India Airport Baggage Handling System Market Size, Share, Trends and Forecast by Identification Technology, Airport Class, Check-In Type, Type, Efficiency, Cost Analysis, and Region, 2025-2033

India Airport Baggage Handling System Market Overview:

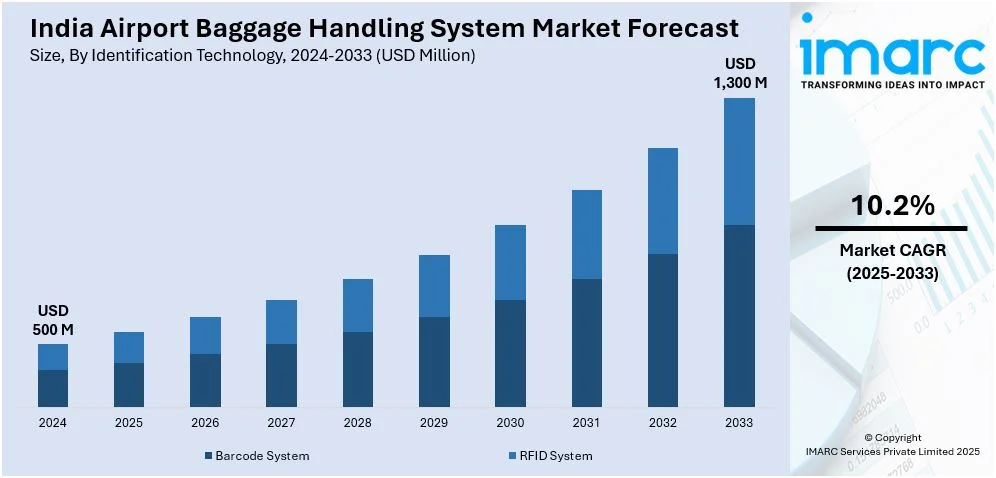

The India airport baggage handling system market size reached USD 500 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,300 Million by 2033, exhibiting a growth rate (CAGR) of 10.2% during 2025-2033. Increased automation, contemporary airport infrastructure, growing air traveler traffic, the use of RFID and IoT-enabled tracking, strict aviation security laws, and the growth of low-cost carriers are the main factors propelling the industry. The market is further growing as a result of government programs, corporate investments, and technical developments that increase the effectiveness of luggage handling.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 500 Million |

| Market Forecast in 2033 | USD 1,300 Million |

| Market Growth Rate 2025-2033 | 10.2% |

India Airport Baggage Handling System Market Trends:

Integration of Artificial Intelligence and Machine Learning in Baggage Handling

In Indian airports, the integration of machine learning (ML) and artificial intelligence (AI) is transforming baggage handling systems. Predictive analytics driven by AI is being utilized to improve baggage flow optimization, reduce delays, and identify possible system issues before they happen. By helping to detect anomalies in luggage tracking, machine learning algorithms lower the rate of neglect and increase operational effectiveness. The use of AI-driven automated sorting systems ensures faster and more accurate baggage transfers, particularly in busy hub airports. With growing air passenger volumes, airports are increasingly investing in AI and ML solutions to streamline baggage handling operations. This technological shift is enhancing passenger experience by reducing wait times and ensuring seamless baggage retrieval, ultimately improving airport service quality. For instance, in November 2024, Tiruchi International Airport commissioned a state-of-the-art In-Line Baggage Handling System (ILBHS) to enhance passenger convenience and security. The ₹98 crore system automates baggage screening, reducing wait times and eliminating the need for manual scanning. Featuring a four-level security screening process, ILBHS ensures heightened safety and operational efficiency.

To get more information on this market, Request Sample

Expansion of Automated Baggage Handling Infrastructure

With rapid airport expansion projects under the UDAN scheme and private sector investments, automated baggage handling systems are gaining traction in India. Advanced conveyor belt systems, tilt-tray sorters, and robotic-assisted baggage loading are being deployed to improve efficiency in major airports. These automated systems enhance baggage transfer speed, reduce manual labor dependency, and lower operational costs for airport authorities. Smaller regional airports are also adopting automated baggage handling solutions to meet growing passenger demand. Additionally, smart conveyor networks are being integrated with baggage handling software to enable seamless coordination between check-in counters, security screening, and loading areas. As airports undergo digital transformation, automation in baggage handling is expected to become a core component of India's aviation infrastructure development. For instance, as per industry reports, the baggage delivery system at six major Indian airports, including Delhi, Mumbai, Kolkata, Chennai, Hyderabad, and Bengaluru, has significantly improved, with 92.5% of passengers receiving their baggage within 30 minutes of landing by May 2024. This marks a sharp increase from 62.2% in January 2024, following upgrades in equipment, monitoring, and services initiated by the Bureau of Civil Aviation Security (BCAS). The Ministry of Civil Aviation (MoCA) has also urged airlines at other airports to enhance baggage delivery efficiency.

India Airport Baggage Handling System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on identification technology, airport class, check-in type, type, efficiency, and cost analysis.

