India Airless Packaging Market Size, Share, Trends and Forecast by Material, Product, Application, and Region, 2026-2034

India Airless Packaging Market Summary:

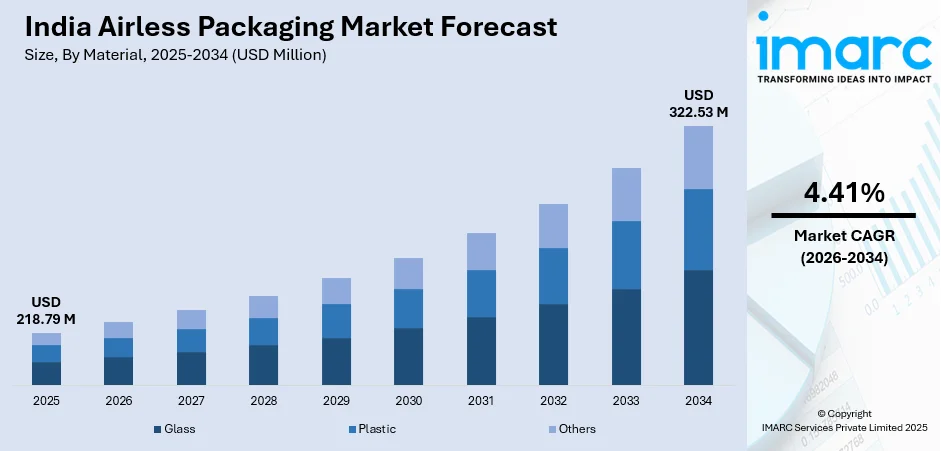

The India airless packaging market size was valued at USD 218.79 Million in 2025 and is projected to reach USD 322.53 Million by 2034, growing at a compound annual growth rate of 4.41% from 2026-2034.

The India airless packaging market is experiencing robust growth, driven by the expanding personal care and cosmetics industry, rising consumer awareness regarding product hygiene and contamination-free packaging solutions. The increasing preference for premium skincare products containing sensitive formulations requiring protection from oxidation is propelling market expansion across the country.

Key Takeaways and Insights:

- By Material: Plastic dominates the market with a share of 75% in 2025, owing to its lightweight properties, cost-effectiveness, versatility in molding, and compatibility with various product formulations across personal care applications.

- By Product: Bottles and Jars lead the market with a share of 46% in 2025, driven by their aesthetic appeal, customization options, and suitability for premium skincare and cosmetic product packaging.

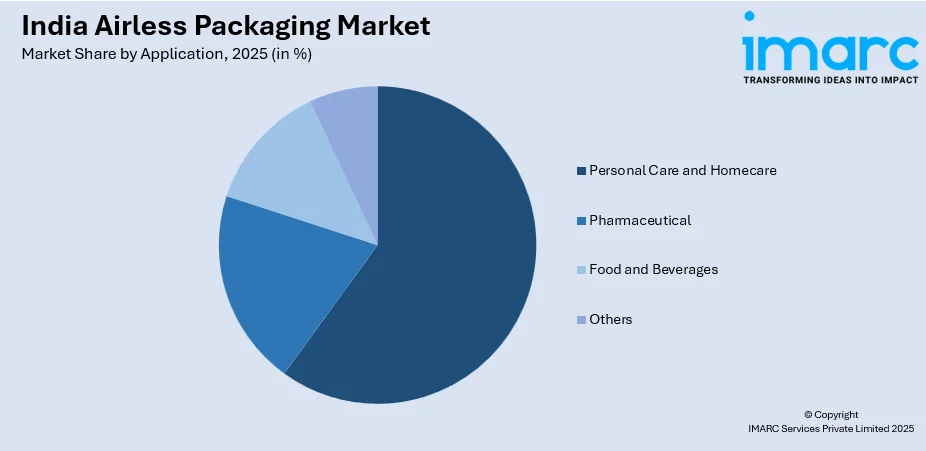

- By Application: Personal Care and Homecare represents the largest segment with a market share of 60% in 2025, fueled by growing consumer spending on beauty products, rising urbanization, and increasing demand for preservative-free cosmetic formulations.

- Key Players: The India airless packaging market exhibits a moderately fragmented competitive landscape, with both multinational packaging corporations and regional manufacturers competing across premium and mass-market segments through innovation in sustainable and recyclable packaging solutions.

