India Agricultural Tires Market Size, Share, Trends and Forecast by Vehicle Type, Demand Category, and Region, 2025-2033

India Agricultural Tires Market Overview:

The India agricultural tires market size reached USD 270.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 400.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The market is growing due to increased farm mechanization and rising tractor sales. The demand is driven by government subsidies, precision farming adoption, and the need for durable, high-traction tires. Advancements in radial tires and sustainable materials further support market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 270.0 Million |

| Market Forecast in 2033 | USD 400.0 Million |

| Market Growth Rate (2025-2033) | 4.2% |

India Agricultural Tires Market Trends:

Rising Adoption of Radial Tires in Modern Agricultural Machinery

The India agricultural tires market is currently witnessing a surge in demand for radial tires mainly because of some robust features such as exceptional durability, fuel efficacy, and better traction. As compared to conventional bias-ply tires, radial tires provide a larger footprint, thus minimizing soil compaction and bringing about improved crop yields. The increased mechanization of agriculture in India, enabled by the government's broadening program and rising farm incomes, may hasten a transition away from conventional tires to newer radial alternatives. For instance, as per industry reports, a steady growth of 5% during FY 2025 was observed in Indian agriculture sector, with a 20% share of gross value added. Moreover, the agricultural income elevated to 5.23% per year. Besides, tractors, harvesters, and other farm equipment manufacturers are integrating radial technology to enhance operational efficiency and reduce maintenance costs. Furthermore, advancements in tire manufacturing, including self-cleaning tread designs and reinforced sidewalls, are increasing the product adoption. As farmers seek to maximize productivity while minimizing fuel consumption, the preference for high-performance radial tires continues to grow. The expansion of domestic tire manufacturers and the entry of global players into the Indian market further contribute to increased availability and affordability of these technologically advanced tires.

.webp)

To get more information on this market, Request Sample

Increasing Demand for Sustainable and High-Durability Tires

Sustainability is becoming a key focus in the India agricultural tires market, with rising demand for eco-friendly and long-lasting tire solutions. Manufacturers are incorporating advanced rubber compounds, bio-based materials, and low rolling resistance designs to enhance tire life while reducing environmental impact. As Indian farmers invest in modernized agricultural equipment, there is a greater emphasis on tires that offer extended service life, resistance to wear, and improved load-carrying capacity. The introduction of puncture-resistant and weather-adaptive tire technologies is also gaining traction, catering to diverse agricultural terrains and climatic conditions. Additionally, increasing awareness about tire retreading and recycling solutions is promoting sustainable practices within the sector. For instance, in 2024, the Government of India mandated EPR regulations for tire manufacturers under which they are advised to recycle waste tires, with targets set to 70% for 2023 to 2024 and 100% from 2024 to 2025 onwards. As a result, companies are expanding their research efforts to develop tires with higher fuel efficiency, better soil protection, and reduced emissions. With the agricultural sector embracing mechanization, the demand for durable and environmentally responsible tires is set to grow steadily in India.

India Agricultural Tires Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type and demand category.

Vehicle Type Insights:

- Tractors

- Combine Harvesters

- Trailers

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes tractors, combine harvesters, trailers, and others.

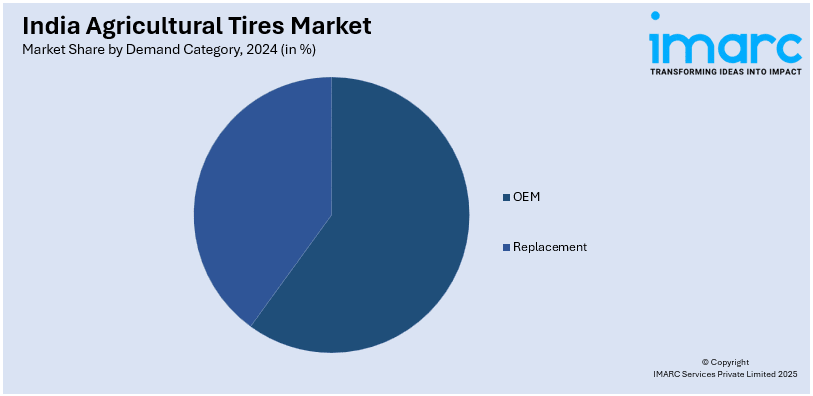

Demand Category Insights:

- OEM

- Replacement

A detailed breakup and analysis of the market based on the demand category have also been provided in the report. This includes OEM, and replacement.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Agricultural Tires Market News:

- In June 2024, TVS Srichakra unveiled its latest Steel Belted Agro Industrial Radial Tyres. This product is developed for backhoe loaders, telescopic handlers, and compact wheel loaders deployed in industrial as well as agricultural applications.

- In November 2024, BKT, an India-based agriculture tire manufacturer, unveiled its new four agriculture tires, named Agrimax Procrop, Agrimax ProHarvest, Agrimax Spargo SB, and Ridemax Frost, that are developed to aid farmers in a comprehensive range of modern applications.

India Agricultural Tires Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Tractors, Combine Harvesters, Trailers, Others |

| Demand Categories Covered | OEM, Replacement |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India agricultural tires market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India agricultural tires market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India agricultural tires industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India agricultural tires market reached a value of USD 270.0 Million in 2024.

The India agricultural tires market is projected to reach USD 400.0 Million by 2033, growing at a CAGR of 4.2% during 2025-2033.

India agricultural tires market growth is fueled by increasing farm mechanization, rising tractor sales, government support for agriculture, and the need for durable and efficient tires to enhance productivity and reduce downtime in farming operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)