India Airborne LiDAR Market Size, Share, Trends and Forecast by Type, Component, Platform, Application, End User, and Region, 2025-2033

India Airborne LiDAR Market Overview:

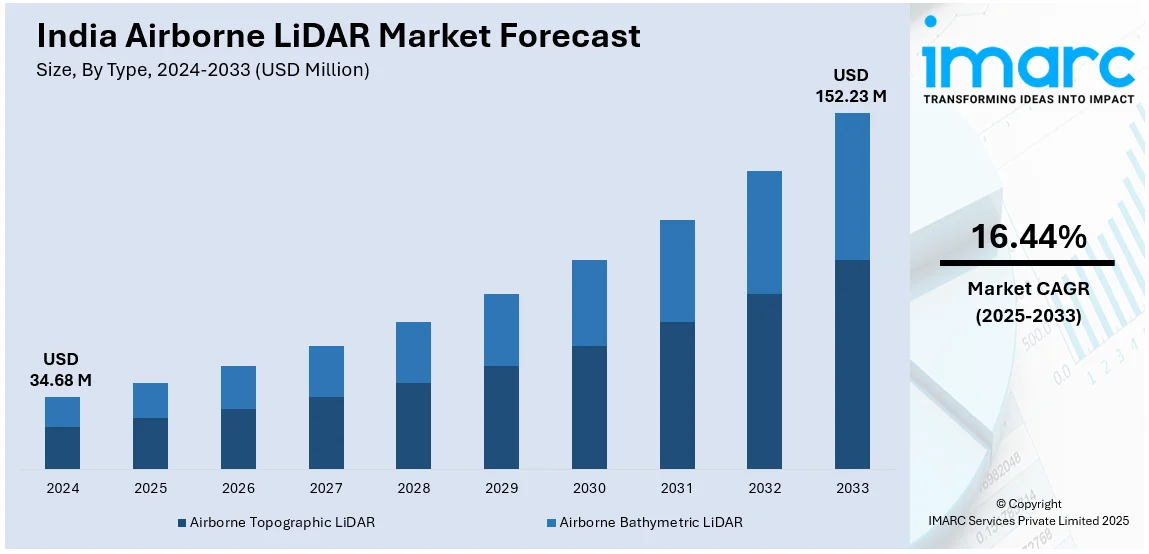

The India airborne LiDAR market size reached USD 34.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 152.23 Million by 2033, exhibiting a growth rate (CAGR) of 16.44% during 2025-2033. The market is witnessing significant, driven by an increasing demand for precision in surveying and mapping and advancements in LiDAR technology and integration with drones.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.68 Million |

| Market Forecast in 2033 | USD 152.23 Million |

| Market Growth Rate (2025-2033) | 16.44% |

India Airborne LiDAR Market Trends:

Increasing Demand for Precision in Surveying and Mapping

The market for Airborne LiDAR in India has burgeoned owing to the rise of various sectors in need of high-precision surveying and mapping, especially focusing on infrastructure, agriculture, and environmental management. Airborne LiDAR has achieved perfect accuracy, efficiency, and rapidity in capturing topographical data; hence, it is of preference for large-scale projects. Thus, government initiatives directed towards urban development, such as the Smart Cities Mission, require information that will be sufficiently detailed and precise to serve various needs for urban planning and management. Therefore, considering the increased demand for spatial data, a reliable solution in airborne LiDAR remains a source for topographic mapping, vegetation analysis, and flooding to be modeled, informed from knowledge-based selectable choices. For instance, in June 2024, Northeast Frontier Railway announced conducting an Airborne Lidar Survey on the Lumding-Badarpur hill section to analyze soil, slope stability, and water accumulation. The survey, awarded to GarudaUAV, covers KM 45 to KM 125. Additionally, industries like agriculture are leveraging airborne LiDAR for crop monitoring and terrain analysis, facilitating better resource management and crop yield predictions. The demand for high-resolution 3D models and digital elevation models (DEMs) has facilitated the adoption of airborne LiDAR in various commercial and industrial applications. Furthermore, the increasing use of LiDAR in transportation and infrastructure sectors for road alignment, bridge design, and railway monitoring further propels the market. These factors collectively contribute to the rising need for airborne LiDAR systems, ensuring long-term growth prospects for the market in India.

To get more information on this market, Request Sample

Advancements in LiDAR Technology and Integration with Drones

Technological advancements in LiDAR systems, combined with the integration of drones, are transforming the airborne LiDAR market in India. Drones equipped with LiDAR sensors are becoming increasingly popular due to their ability to collect data from hard-to-reach or hazardous areas at a fraction of the cost and time required by traditional methods. The ability to fly low and capture highly detailed and accurate geospatial data is making drones an essential tool for industries such as mining, construction, and environmental monitoring. Recent developments in LiDAR sensor technology have also enhanced the capabilities of airborne LiDAR systems. With improved range, resolution, and accuracy, modern LiDAR sensors are now able to capture more detailed topographical features, making them invaluable for tasks such as forestry management, powerline inspections, and floodplain analysis. Additionally, the integration of real-time data processing with advanced GIS (Geographic Information Systems) software has enabled more efficient analysis and interpretation of the data collected. For instance, in March 2025, The Ministry of Defence signed a Rs 2,906 crore deal with Bharat Electronics for the Ashwini Low-Level Transportable Radar, boosting the Indian Air Force's capabilities in tracking aerial targets, including UAVs and helicopters. As drone-based LiDAR solutions continue to evolve, their adoption across various sectors in India is expected to grow exponentially. This trend not only makes airborne LiDAR more accessible but also increases its utility in applications that require real-time, high-precision data. Consequently, the integration of LiDAR technology with drones is set to be a key driver of market expansion in India.

