India Alcohol Free Perfumes Market Size, Share, Trends and Forecast by Product Type, Gender, Price Range, Distribution Channel, End User, and Region, 2025-2033

India Alcohol Free Perfumes Market Size and Share:

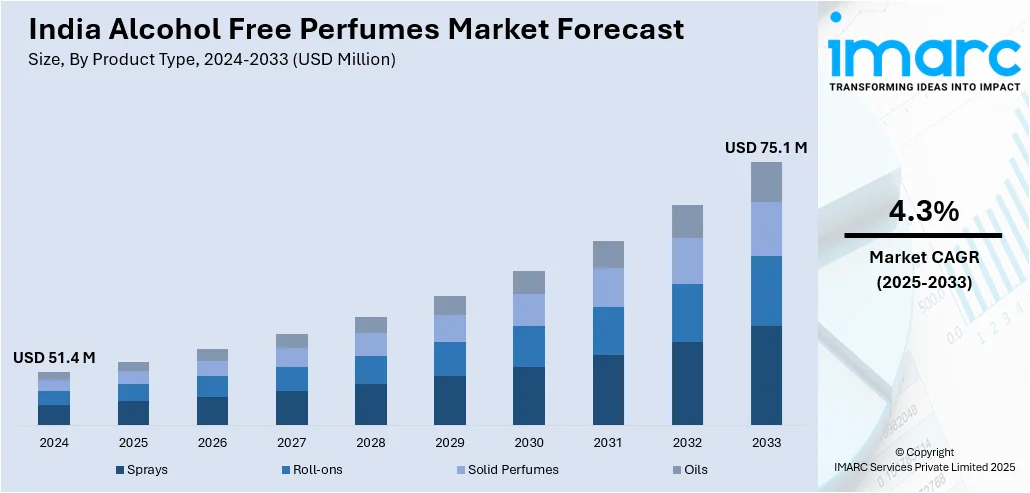

The India alcohol free perfumes market size reached USD 51.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 75.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. The growing consumer preference for skin-friendly and natural fragrances, rising awareness of vegan and cruelty-free beauty products, and increasing demand for sustainable personal care solutions are key drivers. Additionally, the influence of Ayurveda, e-commerce expansion, and health-conscious lifestyles are further expanding the India alcohol free perfumes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.4 Million |

| Market Forecast in 2033 | USD 75.1 Million |

| Market Growth Rate (2025-2033) | 4.3% |

India Alcohol Free Perfumes Market Trends:

Rising Demand for Natural and Organic Ingredients

The rise in demand for natural and organic ingredients, driven by increasing consumer awareness of skin health and environmental sustainability, is creating a positive India alcohol-free perfumes market outlook. Numerous customers are turning away from conventional alcohol-based perfumes due to the fear of skin dryness, irritation, and eventual damage. Rather, they choose alcohol-free options with plant-based extracts, essential oils, and moisturizing ingredients, such as aloe vera and glycerine. Manufacturers are adapting by introducing perfumes with clean-label ingredients and the absence of synthetic chemicals and abrasive preservatives. In addition, the increased popularity of Ayurveda and herbal wellness trends is also accelerating this transition, with consumers looking for perfumes that fit into holistic lifestyle trends. A research report from the IMARC Group indicates that the market for ayurvedic products in India was valued at INR 875.9 Billion (approximately USD 10.51 Billion) in 2024. It is projected to grow to INR 3,605.0 Billion (approximately USD 43.26 Billion) by 2033, reflecting a compound annual growth rate (CAGR) of 16.17% from 2025 to 2033. This growing interest in Ayurvedic and herbal products is mirrored in the fragrance sector, where alcohol-free perfumes are gaining traction. Indian consumers, particularly those with sensitive skin or a preference for traditional wellness practices, are increasingly favoring such formulations. Moreover, e-commerce platforms and specialty stores are amplifying this trend by offering a wider range of natural, alcohol-free perfumes, making them more accessible to urban and semi-urban consumers.

