India Air-Cushion Vehicle Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Air-Cushion Vehicle Market Overview:

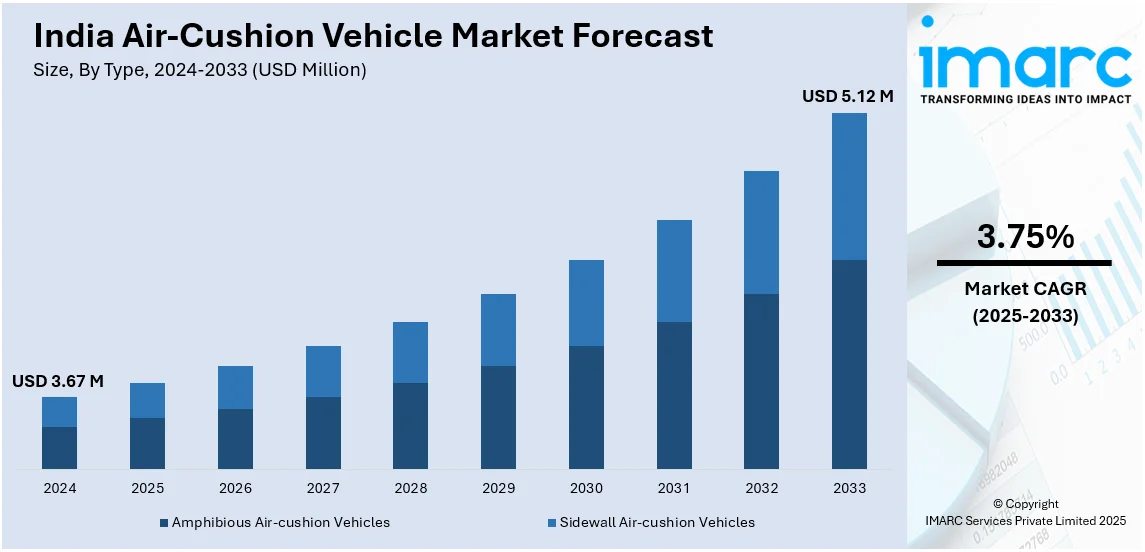

The India air-cushion vehicle market size reached USD 3.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5.12 Million by 2033, exhibiting a growth rate (CAGR) of 3.75% during 2025-2033. The market is driven by increasing defense and border security needs, rising demand for efficient maritime transport, growing tourism in coastal regions, and expanding government investments in modernizing naval capabilities and disaster response infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.67 Million |

| Market Forecast in 2033 | USD 5.12 Million |

| Market Growth Rate (2025-2033) | 3.75% |

India Air-Cushion Vehicle Market Trends:

Rising Adoption in Defense and Border Security

The Indian defense and border security initiatives aimed at enhancement have substantially boosted the India air-cushion vehicles (ACVs) market share. The Indian Navy together with the Coast Guard uses these vehicles for shallow water border protection and patrolling of marshlands and intricate coastal regions where conventional ships fail to operate effectively. In addition to this, ACVs provide India with strategic benefits because of their high mobility and amphibious capabilities under conditions of ongoing geopolitical tensions along its maritime and land borders. Moreover, the Make in India initiative promotes Indian defense industries by creating partnerships between domestic companies and international air-cushion vehicle manufacturers. In line with this push for indigenous manufacturing, Larsen & Toubro (L&T) and Hindustan Aeronautics Limited (HAL) are collaborating to build India’s first private PSLV and deep space equipment, boosting private sector involvement in defense manufacturing. This trend is driving innovation and technological progress along with cost efficiency, which is improving the capabilities of indigenous ACVs. The Indian market also maintains its growth trajectory because government procurement policies agree to buy locally developed ACVs. Furthermore, government plans to sustain investments in the defense sector throughout the next years for both fleet growth and equipment modernization is thereby enhancing the India ACVs market outlook.

To get more information on this market, Request Sample

Expanding Use in Civilian and Commercial Applications

India's civilian and commercial sectors are increasingly adopting ACVs for passenger transport, tourism, and emergency relief operations, driven by their versatility, efficiency, and ability to navigate diverse terrains, including water bodies, marshlands, and flood-prone areas. In line with this, the states of Kerala and West Bengal along with their coastal areas are adopting ACVs to establish efficient water transport systems because of their potential to decrease road traffic density. For instance, in April 2023, Kerala inaugurated the Kochi Water Metro, India's first integrated water transport system, utilizing battery-powered hybrid boats to connect island communities with the mainland. This system enhances passenger transport and reduces road traffic congestion. Additionally, tourism operators have started incorporating ACVs for their adventure and luxury services to provide faster scenic travel through beachfronts and lakefronts and riverine systems. Concurrently, the emergency response operations in flood-prone areas benefit significantly from the operational capabilities of ACVs because other motor vehicles become ineffective. These vehicles prove essential for emergency rescue missions because they can travel between land and water surfaces. Apart from this, the Indian government’s support for water transport and green mobility measures is fueling the future investment in ACV infrastructure and technology development to enhance their application in commercial and public service operations, thus fostering the India ACVs market growth.

