India Air Purifier Market Size, Share, Trends and Forecast by Filter Technology, Mounting Type, Application, Sales Channel, and Region, 2026-2034

India Air Purifier Market Summary:

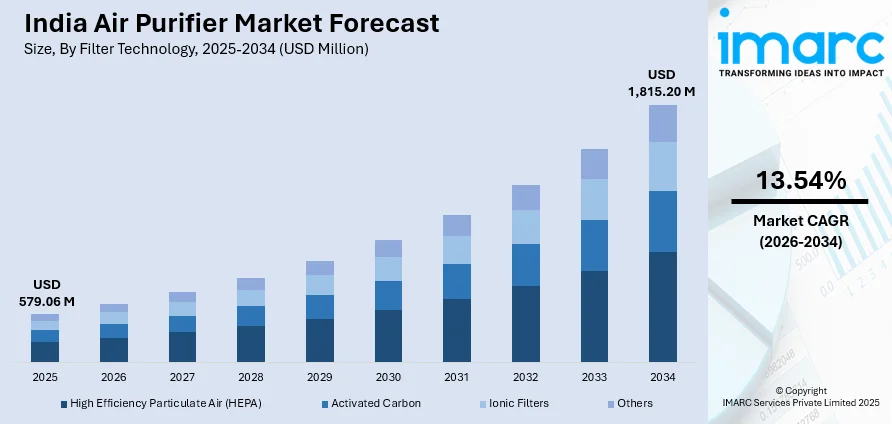

The India air purifier market size was valued at USD 579.06 Million in 2025 and is projected to reach USD 1,815.20 Million by 2034, growing at a compound annual growth rate of 13.54% from 2026-2034.

The India air purifier market is witnessing robust expansion driven by escalating air pollution levels across major urban centers and growing consumer awareness regarding indoor air quality. Rising incidences of respiratory ailments, particularly in northern regions affected by seasonal stubble burning and industrial emissions, are accelerating product adoption. Additionally, technological advancements integrating smart features such as IoT connectivity and AI-enabled air quality monitoring are enhancing consumer appeal and supporting India air purifier market share.

Key Takeaways and Insights:

- By Filter Technology: High Efficiency Particulate Air (HEPA) dominates the market with a share of 45% in 2025, driven by superior particle filtration efficiency and widespread consumer preference for medical-grade air purification solutions.

- By Mounting Type: Portable leads the market with a share of 67% in 2025, owing to flexibility in room-to-room usage and growing demand from urban apartments and rental accommodations.

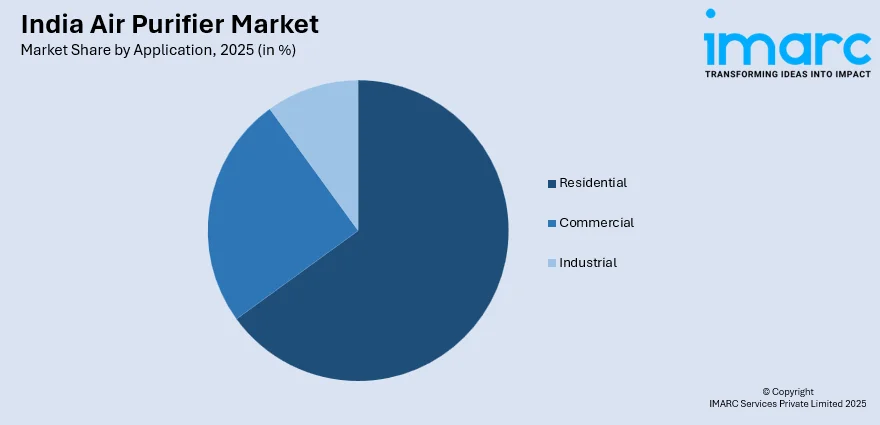

- By Application: Residential represents the largest segment with a market share of 65% in 2025, attributed to heightened health consciousness among households and increasing disposable incomes in metropolitan areas.

- By Sales Channel: Indirect sales dominate for the largest share of 62% in 2025, supported by expanding retail networks, e-commerce growth, and increasing availability through specialty stores.

- By Region: North India leads with a market share of 34% in 2025, fueled by severe air quality deterioration in Delhi-NCR and neighboring states due to vehicular emissions, industrial activity, and seasonal stubble burning.

