India Air Ambulance Services Market Size, Share, Trends and Forecast by Type, Service Provider, Service, and Region, 2025-2033

India Air Ambulance Services Market Size and Share:

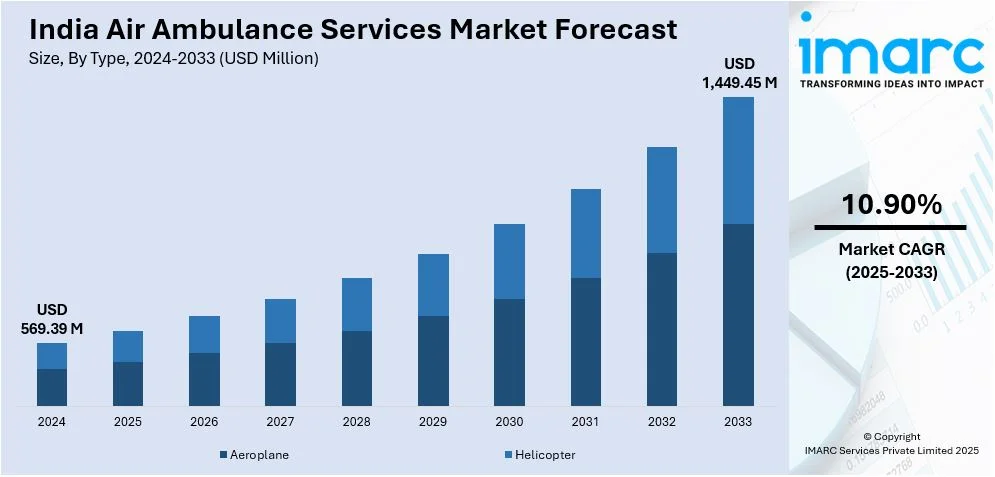

The India air ambulance services market size reached USD 569.39 Million in 2024. The market is expected to reach USD 1,449.45 Million by 2033, exhibiting a growth rate (CAGR) of 10.90% during 2025-2033. The market growth is attributed to the increasing demand for rapid emergency medical evacuation services driven by rising trauma incidents and cardiac emergencies, enhanced healthcare infrastructure development facilitating better emergency response systems, significant growth in medical tourism requiring specialized patient transport services, and heightened public awareness about emergency medical services availability and benefits.

Market Insights:

- On the basis of region, the market has been divided into North, South, East, and West India.

- On the basis of type, the market has been divided into aeroplane and helicopter.

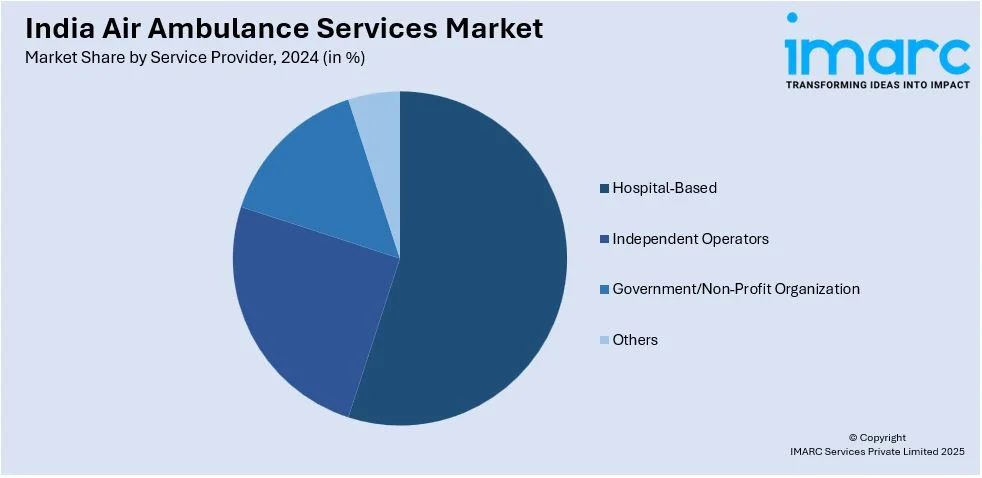

- On the basis of service provider, the market has been divided into hospital-based, independent operators, government/non-profit organization, and others.

- On the basis of service, the market has been divided into domestic and international.

