India Air Conditioning Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Air Conditioning Market Summary:

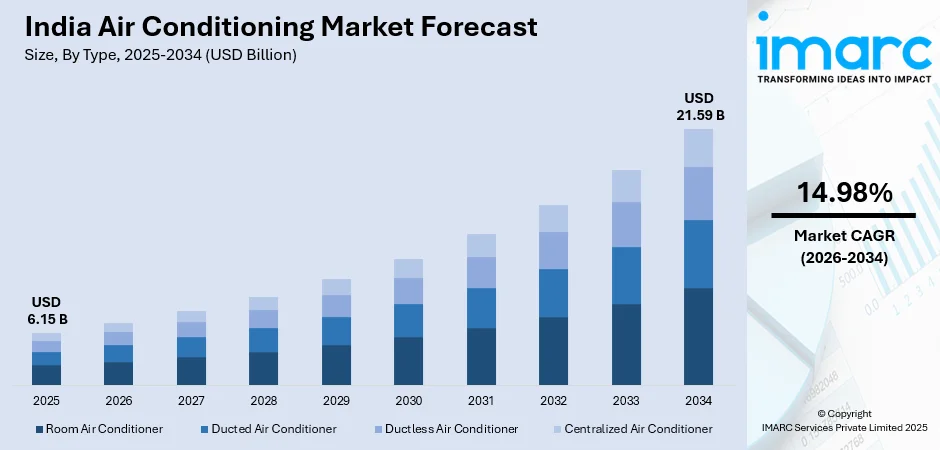

The India air conditioning market size was valued at USD 6.15 Billion in 2025 and is projected to reach USD 21.59 Billion by 2034, growing at a compound annual growth rate of 14.98% from 2026-2034.

The India air conditioning market is experiencing robust expansion driven by escalating temperatures, rapid urbanization, and rising middle-class purchasing power. The growing demand for energy-efficient and intelligent air conditioning systems, coupled with sustained growth across residential and commercial segments, is propelling market development. Government initiatives promoting energy efficiency and the proliferation of smart home technologies are further accelerating market adoption across urban and semi-urban geographies throughout the nation.

Key Takeaways and Insights:

-

By Type: Room air conditioner dominates the market with a share of 48.05% in 2025, driven by their widespread affordability, ease of installation, and suitability for residential and small commercial applications across India's diverse housing configurations and climate zones.

-

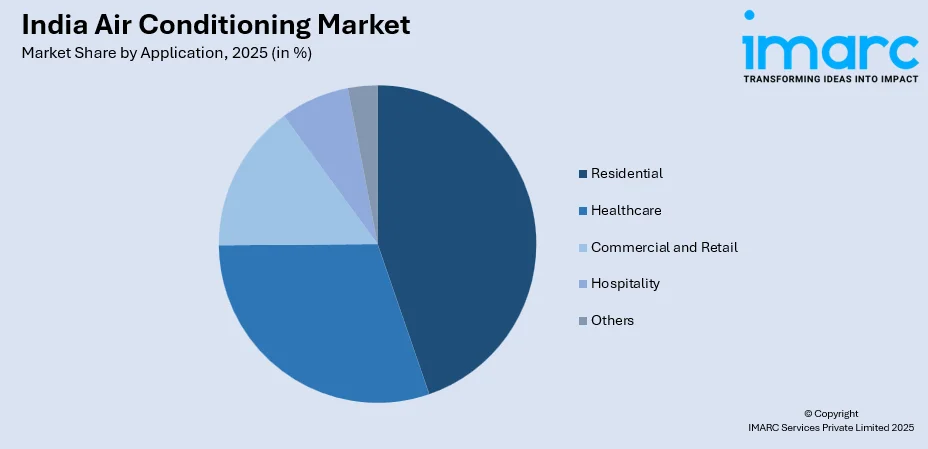

By Application: Residential lead the market with a share of 44.05% in 2025, attributed to rising household penetration, increasing disposable incomes, improved living standards, and growing consumer awareness of comfort cooling solutions among India's expanding middle-class population.

