India Aircraft Line Maintenance Market Size, Share, Trends and Forecast by Service, Type, Aircraft Type, Technology, and Region, 2025-2033

India Aircraft Line Maintenance Market Overview:

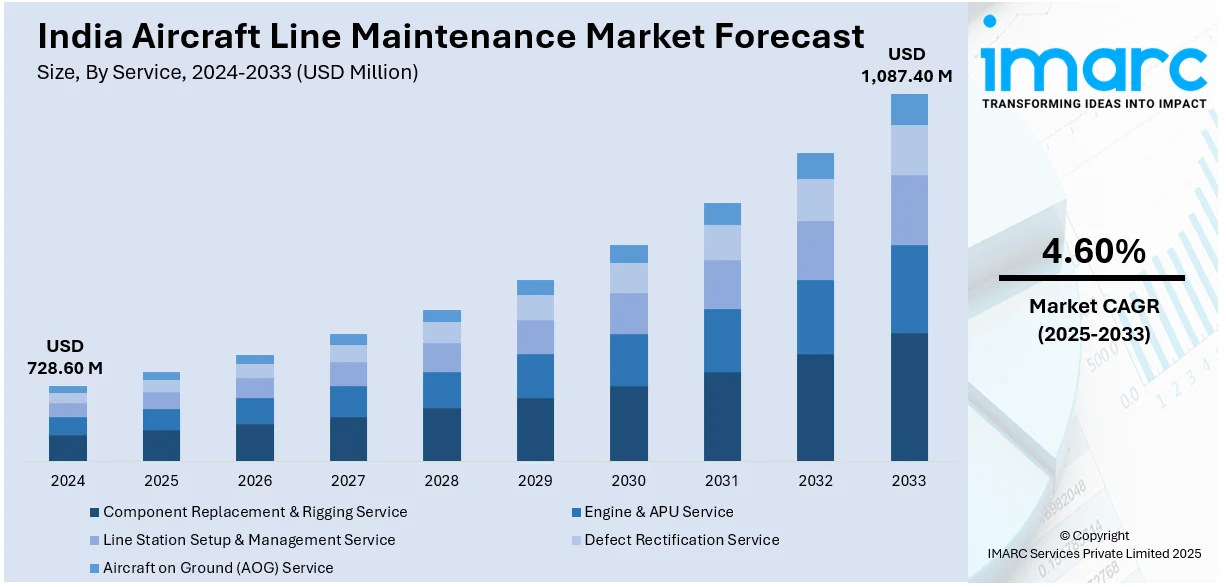

The India aircraft line maintenance market size reached USD 728.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,087.40 Million by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The expansion of India's aviation sector, increasing air passenger traffic, and growing aircraft fleet size are driving demand for line maintenance services. Rising investments in MRO infrastructure, stringent regulatory compliance, and the adoption of advanced diagnostic technologies further propel market growth. Airlines’ focus on reducing turnaround time and enhancing operational efficiency also contributes significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 728.60 Million |

| Market Forecast in 2033 | USD 1,087.40 Million |

| Market Growth Rate (2025-2033) | 4.60% |

India Aircraft Line Maintenance Market Trends:

Adoption of Predictive Maintenance Technologies

Aircraft maintenance in India is shifting toward predictive maintenance, leveraging artificial intelligence (AI), IoT sensors, and big data analytics. Airlines and maintenance service providers are integrating real-time monitoring systems to detect potential failures before they occur, enhancing safety and reducing unplanned downtime. Predictive analytics help optimize maintenance schedules, improving fleet availability and operational efficiency. With growing investments in digital transformation, Indian airlines are adopting AI-powered tools to monitor aircraft health, track component wear, and minimize maintenance costs. The use of machine learning algorithms allows maintenance teams to make data-driven decisions, ensuring quicker turnaround times and reduced flight disruptions. This trend aligns with global aviation standards, positioning India’s aircraft line maintenance sector for increased automation and efficiency. For instance, in September 2024, Air India commenced construction of a mega Maintenance, Repair, and Overhaul (MRO) facility in Bengaluru, reinforcing its commitment to self-reliance in fleet maintenance. The 35-acre facility at Bangalore International Airport will support line and base maintenance for wide-body and narrow-body aircraft. This initiative, in partnership with SIA Engineering Company, will generate 1,200+ jobs and strengthen India’s aviation ecosystem. The MRO will feature advanced maintenance technology, enhancing operational efficiency and global connectivity, making Bengaluru a key aviation hub for Air India.