To get more information on this market Request Sample

The India airless packaging market is witnessing significant transformation driven by the country's booming beauty and personal care sector, which continues to expand rapidly with increasing disposable incomes and evolving consumer preferences. In fact, imports of skincare and cosmetics surged to US $171.9 million in FY25, up from US $80.9 million in FY20, a clear sign that premium beauty products are gaining strong traction across India. The growing penetration of e-commerce platforms has further accelerated market growth by enabling broader distribution of premium beauty products requiring specialized packaging. Manufacturers are increasingly focusing on developing eco-friendly airless packaging solutions incorporating recycled materials and refillable systems to address sustainability concerns. The pharmaceutical sector also presents substantial growth opportunities, with rising demand for contamination-free packaging for dermatological products and sensitive drug formulations. Government initiatives supporting domestic manufacturing and the expansion of international cosmetic brands into the Indian market are creating favorable conditions for airless packaging adoption across diverse product categories.

India Airless Packaging Market Trends:

Growing Adoption of Sustainable and Recyclable Packaging Solutions

Environmental consciousness among Indian consumers and regulatory pressures are driving the adoption of eco-friendly airless packaging solutions. Manufacturers are increasingly incorporating post-consumer recycled plastics, biodegradable materials, and refillable packaging systems. The shift toward mono-material designs enhances recyclability while maintaining product protection. In October 2024, Praj Industries inaugurated India’s first demonstration facility for biopolymers, producing bio‑based polylactic acid (PLA) that can serve as a biodegradable alternative to fossil‑based plastics. Leading packaging companies are investing in research and development to create paper-based airless containers and bio-based polymers that reduce environmental impact without compromising functionality.

Rising Demand for Premium and Luxury Cosmetic Packaging

The expanding middle-class population and increasing aspiration for luxury beauty products are fueling demand for premium airless packaging in India. Consumers increasingly associate sophisticated packaging with product quality and efficacy, prompting brands to invest in aesthetically appealing airless solutions. Customization options including spray finishes, foil stamping, and unique dispensing mechanisms are gaining traction among premium skincare brands seeking differentiation in a competitive marketplace. In 2025, several global beauty firms such as Shiseido have signalled plans to begin local manufacturing in India to meet rising aspirational demand, a move likely to boost adoption of premium, locally produced packaging including luxury‑grade airless containers.

Integration of Advanced Dispensing Technologies

Technological innovations in airless dispensing systems are transforming product delivery mechanisms in the Indian market. Advanced piston-based systems and vacuum-sealed containers ensure complete product evacuation while preventing contamination. Smart packaging features including dose-control mechanisms and tamper-evident designs are gaining prominence, particularly in pharmaceutical and dermocosmetic applications. These innovations enhance user experience while extending product shelf life significantly. For example, in September 2025 The Packaging Company launched a new Airless Pump Jar for skincare and cosmetics designed to minimize air exposure and reduce product waste, a development reflecting growing demand for hygienic, high-performance dispensing systems.

Market Outlook 2026-2034:

The India airless packaging market is poised for substantial expansion over the forecast period, driven by sustained growth in the personal care and pharmaceutical sectors. The increasing preference for contamination-free packaging solutions, coupled with rising investments in sustainable packaging technologies, will continue propelling market development. The expanding e-commerce distribution channels and growing consumer awareness regarding product preservation benefits present significant growth opportunities. The market generated a revenue of USD 218.79 Million in 2025 and is projected to reach a revenue of USD 322.53 Million by 2034, growing at a compound annual growth rate of 4.41% from 2026-2034.

India Airless Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material | Plastic | 75% |

| Product | Bottles and Jars | 46% |

| Application | Personal Care and Homecare | 60% |

Material Insights:

- Glass

- Plastic

- Others

The plastic dominates with a market share of 75% of the total India airless packaging market in 2025.

Plastic materials maintain overwhelming dominance in India's airless packaging market owing to their exceptional versatility, cost-effectiveness, and lightweight properties that reduce transportation costs. Various plastic resins including polyethylene, polypropylene, PET, and PMMA are extensively utilized for manufacturing airless bottles, jars, and tubes across personal care and pharmaceutical applications. The ease of molding plastic into diverse shapes and sizes enables manufacturers to offer customized packaging solutions meeting specific brand requirements.

The growing emphasis on sustainability is driving innovations in plastic airless packaging, with manufacturers increasingly incorporating post-consumer recycled content and developing mono-material designs for enhanced recyclability. Industry leaders are investing in advanced manufacturing technologies to produce plastic airless containers with superior barrier properties while reducing overall material consumption. The segment benefits from continuous research into bio-based plastics and biodegradable alternatives that maintain functional performance.

