India Airless Tires Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, and Region, 2026-2034

India Airless Tires Market Summary:

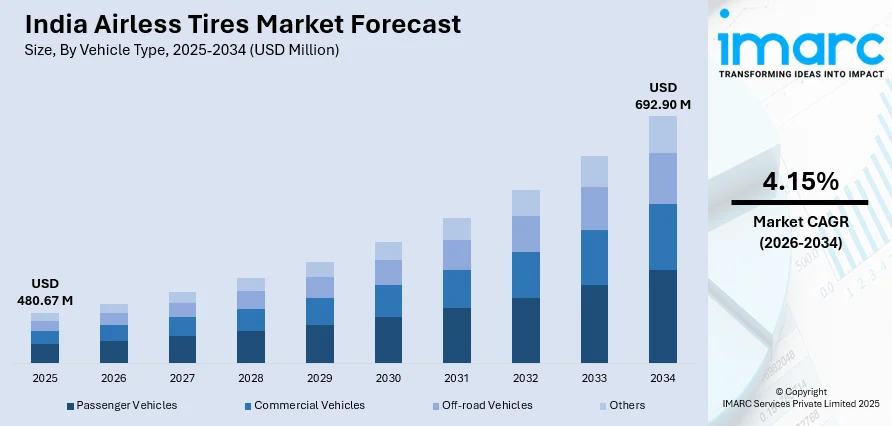

The India airless tires market size was valued at USD 480.67 Million in 2025 and is projected to reach USD 692.90 Million by 2034, growing at a compound annual growth rate of 4.15% from 2026-2034.

India's airless tires market is witnessing significant growth driven by increasing demand for puncture-resistant and low-maintenance tire solutions across various vehicle categories. The expanding automotive sector, rising adoption of advanced tire technologies, and growing emphasis on vehicle safety are propelling market expansion. Infrastructure development initiatives and the proliferation of electric vehicles are further contributing to the India airless tires market share.

Key Takeaways and Insights:

-

By Vehicle Type: Passenger Vehicles dominate the market with a share of 42.3% in 2025, driven by increasing consumer preference for maintenance-free tire solutions and growing adoption of airless technology in personal mobility applications.

-

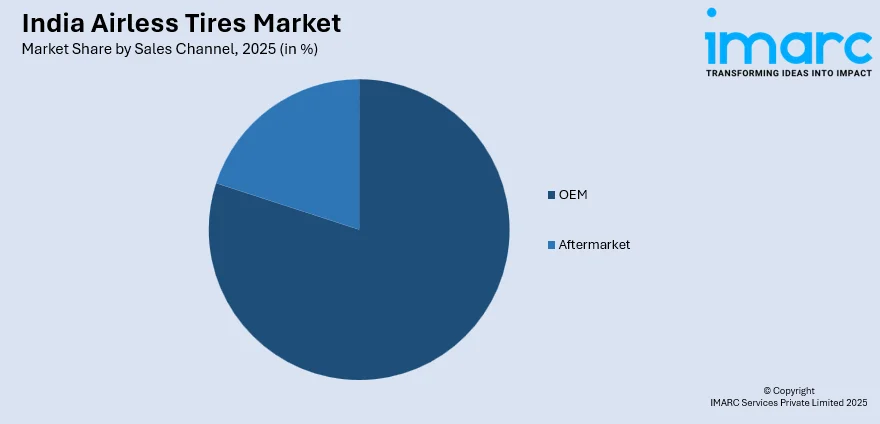

By Sales Channel: OEM leads the market with a share of 80% in 2025, owing to strong partnerships between airless tire manufacturers and vehicle producers for factory-fitted installations across new vehicle models.

-

By Region: North India represents the largest segment with a market share of 33.7% in 2025, attributed to the concentration of automotive manufacturing hubs and higher vehicle ownership rates in the region.