-

By Region: North India dominates the market with a share of 29% in 2025, owing to the region's extreme summer temperatures, high population density in states like Uttar Pradesh, Delhi NCR, Rajasthan, and Punjab, combined with robust urbanization and infrastructure development activities.

-

Key Players: The India air conditioning market is highly competitive, featuring established domestic manufacturers alongside multinational corporations. The sector is characterized by intense rivalry, continuous product innovation, and diverse offerings across residential, commercial, and industrial segments, catering to evolving consumer preferences and climate control needs.

To get more information on this market Request Sample

The India air conditioning market is undergoing rapid transformation, driven by technological advancements and shifting consumer preferences toward energy-efficient and intelligent cooling solutions. In August 2025, Samsung India doubled its room air conditioner sales and achieved around 10% market share by expanding its AI-enabled AC portfolio, highlighting how leading brands are using smart technologies to capture rising demand. Despite strong momentum, AC penetration in India remains significantly lower than in developed economies, indicating substantial long-term growth potential supported by population expansion and rising disposable incomes. The increasing adoption of inverter technology, smart connectivity, and eco-friendly refrigerants is reshaping the product landscape. Additionally, frequent heatwaves and longer summers have made air conditioners a necessity rather than a discretionary purchase across both urban and rural markets.

India Air Conditioning Market Trends:

Accelerating Adoption of Energy-Efficient Inverter Technology

The Indian air conditioning market is rapidly adopting inverter technology as consumers prioritize energy efficiency and lower operating costs. In 2025, Samsung India announced plans to re-enter the residential AC segment with multiple inverter models featuring smart and connected capabilities, reflecting strong manufacturer focus on efficient solutions. Inverter ACs optimize compressor speed based on cooling demand, reducing power consumption versus conventional units. Supportive government efficiency norms and expanding product availability across price segments are accelerating adoption nationwide.

Integration of Smart Connectivity and IoT Features

Air conditioners are increasingly integrated with smart home ecosystems, reshaping India’s AC market. In March 2025, Panasonic Life Solutions India expanded its Matter-enabled smart AC portfolio with 61 new models, enabling seamless control through IoT platforms and mobile apps. IoT-enabled ACs support remote operation, voice assistants, AI-driven performance optimization, energy monitoring, scheduling, and diagnostics. This convergence of cooling and smart technology enhances convenience and efficiency while driving premiumization, especially among urban and tech-savvy consumers.

Transition Toward Eco-Friendly Refrigerants and Sustainable Solutions

India’s air conditioning industry is increasingly embracing eco-friendly refrigerants and sustainable technologies. According to reports, Honeywell partnered with an Indian manufacturer to boost local supply of its low-GWP refrigerant Solstice yf (HFO-1234yf), highlighting global efforts to support climate-friendly cooling solutions. The shift to next-generation refrigerants is paired with energy-efficient designs and health-focused features such as HEPA filtration and UV sterilization, offering environmentally responsible cooling while addressing air quality, appealing to eco-conscious and health-oriented consumers.

Market Outlook 2026-2034:

The India air conditioning market outlook remains highly favorable, supported by sustained demand from residential consumers seeking comfort cooling, expanding commercial infrastructure, and continuous technological innovation across product categories. Rising temperatures attributed to climate change are converting air conditioning from discretionary to essential purchase across Indian households. Government initiatives including Production Linked Incentive schemes are attracting investment in domestic manufacturing capabilities, strengthening supply chain resilience. The market generated a revenue of USD 6.15 Billion in 2025 and is projected to reach a revenue of USD 21.59 Billion by 2034, growing at a compound annual growth rate of 14.98% from 2026-2034.

India Air Conditioning Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Room Air Conditioner | 48.05% |

| Application | Residential | 44.05% |

| Region | North India | 29% |

Type Insights:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

The room air conditioner dominates with a market share of 48.05% of the total India air conditioning market in 2025.

Room air conditioners, including split and window units, dominate India’s residential market due to their suitability for local housing and affordability. In March 2025, Sharp Business Systems re‑entered the market with 11 energy-efficient models across its Reiryou, Seiryo, and Plasma Chill series, reflecting renewed competition and innovation. Split ACs are favored in urban areas for energy efficiency, quiet operation, and design, while window units remain popular among budget-conscious consumers and older buildings. Wide product availability across price points caters to diverse consumer needs.