- Key Players: The India air purifier market exhibits moderate competitive intensity, with established multinational corporations competing alongside domestic manufacturers across price segments. Some of the key players include Blueair India (Unilever plc), Crusaders Technologies India Private Limited, Daikin Airconditioning India Pvt. Ltd. (Daikin Industries Ltd.), Dyson Technology India Pvt Ltd., Eureka Forbes Limited, Kent RO Systems Ltd., LG Electronics India Limited (LG Electronics Inc.), Panasonic Life Solutions India Pvt. Ltd. (Panasonic Corporation), Philips India Limited (Koninklijke Philips N.V.), Sharp Business System (India) Pvt. Ltd., and Xiaomi Technology India Private Limited (Xiaomi Inc.)

To get more information on this market Request Sample

The India air purifier market has evolved from a niche luxury segment to an essential household appliance category, driven by persistent air quality challenges affecting major urban centers. Complementing this trend, the India air quality monitoring market reached USD 169.97 Million in 2024 and is projected to expand to USD 292.07 Million by 2033, registering a CAGR of 6.20% during 2025–2033, reflecting rising awareness and institutional focus on pollution tracking. The market ecosystem encompasses diverse product offerings ranging from entry-level models targeting price-sensitive consumers to premium smart purifiers featuring advanced filtration technologies and IoT integration. Consumer demand exhibits strong seasonality, with peak sales occurring during winter months when air quality index levels deteriorate significantly across northern and central regions. The proliferation of e-commerce platforms has democratized market access, enabling manufacturers to reach consumers in tier-II and tier-III cities previously underserved by traditional retail channels.

India Air Purifier Market Trends:

Integration of Smart and IoT-Enabled Features

Air purifier manufacturers are increasingly integrating smart and IoT-enabled technologies to improve user convenience and operational efficiency. According to reports, Samsung India expanded its connected purifier lineup with models like the AX5500 featuring dual smart sensors for real-time air quality tracking and app connectivity that displays PM2.5/PM10 levels and filter status, reinforcing the shift toward data-driven, connected purification solutions. Modern models offer real-time air quality monitoring, smartphone app control, and voice assistant compatibility. These features support remote operation, automated scheduling, and performance tracking.

Rising Adoption of Multi-Stage Filtration Systems

Consumers are increasingly preferring air purifiers equipped with multi-stage filtration systems combining HEPA, activated carbon, and UV-C technologies for comprehensive indoor air cleaning. Reflecting this trend, Atlanta Healthcare launched two next-generation air purifiers in India, featuring advanced seven-stage filtration targeting particulate and biological contaminants. Moreover, the rising awareness of particulate matter, volatile organic compounds, and airborne pathogens has driven consumer demand for multi-stage air purification systems. Multi-layer systems address multiple pollutant categories simultaneously, delivering stronger protection than single-technology solutions. Manufacturers are developing advanced filter combinations that capture ultrafine particles while neutralizing odors, gases, and biological contaminants.

Emergence of Sustainable and Eco-Friendly Purification Solutions

Growing environmental consciousness is accelerating the development of sustainable and eco-friendly air purification solutions that reduce energy use and environmental impact. In September 2025, IQAir launched the Atem Earth air purifier, the first model with a sustainably sourced wood housing designed to cut plastic use and reduce resource consumption while meeting ENERGY STAR Most Efficient standards for low energy use, illustrating how manufacturers are rethinking materials and design for environmental responsibility. Manufacturers are adopting recyclable materials, energy-efficient designs, and natural or plant-based filtration concepts to attract eco-aware consumers. Sustainability efforts also extend to packaging, production processes, and end-of-life management. This trend aligns with consumer demand for health-focused products that deliver clean air while supporting long-term environmental responsibility.

Market Outlook 2026-2034:

The outlook for the India air purifier market remains positive, driven by persistent air pollution concerns, rapid urbanization, and rising consumer awareness regarding respiratory health. Continuous technological advancements such as nanotechnology-enabled filtration systems and AI-driven air quality optimization are accelerating demand for premium products. Additionally, supportive government regulations aimed at pollution control, along with increasing adoption across offices, healthcare facilities, hospitality venues, and educational institutions, are creating significant growth and long-term market expansion opportunities. The market generated a revenue of USD 579.06 Million in 2025 and is projected to reach a revenue of USD 1,815.20 Million by 2034, growing at a compound annual growth rate of 13.54% from 2026-2034.