Identification Technology Insights:

- Barcode System

- RFID System

The report has provided a detailed breakup and analysis of the market based on the identification technology. This includes barcode system and RFID system.

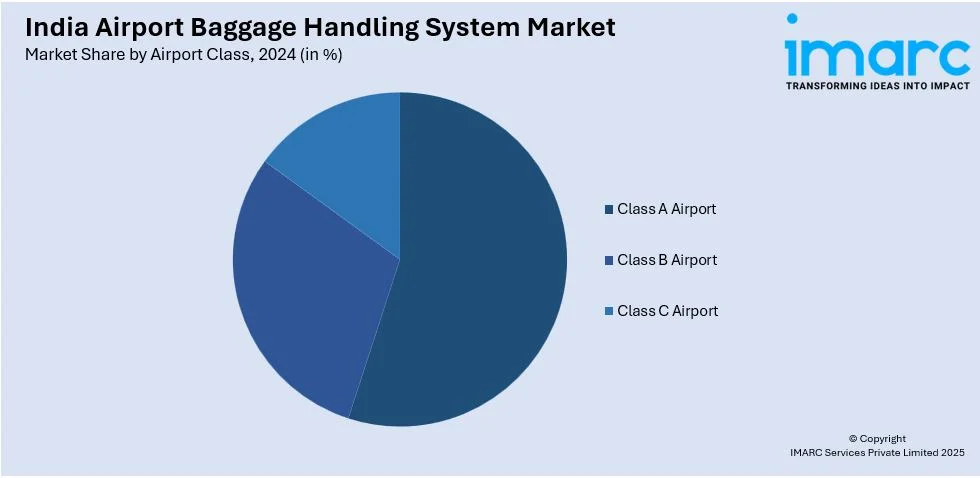

Airport Class Insights:

- Class A Airport

- Class B Airport

- Class C Airport

A detailed breakup and analysis of the market based on the airport class have also been provided in the report. This includes class A, class B, and class C airport.

Check-In Type Insights:

- Assisted Service Bag Check-In

- Self-Service Bag Check-In

A detailed breakup and analysis of the market based on the check-in type have also been provided in the report. This includes assisted service bag check-in and self-service bag check-in.

Type Insights:

- Conveyor System

- Destination Coded Vehicle

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes conveyor system and destination coded vehicle.

Efficiency Insights:

- Below 3000

- 3000 to 6000

- Above 6000

A detailed breakup and analysis of the market based on the efficiency have also been provided in the report. This includes below 3000, 3000 to 6000, and above 6000.

Cost Analysis Insights:

- Operational Cost Analysis

- Installation Cost Analysis

A detailed breakup and analysis of the market based on the cost analysis have also been provided in the report. This includes operational and installation cost analysis.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Airport Baggage Handling System Market News:

- In February 2024, Alstef India announced that it has expanded its presence with a new office and manufacturing facility in Pune to meet the growing demand for baggage and cargo handling solutions. The company is investing in high-speed systems, advanced sorting technologies, and predictive maintenance solutions like BAGXPERT to enhance efficiency. With a focus on operations, maintenance contracts, and cost-effective solutions, Alstef aims to tailor its offerings to the Indian market while maintaining high-quality standards. This move underscores its commitment to India’s airport infrastructure development.

- In March 2025, Air India launched ‘ZipAhead’, a paid priority check-in and baggage handling service for Economy Class passengers on domestic flights from Delhi, Mumbai, Hyderabad, Chennai, Bengaluru, and Kolkata. Passengers can purchase the service up to 75 minutes before departure via Air India’s website, mobile app, airport ticketing offices, and customer contact center. Platinum and Gold Maharaja Club members receive the service free of charge, offering faster check-in and baggage processing for time-sensitive travelers.

India Airport Baggage Handling System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Identification Technologies Covered | Barcode System, RFID System |

| Airport Classes Covered | Class A Airport, Class B Airport, Class C Airport |

| Check-In Types Covered | Assisted Service Bag Check-In, Self-Service Bag Check-In |

| Types Covered | Conveyor System, Destination Coded Vehicle |

| Efficiencies Covered | Below 3000, 3000 to 6000, Above 6000 |

| Cost Analysis Covered | Operational Cost Analysis, Installation Cost Analysis |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India airport baggage handling system market performed so far and how will it perform in the coming years?

- What is the breakup of the India airport baggage handling system market on the basis of identification technology?

- What is the breakup of the India airport baggage handling system market on the basis of airport class?

- What is the breakup of the India airport baggage handling system market on the basis of check-in type?

- What is the breakup of the India airport baggage handling system market on the basis of type?

- What is the breakup of the India airport baggage handling system market on the basis of efficiency?

- What is the breakup of the India airport baggage handling system market on the basis of cost analysis?

- What are the various stages in the value chain of the India airport baggage handling system market?

- What are the key driving factors and challenges in the India airport baggage handling system market?

- What is the structure of the India airport baggage handling system market and who are the key players?

- What is the degree of competition in the India airport baggage handling system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India airport baggage handling system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India airport baggage handling system market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India airport baggage handling system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)