The proliferation of inverter-enabled room air conditioners has accelerated segment growth as manufacturers introduce feature-rich products at increasingly competitive prices. Easy installation requirements, minimal structural modifications, and availability through extensive retail networks support strong consumer adoption. The emergence of convertible air conditioners offering variable tonnage operation has enhanced value propositions, enabling consumers to optimize energy consumption based on seasonal requirements and room occupancy patterns. These technological advancements sustain room air conditioner dominance amid growing commercial and centralized air conditioning alternatives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Healthcare

- Commercial and Retail

- Hospitality

- Others

The residential leads with a share of 44.05% of the total India air conditioning market in 2025.

Residential applications lead demand in India’s air conditioning market, as ACs shift from luxury to essential household items. Rising disposable incomes, improved living standards, and growing awareness of comfort cooling drive adoption across urban, semi-urban, and rural areas. In February 2025, Blue Star Ltd announced plans to expand room AC manufacturing from 1.4 million to 1.8 million units, reflecting efforts to meet increasing household demand. Growth is supported by new housing, real estate development in tier‑2 and tier‑3 cities, and replacement of aging units.

Extreme heatwaves affecting multiple Indian states have accelerated residential air conditioner penetration as households prioritize thermal comfort and health protection. The availability of affordable financing options including no-cost EMI schemes, exchange programs, and festive season promotions has reduced entry barriers for first-time buyers. Multi-room air conditioning is gaining traction in larger households as consumers install units in bedrooms, living areas, and home offices. The work-from-home trend has reinforced residential cooling importance, positioning air conditioners as productivity-enabling appliances essential for comfortable remote work environments.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India air conditioning market in 2025.

North India maintains market leadership driven by the region's severe climatic conditions characterized by extreme summer temperatures that create compelling cooling requirements. The region encompasses densely populated states including Uttar Pradesh, Delhi National Capital Region, Rajasthan, Punjab, and Haryana, representing substantial consumer bases with growing purchasing power. Metropolitan centers like Delhi, Noida, Gurgaon, and Jaipur demonstrate robust demand for both residential and commercial air conditioning solutions, supported by infrastructure development and urbanization trends.

The Delhi NCR region serves as a significant market hub with high disposable incomes, cosmopolitan demographics, and strong preference for premium air conditioning products featuring advanced technologies. Extreme temperature variations, with summer peaks frequently exceeding forty-five degrees Celsius in parts of Rajasthan and northern plains, position air conditioning as essential rather than discretionary. Extensive retail infrastructure, brand showroom networks, and growing e-commerce penetration ensure comprehensive market coverage. Agricultural prosperity in Punjab and Haryana combined with industrial growth in Uttar Pradesh supports rising consumer electronics demand, reinforcing North India's dominant market positioning.

Market Dynamics:

Growth Drivers:

Why is the India Air Conditioning Market Growing?

Rising Temperatures and Climate Change Impact

India is experiencing increasingly severe heatwaves, turning air conditioning from a luxury into a health necessity. In 2025, the India Meteorological Department reported unusually early heatwaves starting in February in some states, with record-high warm nights and above-normal average temperatures. Climate change is prolonging hot seasons, increasing humidity, and affecting traditionally moderate regions. Early government heatwave advisories raise public awareness, while vulnerable populations such as the elderly, children, and those with medical conditions face higher health risks, driving faster adoption of air conditioners as essential household infrastructure.

Rapid Urbanization and Middle Class Expansion

India’s rapid urbanization and a growing middle class are driving strong air conditioner demand. Expanding city populations in modern housing increasingly expect ACs, while rising incomes enable upgrades from fans and coolers to efficient units. In 2025, LG Electronics India reported robust FY25 revenue growth, partly fueled by strong AC sales in urban and emerging markets, highlighting rising middle-class demand. Broader electrification, lifestyle aspirations, and higher purchasing power are positioning air conditioning as a necessary appliance across diverse socioeconomic segments.

