India Air Cooler Market Size, Share, Trends and Forecast by Organized/Unorganized, End Use, Tank Capacity, Distribution Channel, and Region, 2025-2033

India Air Cooler Market Size and Share:

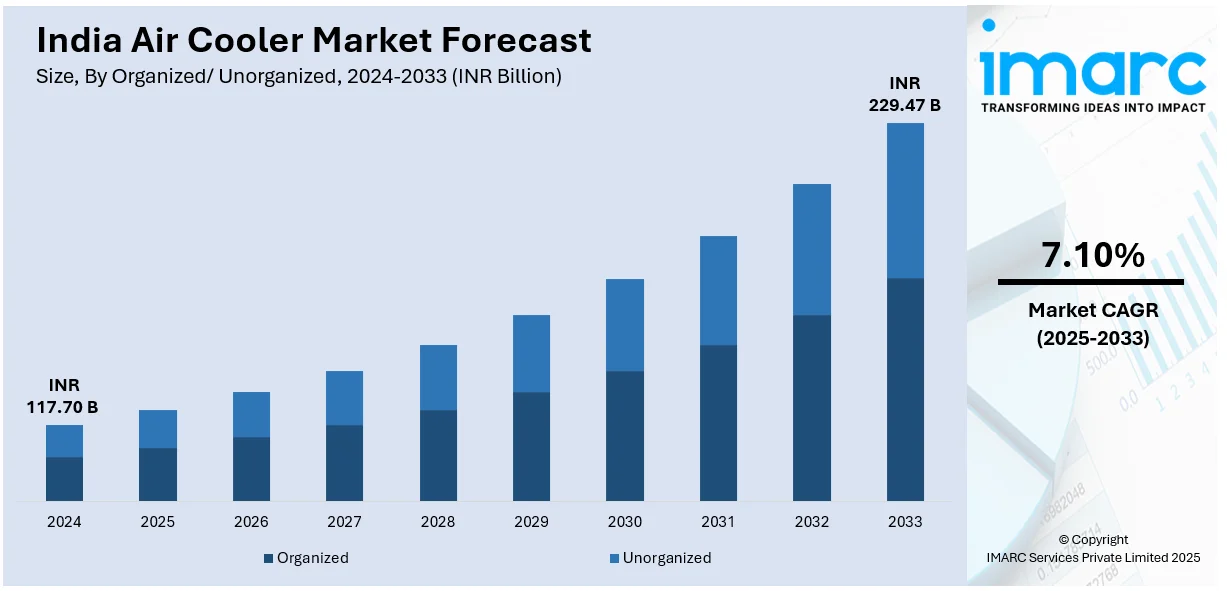

The India air cooler market size was valued at INR 117.70 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 229.47 Billion by 2033, exhibiting a CAGR of 7.10% from 2025-2033. Rising temperatures, rapid urbanization, expanding middle-class population, rising demand for cost-effective cooling solutions, increasing electricity costs, technological advancements, expanding retail and e-commerce channels, and supportive government initiatives for energy-efficient appliances are some of the major factors positively impacting India air cooler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | INR 117.70 Billion |

| Market Forecast in 2033 | INR 229.47 Billion |

| Market Growth Rate (2025-2033) | 7.10% |

The market is primarily driven by rising temperatures due to climate change and urban heat island effects, which significantly increases the demand for affordable cooling solutions. In addition to this, the expansion of the e-commerce sector enhances product accessibility, offering consumers a wide range of options at competitive prices, thereby extending the market reach. The India Brand Equity Foundation projects that the country's e-commerce market will grow USD 292.3 Billion in 2028, up from USD 123 Billion in 2024. In line with this, supportive government initiatives promoting energy-efficient appliances further support the demand for air coolers, thereby providing a boost to the overall India air cooler market growth.