India Air Purifier Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Filter Technology | High Efficiency Particulate Air (HEPA) | 45% |

| Mounting Type | Portable | 67% |

| Application | Residential | 65% |

| Sales Channel | Indirect Sales | 62% |

| Region | North India | 34% |

Filter Technology Insights:

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Others

The high efficiency particulate air (HEPA) dominates with a market share of 45% of the total India air purifier market in 2025.

High Efficiency Particulate Air (HEPA) filters have established market leadership owing to their proven efficacy in capturing fine particulate matter, allergens, and microscopic pollutants. These filters can remove extremely small particles with exceptional efficiency rates, making them particularly relevant for Indian urban environments characterized by elevated particulate matter concentrations. In September 2025, Camfil India inaugurated a new HEPA and ULPA filter production line at Manesar to boost domestic ISO‑compliant filter supply for hospitals, cleanrooms, and advanced purification systems. Consumer preference for HEPA technology is reinforced by growing awareness regarding respiratory health benefits and recommendations from healthcare professionals for managing allergy and asthma symptoms.

The segment’s growth is fueled by innovations combining HEPA with complementary filtration technologies. Manufacturers are introducing advanced and medical-grade HEPA filters to meet rising consumer demand for superior purification. Widespread availability of replacement filters through multiple retail channels, along with standardized HEPA specifications, has strengthened consumer trust. These factors collectively reinforce the reliability and effectiveness of HEPA technology, sustaining its strong presence and dominance in the Indian air purifier market.

Mounting Type Insights:

- Fixed

- Portable

The portable leads with a share of 67% of the total India air purifier market in 2025.

Portable air purifiers have gained substantial market traction due to their versatility, ease of installation, and suitability for diverse living arrangements prevalent in urban India. In October 2025, Dyson launched the compact Purifier Cool PC1–TP11 in India, combining HEPA and activated carbon filtration with smart connectivity, highlighting global brands’ focus on portable purifiers for urban homes. The flexibility to relocate units between rooms appeals to apartment dwellers, renters, and consumers seeking targeted air purification in specific living spaces. Additionally, portable models typically offer lower price points compared to fixed installations, making them accessible to a broader consumer base including first-time buyers and middle-income households.

The segment benefits from continuous product innovation focused on enhancing portability while maintaining purification efficiency. Manufacturers are developing compact, lightweight models with improved coverage areas and reduced noise levels to address consumer preferences for unobtrusive operation. The growing trend toward personal air purification solutions for bedrooms, home offices, and children's rooms further drives portable segment growth as consumers prioritize targeted protection in frequently occupied spaces.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Industrial

- Residential

The residential dominates with a market share of 65% of the total India air purifier market in 2025.

Residential applications constitute the primary demand driver for air purifiers in India, fueled by increasing household awareness regarding indoor air quality and its impact on family health. In 2025, leading electronics retailer Croma saw a 30% year‑on‑year increase in air purifier sales, driven mainly by residential buyers upgrading homes amid worsening air quality in cities like Delhi‑NCR. Urban households, particularly in pollution-affected northern cities, are investing in air purification solutions to protect family members from respiratory ailments, allergies, and long-term health complications associated with prolonged exposure to contaminated air. The presence of vulnerable populations including children, elderly family members, and individuals with pre-existing respiratory conditions further motivates residential adoption.

The residential segment's expansion is supported by increasing disposable incomes, nuclear family structures, and growing health consciousness among urban consumers. Market penetration is extending beyond metropolitan centers to tier-II and tier-III cities as awareness spreads and product prices become more accessible. The segment also benefits from seasonal demand spikes during winter months when households seek protection from deteriorating ambient air quality caused by stubble burning and reduced atmospheric dispersion.

Sales Channel Insights:

- Direct Sales

- Indirect Sales

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

The indirect sales leads with a share of 62% of the total India air purifier market in 2025.

Indirect sales channels have emerged as the dominant distribution pathway for air purifiers in India, encompassing retail outlets, specialty stores, e-commerce platforms, and supermarket chains. This channel preference reflects consumer buying behavior favoring hands-on product evaluation, comparative shopping, and immediate availability. Specialty electronics retailers and home appliance stores offer dedicated product displays, knowledgeable sales staff, and after-sales service assurances that influence purchase decisions.