Market Size and Forecast:

- 2024 Market Size: USD 569.39 Million

- 2033 Projected Market Size: USD 1,449.45 Million

- CAGR (2025-2033): 10.90%

India Air Ambulance Services Market Trends:

Increasing Demand for Emergency Medical Transport

The need for air ambulance in India is developing at a fast pace because of the growing necessity for rapid emergency medical evacuation. In serious medical emergencies like serious trauma, stroke, or cardiac arrest, immediate access to specialist care can drastically enhance patient recovery. Air ambulances that are well equipped with sophisticated medical gear and crewed by experienced medical professionals ensure that patients get uninterrupted care throughout the journey. The service is especially critical in rural and underserved communities with poor road infrastructure. Further, as the footprint of tertiary care hospitals and trauma centers is spreading across metro cities, inter-hospital transfer needs are mounting faster. Initiatives by governments to increase the accessibility of healthcare and improve emergency medical response mechanisms are also creating more demand. Heightened awareness of air ambulance services, advancements in operational effectiveness, and growth of the private healthcare industry are also helping drive the market's growth. Increased affordability and infrastructure developments mean the adoption of air ambulance services is also poised to grow.

To get more information on this market, Request Sample

Growth in Medical Tourism Supporting Air Ambulance Services

India's thriving medical tourism industry is playing a big role in the expansion of air ambulance services. Since the nation is becoming a top destination for low-cost yet quality medical care, patients from other countries tend to need special transport to reach healthcare centers. Air ambulances provide a secure and effective means of transporting seriously ill patients from other countries and remote areas. Moreover, domestic medical tourists visiting major cities for advanced treatment depend on air ambulances for more convenient and secure transfers. According to the news, in May 2023, RED.Health introduced air ambulance services in 550+ Indian cities, providing trusted emergency medical transport with specialized aircraft, helicopters, and expert medical teams for speedy patient evacuation. Moreover, health professionals are forming more collaborations with air ambulance companies to facilitate smoother patient transfers, most notably for organ transplantations, heart surgeries, and oncology treatments. Medical escorts and planes equipped with intensive care facilities also support higher quality services. With the government encouraging medical tourism through easier visa procedures and more developed healthcare facilities, demand for air ambulance service is likely to increase for local as well as foreign patients.

Expansion of Helicopter Emergency Medical Services (HEMS)

The growth of Helicopter Emergency Medical Services (HEMS) is at the center of India's air ambulance growth. Helicopters offer rapid and versatile modes of medical transport, particularly in areas where terrain is hard, or road access is weak. They are routinely used in time-critical medical emergencies, such as accident rescue missions, critical patient transfer, and natural disaster response operations. State governments and private healthcare operators are investing more in HEMS networks to improve emergency response systems. As per the sources, in February 2024, Civil Aviation Minister launched India's first Helicopter Emergency Medical Service (HEMS) at AIIMS Rishikesh, improving trauma care and emergency response within a radius of 150 km. Further, improvements in aviation technology and medical equipment onboard helicopters have increased the operational effectiveness of helicopter ambulances, making medical treatment during transportation prompt. Partnerships between hospitals, aviation firms, and government agencies are also helping in the expansion of HEMS. With the growing demand for quick medical evacuation, especially in rural and mountainous regions, the use of helicopter ambulances is projected to rise, amplifying access to emergency care and preserving lives.

Technological Innovations in Air Ambulance Equipment

The India air ambulance services market is experiencing a revolutionary transformation through cutting-edge technological innovations that are enhancing patient care capabilities and operational efficiency during critical medical transport situations. Advanced life support systems including portable ventilators, defibrillators, and cardiac monitors with real-time telemetry capabilities are being integrated into aircraft, enabling medical teams to provide intensive care equivalent to hospital emergency rooms while airborne. State-of-the-art navigation systems incorporating GPS tracking, weather radar, and collision avoidance technology are improving flight safety and reducing transit times, particularly crucial during emergency situations where every minute matters for patient survival. The integration of telemedicine capabilities allows onboard medical personnel to consult with specialists at destination hospitals in real-time, facilitating immediate diagnostic decisions and treatment protocols during transport. Innovative patient monitoring systems with wireless connectivity enable continuous transmission of vital signs, ECG readings, and other critical medical data to receiving hospitals, allowing medical teams to prepare appropriate treatment protocols before patient arrival.

Regulatory and Licensing Changes

The regulatory landscape governing air ambulance services in India is undergoing significant transformation through comprehensive policy reforms and streamlined licensing procedures designed to enhance service accessibility while maintaining stringent safety standards. The Directorate General of Civil Aviation (DGCA) has implemented updated regulations specifically addressing air ambulance operations, including revised certification requirements for medical equipment, crew training standards, and operational protocols that ensure compliance with international aviation safety standards. Recent regulatory changes have simplified the approval process for new air ambulance operators, reducing bureaucratic delays and enabling faster market entry for qualified service providers, particularly benefiting regions with limited emergency medical transport coverage. The Ministry of Civil Aviation has introduced standardized licensing frameworks that harmonize requirements across different aircraft types, from helicopters to fixed-wing aircraft, creating consistency in operational standards while allowing for specialized medical transport configurations. New regulations mandate minimum medical equipment standards, crew qualification requirements, and maintenance protocols specifically tailored for medical transport aircraft, ensuring that all air ambulance services meet uniform quality and safety benchmarks.

