India AI in Agriculture Market Size, Share, Trends and Forecast by Offering, Technology, Application, and Region, 2025-2033

India AI in Agriculture Market Overview:

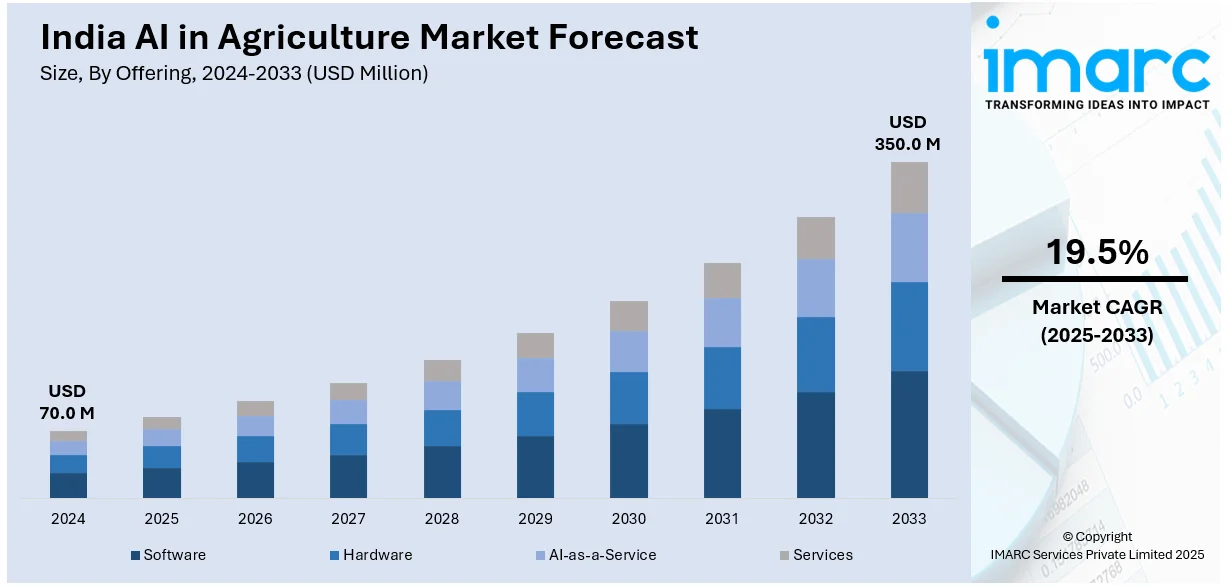

The India AI in agriculture market size reached USD 70.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 350.0 Million by 2033, exhibiting a growth rate (CAGR) of 19.5% during 2025-2033. The market is driven by the need for sustainable farming, rising food demand, and government initiatives promoting digital agriculture. Technological advancements, such as AI-powered precision farming and supply chain optimization, along with increasing agritech startup activity, are key factors accelerating adoption and the India AI in agriculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 70.0 Million |

| Market Forecast in 2033 | USD 350.0 Million |

| Market Growth Rate (2025-2033) | 19.5% |

India AI in Agriculture Market Trends:

Adoption of AI-Driven Precision Farming Techniques

The significant shift toward precision farming, driven by the need for sustainable and efficient agricultural practices is majorly driving the India AI in agriculture market growth. A research report from the IMARC Group indicates that the smart agriculture market in India was valued at USD 714.1 Million in 2024. It is projected to grow to USD 3,837.6 Million by 2033, reflecting a compound annual growth rate (CAGR) of 20.54% from 2025 to 2033. Artificial intelligence (AI) powered technologies, such as drones, Internet of Things (IoT) sensors, and satellite imagery, are being adopted to monitor crop and soil health as well as weather systems in real utilized. Such innovations will enable farmers to make data-driven decisions and optimize the use of water, fertilizers, and pesticides. AI algorithms analyze large volumes of data to offer actionable insights, enabling waste reduction and increased crop yields. This movement is aided further by initiatives launched by the Indian government, such as the Digital India campaign and subsidies for advanced farmland equipment. In addition, AI solutions (tailor-made for small and marginal farmers) that offer personalized recommendations at cost-effective prices are making their way to the firms via agritech companies and startups. As a result, precision farming is an essential instrument of transformation in India's agriculture that solves expositions to climate change and food security.

To get more information on this market, Request Sample

Rise of AI-Powered Agri Marketplaces and Supply Chain Solutions

The proliferation of AI-powered agri marketplaces and supply chain platforms is creating a positive India AI in agriculture market outlook. These platforms leverage AI to connect farmers directly with buyers, eliminating intermediaries and ensuring fair pricing. AI algorithms analyze market demand, predict price fluctuations, and provide farmers with insights on the best time to sell their produce. On 17th September 2024, the Indian Government announced plans to invest INR 6,000 crore (approximately USD 731.71 Million) in smart precision farming for the financial years 2024–25 to 2028–29. The initiative will leverage artificial intelligence, drones, the Internet of Things, and data analytics to improve crop yield of over 15,000 acres, covering approximately 60,000 farmers. Also, a Smart Precision Horticulture Programme under the MIDH scheme to encourage technology-driven practices for site-specific needs through the setting up of 22 Planting and Farming Development Centres (PFDCs). This will enrich the Indian agricultural ecosystem through the employment of AI, especially in fiber crops and smart farming infrastructure aided by the Agriculture Infrastructure Fund. Additionally, AI is being used to optimize logistics and reduce post-harvest losses, which present significant challenges for the agricultural sector in India. For example, Artificial intelligence-enabled cold chain management systems ensure that perishables are kept and transported under the right conditions. This change is already being led by several businesses that are integrating AI into their operations to the advantage of producers and consumers alike. Indeed, this initiative is increasing the income earned by farmers and making the management of the agricultural supply chain more efficient, transparent, and resilient.

