India Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

India Agribusiness Market Overview:

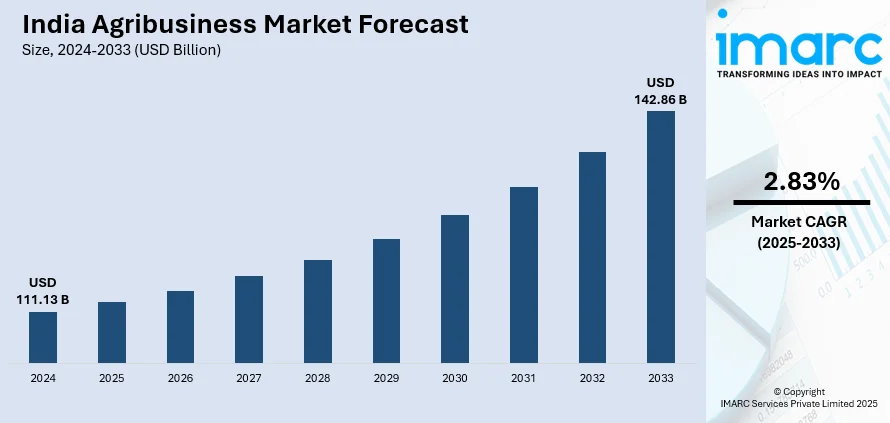

The India agribusiness market size reached USD 111.13 Billion in 2024. The market is projected to reach USD 142.86 Billion by 2033, exhibiting a growth rate (CAGR) of 2.83% during 2025-2033. Changing dietary patterns, including greater consumption of fruits, vegetables, dairy, and processed food items, are creating opportunities for agribusiness companies to broaden their product portfolios. Besides this, the government’s promotion of food processing clusters and agricultural export zones is contributing to the expansion of the India agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 111.13 Billion |

| Market Forecast in 2033 | USD 142.86 Billion |

| Market Growth Rate 2025-2033 | 2.83% |

India Agribusiness Market Trends:

Growing food demand

Rising food demand is a key driver of the market in India, as the country’s growing population is significantly increasing the need for diverse and nutritious food products. As per the datareportal, in January 2024, India's population was 1.44 Billion. India is facing consistent pressure to enhance agricultural output to meet the requirements of both rural and urban users. Changing dietary patterns, including greater consumption of fruits, vegetables, dairy, and processed food items, are creating opportunities for agribusiness companies to broaden their product portfolios. Additionally, the expanding middle class is willing to pay for higher-quality, packaged, and value-added food items, encouraging investments in food processing, storage, and distribution. The demand for ready-to-eat (RTE) and convenience food products is also supporting the growth of allied sectors like cold chain logistics and packaging. Rising food security requirements are fueling the adoption of advanced farming techniques, efficient supply chain solutions, and agritech innovations, ultimately making agribusiness in India a more integrated, technology-driven, and competitive sector. As a result, the industry is evolving from traditional farming practices to a more commercial, market-oriented system capable of catering to both domestic and international markets.

To get more information on this market, Request Sample

Rising government support through subsidies

Increasing government support through subsidies and schemes is impelling the India agribusiness market growth. Subsidies on seeds, fertilizers, and irrigation equipment lower input expenses, making modern farming techniques more affordable. Initiatives provide direct income support, while crop insurance schemes reduce financial risks, encouraging farmers to invest in better-quality inputs. Infrastructure development, including cold storage facilities, rural roads, irrigation projects, and modernized mandis, is strengthening the agricultural value chain by decreasing post-harvest losses and improving connectivity to domestic and export markets. The government’s promotion of food processing clusters and agricultural export zones is also opening new revenue streams for agribusiness players. Digital platforms for the national agriculture market (e-NAM) are streamlining trade and guaranteeing better price realization. Policies to boost mechanization are further increasing operational efficiency. Additionally, rising wheat procurement ensures stable income for farmers and supports food security goals. As of 22 May, government wheat procurement for the rabi marketing season of 2025-26 (April–June) exceeded 29.7 Million Tons (MT) in India, marking the highest level since the 2021-22 season, based on official statistics. Together, these measures are creating a robust ecosystem that is fostering growth, encouraging private investment, and transforming Indian agriculture into a more competitive sector.

India Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

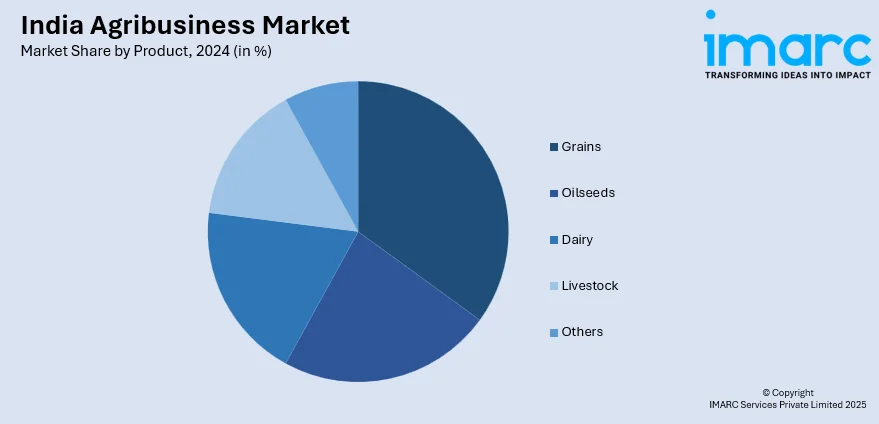

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Agribusiness Market News:

- In November 2024, Godrej Agrovet (GAVL), the prominent agribusiness company, established a strategic alliance with US-based Provivi to provide sustainable pheromone-based pest management solutions for rice and corn farmers in India. According to the contract, GAVL would disperse Provivi's YSB Eco-Dispenser to manage the yellow stem borer in rice farms. The firm also obtained exclusive commercialization rights in India for the FAW Eco-Dispenser, aimed at combating fall armyworm in maize.

- In August 2024, Accion, in collaboration with India-based VC firm Omnivore, led a USD 9.8 Million Series A funding round for Agrizy, a Bengaluru-based agribusiness platform that linked processors and buyers of non-perishable food products through a digital marketplace. Their cutting-edge platform for contract manufacturing was intended to optimize intricate, export-focused supply chains and tackle persistent challenges within the industry. This would aid rural economic growth, aligning with India’s wider agricultural reform objectives.

India Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the India agribusiness market on the basis of product?

- What is the breakup of the India agribusiness market on the basis of region?

- What are the various stages in the value chain of the India agribusiness market?

- What are the key driving factors and challenges in the India agribusiness market?

- What is the structure of the India agribusiness market and who are the key players?

- What is the degree of competition in the India agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)