India Agriculture Drones Market Size, Share, Trends and Forecast by Offering, Component, Farming Environment, Application, and Region, 2025-2033

India Agriculture Drones Market Overview:

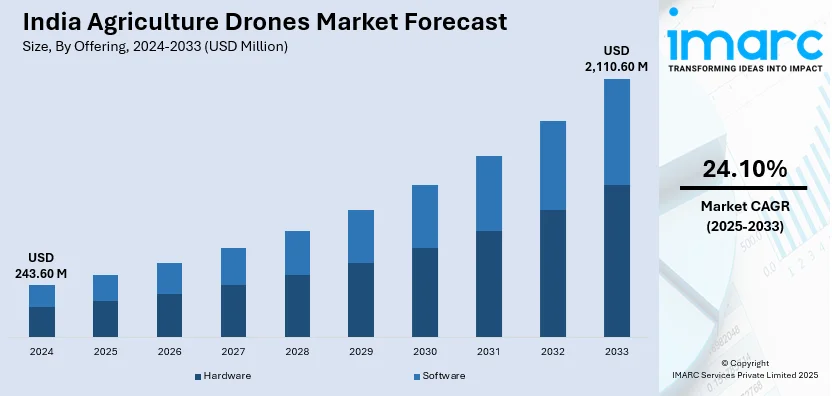

The India agriculture drones market size reached USD 243.60 Million in 2024. The market is expected to reach USD 2,110.60 Million by 2033, exhibiting a growth rate (CAGR) of 24.10% during 2025-2033. The market growth is attributed to government support, rising adoption of precision farming, labor shortages, and technological advancements. Moreover, increasing investment by agri-tech startups and partnerships with drone service providers are further accelerating adoption.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of offering, the market has been divided into hardware (fixed wing, rotary wing, and hybrid wing), and software (data management software, imaging software, data analytics software, and others).

- On the basis of component, the market has been divided into controller systems, propulsion systems, cameras, batteries, navigation systems, and others.

- On the basis of farming environment, the market has been divided into indoor and outdoor.

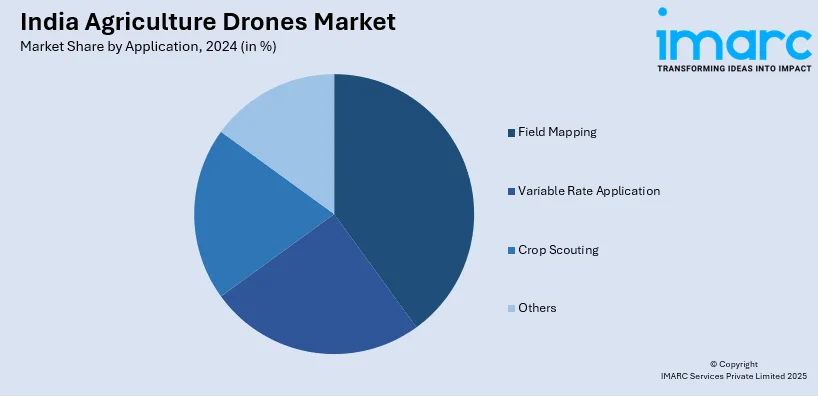

- On the basis of application, the market has been divided into field mapping, variable rate application, crop scouting, and others.

Market Size and Forecast:

- 2024 Market Size: USD 243.60 Million

- 2033 Projected Market Size: USD 2,110.60 Million

- CAGR (2025-2033): 24.10%

India Agriculture Drones Market Trends:

Government Support and Policies

The Indian government's active support for agricultural innovation plays a key role in fueling the India agriculture drones market share. Initiatives like the “Sub-Mission on Agricultural Mechanization” (SMAM) and financial incentives for drone adoption promote modern farming technologies. Subsidies, pilot projects, and the inclusion of drones in the PM-Kisan scheme encourage farmers to adopt this advanced solution. The liberalization of drone regulations under the Drone Rules 2021 has also simplified usage, licensing, and manufacturing processes. These supportive policies create a favorable ecosystem for startups, manufacturers, and service providers, significantly accelerating drone adoption across India’s diverse and expanding agricultural sector. This proactive government backing is fostering innovation and encouraging private sector participation in agri-tech development. For instance, in October 2024, Amber Wings introduced the 'Vihaa' agricultural drone, developed by IIT Madras, to transform farming practices in India. Recently certified by the DGCA, the drone can spray crops seven times faster than traditional methods, saving farmers valuable time and resources. Prof. Satya Chakravarthy emphasized its potential to revolutionize agribusiness and promote widespread access to advanced technology, with plans for future innovations in drone solutions across various sectors.

