India Aircraft Components Market Size, Share, Trends and Forecast by Aircraft Type, Component, End User, and Region, 2025-2033

India Aircraft Components Market Overview:

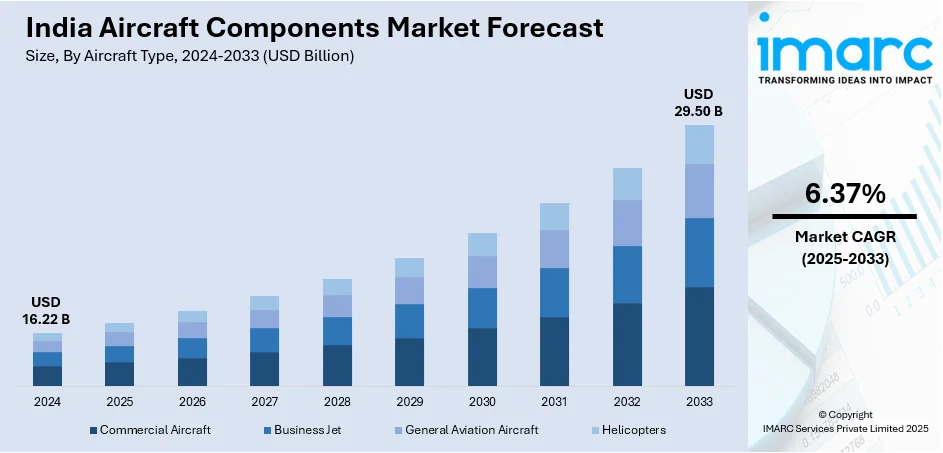

The India aircraft components market size reached USD 16.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.50 Billion by 2033, exhibiting a growth rate (CAGR) of 6.37% during 2025-2033. The market is expanding due to rising aircraft production, increasing defense investments, and the growth of domestic aviation. Government initiatives like ‘Make in India’ and partnerships with global aerospace firms drive localization, technological advancements, and supply chain development, boosting market competitiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.22 Billion |

| Market Forecast in 2033 | USD 29.50 Billion |

| Market Growth Rate (2025-2033) | 6.37% |

India Aircraft Components Market Trends:

Increasing Localization and Indigenous Manufacturing

The India aircraft components market is witnessing a significant shift toward localization, driven by government initiatives like Make in India and Atmanirbhar Bharat. For instance, in September 2024, Airbus demonstrated its active efforts to cater to Make in India initiative by forming strategic alliance with Mahindra Aerospace Structures Private Limited and Tata Advanced Systems Limited for the procurement of commercial aircraft components. As per the agreement, Mahindra Aerostructures as well as Tata will produce metallic detail parts, assemblies, and components for Airbus' programmes named A320neo, A330neo, and A320neo. In line with this, the focus on reducing dependence on imports has encouraged domestic production of critical aerospace components, including fuselage structures, avionics, and propulsion systems. Major global aerospace firms are entering joint ventures and technology transfer agreements with Indian manufacturers to establish local supply chains. The growth of small and medium enterprises (SMEs) specializing in precision engineering and composite materials further strengthens indigenous manufacturing. Additionally, policy support enhances the business environment for aerospace component production. With rising aircraft procurement from domestic and defense aviation sectors, the demand for locally produced components is expected to grow, positioning India as a global aerospace manufacturing hub while ensuring cost efficiency, supply chain resilience, and technological self-reliance.

To get more information on this market, Request Sample

Expanding Aerospace Exports and Global Collaborations

India’s aircraft components market is experiencing rapid growth in aerospace exports, supported by increased global collaborations with leading Original Equipment Manufacturers (OEMs). For instance, as per industry reports, in February 2025, a newly formed organization, Aerospace India Association, announced its plans to boost India's aerospace exports by tenfold in upcoming years, which, as of 2025, stands at a valuation of USD 2 Billion. In parallel, the aviation market of India is anticipated to become third largest globally by the year 2030. Moreover, Indian companies are expanding their capabilities to meet international aerospace standards. The rising demand for cost-effective, high-quality components in the global supply chain has positioned India as a competitive exporter of precision-engineered parts, landing gear systems, and avionics. Agreements with major aircraft manufacturers further strengthen India’s role in the global aerospace ecosystem. Additionally, Special Economic Zones (SEZs) and aerospace parks in states like Karnataka, Telangana, and Tamil Nadu are fostering industry growth by providing infrastructure, R&D support, and tax incentives. As global demand for commercial and defense aircraft rises, India’s aerospace export market is set to expand, enhancing its reputation as a reliable supplier of aircraft components.

India Aircraft Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on aircraft type, component, and end user.

Aircraft Type Insights:

- Commercial Aircraft

- Business Jet

- General Aviation Aircraft

- Helicopters

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes commercial aircraft, business jet, general aviation aircraft, and helicopters.

Component Insights:

- Engine

- Wheel and Brakes

- Landing Gear

- Avionics

- Fuel System

- Hydraulic System

- Cockpit System

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes engine, wheel and brakes, landing gear, avionics, fuel system, hydraulic system, cockpit system, and others.

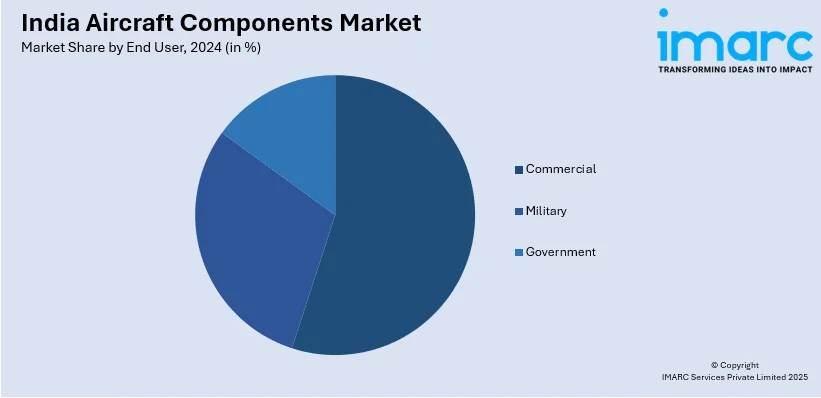

End User Insights:

- Commercial

- Military

- Government

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial, military, and government.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aircraft Components Market News:

- In February 2025, Hindustan Aeronautics Limited announced signing of a contract with Safran Aircraft Engines for turbine forged parts supply for their engines named Leading Edge Aviation Propulsion.

- In September 2024, GE Aerospace announced plans to boost components sourcing from India, a potent aviation market. The firm has already a manufacturing plant in Pune, with 13 key suppliers, including TATA.

India Aircraft Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Commercial Aircraft, Business Jet, General Aviation Aircraft, Helicopters |

| Components Covered | Engine, Wheel and Brakes, Landing Gear, Avionics, Fuel System, Hydraulic System, Cockpit System, Others |

| End Users Covered | Commercial, Military, Government |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aircraft components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aircraft components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aircraft components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aircraft components market in India was valued at USD 16.22 Billion in 2024.

The India aircraft components market is projected to exhibit a CAGR of 6.37% during 2025-2033, reaching a value of USD 29.50 Billion by 2033.

The India aircraft components market is driven by rising air passenger traffic, government initiatives to boost domestic aerospace manufacturing, and increasing investments from global OEMs. Growth in defense aviation, coupled with the “Make in India” program and technological advancements, is further propelling demand for locally produced aircraft components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)