India AI in Agriculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on offering, technology, and application.

Offering Insights:

- Software

- Hardware

- AI-as-a-Service

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes software, hardware, AI-as-a-service, and services.

Technology Insights:

- Machine Learning

- Computer Vision

- Predictive Analytics

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes machine learning, computer vision, and predictive analytics.

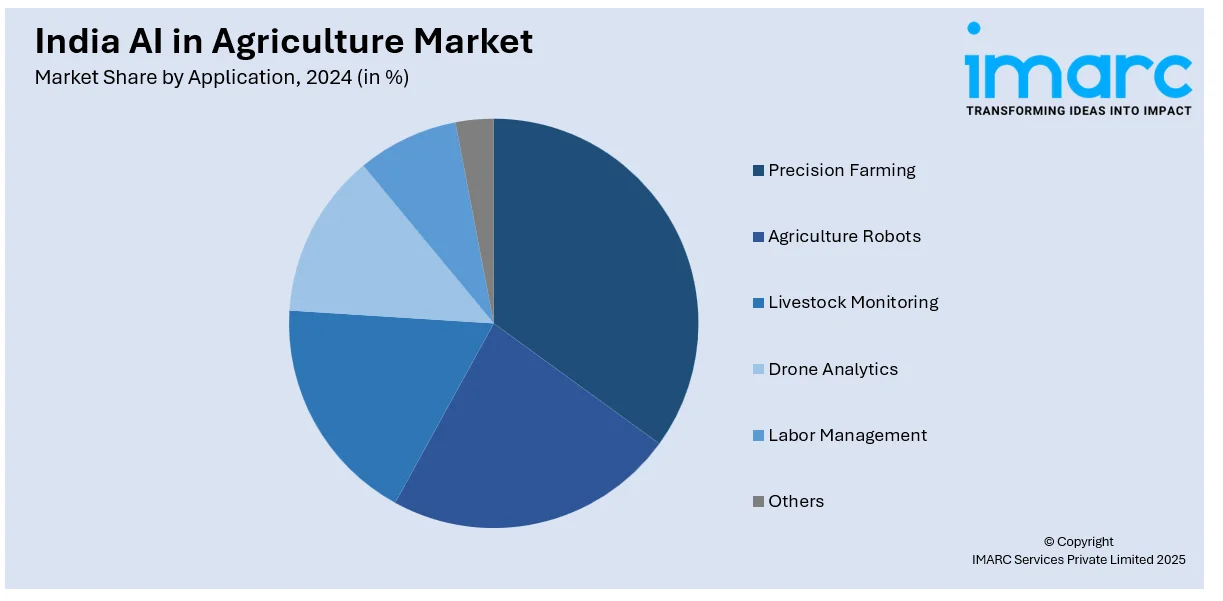

Application Insights:

- Precision Farming

- Agriculture Robots

- Livestock Monitoring

- Drone Analytics

- Labor Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes precision farming, agriculture robots, livestock monitoring, drone analytics, labor management, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India AI in Agriculture Market News:

- July 18, 2024: Google launched its AI-powered service called Agricultural Landscape Understanding (ALU) in India, based on high-res satellite images and machine learning. It provides farm-level insights into drought preparedness, irrigation practices, crop types, and market access. This Google Cloud-native tool is linked with India’s AgriStack, which simplifies data-based agriculture and is now used by customers including Ninjacart, Skymet, and IIT Bombay. This stems a great step in deploying AI in India's agriculture sector, enhancing productivity and decision-making for farmers across the nation.

- April 16, 2024: Cropin Technology launched a generative AI system called Aksara to support climate-smart agriculture for nine key crops, including rice, maize, and millet, among others, in five countries in the Indian subcontinent. Aksara is driven by Mistral’s foundational model, which is designed as an open-source microlanguage model (µ-LM) that delivers agronomic input suggestions and climate advisory to specific agro-climatic situations. Targeted towards benefitting smallholder farmers, Aksara adds to India's growing AI agriculture landscape by enabling scalable, tech-led solutions that foster climate resiliency and help increase productivity.

India AI in Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Software, Hardware, AI-as-a-Service, Services |

| Technologies Covered | Machine Learning, Computer Vision, Predictive Analytics |

| Applications Covered | Precision Farming, Agriculture Robots, Livestock Monitoring, Drone Analytics, Labor Management, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India AI in agriculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India AI in agriculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India AI in agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The AI in agriculture market in India was valued at USD 70.0 Million in 2024.

The AI in agriculture market in India is projected to reach USD 350.0 Million by 2033, exhibiting a CAGR of 19.5% during 2025-2033.

The India AI in agriculture market is driven by the need for sustainable farming, increasing food demand, and growing support from government-led digital agriculture programs. The adoption of AI-powered tools in precision farming, crop monitoring, and post-harvest supply chain management is also accelerating growth. Investments in agritech startups and the availability of AI tools designed for smallholder farmers are expanding reach and impact. Innovations in satellite imaging, drone analytics, and predictive data models are helping farmers make better decisions, reduce input costs, and increase yield.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)