Product Insights:

- Bottles and Jars

- Bags and Pouches

- Tubes

- Others

The bottles and jars leads with a share of 46% of the total India airless packaging market in 2025.

Bottles and jars maintain market leadership driven by their exceptional versatility, aesthetic appeal, and extensive customization possibilities. These containers offer superior product visibility and premium brand presentation, making them preferred choices for high-end skincare and cosmetic products. The availability of various finishing options including spray painting, foil stamping, and frosted effects enables brands to create distinctive packaging that enhances consumer appeal and shelf presence.

Technological advancements in airless bottle design continue improving product evacuation rates while ensuring complete protection from air exposure and contamination. Manufacturers are introducing innovative dispensing mechanisms including precision pumps and controlled-dose systems that enhance user convenience. The segment benefits from growing demand for refillable airless bottles that support sustainability initiatives while maintaining premium packaging aesthetics. For example, in August 2025, The Packaging Company unveiled a new 30 ml refillable airless skincare bottle, explicitly designed for precise dispensing, reusability, and preservation of sensitive cosmetic formulations, a move that reflects growing demand for sustainable, high‑performance airless containers.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Personal Care and Homecare

- Pharmaceutical

- Food and Beverages

- Others

The personal care and homecare dominate with a market share of 60% of the total India airless packaging market in 2025.

The personal care and homecare segment drives airless packaging demand in India, propelled by the country's rapidly expanding beauty and cosmetics industry. Rising disposable incomes, increasing urbanization, and growing consumer awareness regarding skincare are accelerating adoption of premium products requiring specialized packaging. Airless technology is particularly valued for preserving sensitive formulations containing antioxidants, vitamins, and natural extracts that degrade upon air exposure. For instance, in August 2025, APackaging Group (APG) introduced a new mono‑material airless pump bottle designed for modern skincare, a fully recyclable solution that underscores the growing demand for sustainable, high-quality airless packaging solutions even among global suppliers.

The segment benefits from the proliferation of e-commerce platforms enabling broader distribution of premium beauty products across urban and semi-urban markets. International cosmetic brands entering India are driving demand for sophisticated airless packaging solutions that align with global quality standards. Growing preference for organic and natural skincare products, which typically lack synthetic preservatives, further reinforces the necessity for contamination-free airless packaging systems.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents a significant market for airless packaging, driven by the concentration of consumer goods companies in Delhi-NCR and surrounding industrial hubs. The region's large urban population with growing disposable incomes fuels demand for premium personal care products. Expanding retail infrastructure and e-commerce penetration are accelerating adoption of sophisticated packaging solutions across beauty and pharmaceutical sectors.

South India emerges as a key growth region, benefiting from the presence of major cosmetic manufacturing facilities in Tamil Nadu and Karnataka. The region's established pharmaceutical industry drives demand for airless packaging in drug delivery applications. High literacy rates and health-conscious consumer base support premium skincare product adoption requiring advanced packaging technologies.

East India presents emerging opportunities for airless packaging growth, supported by improving economic conditions and expanding retail presence. The region's growing middle class is increasingly adopting branded personal care products. Developing manufacturing infrastructure and government initiatives promoting industrial growth create favorable conditions for packaging industry expansion.

West India dominates the airless packaging landscape, anchored by Mumbai's position as India's cosmetics and fashion capital. Maharashtra and Gujarat host numerous packaging manufacturing facilities serving domestic and export markets. The region's strong pharmaceutical manufacturing base in Gujarat drives substantial demand for contamination-free airless packaging solutions.

Market Dynamics:

Growth Drivers:

Why is the India Airless Packaging Market Growing?

Expanding Beauty and Personal Care Industry

India's beauty and personal care industry is experiencing remarkable expansion, driven by rising disposable incomes, urbanization, and evolving consumer preferences toward premium skincare products. The growing awareness regarding personal grooming and the influence of social media beauty trends are accelerating demand for high-quality cosmetic products requiring specialized packaging. International beauty brands are increasingly targeting the Indian market, bringing sophisticated product formulations that necessitate airless packaging for optimal preservation. For example, in July 2024, YSL Beauty officially launched in India via Nykaa, marking a major influx of global luxury beauty products into the country and likely increasing demand for premium‑grade packaging. The expansion of organized retail and e-commerce platforms enables wider distribution of premium products, further supporting market growth. This sustained industry expansion creates substantial opportunities for airless packaging manufacturers to serve the growing demand for contamination-free packaging solutions.