To get more information on this market, Request Sample

Expansion of MRO Facilities and Strategic Partnerships

The increasing demand for Maintenance, Repair, and Overhaul (MRO) services is leading to the establishment of new line maintenance facilities across India. For instance, as per recent industry reports, the Indian aircraft MRO industry is projected to experience a 50% revenue growth, reaching ₹4,500 crore by fiscal year 2026. This surge is primarily driven by the anticipated 20-25% expansion in airline fleets, increasing demand for maintenance services. Airlines are forming strategic partnerships with global MRO providers to access specialized maintenance capabilities, advanced tooling, and skilled workforce training. Additionally, regulatory initiatives supporting "Make in India" policies are encouraging foreign direct investments (FDI) in aviation maintenance, reducing dependency on overseas MRO services. As Indian carriers expand their fleets, collaboration with OEM-certified maintenance providers ensures compliance with safety regulations and improves operational readiness. This localized MRO expansion is expected to significantly reduce maintenance costs and improve service efficiency for airlines operating in India.

India Aircraft Line Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service, type, aircraft type, and technology.

Service Insights:

- Component Replacement & Rigging Service

- Engine & APU Service

- Line Station Setup & Management Service

- Defect Rectification Service

- Aircraft on Ground (AOG) Service

The report has provided a detailed breakup and analysis of the market based on the service. This includes component replacement & rigging service, engine & APU service, line station setup & management service, defect rectification service, and aircraft on ground (AOG) service.

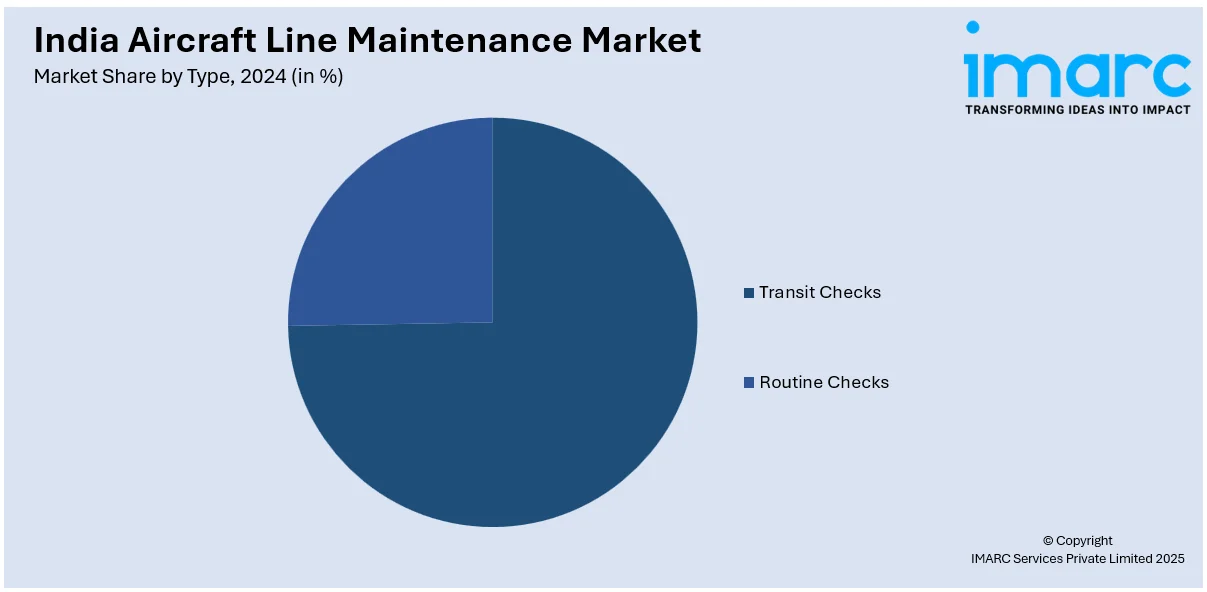

Type Insights:

- Transit Checks

- Routine Checks

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes transit and routine checks.

