India Agricultural Micronutrients Market Size, Share, Trends and Forecast by Type, Source, Application, Crop Type, and Region, 2025-2033

India Agricultural Micronutrients Market Overview:

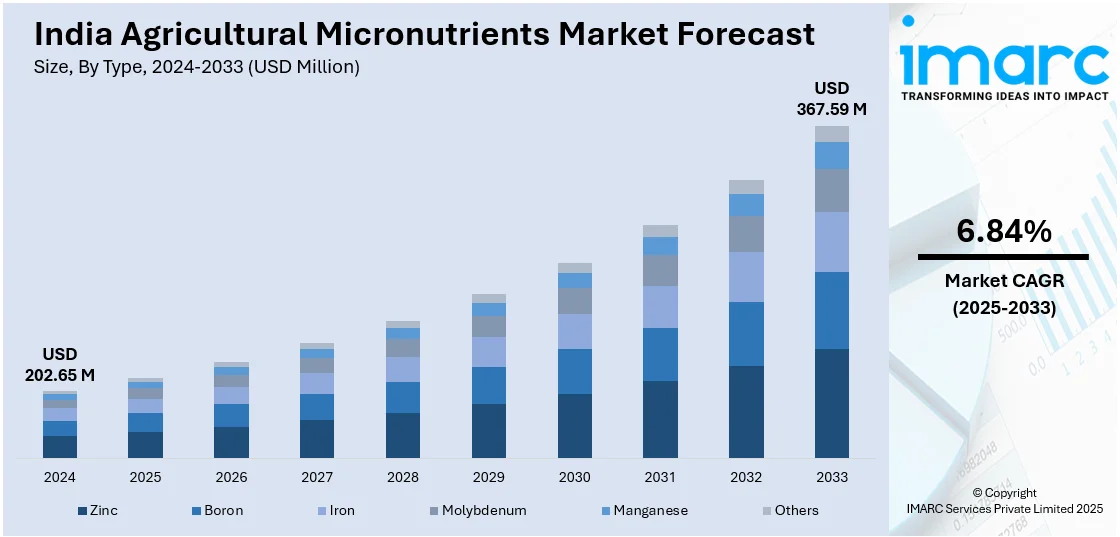

The India agricultural micronutrients market size reached USD 202.65 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 367.59 Million by 2033, exhibiting a growth rate (CAGR) of 6.84% during 2025-2033. The market is driven by declining soil fertility, increasing demand for high-yield crops, and government initiatives promoting balanced fertilization. Moreover, the rising awareness towards nutrient deficiencies, expanding precision farming, and the adoption of chelated micronutrients are further boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 202.65 Million |

| Market Forecast in 2033 | USD 367.59 Million |

| Market Growth Rate 2025-2033 | 6.84% |

India Agricultural Micronutrients Market Trends:

Rising Adoption of Precision Farming and Soil Testing Technologies

Precision farming is transforming Indian agriculture by optimizing micronutrient application and enhancing crop yields while reducing resource wastage. In order for farmers to implement focused and effective micronutrient remedies, advanced soil testing methods are essential in detecting nutrient deficits. According to the Indian Council of Agricultural Research (ICAR), more than 40% of Indian soil is deficient in vital micronutrients, including zinc, iron, and boron, raising serious concerns about declining soil fertility. As a result, the need for specialized fertilizer mixes made for certain soil types has increased. The Indian government’s Soil Health Card Scheme, which has tested over 120 million soil samples since 2015, is further encouraging balanced fertilizer use by providing farmers with precise nutrient insights. Furthermore, the precision agriculture market in India is expected to increase at a CAGR of 9.70% between 2025 and 2033, driving the need for specialist micronutrient solutions. As data-driven agricultural methods become more prevalent, the market for high-efficiency fertilizers, such as chelated minerals, is expanding rapidly. Industry giants, such as Coromandel International and Tata Chemicals, are investing extensively in sophisticated micronutrient formulations to meet the changing demands of precision farming, thereby assuring sustainability and increased agricultural output.

To get more information on this market, Request Sample

Increasing Demand for Organic and Bio-Based Micronutrients

The growing shift toward organic and sustainable farming is fueling the demand for bio-based micronutrients, which serve as eco-friendly alternatives to synthetic fertilizers. Farmers are increasingly incorporating organic micronutrient-enriched composts, biofertilizers, and chelated organic formulations to enhance soil fertility and crop productivity. The rise of organic farming practices is a key driver, with India’s domestic organic farm products market having grown 20% year-on-year in fiscal year 2021 (APEDA, 2024), boosting the demand for natural micronutrient sources like seaweed extracts, humic acid, and bio-chelates. Furthermore, government regulations supporting sustainable agriculture, such as the National Mission for Sustainable Agriculture (NMSA), encourage farmers to use organic micronutrients to increase soil health and minimize their dependency on chemical inputs. Consumer interest towards residue-free crops is also driving this trend, as food safety and pesticide-free produce become more widely known. In response to the rising demand, major industry players, such as UPL Limited and Rashtriya Chemicals & Fertilizers (RCF), are extending their organic micronutrient portfolios and investing in novel formulations to promote sustainable farming methods while meeting changing agricultural demands.