-

Key Players: The India airless tires market exhibits a competitive landscape with domestic manufacturers and international tire corporations vying for market share. Market participants are focusing on research and development investments, strategic collaborations with automotive OEMs, and expansion of manufacturing capabilities to strengthen their competitive positioning in this emerging technology segment.

To get more information on this market Request Sample

The airless tires sector in India is experiencing transformative growth as automotive manufacturers and consumers increasingly recognize the benefits of non-pneumatic tire technology. These innovative tires eliminate the risk of punctures and blowouts, offering enhanced safety and reduced maintenance requirements. For instance, MRF Ltd. filed a patent application in February 2024 for a “non-puncture airless tyre for vehicle and a method thereof,” underlining concrete momentum in the domestic airless tyre segment. The technology is gaining traction across passenger vehicles, commercial fleets, and off-road applications. Government initiatives promoting automotive innovation and sustainable mobility solutions are creating favorable conditions for market expansion. Research and development activities are advancing tire performance characteristics, addressing concerns related to ride comfort and noise reduction while maintaining the core advantages of airless technology.

India Airless Tires Market Trends:

Integration with Electric Vehicle Platforms

The growing electric vehicle segment in India is creating significant opportunities for airless tire adoption. Manufacturers are developing specialized airless tire solutions optimized for electric vehicle characteristics, including weight distribution and regenerative braking systems. The maintenance-free nature of airless tires aligns well with the low-maintenance proposition of electric vehicles, making them an attractive option for eco-conscious consumers and fleet operators seeking comprehensive sustainable mobility solutions.

Advancement in Material Science and Design

Continuous innovation in polymer compounds and structural design is enhancing the performance capabilities of airless tires in the Indian market. Manufacturers are developing advanced materials that improve load-bearing capacity, heat dissipation, and durability under diverse road conditions. According to sources, Goodyear Tire & Rubber Company, though a global firm, has extended its nonpneumatic tyre (NPT) technology to support autonomous delivery robots, demonstrating realworld viability of airless designs. Novel spoke designs and geometric patterns are being engineered to optimize comfort levels while maintaining the puncture-proof characteristics that define airless tire technology.

Expansion in Commercial and Industrial Applications

Commercial and industrial vehicle segments are increasingly adopting airless tire technology to minimize operational downtime and maintenance costs. Fleet operators are recognizing the total cost of ownership benefits offered by airless tires, particularly for vehicles operating in challenging environments. For instance, Bridgestone, a major global tyre maker active in India’s commercialvehicle segment, has developed its “Air Free Concept” nonpneumatic tyre design for trucks and heavyduty fleets. Warehousing, logistics, and material handling equipment manufacturers are integrating airless tire solutions to enhance operational efficiency and reduce tire-related service interruptions.

Market Outlook 2026-2034:

The India airless tires market is poised for substantial growth throughout the forecast period, supported by technological advancements, expanding automotive production, and increasing consumer awareness regarding tire safety and maintenance. The proliferation of electric vehicles and government initiatives promoting automotive innovation are expected to accelerate market adoption. Manufacturing capacity expansions and localization of production facilities will enhance product accessibility and price competitiveness. The market generated a revenue of USD 480.67 Million in 2025 and is projected to reach a revenue of USD 692.90 Million by 2034, growing at a compound annual growth rate of 4.15% from 2026-2034.

India airless tires Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Passenger Vehicles |

42.3% |

|

Sales Channel |

OEM |

80% |

|

Region |

North India |

33.7% |

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Off-road Vehicles

- Others

The passenger vehicles dominate with a market share of 42.3% of the total India airless tires market in 2025.

Passenger vehicles represent the leading segment within India's airless tires market, accounting for the maximum total market revenue. This dominance is attributed to the growing consumer demand for enhanced safety features and reduced maintenance requirements in personal mobility applications. Urban commuters and suburban drivers are increasingly recognizing the benefits of puncture-proof tires, particularly in regions with challenging road conditions. The India passenger car market size reached USD 0.06 Trillion in 2024, and looking forward, IMARC Group expects it to reach USD 0.11 Trillion by 2033, reflecting growing potential for adoption of innovative tyre solutions including airless tyres. The segment continues to expand as manufacturers introduce airless tire options compatible with popular passenger vehicle models.