To get more information on this market, Request Sample

Technological Advancements and Startup Ecosystem

As per the India agriculture drones market forecast, India’s vibrant startup ecosystem is fueling rapid innovation in agricultural drone technology. Startups are developing cost-effective, easy-to-use drones tailored for small and marginal farmers. Advances in AI, machine learning, GPS, and data analytics are being integrated into drones, enabling precise crop health assessments and actionable insights. Collaborations between agritech firms, research institutions, and government bodies further drive product development and market reach. Increased funding, incubation support, and awareness campaigns are helping bridge the gap between technology and rural adoption. These innovations are making drones more accessible and efficient thereby creating a positive India agriculture drones market outlook. For instance, in August 2024, Raminfo Limited launched Kisan Drones Private Limited, aiming to transform agriculture with innovative drone services in India. The initiative plans to establish 100 centers across Andhra Pradesh, Telangana, Rajasthan, Madhya Pradesh, and Odisha within two years. Kisan Drones will offer farmers advanced drone technology, training, and support, while creating over 1,000 new entrepreneurs. This program is set to enhance productivity and foster entrepreneurship in rural areas.

Digital Transformation of Indian Agriculture

Indian agriculture is experiencing an immense digital transformation with the help of drones, which are proving to be the driving force behind the expansion of agriculture drones industry size in India. Farmers are going more and more toward digital platforms and IoT devices that operate in tandem with farming drones to build end-to-end farming ecosystems. This evolution involves the incorporation of cloud-based data storage systems, mobile applications for real-time monitoring, and automated reporting mechanisms that assist farmers in making data-driven decisions. The market forecast suggests sustained growth as more and more farmers realize the importance of digital agriculture solutions. Advanced analytics capabilities are facilitating predictive farming practices, which permit farmers to foresee crop diseases, optimize irrigation schedules, and predict harvest yields more accurately. The convergence of multiple technologies is producing synergistic effects that compound the advantages of drone adoption in Indian agriculture.

Region-Specific Drone Solutions for Local Agricultural Practices

Diversity of Indian agricultural production has created region-specific drone solutions that are customized to local farming practices and crop types. Drones are developing customized drones for precise crops like rice paddies in the eastern states, wheat farms in the northern states, and cotton fields in central India. agriculture drones industry in India is experiencing more customization with respect to payload capacity, endurance, and sensor configuration to suit different regional needs. Local collaboration among farm equipment makers and farm cooperatives is enabling the creation of solutions that aim at addressing problems specific to farmers in particular geographic regions. This shift towards regionalization is enhancing adoption rates since farmers discover drones that are specifically tailored to address their respective farming conditions and crop management requirements.

Some of the other trends in the market include,

- Environmental-friendly Drone Design and Battery Sustainability: Companies are working on solar-powered recharging stations and biodegradable materials to minimize impact. Energy-conserving battery systems are being crafted to maximize flight hours and reduce carbon footprint. Green materials are more commonly used in building drones to meet eco-friendly farming practices.

- Farmer Training or Skill Development Initiatives: In-depth training modules are being formulated to train farmers in the use of drones, maintenance, and interpretation of data. Rural youth are being trained to work as drone service providers for generating local employment opportunities. This is augmenting the agriculture drones industry share in India. Certification programs are setting guidelines for drone operators in agricultural areas.

- IoT Deployments: Drones are being added with soil sensors, weather stations, and irrigation systems to develop networked farming environments. The sharing of real-time data between different agricultural devices is facilitating automated farming decisions. Smart farming platforms are integrating drone information with other farm inputs to realize holistic farm management.

Growth Drivers of the India Agriculture Drones Market:

The market is experiencing robust growth driven by the government support through various initiatives and subsidies is creating a favorable environment for drone adoption among farmers. Rising labor shortages in agricultural sectors are compelling farmers to seek automated solutions, making drones an attractive alternative, further increasing the agriculture drones demand in Indian market. The market analysis indicates sustained growth as technological advancements continue to make drones more efficient and cost-effective. Increasing awareness about precision farming benefits is driving demand for drone-based crop monitoring and management solutions. The growing need for food security in a country with a large population is pushing agricultural modernization efforts that include drone technology adoption.

