India Aircraft MRO Market Size, Share, Trends and Forecast by Type, Industry, Aircraft Type, Periodicity, Operator, and Region, 2025-2033

India Aircraft MRO Market Overview:

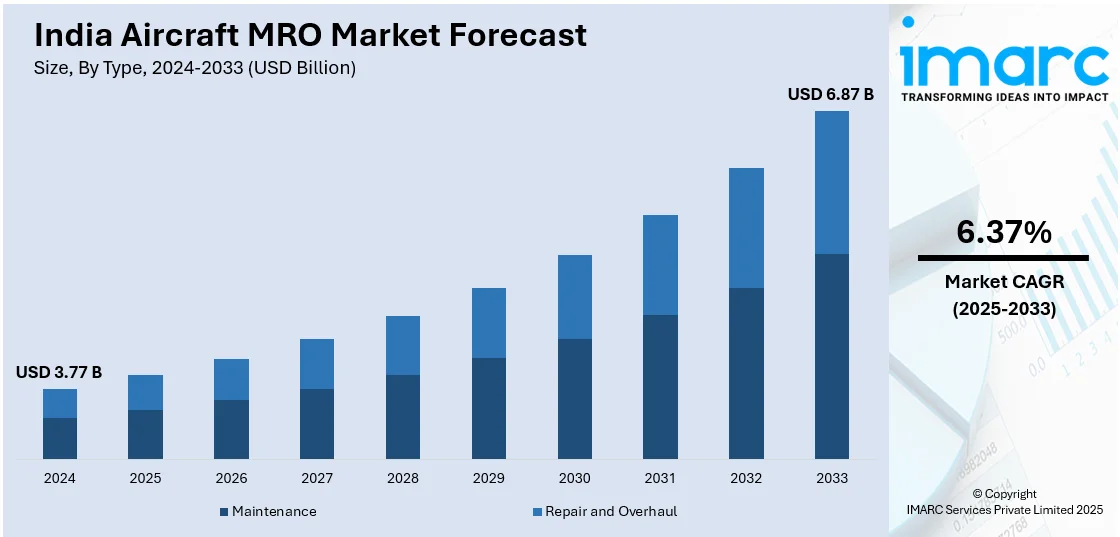

The India aircraft MRO market size reached USD 3.77 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.87 Billion by 2033, exhibiting a growth rate (CAGR) of 6.37% during 2025-2033. The increasing air passenger traffic, fleet expansion, government initiatives like UDAN, low labor costs, growing presence of international MRO providers, technological advancements, rising aircraft imports, and the establishment of dedicated MRO hubs and tax incentives are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.77 Billion |

| Market Forecast in 2033 | USD 6.87 Billion |

| Market Growth Rate 2025-2033 | 6.37% |

India Aircraft MRO Market Trends:

Expansion of Domestic MRO Capabilities

India's aviation sector is witnessing a significant shift with the strengthening of local maintenance, repair, and overhaul (MRO) capacities. Strategic investments in MRO firms are enhancing indigenous capabilities, reducing dependency on foreign service providers, and creating employment opportunities. This development also supports the government's initiatives to bolster the aviation ecosystem. With more companies aiming to offer integrated services for both defense and civil aviation, the sector is poised for accelerated growth. Such moves also cater to the increasing demand for aircraft maintenance driven by expanding airline fleets. Additionally, increased domestic MRO capabilities are expected to reduce service turnaround times and lower operational costs for airlines, further supporting the growth of the aviation sector. For example, in December 2024, Adani Defence Systems & Technologies Ltd. (ADSTL) signed a binding agreement to acquire an 85.8% stake in Air Works, India's largest private-sector MRO company, for an enterprise value of INR 400 Crore. Air Works operates across 35 cities with over 1,300 employees, offering services for both fixed-wing and rotary-wing aircraft. This acquisition enhances Adani's capabilities in the defense MRO sector and supports its expansion into civil aviation services.

To get more information on this market, Request Sample

Boosting Self-Reliance in Defense Aviation Services

India’s defense aviation sector is experiencing an increased focus on localized MRO services. Establishing dedicated military MRO facilities enhances operational readiness, ensuring quicker turnaround times for aircraft maintenance. This shift reduces reliance on foreign support while fostering technological expertise within the country. Such initiatives align with the government’s vision of self-reliance in defense manufacturing. Additionally, they create skilled employment opportunities and stimulate the development of a robust defense ecosystem. By focusing on in-country maintenance solutions, the sector is better equipped to support the operational needs of the armed forces, contributing to national security and economic growth. This development also positions India as a key player in regional defense aviation maintenance. For instance, in September 2024, Dassault Aviation launched Dassault Aviation MRO India (DAMROI), a subsidiary based in Noida, Uttar Pradesh, dedicated to military MRO services. DAMROI aims to support the Indian Air Force's Mirage 2000 fleet and other Dassault-supplied fighter aircraft, enhancing responsiveness and efficiency. Aligned with the "Atmanirbhar Bharat" initiative, this move strengthens India's self-reliance in defense aviation services.