Automotive manufacturers are collaborating with tire producers to integrate airless technology into new vehicle platforms, enhancing the value proposition for end consumers. The rising emphasis on total cost of ownership considerations is driving adoption among cost-conscious buyers who prioritize long-term savings over initial purchase price. Marketing initiatives highlighting the safety and convenience advantages of airless tires are strengthening consumer awareness and acceptance across diverse demographic segments.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

The OEM leads with a share of 80% of the total India airless tires market in 2025.

Original equipment manufacturer partnerships constitute the dominant sales channel within India's airless tires market. This overwhelming dominance reflects the strategic importance of factory-fitted installations in driving airless tire adoption. As part of supporting advanced tyre (and automotive component) manufacturing, which would include technologies like airless tyres, the Indian government in August 2024 began disbursing incentives under the PLIAuto Scheme (Production Linked Incentive for Automobile & Auto Components). Vehicle manufacturers are increasingly offering airless tire options as standard or optional equipment across various model lines, providing consumers with convenient access to this advanced technology at the point of vehicle purchase.

The OEM channel benefits from established supply chain relationships, quality assurance protocols, and integrated warranty coverage that enhance consumer confidence. Tire manufacturers are investing significantly in research and development collaborations with automotive OEMs to develop vehicle-specific airless tire solutions optimized for performance, comfort, and aesthetics. These partnerships are accelerating technology refinement and expanding the range of vehicles equipped with airless tire technology.

Regional Insights:

- North India

- South India

- East India

- West India

The North India exhibits a clear dominance with a 33.7% share of the total India airless tires market in 2025.

North India represents the largest regional market for airless tires, accounting for the majority of total market share. The region benefits from a dense concentration of automotive manufacturing facilities, especially in hubs across Haryana, Uttar Pradesh, and Punjab, where OEMs and component suppliers actively explore next-generation mobility solutions. High vehicle ownership rates, rising adoption of electric two-wheelers, and a growing preference for low-maintenance mobility options strengthen the appeal of airless tires. The presence of industrial clusters, logistics fleets, and commercial vehicle operators further amplifies baseline demand. Under the Uttar Pradesh EV Manufacturing Policy 2022, extended incentives through 2027 for electric two and fourwheelers are expected to boost EV adoption and drive demand for lowmaintenance airless tyres.

Major metropolitan centers such as Delhi NCR, Chandigarh, and Lucknow drive substantial interest in advanced tire technologies due to frequent urban commuting, road safety concerns, and the need for puncture-resistant solutions. Well-developed automotive retail and service networks support product availability, market penetration, and after-sales assistance, making the region more conducive to early technology adoption. Government-led smart city projects and improving road infrastructure also encourage the uptake of innovative tire systems.

Market Dynamics:

Growth Drivers:

Why is the India Airless Tires Market Growing?

Rising Demand for Enhanced Vehicle Safety

Growing consumer awareness regarding vehicle safety is driving demand for airless tire technology across India. The elimination of puncture and blowout risks addresses critical safety concerns that affect millions of motorists traversing diverse road conditions. Highway travel safety considerations are particularly influential in adoption decisions, as tire failures at high speeds represent significant hazards. For example, in April 2025, the Automotive Tyre Manufacturers Association (ATMA) and Indian Tyre Technical Advisory Committee (ITTAC) conducted a threeday tyresafety campaign on the Yamuna Expressway, inspecting over 2,000 tyres, with more than 2 % found in poor or unsafe condition. The increasing emphasis on occupant protection and accident prevention is positioning airless tires as a compelling safety enhancement for vehicles across all categories.