To get more information on this market, Request Sample

Besides this, growing awareness regarding environmental sustainability prompts consumers to opt for eco-friendly cooling solutions with lower carbon footprints. Moreover, air coolers are an energy-efficient alternative to air conditioners, which makes them a preferred choice among cost-conscious consumers. Furthermore, rapid urbanization and increasing disposable incomes lead to greater adoption of air coolers, which is providing an impetus to the market. According to recent industry reports, on March 2, 2024, India’s expected per capita disposable income for 2023–24 was revised from INR 2.12 lakh to INR 2.14 lakh based on government-issued GDP data. According to the most recent data, per capita disposable income increased by 8% in FY24 after rising by 13.3% in 2023.

India Air Cooler Market Trends:

Growing Preference for Smart and Technologically Advanced Air Coolers

The shift towards smart and technologically advanced models is enriching the India air cooler market outlook. Consumers often choose air coolers featuring features including digital touch screens, Wi-Fi connectivity, remote control operation, and smart home system compatibility. Additionally, manufacturers are integrating air purification technologies, such as HEPA and activated carbon filters, to improve indoor air quality. These technologies are improving user convenience and efficiency, and smart air coolers are emerging as a sought-after option in urban and semi-urban households. For example, in August 2024, Symphony Coolers partnered with AKOOL to launch its Silenzo 100 Desert Air Cooler by integrating AKOOL's streaming avatar technology on its website. This virtual product specialist provided real-time assistance to customers, responding to technical queries, providing weather-specific advice, and facilitating buying decisions. The initiative led to a 27% increase in customer engagement compared to traditional FAQs and improved overall customer satisfaction.

Expanding Penetration in Rural and Semi-Urban Markets

The increasing affordability of air coolers, along with continual improvements in distribution networks, are increasing the product adoption in rural and semi-urban areas of India, which is one of the emerging India air cooler market trends. The majority of the manufacturers are targeting localized manufacturing to decrease costs and meet growing demand in non-metro cities. Furthermore, the implementation of government initiatives to improve the availability of electricity in rural areas has made air coolers a cost-effective cooling solution for homes, which were previously dependent on traditional fans. According to Ministry of Power reports, under Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), the Indian government electrified all the non-electrified villages. It improved the rural sub-transmission and distribution system. 18,374 villages were electrified under the program.

Increasing Popularity of Energy-Efficient and Eco-Friendly Air Coolers

Environmental concerns and rising electricity costs leads to the development of energy-efficient and eco-friendly, which increases the Indian air cooler market demand. Companies are developing more coolers with energy-saving motors, inverters, and water-saving features to meet trends for sustainability. For example, on March 30, 2024, Symphony Ltd. introduced the world's first BLDC-powered air cooler series, consuming 60% less power than traditional models. The new series includes models with 80-liter, 55-liter, and 30-liter capacities, featuring seven-speeds, up to eight hours of night sleep mode, a touchscreen control panel, and low-water tank reminders. The trend for employing long-lasting, reusable materials like ABS plastic and eco-friendly cooling pads is also gaining momentum.

India Air Cooler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India air cooler market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on organized/unorganized, end use, tank capacity, and distribution channel.

Analysis by Organized/ Unorganized:

- Organized

- Unorganized

The organized segment in India's air cooler market comprises existing players that trade in standardized products with enhanced features like inverter technology, IoT-based air cooling, and energy efficiency. The players make heavy investments in R&D, quality checks, and brand promotion through extensive promotional campaigns. The players operate through organized distribution channels like modern retail stores, exclusive brand stores, and web-based e-commerce websites. The organized market comprises after-sales support, guarantees, and customer services, which fosters consumer confidence and brand loyalty. With rising disposable income, urbanization, and demand for quality cooling solutions, the organized market is witnessing continuous growth, expanding its reach across metro cities and tier-2 and tier-3 cities as well.