The online sub-segment within indirect sales has witnessed accelerated growth, supported by expanding internet penetration and smartphone adoption across India. E-commerce platforms offer consumers extensive product selection, competitive pricing, customer reviews, and convenient doorstep delivery. Major e-commerce events and festive season sales campaigns generate significant demand surges, with manufacturers reporting substantial sales increases during promotional periods coinciding with winter pollution episodes.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 34% share of the total India air purifier market in 2025.

North India's market leadership is directly attributable to severe air quality challenges affecting the Delhi-NCR region and surrounding states including Punjab, Haryana, and Uttar Pradesh. The region experiences persistent pollution from vehicular emissions, industrial activity, construction dust, and seasonal agricultural stubble burning that significantly deteriorates ambient air quality during autumn and winter months. Air quality levels frequently reach hazardous thresholds, prompting regulatory authorities to implement emergency response measures including construction bans and vehicle restrictions.

Consumer awareness and adoption rates in North India substantially exceed other regions, with the Delhi-NCR metropolitan area accounting for the majority of national demand. The region's market maturity is reflected in higher penetration of premium products featuring advanced filtration technologies and smart features. Market expansion is occurring in secondary cities including Jaipur, Lucknow, Chandigarh, and Ludhiana as air quality concerns extend beyond the national capital region and consumer awareness continues to grow.

Market Dynamics:

Growth Drivers:

Why is the India Air Purifier Market Growing?

Escalating Air Pollution Levels Across Urban Centers

India’s worsening urban air quality remains a key driver of air purifier market growth. Several cities consistently record particulate matter levels far exceeding national and international standards, driven by vehicular emissions, industrial activity, construction dust, and poor waste management. The Centre for Research on Energy and Clean Air’s winter 2024–25 snapshot reported that 173 of 238 Indian cities exceeded the national PM2.5 standard of 40 µg/m³, with none meeting WHO guidelines; Delhi averaged 159 µg/m³. Prolonged exposure to polluted air is linked to respiratory illnesses, cardiovascular diseases, and reduced life expectancy, prompting households to prioritize indoor air protection. Seasonal winter smog episodes further intensify demand, as stagnant atmospheric conditions trigger acute pollution spikes and immediate consumer response.

Rising Health Awareness and Respiratory Disease Incidence

Heightened awareness of the link between air quality and health outcomes is accelerating air purifier adoption across India. Increasing cases of asthma, allergies, bronchitis, and chronic respiratory conditions have made indoor air quality a household concern. According to reports, doctors in cities like Noida and Ghaziabad are actively advising patients with asthma and other respiratory issues to avoid polluted air and install air purifiers at home when possible, citing indoor pollution as a major trigger for uncontrolled symptoms. Medical professionals increasingly recommend air purifiers for pollution-sensitive patients, reinforcing consumer confidence. Extensive media coverage, government advisories during smog episodes, and environmental awareness campaigns have amplified risk perception. Households with infants, elderly members, or immunocompromised individuals are particularly motivated to invest in air purification solutions.

Technological Advancements and Smart Feature Integration

Ongoing technological innovation is enhancing product differentiation and encouraging consumers to upgrade to advanced air purifiers. Smart features such as IoT connectivity, mobile app control, voice assistant integration, and real-time air quality monitoring have repositioned purifiers as intelligent home management devices. At CES 2025, Korean firm CLEARCHANG introduced the Rebreeze window‑mounted smart air purifier, featuring AI-driven monitoring, sensors, and app connectivity to automatically optimize ventilation and purification, highlighting IoT integration in next‑gen air quality solutions. AI-enabled systems automatically optimize performance based on pollution levels, improving efficiency and energy savings. Multi-layer filtration technologies and quieter, compact, aesthetically appealing designs further expand consumer appeal, supporting premium pricing and adoption among tech-oriented urban households.

Market Restraints:

What Challenges the India Air Purifier Market is Facing?

High Product and Maintenance Costs

The relatively high upfront cost of quality air purifiers and ongoing filter replacement expenses present significant adoption barriers for price-sensitive Indian consumers. Premium models featuring advanced filtration technologies and smart capabilities command prices that exceed affordability thresholds for middle-income households. Recurring maintenance costs, including periodic filter replacements required to maintain purification effectiveness, add to total ownership expenses and discourage budget-conscious consumers.