Expanding Automotive Manufacturing Sector

India's robust automotive manufacturing ecosystem is creating favorable conditions for airless tire market growth. The country's position as a major vehicle production hub attracts investments in advanced automotive technologies, including innovative tire solutions. In support of this, the governmentbacked PLI Scheme for Automobile & Auto Components (PLIAuto) has already catalyzed over ₹ 25,000 crore in committed investments by OEMs and component suppliers as of December 2024, providing a major boost for domestic manufacturing of advanced automotive components. Domestic and international manufacturers are establishing production facilities and research centers to develop airless tire products tailored to Indian market requirements. The integration of local supply chains is enhancing product accessibility and supporting competitive pricing strategies.

Total Cost of Ownership Advantages

The economic benefits of airless tires over their operational lifecycle are driving adoption among cost-conscious consumers and fleet operators. Elimination of puncture-related repairs, reduced maintenance requirements, and extended service life contribute to attractive total cost of ownership propositions. For example, recent analysis of fleettyre management practices in India shows tyrerelated costs account for 20–30% of total operating expenses for commercial fleets and adopting a “total tyre management” approach reduced tyre expenses by up to 30% while improving vehicle uptime and lowering downtime risks. Commercial vehicle operators are particularly receptive to these advantages, recognizing the potential for reduced downtime and enhanced fleet availability. The ability to avoid unexpected tire failures translates into operational reliability and planning predictability.

Market Restraints:

What Challenges the India Airless Tires Market is Facing?

Higher Initial Purchase Costs

Airless tires currently command premium pricing compared to conventional pneumatic alternatives, presenting adoption barriers for price-sensitive consumers. The advanced materials and manufacturing processes required for airless tire production contribute to elevated cost structures. While total cost of ownership calculations may favor airless technology, the higher upfront investment discourages some buyers from making the switch.

Ride Comfort and Noise Considerations

Current airless tire designs face challenges in matching the ride comfort characteristics of traditional pneumatic tires. The structural design of non-pneumatic tires can generate different vibration and noise profiles that some consumers find less desirable. Ongoing research and development efforts are addressing these concerns, but market perception regarding comfort trade-offs remains a consideration for potential adopters.

Limited Aftermarket Infrastructure

The aftermarket service network for airless tires remains underdeveloped compared to the extensive infrastructure supporting conventional tire products. Limited availability of retail outlets, fitting services, and technical expertise outside major metropolitan areas constrains market accessibility. The emerging nature of airless tire technology requires continued investment in service network development and technician training.

Competitive Landscape:

The India airless tires market features a competitive landscape comprising established tire manufacturers, automotive technology innovators, and emerging domestic players. Leading international tire corporations are investing in research facilities and manufacturing capabilities to capture market share in this growing segment. Strategic partnerships between tire manufacturers and vehicle OEMs are shaping competitive dynamics, with exclusive supply agreements and co-development initiatives creating differentiation opportunities. Market participants are focusing on product performance improvements, cost optimization through manufacturing efficiencies, and brand building to establish market leadership positions.

Recent Developments:

-

In May 2025, MRF launched airless tyres for electric vehicles, targeting 50,000 units annually, advancing India’s emerging USD 8.5M airless-tyre market. Globally, innovations like Michelin’s UPTIS reflect rising interest in puncture-proof, low-maintenance tyre technology.

India Airless Tires Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Off-road Vehicles, Others |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India airless tires market size was valued at USD 480.67 Million in 2025.

The India airless tires market is expected to grow at a compound annual growth rate of 4.15% from 2026-2034 to reach USD 692.90 Million by 2034.

Passenger vehicles dominated the vehicle type segment with 42.3% market share, driven by growing consumer demand for puncture-resistant and low-maintenance tire solutions in personal mobility applications.

Key factors driving the India airless tires market include rising demand for enhanced vehicle safety, expanding automotive manufacturing sector, total cost of ownership advantages, and increasing adoption of electric vehicles requiring maintenance-free tire solutions.

Major challenges include higher initial purchase costs compared to conventional tires, ride comfort and noise considerations, limited aftermarket service infrastructure, and the need for continued consumer education regarding airless tire technology benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)