India Aliphatic Hydrocarbons Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

India Aliphatic Hydrocarbons Market Summary:

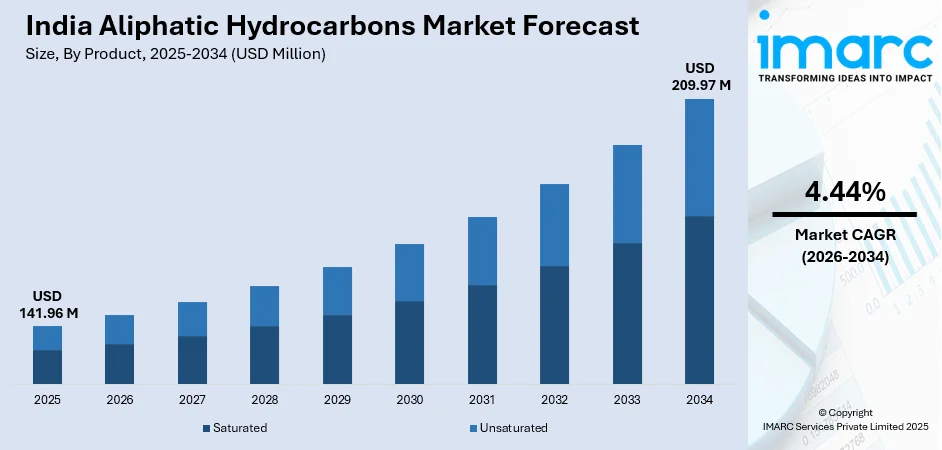

The India aliphatic hydrocarbons market size was valued at USD 141.96 Million in 2025 and is projected to reach USD 209.97 Million by 2034, growing at a compound annual growth rate of 4.44% from 2026-2034.

The market is expanding steadily, supported by rising demand from paints and coatings, adhesives, rubber processing, and industrial cleaning applications. Growth in manufacturing, infrastructure development, and automotive production is increasing consumption of these solvents across key sectors. Refinery modernization and improved supply capabilities are further strengthening market accessibility. Additionally, the shift toward high purity grades and consistent product performance is enhancing adoption across specialty chemical and industrial end use segments.

Key Takeaways and Insights:

- By Product: Unsaturated dominates the market with a share of 55% in 2025, driven by extensive applications in polymer synthesis, plastics manufacturing, and chemical intermediates production across diverse industrial sectors.

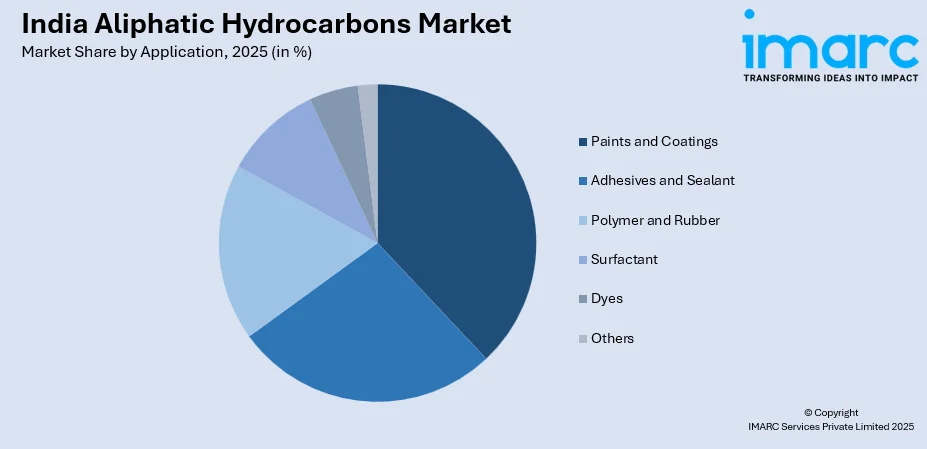

- By Application: Paints and coatings lead the market with a share of 32% in 2025, owing to robust construction activity, expanding decorative coatings demand, and growing automotive refinishing requirements nationwide.