Limited Consumer Awareness in Non-Metropolitan Areas

Despite growing market penetration in major cities, awareness regarding indoor air quality and air purifier benefits remains limited in smaller towns and rural areas. Many consumers outside metropolitan centers underestimate indoor pollution levels or remain unfamiliar with air purification technology and its health benefits. This awareness gap constrains market expansion beyond established urban markets and limits overall penetration rates across India's diverse geographic landscape.

Concerns Regarding Byproduct Emissions

Certain air purification technologies, particularly ionizers and electrostatic precipitators, may generate ozone and other potentially harmful byproducts during operation. Consumer concerns regarding these emissions, amplified by media reports and regulatory scrutiny, create hesitation among health-conscious buyers. Manufacturers face ongoing pressure to demonstrate product safety and minimize secondary pollution, which can impact consumer confidence and purchasing decisions for certain technology categories.

Competitive Landscape:

The India air purifier market exhibits moderate competitive intensity characterized by the presence of established multinational corporations alongside domestic manufacturers competing across various price segments. Market leaders leverage technological innovation, extensive distribution networks, brand recognition, and after-sales service infrastructure to maintain competitive positioning. Companies differentiate through filtration efficiency ratings, smart feature integration, energy efficiency, noise levels, and design aesthetics. Strategic initiatives include new product launches featuring advanced technologies, expansion of retail and online distribution channels, targeted marketing campaigns during pollution seasons, and partnerships with healthcare organizations. The competitive landscape continues to evolve with emerging domestic players introducing value-oriented products targeting price-sensitive consumer segments while premium brands focus on technology leadership and experiential marketing.

Some of the key players include:

- Blueair India (Unilever plc)

- Crusaders Technologies India Private Limited

- Daikin Airconditioning India Pvt. Ltd. (Daikin Industries Ltd.)

- Dyson Technology India Pvt Ltd

- Eureka Forbes Limited

- Kent RO Systems Ltd

- LG Electronics India Limited (LG Electronics Inc.)

- Panasonic Life Solutions India Pvt. Ltd. (Panasonic Corporation)

- Philips India Limited (Koninklijke Philips N.V.)

- Sharp Business System (India) Pvt. Ltd.

- Xiaomi Technology India Private Limited (Xiaomi Inc.)

Recent Developments:

- In March 2025, Indian clean-tech company Praan launched Praan Hive, a smart air purifier engineered for extreme urban pollution in cities such as Delhi and Mumbai. The device uses medical-grade H14 HEPA filtration and offers real-time monitoring of air quality, temperature, humidity, and CO₂ levels, with remote operation enabled through Wi-Fi and cellular connectivity.

India Air Purifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Filter Technologies Covered | High Efficiency Particulate Air (HEPA), Activated Carbon, Ionic Filters, Others |

| Mounting Types Covered | Fixed, Portable |

| Applications Covered | Commercial, Industrial, Residential |

| Sales Channels Covered |

|

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Blueair India (Unilever plc), Crusaders Technologies India Private Limited, Daikin Airconditioning India Pvt. Ltd. (Daikin Industries Ltd.), Dyson Technology India Pvt Ltd, Eureka Forbes Limited, Kent RO Systems Ltd, LG Electronics India Limited (LG Electronics Inc.), Panasonic Life Solutions India Pvt. Ltd. (Panasonic Corporation), Philips India Limited (Koninklijke Philips N.V.), Sharp Business System (India) Pvt. Ltd., Xiaomi Technology India Private Limited (Xiaomi Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India air purifier market size was valued at USD 579.06 Million in 2025.

The India air purifier market is expected to grow at a compound annual growth rate of 13.54% from 2026-2034 to reach USD 1815.20 Million by 2034.

High Efficiency Particulate Air (HEPA) technology dominates the India air purifier market with a 45% share, driven by superior particle filtration efficiency and growing consumer preference for medical-grade purification solutions effective against particulate matter pollutants.

Key factors driving the India air purifier market include escalating air pollution levels across urban centers, rising health awareness and respiratory disease incidence, technological advancements integrating smart features, and government initiatives promoting clean air awareness.

Major challenges include high product and maintenance costs limiting accessibility for price-sensitive consumers, limited awareness in non-metropolitan areas constraining market expansion, concerns regarding byproduct emissions from certain technologies, and seasonal demand volatility affecting consistent market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)