The unorganized segment is a major driver of India's air cooler market, mainly in rural and semi-urban regions. The unorganized sector comprises small-sized manufacturers and regional dealers who manufacture and sell air coolers at low prices with a focus on price-sensitive consumers. These coolers are mainly customized and made with local resources, which makes them price-friendly at the cost, but they often lack durability and efficiency. The unorganized market has the benefit of limited regulatory compliance and low operational costs, which enable companies to provide price competitiveness. Despite growing competition from organized brands, the sector remains strong due to price sensitivity and growing demand for economical cooling solutions across non-metro locations.

Analysis by End Use:

- Residential Air Coolers

- Room Air Coolers

- Desert Air Coolers

- Tower Air Coolers

- Industrial and Commercial Air Coolers

- Mobile Commercial Air Coolers

- Centralized Air Coolers

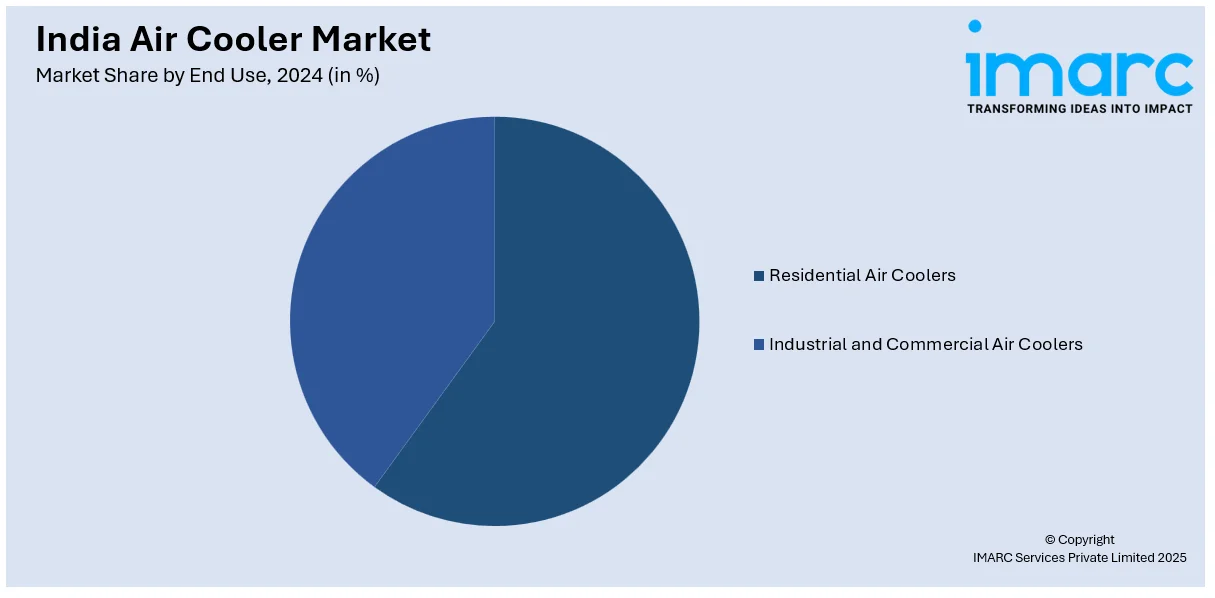

Residential air coolers account for a large share of the air cooler market in India, driven by rising temperatures, urbanization, and demand for low-cost cooling solutions. The coolers are in high requirement in residential segments due to their low price, low power consumption, and eco-friendliness compared to air conditioners. The residential market provides a variety of models, including desert coolers, personal coolers, and tower coolers, to suit different space requirements. With higher disposable incomes, customers prefer branded air coolers featuring cutting-edge technologies including remote control, inverter technology, and Internet of Things (IoT) connectivity.

Industrial and commercial air coolers are important in high-volume applications like factories, warehouses, shopping malls, restaurants, and offices. These coolers offer high air delivery and effective cooling for high volumes of space, providing an energy-efficient option compared to central air conditioning systems. Heat-intensive process industries like manufacturing and textiles rely heavily upon air coolers to offer workplace comfort and productivity. Commercial businesses also use energy-saving cooling systems to lower operational costs while ensuring a comfortable working atmosphere for employees and customers. Demand for industrial air coolers is growing with energy prices climbing further and concern for sustainable cooling solutions, and hence, they are a significant segment in the Indian air cooler market.