Opportunities in the India Agriculture Drones Market:

Significant opportunities exist in expanding drone services to small and marginal farmers who represent the majority of India's agricultural community. As per the India agriculture drones market forecast, the development of drone-as-a-service models can make advanced technology accessible without requiring large capital investments from individual farmers. Integration opportunities with existing agricultural supply chains and cooperatives present pathways for scaled adoption across rural communities. Export potential for Indian-manufactured agricultural drones to other developing countries with similar agricultural challenges offers market expansion possibilities. Partnerships between technology companies and financial institutions can create innovative financing solutions that accelerate market penetration. The emerging potential for data analytics and artificial intelligence services built on drone-collected agricultural data represents a significant value-added opportunity.

Challenges in the India Agriculture Drones Market:

According to the India agriculture drones market analysis, the market faces several challenges that need to be addressed. Limited awareness and technical expertise among rural farmers create barriers to widespread adoption of drone technology. High initial costs and maintenance expenses can be prohibitive for small-scale farmers operating on tight margins. Regulatory complexities and licensing requirements may discourage some potential users from adopting drone technology. Infrastructure limitations in rural areas, including poor internet connectivity and limited charging facilities, pose operational challenges. Weather dependency and seasonal variations in agricultural activities can affect the consistent utilization of drone services throughout the year.

India Agriculture Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on offering, component, farming environment, and application.

Offering Insights:

- Hardware

- Fixed Wing

- Rotary Wing

- Hybrid Wing

- Software

- Data Management Software

- Imaging Software

- Data Analytics Software

- Others

The report has provided a detailed breakup and analysis of the market based on the offering. This includes hardware (fixed wing, rotary wing, and hybrid wing), and software (data management software, imaging software, data analytics software, and others).

Component Insights:

- Controller Systems

- Propulsion Systems

- Cameras

- Batteries

- Navigation Systems

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes controller systems, propulsion systems, cameras, batteries, navigation systems, and others.

Farming Environment Insights:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the farming environment have also been provided in the report. This includes indoor and outdoor.

Application Insights:

- Field Mapping

- Variable Rate Application

- Crop Scouting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes field mapping, variable rate application, crop scouting, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Agriculture Drones Market News:

- In July 2025, the Government of India launched the enhanced Direct Benefit Transfer (DBT) Platform Version 2.0 and the NaMo Drone Didi Portal to modernize agricultural subsidy distribution and promote mechanization. The NaMo Drone Didi Yojana, a flagship initiative, empowers women from Self-Help Groups (SHGs) by training them to operate drones for agricultural tasks such as spraying fertilizers and pesticides.

- In June 2025, Garuda Aerospace inaugurated India's first Agri-Drone Indigenization Facility in Thalambur, Chennai. This 35,000-square-foot facility is dedicated to the design, manufacturing, and testing of unmanned aerial systems (UAS) tailored for agricultural applications. The launch event featured the unveiling of 300 Centres of Excellence (CoEs) and the DGCA-approved "Train the Trainer" (TTT) drone skilling program.

- In September 2024, Drone Destination and DeHaat announced a strategic partnership to integrate drone technology into Indian agriculture. The partnership seeks to improve agricultural efficiency and sustainability by delivering drone-based spraying solutions, while also expanding the reach of DeHaat’s portfolio of seeds, fertilizers, and pesticides to rural farming communities in India. Through this initiative, over 2.7 Million farmers are expected to benefit from enhanced productivity and sustainable farming practices.

- In February 2025, Skylark Drones, a leading drone solutions startup, launched DMO-AG at the Krishi Darshan Expo in Hisar. This first-of-its-kind software platform is expected to revolutionize the management and operation of agricultural drones throughout India as the country gets ready for exponential growth.

- In July 2024, Optiemus Unmanned Systems (OUS) introduced its latest collection of locally designed and produced drones for agricultural and mapping purposes during the 5th Drone International Expo at Pragati Maidan, New Delhi.

India Agriculture Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Components Covered | Controller Systems, Propulsion Systems, Cameras, Batteries, Navigation Systems, Others |

| Farming Environments Covered | Indoor, Outdoor |

| Applications Covered | Field Mapping, Variable Rate Application, Crop Scouting, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India agriculture drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India agriculture drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India agriculture drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India agriculture drones market was valued at USD 243.60 Million in 2024.

The India agriculture drones market is projected to exhibit a CAGR of 24.10% during 2025-2033, reaching a value of USD 2,110.60 Million by 2033.

The India agriculture drones market is driven by expanding precision farming, rising labor shortages, and increasing need for crop monitoring. Government subsidies and pilot programs support widespread adoption. Farmers use drones for spraying, seeding, and data collection. Technological advancements, affordability, and demand for higher yields further accelerate market growth across rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)