India Agricultural Micronutrients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, source, application, and crop type.

Type Insights:

- Zinc

- Boron

- Iron

- Molybdenum

- Manganese

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes zinc, boron, iron, molybdenum, manganese, and others.

Source Insights:

- Chelated

- Non-Chelated

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes chelated and non-chelated.

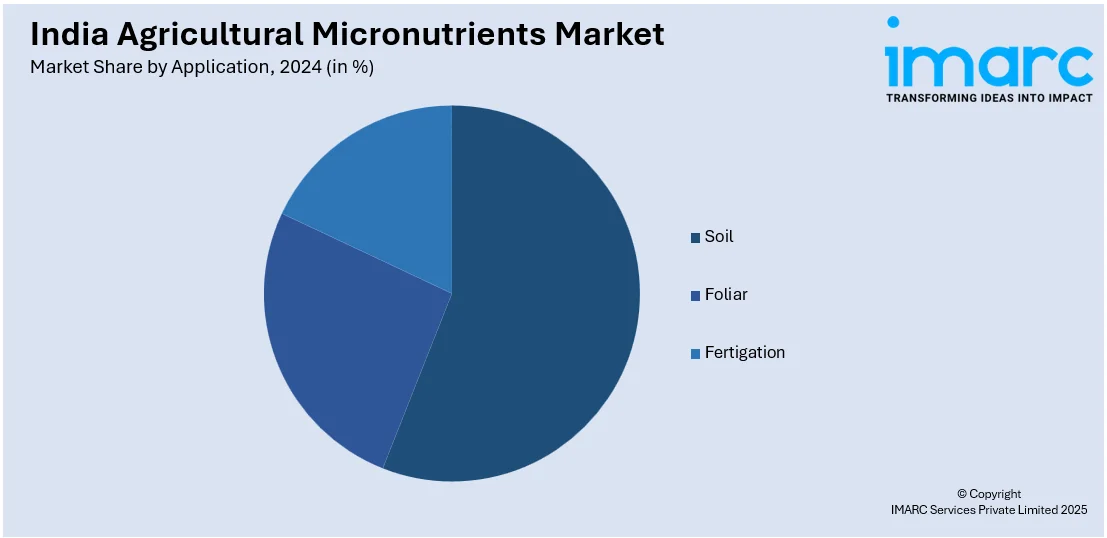

Application Insights:

- Soil

- Foliar

- Fertigation

The report has provided a detailed breakup and analysis of the market based on the application. This includes soil, foliar, and fertigation.

Crop Type Insights:

- Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes cereals, pulses and oilseeds, fruits and vegetables, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Agricultural Micronutrients Market News:

- October 2024: The Indian government approved the continuation of supplying fortified rice under all its schemes, including the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), until December 2028. This initiative, fully funded by the Centre, aims to combat anemia and micronutrient deficiencies by adding Fortified Rice Kernels containing iron, folic acid, and Vitamin B12 to regular rice. The program's phased implementation began in March 2024.

- May 2024: IFFCO gained a central government license to market two new products: nano liquid zinc and nano liquid copper. These products seek to reduce zinc and copper deficits in agricultural crops while increasing yield. IFFO’s Nano formulations are intended to combat hunger, boost crop output and quality, and pave the road for farmer wealth and agricultural sustainability.

- December 2023: Rallis India Limited introduced NAYAZINC, a unique, patented zinc fertilizer for soil application. NAYAZINC is a completely FCO-compliant product that offers plants with optimal zinc nutrition at a fraction of the cost of Zinc Sulphate. It also includes 9% magnesium, which promotes photosynthesis during the early development stage.

India Agricultural Micronutrients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Zinc, Boron, Iron, Molybdenum, Manganese, Others |

| Sources Covered | Chelated, Non-Chelated |

| Applications Covered | Soil, Foliar, Fertigation |

| Crop Types Covered | Cereals, Pulses and Oilseeds, Fruits and Vegetables, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India agricultural micronutrients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India agricultural micronutrients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India agricultural micronutrients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural micronutrients market in India was valued at USD 202.65 Million in 2024.

The India agricultural micronutrients market is projected to exhibit a CAGR of 6.84% during 2025-2033, reaching a value of USD 367.59 Million by 2033.

The key drivers of India’s agricultural micronutrients market include declining soil fertility resulting from the overuse of chemical fertilizers, increased awareness among farmers about micronutrient deficiencies, and strong government support through initiatives such as the Soil Health Card scheme. Rising demand for high-yield crops and precision farming technologies also fuels market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)