To get more information on this market, Request Sample

Increasing Popularity Among Health-Conscious and Vegan Consumers

Another key trend in India’s alcohol-free perfume market is the rising preference among health-conscious and vegan consumers. With a growing emphasis on cruelty-free and non-toxic personal care products, many buyers are opting for alcohol-free perfumes that comply with vegan and clean beauty standards. These fragrances often use water-based formulations or oil-based alternatives, which makes them gentler on sensitive skin and suitable for frequent use. Social media influencers and beauty experts are also promoting alcohol-free perfumes as a safer choice, especially for those with allergies or skin conditions such as eczema. According to an industry report, India is estimated to have over 900 Million social media users by the year 2025, and the platforms with the highest number of users are WhatsApp (83%), Instagram (80.6%), and YouTube (476 Million users). The average time spent by individuals in India on social media is 2 hours and 30 minutes a day, hence making it one of the most sought-after platforms for increasing awareness about the product among consumers. Furthermore, the increasing number of working professionals and younger consumers seeking long-lasting, yet skin-friendly fragrances are enhancing the India alcohol-free perfume market growth. Brands are capitalizing on this trend by incorporating sustainable packaging and ethical sourcing practices, further enhancing their appeal to eco-aware customers.

India Alcohol Free Perfumes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, gender, price range, distribution channel, and end user.

Product Type Insights:

- Sprays

- Roll-ons

- Solid Perfumes

- Oils

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sprays, roll-ons, solid perfumes, and oils.

Gender Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes men, women, and unisex.

Price Range Insights:

- Premium

- Mid-Range

- Economy

The report has provided a detailed breakup and analysis of the market based on the price range. This includes premium, mid-range, and economy.

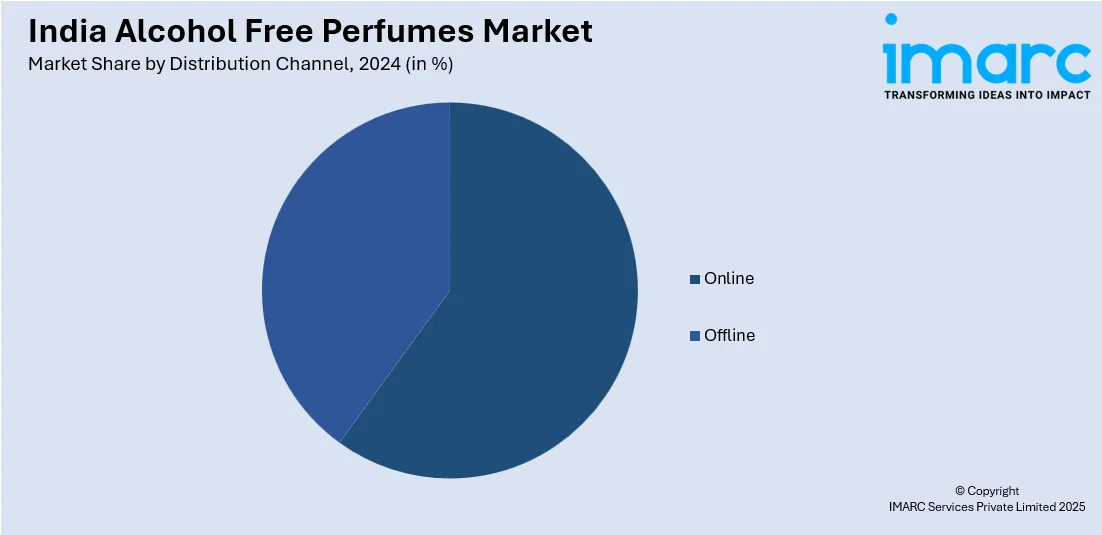

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Personal Use

- Gifting

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal use and gifting.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Alcohol Free Perfumes Market News:

- Aug 07, 2024: Dolce & Gabbana introduced the alcohol-free Fefe dog perfume priced at approximately INR 9,000 (approximately USD 108) in response to the growing trend of luxury pet care in India. The luxe scent combines ylang-ylang musk and sandalwood, all nestled in a green lacquered bottle embellished with a 24-carat gold plated claw. Pet owners are confined to applying the scent sparingly to avoid interfering with the animal's health and comfort.

India Alcohol Free Perfumes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Roll-ons, Solid Perfumes, Oils |

| Genders Covered | Men, Women, Unisex |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal Use, Gifting |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India alcohol free perfumes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India alcohol free perfumes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India alcohol free perfumes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alcohol free perfumes market in India was valued at USD 51.4 Million in 2024.

The India alcohol free perfumes market is projected to exhibit a CAGR of 4.3% during 2025-2033, reaching a value of USD 75.1 Million by 2033.

The growth of the India alcohol free perfumes market is driven by rising consumer preference for natural and skin-friendly products. Increased awareness of the harmful effects of alcohol in traditional perfumes, along with the growing demand for vegan and cruelty-free options, are key factors. Additionally, the rise in disposable income and shifting consumer habits towards wellness and sustainability contribute to the market's expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)