India Aircraft MRO Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, industry, aircraft type, periodicity, and operator.

Type Insights:

- Maintenance

- Line Maintenance

- Component Maintenance

- Airframe Maintenance

- Engine Maintenance

- Repair and Overhaul

The report has provided a detailed breakup and analysis of the market based on the type. This includes maintenance (line maintenance, component maintenance, airframe maintenance, engine maintenance) and repair and overhaul.

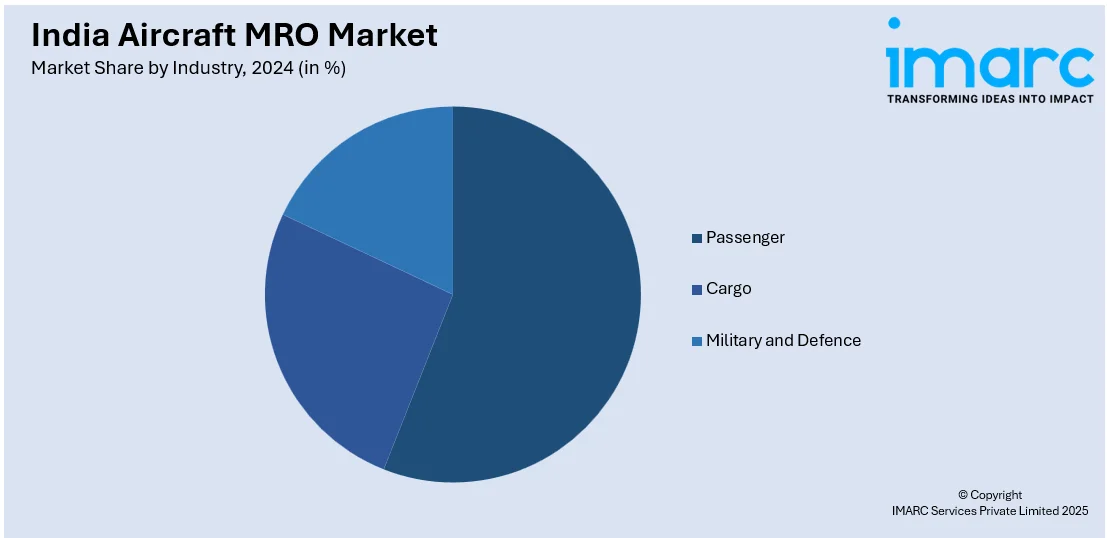

Industry Insights:

- Passenger

- Cargo

- Military and Defence

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes passenger, cargo, and military and defence.

Aircraft Type Insights:

- Aircraft

- Wide Body

- Narrow Body

- Jets

- Helicopters

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes aircraft (wide body and narrow body), jets, and helicopters.

Periodicity Insights:

- Scheduled Maintenance

- Unscheduled Maintenance

A detailed breakup and analysis of the market based on the periodicity have also been provided in the report. This includes scheduled maintenance and unscheduled maintenance.

Operator Insights:

- OEMs Aftermarket

- Third Party Vendors

A detailed breakup and analysis of the market based on the operator have also been provided in the report. This includes OEMs aftermarket and third party vendors.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aircraft MRO Market News:

- In March 2025, Thales inaugurated a new avionics maintenance, repair, and overhaul (MRO) facility in Gurugram, strategically located near Delhi Airport. This center would provide comprehensive avionics maintenance and repair services to major Indian airlines, including Air India and IndiGo, supporting the growth of India's aviation industry. Certified by the Directorate General of Civil Aviation (DGCA) in December 2024, the facility aligns with the "Aatmanirbhar Bharat" vision by enhancing local MRO capabilities.

- In January 2025, Bangalore-based regional carrier Star Air announced its plan to enter the aircraft MRO sector through a joint venture aimed at servicing regional and business jets. Celebrating six years of operations, the airline intends to expand its fleet to 14 aircraft and increase its network to over 100 flights.

India Aircraft MRO Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Industries Covered | Passenger, Cargo, Military and Defence |

| Aircraft Types Covered |

|

| Periodicities Covered | Scheduled Maintenance, Unscheduled Maintenance |

| Operators Covered | OEMs Aftermarket, Third Party Vendors |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aircraft MRO market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aircraft MRO market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aircraft MRO industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India aircraft maintenance, repair, and overhaul (MRO) market reached a value of USD 3.77 Billion in 2024.

The India aircraft MRO market is projected to reach USD 6.87 Billion by 2033, growing at a CAGR of 6.37% during 2025-2033.

The market growth is fueled by the rapid expansion of the aviation sector, increasing aircraft fleet size, and rising air passenger traffic across domestic and international routes. The government's push to make India a global aviation hub, along with favorable policy reforms such as reduced taxation and the establishment of dedicated MRO zones, is attracting investment. Furthermore, technological advancements in predictive maintenance, digitization of MRO processes, and growing demand for MRO services for defense and cargo aircraft are enhancing the market potential.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)