Government Energy Efficiency Initiatives and Regulatory Support

Government policies are actively shaping India’s air conditioning market through energy efficiency and sustainability measures. Programs like star ratings guide consumers toward cost-saving appliances, while the India Cooling Action Plan promotes innovation and sustainable production. In 2025, the government reopened the Production Linked Incentive scheme for air conditioners and LED lights, encouraging domestic manufacturing, reducing import dependence, and generating jobs. State subsidies and financing options further support efficient appliance adoption. Collectively, these initiatives stimulate market growth while advancing environmental and climate objectives.

Market Restraints:

What Challenges the India Air Conditioning Market is Facing?

High Electricity Costs and Power Infrastructure Constraints

Elevated electricity tariffs represent significant operational cost concerns constraining air conditioner adoption among price-sensitive Indian consumers. Air conditioning systems constitute substantial portions of household electricity consumption, creating ongoing operational expenses that compound initial purchase investments. Power infrastructure limitations including inconsistent supply, voltage fluctuations, and load shedding in certain regions reduce air conditioner utilization effectiveness and raise concerns about equipment reliability and longevity.

Seasonal Demand Fluctuations and Market Volatility

The Indian air conditioning market experiences pronounced seasonality with demand concentrated heavily during summer months, creating inventory management challenges for manufacturers and retailers. Unpredictable weather patterns including unexpected rainfall during peak summer periods can significantly dampen sales volumes, forcing companies to revise growth projections. This demand volatility complicates production planning, supply chain management, and working capital requirements across the industry value chain.

Intense Price Competition and Margin Pressure

The Indian air conditioning market experiences significant competitive intensity with numerous domestic and international brands competing primarily on price positioning. The proliferation of manufacturers and brands has compressed profit margins across industry participants, limiting investment capacity in research and development, premium product innovation, and brand building activities. This pricing pressure particularly affects established players facing aggressive competition from new entrants offering comparable specifications at lower price points.

Competitive Landscape:

The India air conditioning market is highly competitive, with domestic manufacturers and multinational corporations vying across all segments. Market leaders leverage extensive distribution networks, strong brand recognition, and competitive pricing, while others focus on technology innovations, smart features, and premium positioning. Both residential and commercial segments see active participation, supported by robust institutional relationships. The landscape is driven by continuous product innovation, aggressive marketing, and expanding dealer networks. Omnichannel strategies, including traditional retail and e-commerce, further intensify competition, making the market dynamic and fast-evolving, with companies striving to differentiate through performance, energy efficiency, and advanced smart capabilities.

Recent Developments:

-

In December 2025, Haier India launched its Gravity AI Series of air conditioners at the “AI for Air” event in Greater Noida. Powered by AI-AtmoX technology, the new range delivers intelligent climate control, adaptive cooling, and auto-cleaning features. The launch marks Haier’s most advanced AI-enabled AC lineup in India, alongside expanded local manufacturing capacity.

India Air Conditioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner |

| Applications Covered | Residential, Healthcare, Commercial and Retail, Hospitality, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India air conditioning market size was valued at USD 6.15 Billion in 2025.

The India air conditioning market is expected to grow at a compound annual growth rate of 14.98% from 2026-2034 to reach USD 21.59 Billion by 2034.

Room air conditioners dominated the market with a share of 48.05%, driven by their widespread affordability, ease of installation, and suitability for residential and small commercial applications across India's diverse housing configurations and climate zones.

Key factors driving the India air conditioning market include rising temperatures and extreme heatwaves intensifying cooling requirements, rapid urbanization and middle class expansion increasing purchasing power, government energy efficiency initiatives promoting adoption, technological innovation in inverter and smart connectivity features, and improving electrification extending market reach to semi-urban and rural areas.

Major challenges include high electricity costs creating operational expense concerns for price-sensitive consumers, power infrastructure constraints limiting utilization in certain regions, seasonal demand fluctuations creating inventory management challenges, intense price competition compressing industry margins, and the need for continuous innovation to differentiate in an increasingly crowded marketplace.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)