Analysis by Tank Capacity:

- Low

- Medium

- High

Low tank capacity air coolers with 10 to 20-liter capacity are ideal for small rooms such as bedrooms, study rooms, or individual workstations. These coolers are lightweight, compact, and power-saving and are a favorite among price-conscious customers and space-constrained consumers. Since these coolers use less water, they are easy to maintain and refill and are, therefore, it is an ideal choice for urban consumers where water supply could be a problem. Personal and tower coolers typically fall in this category, meeting individual cooling needs. With the increasing demand for portable and affordable cooling systems, the market for low-tank capacity air coolers continues to grow, especially for apartments and small families.

Medium tank capacity air coolers with capacities ranging from 21 to 50 liters provide a perfect combination of efficiency and convenience. These coolers are widely used in living rooms, small offices, and mid-sized commercial spaces, providing extended cooling hours without frequent refills. They are used by a large consumer base, including families and corporate professionals looking for reliable cooling systems at an affordable price. Medium-sized desert and room coolers are the major players in this segment, which may be provided with additional features such as remote control, inverter compatibility, and longer air flow.

High capacity tank air coolers, with a capacity of over 50 liters, are used for big spaces like halls, open spaces, warehouses, and industrial purposes. These coolers provide strong air delivery and long-term cooling, minimizing the need for frequent refilling of water. They are commonly used in areas with extreme summer weather conditions and are commonly used in industrial and commercial applications. High-end products have the option of auto water refill, humidity control, and large fan sizes for more air circulation. The demand for energy-saving and cost-effective cooling technology in commercial and industrial applications accelerates the business for high-capacity tank air coolers in the market, and they are a necessary option for large-scale cooling requirements.

Analysis by Distribution Channel:

- Online

- Offline

The online distribution channel is growing at a rapid growth in the Indian air cooler market due to the growing penetration of the internet, smartphone usage, and convenience through online platforms. Consumers opt for buying air coolers online because of the ease of product comparison, offers, and doorstep delivery. Major e-commerce websites and company websites provide various models with appropriate specifications, customer reviews, and easy payment options. The penetration of digital payment and promotional offers through online platforms further increases air cooler adoption through this channel, and thus, it constitutes a significant part of the market.

The offline channel is the largest mode of sales in the market due to the need for physical checks prior to purchase, as preferred by customers. It includes offline retail outlets, multi-brand outlets, and standalone brand outlets providing hands-on experience, live demos, and expert opinions. Dealerships and local retailers play an important role especially in rural and semi-urban regions where trust and face-to-face interaction play the dominant role. The offline segment also provides easy access to after-sales services, including repair and claims under warranty.

Regional Analysis:

- North India

- East India

- West and Central India

- South India

North India is among the largest markets for air coolers, with rigorous summer temperatures and arid climate propelling demand. Delhi, Punjab, Haryana, Uttar Pradesh, and Rajasthan are the states that are ravaged by extended heat waves, leading to the robust need for cost-effective and effective cooling solutions. High tank capacity desert coolers are in great demand in the region due to their high cooling capacity in arid climates. The market is greatly penetrated by organized and unorganized players, and a wide range of products is provided for urban and rural customers. Rapid urbanization, increasing disposable income, and increasing distribution networks further drive the growth of the air cooler market in North India.

The air cooler market in East India, which includes states such as West Bengal, Bihar, Odisha, and Assam, is expanding steadily due to the humid climate of the region. The demand is increasing in semi-urban and rural markets, where affordability and energy efficiency make air coolers a popular choice. Portable and medium-sized coolers with humidity control technology are gaining popularity in the region. Expansion of e-commerce and retail distribution is facilitating penetration, especially in tier-2 and tier-3 cities. With increasing awareness of energy-efficient cooling solutions, the East Indian air cooler market is poised to witness gradual growth over the next several years.