India Airborne LiDAR Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, component, platform, application, and end user.

Type Insights:

- Airborne Topographic LiDAR

- Airborne Bathymetric LiDAR

The report has provided a detailed breakup and analysis of the market based on the type. This includes airborne topographic LiDAR and airborne bathymetric LiDAR

Component Insights:

- Laser Scanners

- Inertial Navigation Systems

- Camera

- GPS and GNSS Receivers

- Micro-Electromechanical Systems

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes laser scanners, inertial navigation systems, camera, GPS and GNSS receivers, and micro-electromechanical systems.

Platform Insights:

- Fixed Wing Aircraft

- Rotary Wing Aircraft

- UAVs

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes fixed-wing aircraft, rotary wing aircraft, and UAVs.

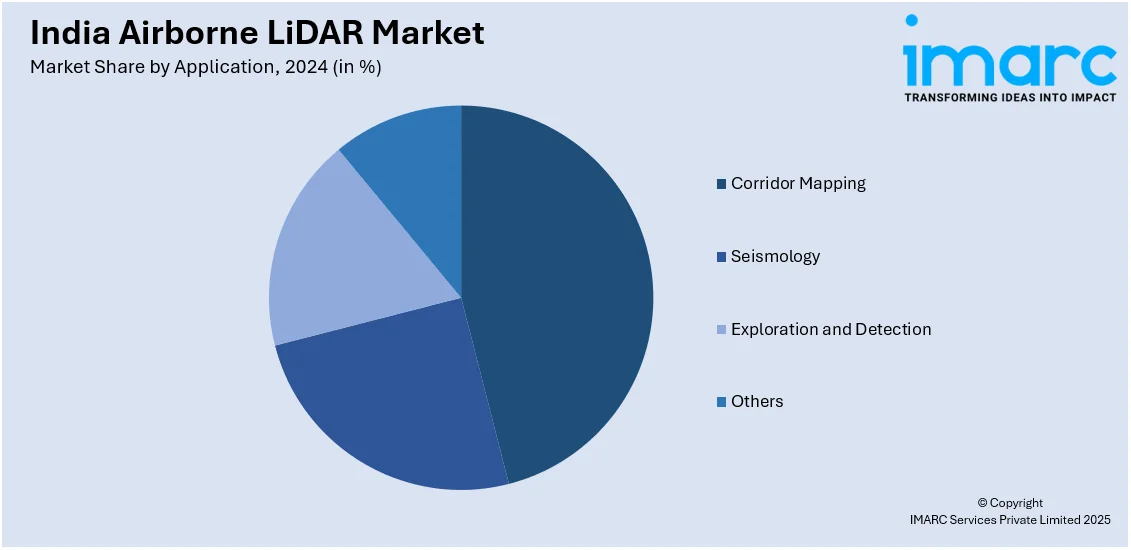

Application Insights:

- Corridor Mapping

- Seismology

- Exploration and Detection

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes corridor mapping, seismology, exploration and detection, and others.

End User Insights:

- Aerospace and Defense

- Civil Engineering

- Forestry and Agriculture

- Transportation

- Archaeology

- Mining Industry

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes aerospace and defense, civil engineering, forestry and agriculture, transportation, archaeology, and mining industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Airborne LiDAR Market News:

- In February 2025, at Aero India, HENSOLDT showcased next-gen airborne sensor solutions, including Advanced AESA Radar & ISR Systems, to support India’s defense modernization. As a technology partner in India’s ‘Make in India’ and ‘Atmanirbhar Bharat’ initiatives, HENSOLDT aims to enhance India’s self-reliance in aerospace and defence with cutting-edge solutions.

India Airborne LiDAR Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Airborne Topographic LiDAR and Airborne Bathymetric LiDAR |

| Components Covered | Laser Scanners, Inertial Navigation Systems, Camera, GPS and GNSS Receivers, and Micro-Electromechanical Systems |

| Platforms Covered | Fixed Wing Aircraft, Rotary Wing Aircraft, UAVs |

| Applications Covered | Corridor Mapping, Seismology, Exploration and Detection, Others |

| End Users Covered | Aerospace and Defense, Civil Engineering, Forestry and Agriculture, Transportation, Archaeology, Mining Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India airborne LiDAR market performed so far and how will it perform in the coming years?

- What is the breakup of the India airborne LiDAR market on the basis of type?

- What is the breakup of the India airborne LiDAR market on the basis of component?

- What is the breakup of the India airborne LiDAR market on the basis of platform?

- What is the breakup of the India airborne LiDAR market on the basis of application?

- What is the breakup of the India airborne LiDAR market on the basis of end user?

- What is the breakup of the India airborne LiDAR market on the basis of region?

- What are the various stages in the value chain of the India airborne LiDAR market?

- What are the key driving factors and challenges in the India airborne LiDAR?

- What is the structure of the India airborne LiDAR market and who are the key players?

- What is the degree of competition in the India airborne LiDAR market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India airborne LiDAR market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India airborne LiDAR market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India airborne LiDAR industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)