Rising Consumer Awareness Regarding Product Hygiene

Consumer awareness regarding product hygiene and contamination-free packaging has intensified significantly, particularly following heightened health consciousness. Indian consumers increasingly recognize the importance of packaging that prevents bacterial contamination and oxidation, especially for skincare products containing active ingredients. The preference for touch-free dispensing mechanisms that minimize product exposure to external contaminants is driving adoption of airless packaging across various product categories. Brands are leveraging airless packaging as a key differentiator to communicate product safety and quality to discerning consumers. This heightened awareness creates favorable demand dynamics for airless packaging solutions offering superior product protection compared to conventional packaging formats.

Growing Demand for Sustainable Packaging Solutions

Environmental sustainability has become a critical consideration influencing packaging choices in India's consumer goods industry. Regulatory pressures and consumer preferences are driving manufacturers toward eco-friendly airless packaging solutions incorporating recycled materials and refillable designs. The India sustainable packaging market size reached USD 10,226.21 Million in 2025, highlighting the growing significance of eco-conscious packaging. The implementation of extended producer responsibility regulations is compelling brands to adopt sustainable packaging practices throughout their product portfolios. Innovations in mono-material airless packaging and bio-based alternatives are addressing recyclability concerns while maintaining functional performance. The convergence of environmental responsibility and consumer demand for sustainable products creates significant growth opportunities for manufacturers offering eco-conscious airless packaging solutions.

Market Restraints:

What Challenges the India Airless Packaging Market is Facing?

Higher Manufacturing Costs

Airless packaging systems involve complex manufacturing processes and specialized components that result in higher production costs compared to conventional packaging. The sophisticated piston mechanisms and precision engineering required for effective airless dispensing increase overall packaging expenses, limiting adoption in price-sensitive market segments.

Limited Awareness in Tier-2 and Tier-3 Markets

Consumer awareness regarding airless packaging benefits remains limited in smaller cities and rural areas across India. The preference for conventional packaging formats and lower willingness to pay premiums for advanced packaging solutions restrict market penetration beyond metropolitan centers and premium consumer segments.

Recycling Infrastructure Challenges

The complexity of multi-material airless packaging components poses challenges for existing recycling infrastructure in India. Separating different materials used in airless systems for effective recycling requires specialized facilities that remain limited, creating sustainability concerns despite industry efforts toward eco-friendly solutions.

Competitive Landscape:

The India airless packaging market exhibits a moderately fragmented competitive structure characterized by the presence of both multinational packaging corporations and regional manufacturers. Key players are focusing on innovation in sustainable packaging solutions, incorporating recycled materials and developing refillable systems to address environmental concerns. Strategic partnerships between global packaging technology providers and domestic manufacturers are facilitating technology transfer and capacity expansion. Companies are investing in research and development to create advanced dispensing mechanisms and customizable packaging solutions meeting diverse brand requirements. The market witnesses intensifying competition around eco-friendly innovations as brands increasingly prioritize sustainability in packaging selection.

Recent Developments:

- In October 2024, Lumson introduced XTAG, a premium glass airless-refill bottle featuring a pouch-based refill system that enhances product protection for high-performance cosmetic formulations. The innovation supports sustainability while maintaining the precision and safety of airless dispensing.

India Airless Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Glass, Plastic, Others |

| Products Covered | Bottles and Jars, Bags and Pouches, Tubes, Others |

| Applications Covered | Personal Care and Homecare, Pharmaceutical, Food and Beverages, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India airless packaging market size was valued at USD 218.79 Million in 2025.

The India airless packaging market is expected to grow at a compound annual growth rate of 4.41% from 2026-2034 to reach USD 322.53 Million by 2034.

Plastic dominated the India airless packaging market with a 75% share, driven by its lightweight properties, cost-effectiveness, versatility in molding, and compatibility with various personal care and pharmaceutical product formulations.

Key factors driving the India airless packaging market include expanding beauty and personal care industry, rising consumer awareness regarding product hygiene and contamination-free packaging, growing demand for sustainable packaging solutions, and increasing pharmaceutical sector requirements.

Major challenges include higher manufacturing costs compared to conventional packaging, limited consumer awareness in tier-2 and tier-3 markets, recycling infrastructure limitations for multi-material components, and price sensitivity in mass-market segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)