Aircraft Type Insights:

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large body Aircraft

- Others

A detailed breakup and analysis of the market based on the aircraft type have also been provided in the report. This includes narrow body aircraft, wide-body aircraft, very large body aircraft, and others.

Technology Insights:

- Traditional Line Maintenance

- Digital Line Maintenance

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes traditional line maintenance and digital line maintenance.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aircraft Line Maintenance Market News:

- In January 2025, Air India announced plans to in-source aircraft line maintenance at all 55 domestic stations by April 2025, currently managing 42 stations internally. This strategic move aims to enhance control over maintenance quality and timeliness, allowing for a broader range of in-house tasks, including lighter checks during extended transits and overnight stops. This initiative is part of Air India's comprehensive transformation plan under the Tata Group, which also includes merging Vistara and integrating AIX Connect to streamline operations and improve service delivery.

- In December 2024, the Adani Group announced its acquisition of Air Works, India’s largest private aircraft maintenance, repair, and overhaul (MRO) company, for ₹400 crore. This acquisition enhances Adani's presence in both commercial and defence aviation services, strengthening India's self-sufficient MRO ecosystem. Air Works, operating in 35 cities with over 1,300 personnel, provides line maintenance, heavy checks, interior refurbishment, and avionics services. The move aligns with India's growing aviation sector, expected to induct over 1,500 aircraft in the coming years.

- In January 2025, Star Air entered the aircraft maintenance, repair, and overhaul (MRO) business through a joint venture, focusing on line and major maintenance for regional and business jets. The airline, operating 44 daily flights across 23 destinations, plans to expand its fleet to 14 aircraft by March 2025. It will also increase commercial and RCS flights under India's UDAN scheme.

- In November 2024, Air India partnered with Bengaluru Airport City Limited (BACL) to establish an Aircraft Maintenance Engineering (AME) training facility at Bengaluru Airport City. The 86,000-square-foot campus, set to open by mid-2026, will support Air India’s growing fleet maintenance needs. The facility will function as a Basic Maintenance Training Organisation (BMTO), providing DGCA-certified programs to train skilled engineers. This initiative aligns with Air India’s Vihaan AI transformation plan, which includes a mega MRO facility and in-house line maintenance operations.

- In March 2024, Boeing and AI Engineering Services Ltd (AIESL) partnered to enhance aircraft maintenance training in India. Boeing will provide training materials and support, while AIESL will leverage its infrastructure and seek regulatory approval. The collaboration aligns with Boeing’s projection of a rising demand for aviation professionals in India. This initiative is part of Boeing's India Repair Development and Sustainment (BIRDS) program, aiming to strengthen India’s Maintenance, Repair, and Overhaul (MRO) capabilities and foster a skilled aviation workforce.

India Aircraft Line Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Component Replacement & Rigging Service, Engine & APU Service, Line Station Setup & Management Service, Defect Rectification Service, Aircraft on Ground (AOG) Service |

| Types Covered | Transit Checks, Routine Checks |

| Aircraft Types Covered | Narrow Body Aircraft, Wide-Body Aircraft, Very Large Body Aircraft, Others |

| Technologies Covered | Traditional Line Maintenance, Digital Line Maintenance |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India aircraft line maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the India aircraft line maintenance market on the basis of service?

- What is the breakup of the India aircraft line maintenance market on the basis of type?

- What is the breakup of the India aircraft line maintenance market on the basis of aircraft type?

- What is the breakup of the India aircraft line maintenance market on the basis of technology?

- What are the various stages in the value chain of the India aircraft line maintenance market?

- What are the key driving factors and challenges in the India aircraft line maintenance market?

- What is the structure of the India aircraft line maintenance market and who are the key players?

- What is the degree of competition in the India aircraft line maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aircraft line maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aircraft line maintenance market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aircraft line maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)