West and Central India, including Maharashtra, Gujarat, Madhya Pradesh, and Chhattisgarh, have a significant share of the air cooler market. These states experience long, hot summers, and therefore, desert and room air coolers are in high requirement in the region. Gujarat and Rajasthan have a well-established market due to their hot and dry climate and preference for using air coolers over air conditioners. Strong manufacturing hubs available in Maharashtra and Gujarat are also supplementing supply and distribution. Both organized and unorganized players have a strong presence in this market, with products available at various price points. Growing urbanization and the need for energy-saving cooling products are also driving market growth in the region.

The air cooler market in South India, including Tamil Nadu, Karnataka, Kerala, Andhra Pradesh, and Telangana, is smaller than that of North and West India due to the humid climate in this region. The demand is still growing in interior areas and tier-2 and tier-3 cities where air coolers are an affordable option to ACs. Personal and tower coolers with humidity control are gaining popularity in this market. Growth in e-commerce and expansion in organized retail networks are making markets more accessible. Also, growing awareness of eco-friendly and energy-saving appliances is making the air cooler market grow incrementally in South India.

Competitive Landscape:

The Indian market for air coolers is extremely competitive, with a vast number of regional and international players. The companies compete on the dimensions of price, product innovation, energy consumption, and distribution. The market is experiencing a boom in advanced cooling technologies, including inverter coolers, IoT-based smart coolers, and green designs. Strong brand positioning, aggressive promotion, and extensive retail and online distribution are required to acquire market share. Furthermore, strategic collaborations between manufacturers and distribution channels also enhance the market outlook. With increasing demand, new entrants and well-established brands continue to expand their product portfolios, further intensifying competition in the market.

The report provides a comprehensive analysis of the competitive landscape in the India air cooler market with detailed profiles of all major companies.

Latest News and Developments:

- April 11, 2024: Orient Electric introduced a new series of high-capacity air coolers in India, including models like Smartchill 125L, Avante 105L, Titan 100L, and Maxochill 100L. These coolers are designed with advanced features such as Aero Fan technology for air throw up to 60 feet, DenseNest honeycomb cooling pads for improved water retention and efficiency, It includes prevention of mosquito breeding, ice chamber, castor wheels and collapsible louvers.

- May 31, 2024: Carrier Airconditioning & Refrigeration Limited (Carrier India) announced the launch of the 30RB Air-Cooled Modular Scroll Chiller, designed and manufactured in India to meet the country's diverse cooling requirements. This chiller offers modularity by allowing up to 16 units to be combined, ensuring uninterrupted performance across a temperature range of 10°C to 48°C, and features Shell-&-Tube heat exchangers to maintain operation even with suboptimal water quality.

- September 4, 2024: Epack Durable announced a partnership with Symphony to function as an original equipment manufacturer (OEM) for air coolers. The collaboration will focus on leveraging Epack's manufacturing capacity and increasing its customer base.

India Air Cooler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Organized/ Unorganized Covered | Organized, Unorganized |

| End-Uses Covered |

|

| Tank Capacities Covered | Low, Medium, High |

| Distribution Channels Covered | Online, Offline |

| Region Covered | North India, East India, West and Central India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India air cooler market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India air cooler market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India air cooler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air cooler market in India was valued at INR 117.70 Billion in 2024.

The key factors driving the market are rising temperatures due to climate change, increasing urbanization, and growing demand for energy-efficient cooling solutions. Affordable pricing compared to air conditioners, lower power consumption, and eco-friendly cooling technology further boost adoption. Expanding middle-class income, rural electrification, and technological advancements like smart and inverter coolers also contribute to market growth.

The air cooler market in India is projected to exhibit a CAGR of 7.10% during 2025-2033, reaching a value of INR 229.47 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)