India Air-Cushion Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Amphibious Air-cushion Vehicles

- Sidewall Air-cushion Vehicles

The report has provided a detailed breakup and analysis of the market based on the type. This includes amphibious air-cushion vehicles and sidewall air-cushion vehicles.

Application Insights:

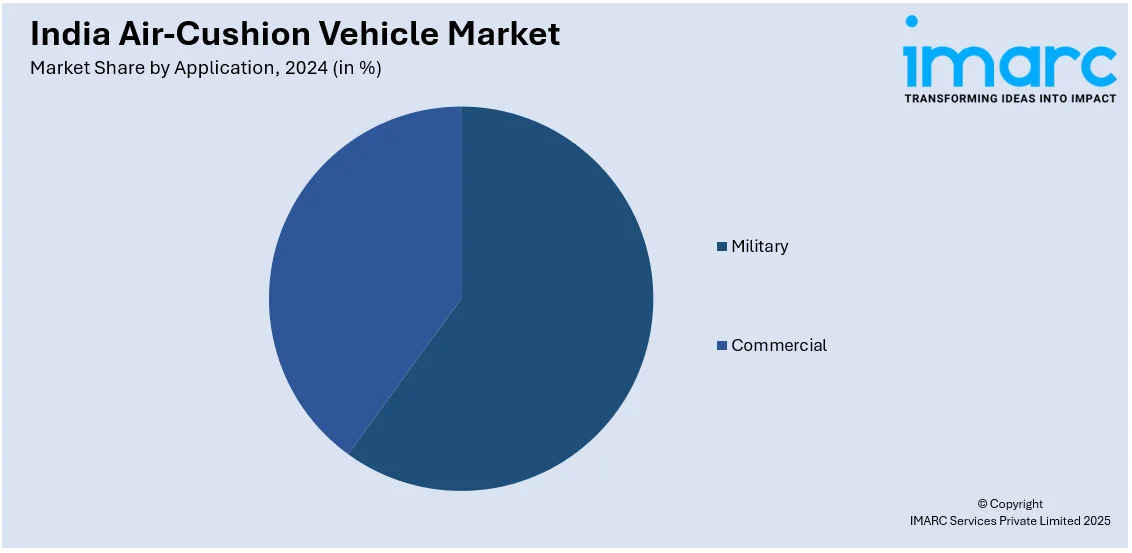

- Military

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes military and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Air-Cushion Vehicle Market News:

- In October 2024, the Ministry of Defense signed a ₹387.44 crore contract with Chowgule & Company Pvt. Ltd., Goa, for six indigenous ACVs for the Indian Coast Guard. These hovercrafts will enhance coastal patrolling, reconnaissance, and search and rescue operations, boosting maritime security and supporting the 'Aatmanirbhar Bharat' initiative.

- In February 2024, DRDO, in collaboration with Mahindra Defense, showcased an advanced Wheeled Armored Platform at the Defense Expo in Pune. This vehicle, designed for chemical, biological, radiological, and nuclear (CBRN) defense, as well as roles like Infantry Combat Vehicle (ICV) and Armored Personnel Carrier (APC), underscores India's commitment to indigenous defense technologies.

India Air-Cushion Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Amphibious Air-cushion Vehicles, Sidewall Air-cushion Vehicles |

| Applications Covered | Military, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India air-cushion vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India air-cushion vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India air-cushion vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air-cushion vehicle market in India was valued at USD 3.67 Million in 2024.

The India air-cushion vehicle market is projected to exhibit a CAGR of 3.75% during 2025-2033, reaching a value of USD 5.12 Million by 2033.

Growth is driven by expanding defense and military uses, coastal and inland transportation needs, and growing tourism. Advances in hovercraft technology, material lightness, and fuel consumption optimize adoption. Expanded infrastructure for amphibious operations, government strategic mobility emphasis, and potential commercial transport all support India's air-cushion vehicle market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)