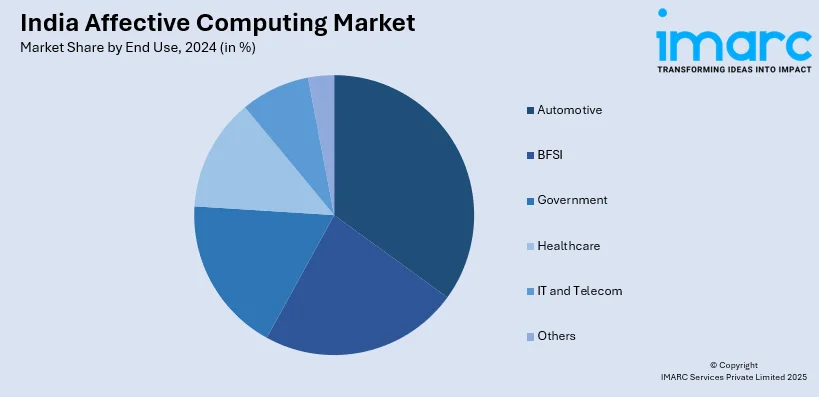

End Use Insights:

- Automotive

- BFSI

- Government

- Healthcare

- IT and Telecom

- Others

The report has provided a detailed breakup and analysis of the market based on the end uses. This includes automotive, BFSI, government, healthcare, it and telecom, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Affective Computing Market News:

- In September 2024, the Union Minister of Textiles, Shri Giriraj Singh, inaugurated the ‘VisioNxt Fashion Forecasting Initiative’ by the National Institute of Fashion Technology (NIFT), which included the India-specific Fashion Trend Book ‘Paridhi 24x25’ and a bilingual web portal. The fashion sector was set to gain from the trend insights provided by VisioNxt, utilizing artificial intelligence (AI) and emotional intelligence (EI), also known as affective computing.

- In May 2024, the Indian Institute of Technology (IIT) Mandi established the ‘Centre for Human-Computer Interaction’ aimed at healthcare and various other sectors. Its goal was to establish a top-tier center to cultivate science and technology within the swiftly advancing field of human-computer interaction (HCI). During the launch event, Prof. Uttama Lahiri, an Electrical Engineering professor at IIT Gandhinagar, highlighted the important impact of HCI in healthcare during her presentation titled ‘Witnessing the Power of HCI in Diagnostics, Rehabilitation, and Affective Computing.’ She emphasized how HCI, combined with wearables, could revolutionize diagnostics and rehabilitation for patients recovering from strokes and those with Parkinson's disease.

India Affective Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Touch-based, Touchless |

| Components Covered |

|

| End Uses Covered | Automotive, BFSI, Government, Healthcare, IT and Telecom, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India affective computing market performed so far and how will it perform in the coming years?

- What is the breakup of the India affective computing market on the basis of technology?

- What is the breakup of the India affective computing market on the basis of components?

- What is the breakup of the India affective computing market on the basis of end use?

- What is the breakup of the India affective computing market on the basis of region?

- What are the various stages in the value chain of the India affective computing market?

- What are the key driving factors and challenges in the India affective computing?

- What is the structure of the India affective computing market and who are the key players?

- What is the degree of competition in the India affective computing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India affective computing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India affective computing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India affective computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)