India AI in Medical Diagnostics Market Size, Share, Trends and Forecast by Component, Application, End User, and Region, 2025-2033

India AI in Medical Diagnostics Market Overview:

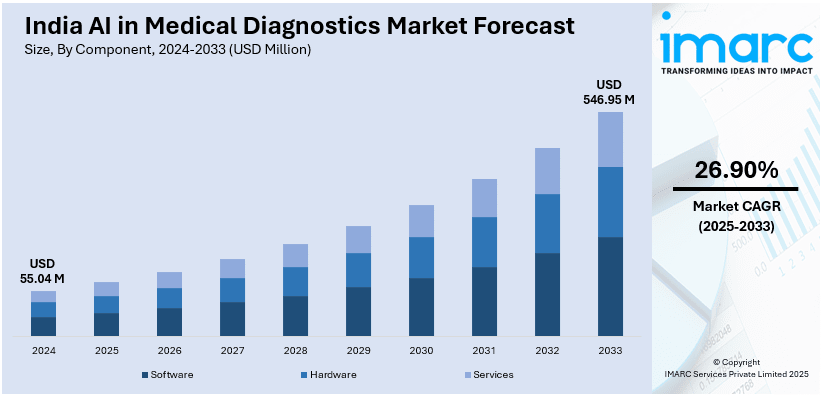

The India AI in medical diagnostics market size reached USD 55.04 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 546.95 Million by 2033, exhibiting a growth rate (CAGR) of 26.90% during 2025-2033. The India AI in medical diagnostics market share is expanding, driven by the growing reliance of healthcare providers on artificial intelligence (AI)-based tools to enhance diagnostic accuracy and speed, along with the increasing focus on digital transformation in healthcare, which is encouraging companies to introduce modern platforms that incorporate new technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 55.04 Million |

| Market Forecast in 2033 | USD 546.95 Million |

| Market Growth Rate 2025-2033 | 26.90% |

India AI in Medical Diagnostics Market Trends:

Increasing demand for early disease detection

The rising demand for early disease detection is impelling the India AI in medical diagnostics market growth. Healthcare providers rely on AI-oriented tools to improve diagnostic accuracy and speed. AI algorithms examine extensive amounts of patient data, such as medical images, genetic data, and clinical records, to detect trends and uncover possible health problems at an early stage. This capability is particularly valuable in identifying conditions like cancer, cardiovascular diseases, and neurological disorders where early diagnosis significantly enhances treatment outcomes. AI-based imaging systems refine radiology by identifying subtle abnormalities that might be overlooked in traditional scans, enabling doctors to make faster and more precise decisions. The increasing adoption of AI in diagnostics is encouraging healthcare providers to invest in specialized diagnostic centers and facilities equipped with AI, expanding access to better diagnostic services. In December 2024, NURA, a cutting-edge diagnostic initiative from Fujifilm Healthcare and Dr. Kutty’s Healthcare, was prepared to launch its AI-focused health screening center in Calicut, India. The facility was set up to screen as many as 50 individuals daily, providing screening test experiences with modern tools to enable quicker and more accurate identification of illnesses at their earliest stages.

To get more information on this market, Request Sample

Rising adoption of digital health technologies

The increasing employment of digital health technologies is offering a favorable India AI in medical diagnostics market outlook. Digital health platforms, such as electronic health records (EHRs), remote patient monitoring systems, and telemedicine, produce large quantities of patient data. AI algorithms examine this information to detect patterns, identify risk factors, and provide early warnings for potential medical conditions. This integration enables doctors to make faster and more informed decisions, improving patient outcomes. AI-based diagnostic solutions are also enhancing virtual consultations by providing real-time insights based on patient data. Additionally, AI-oriented wearable devices monitor vital signs, helping to identify irregularities that may require medical attention. The growing focus on digital transformation in healthcare is encouraging companies to develop modern devices and platforms that incorporate new technologies. In December 2024, Aciana, a well-known health tech company based in India, unveiled a unique integrated healthcare platform, Ciana, which utilized advanced genetic insights and AI-oriented analytics. The firm offered AI-driven facial scans that could assess 25 essential health metrics within only 30 seconds. Aiming to transform the healthcare experience in India, the platform was crafted to fill significant voids in healthcare delivery by providing personalized, predictive, and accurate care.

India AI in Medical Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, application, and end user.

Component Insights:

- Software

- Hardware

- Services

The report has provided a detailed breakup and analysis of the market based on the components. This includes software, hardware, and services.

Application Insights:

- In Vivo Diagnostics

- In Vitro Diagnostics

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes in vivo diagnostics and in vitro diagnostics.

End User Insights:

- Hospitals

- Diagnostics Imaging Centers

- Diagnostic Laboratories

- Others

The report has provided a detailed breakup and analysis of the market based on the end users. This includes hospitals, diagnostics imaging centers, diagnostic laboratories, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India AI in Medical Diagnostics Market News:

- In March 2025, Wipro GE Healthcare launched the Versana Premier R3, an AI-oriented ultrasound solution. The advanced ultrasound system is produced at the firm's PLI facility in Bengaluru, bolstering its dedication to the Make in India initiative. The device incorporates AI-based automation and productivity tools to streamline workflows, improve imaging features, and assist clinicians in providing more tailored and preventive care.

- In February 2025, Virohan, India’s top healthcare EdTech platform, teamed up with Mahajan Imaging & Labs, a leader in diagnostics, to provide placement opportunities for students. The partnership aims to bridge the divide between education and healthcare by offering students practical experience with modern AI-focused medical imaging and diagnostic tools.

India AI in Medical Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Hardware, Services |

| Applications Covered | In Vivo Diagnostics, In Vitro Diagnostics |

| End Users Covered | Hospitals, Diagnostics Imaging Centers, Diagnostic Laboratories, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India AI in medical diagnostics market performed so far and how will it perform in the coming years?

- What is the breakup of the India AI in medical diagnostics market on the basis of component?

- What is the breakup of the India AI in medical diagnostics market on the basis of application?

- What is the breakup of the India AI in medical diagnostics market on the basis of end user?

- What is the breakup of the India AI in medical diagnostics market on the basis of region?

- What are the various stages in the value chain of the India AI in medical diagnostics market?

- What are the key driving factors and challenges in the India AI in medical diagnostics market?

- What is the structure of the India AI in medical diagnostics market and who are the key players?

- What is the degree of competition in the India AI in medical diagnostics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India AI in medical diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India AI in medical diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India AI in medical diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)