Insurance and Reimbursement Trends

The insurance coverage landscape for air ambulance services in India is evolving rapidly as private health insurance providers, government schemes, and corporate policies increasingly recognize the critical importance of emergency medical transport coverage. Air ambulance expenses are covered under health insurance policies only when the transfer is medically necessary and prescribed by a doctor, requiring a letter of medical necessity or emergency physician determination for insurance approval. Government health schemes including Ayushman Bharat and state-specific programs are gradually incorporating air ambulance services for beneficiaries in remote areas where ground transport is inadequate or time-critical medical situations warrant immediate evacuation. Corporate health insurance policies offered by major employers are increasingly including comprehensive emergency transport benefits, recognizing that executive and employee safety requires access to rapid medical evacuation services, particularly for personnel working in remote locations or high-risk environments. The emergence of specialized air ambulance insurance products and add-on covers enables individuals to purchase dedicated coverage for emergency medical transport, addressing gaps in standard health insurance policies that may have limited or no air ambulance benefits.

Growth, Opportunities, and Challenges in the India Air Ambulance Services Market:

- Growth Drivers of the India Air Ambulance Services Market: The increasing incidence of road accidents and trauma cases requiring immediate medical evacuation is driving substantial demand for air ambulance services across urban and rural regions. Growing medical tourism industry and international patient flows are creating opportunities for specialized air medical transport services with enhanced medical capabilities. Government initiatives to improve emergency healthcare infrastructure and response systems are supporting market expansion through policy reforms and regulatory improvements.

- Opportunities in the India Air Ambulance Services Market: The expansion into tier-II and tier-III cities presents significant growth potential as healthcare infrastructure development creates demand for emergency medical transport services. Strategic partnerships with hospitals, insurance companies, and government agencies offer opportunities for integrated service delivery and enhanced market penetration. The emerging eVTOL technology and electric aircraft development create opportunities for sustainable, cost-effective air ambulance solutions in urban areas.

- Challenges in the India Air Ambulance Services Market: High operational costs including aircraft maintenance, fuel expenses, and specialized medical equipment create pricing pressures that limit service accessibility for middle-income populations. Limited insurance coverage and reimbursement gaps result in significant out-of-pocket expenses for patients requiring emergency air medical transport. Regulatory complexities across different states and limited airport infrastructure in remote areas pose operational challenges for service providers.

India Air Ambulance Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, service provider, and service.

Type Insights:

- Aeroplane

- Helicopter

The report has provided a detailed breakup and analysis of the market based on the type. This includes aeroplane and helicopter.

Service Provider Insights:

- Hospital-Based

- Independent Operators

- Government/Non-Profit Organization

- Others

A detailed breakup and analysis of the market based on the service provider have also been provided in the report. This includes hospital-based, independent operators, government/non-profit organization, and others.

Service Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the service. This includes domestic and international.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Air Ambulance Services Market News:

- In February 2025, ICATT and ePlane Company entered into a $1 billion agreement to have 788 eVTOL air ambulances deployed in India by 2026. This project is going to transform emergency medical services through quicker, environment-friendly air transportation of patients, especially in heavy traffic urban zones and remote rural areas.

- In April 2024, Jharkhand's Directorate of Civil Aviation launched a government-facilitated air ambulance service to enhance emergency medical transport, connecting Ranchi to key cities like Delhi, Hyderabad, Chennai, Bengaluru, and Mumbai.

- In February 2024, Jyotiraditya Scindia, India's Civil Aviation Minister, announced the launch of the country’s first Helicopter Emergency Medical Service (HEMS) in Uttarakhand. The service, based at AIIMS Rishikesh, aims to provide rapid airlift services to remote areas, enhancing emergency healthcare accessibility.

India Air Ambulance Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aeroplane, Helicopter |

| Service Providers Covered | Hospital-Based, Independent Operators, Government/Non-Profit Organization, Others |

| Services Covered | Domestic, International |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India air ambulance services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India air ambulance services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India air ambulance services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India air ambulance services market was valued at USD 569.39 Million in 2024.

The India air ambulance services market is projected to exhibit a CAGR of 10.90% during 2025-2033, reaching a value of USD 1,449.45 Million by 2033.

Key factors driving the India air ambulance services market include rising incidence of critical medical emergencies, growing demand for rapid inter-city and remote area transport, increased healthcare awareness, expansion of premium and corporate healthcare offerings, government initiatives to improve emergency response, and technological advancements in medical aviation infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)