- Key Players: The India aliphatic hydrocarbons market exhibits moderate competitive intensity, with major domestic petrochemical corporations and multinational chemical companies competing across product grades. Leading players are focusing on capacity expansions, technological upgrades, and strategic partnerships to strengthen market positioning and capture emerging demand opportunities.

To get more information on this market Request Sample

The India aliphatic hydrocarbons market is witnessing sustained growth driven by rising demand across paints and coatings, adhesives, rubber processing, pharmaceuticals, and industrial cleaning applications. The India paints and coatings market size is estimated at USD 8.8 Billion in 2024, and is expected to reach USD 17.4 Billion by 2033, which is further strengthening solvent consumption, particularly grades offering controlled volatility, consistent solvency power, and cleaner burn characteristics. Expanding manufacturing activity, infrastructure development, and steady automotive production are enhancing market uptake. Refinery expansions and improved domestic supply are supporting availability and competitive pricing. Growing preference for high purity, low odor, and environmentally aligned grades, along with advancements in process efficiency and wider adoption in specialty formulations, continues to reinforce market momentum over the forecast period.

India Aliphatic Hydrocarbons Market Trends:

Growing Preference for High Purity Grades

The India aliphatic hydrocarbons market is increasingly driven by rising demand for high purity, low odor, and consistent quality solvents that align with advanced manufacturing and regulatory standards. Industries such as coatings, adhesives, pharmaceuticals, and specialty chemicals are prioritizing cleaner compositions to enhance formulation efficiency and ensure compatibility with sensitive applications. In October 2025, the Indian government launched the PRIP scheme, allocating INR 5,000 crore to strengthen R&D in pharmaceuticals and MedTech, supporting startups and MSMEs and promoting industry–academia collaboration. These initiatives are boosting innovation and reinforcing the need for reliable, high grade aliphatic hydrocarbons across the value chain.

Rising Adoption in Low VOC Formulations

Growing emphasis on air quality and emissions control is encouraging wider use of aliphatic hydrocarbons that support low VOC and cleaner burning formulations. Industries are integrating these solvents to reduce environmental impact while maintaining application performance in paints, coatings, inks, and cleaning agents. This trend is reinforced by regulatory momentum and increasing preference for safer, more sustainable industrial inputs. In October 2025, India set greenhouse gas emission intensity targets for nine industrial sectors under its Carbon Credit Trading Scheme, aiming to operationalize a domestic carbon market. The final targets, covering 740 entities, will drive significant reductions in emissions by 2027, aligning with India's climate commitments under the Paris Agreement.

Expansion of Downstream Manufacturing Sectors

India’s expanding automotive, construction, packaging, and industrial manufacturing sectors continue to increase the consumption of aliphatic hydrocarbons. According to the report published by the India Brand Equity Foundation (IBEF), the Indian automobile industry is thriving, with FY25 production at 3,10,34,174 units, a 17% increase from June 2023. Exports rose 19% to over 5.3 million units. The EV market sold 1,00,000 units in CY24, and is projected to reach a USD 206 Billion opportunity by 2030. These solvents play a vital role in surface preparation, cleaning, rubber processing, and formulation development. Rising production activity and diversification of end use industries are strengthening demand, making aliphatic hydrocarbons integral to multiple industrial workflows and operational processes.

Market Outlook 2026-2034:

The India aliphatic hydrocarbons market outlook remains positive, supported by expanding manufacturing activity, rising infrastructure development, and consistent demand across coatings, adhesives, rubber processing, and industrial cleaning applications. Growing preference for high purity and low VOC formulations is shaping product innovation, while refinery upgrades and improved domestic supply capabilities are strengthening market stability. As downstream industries scale production and shift toward performance optimized solvents, the market is expected to witness steady growth over the forecast period. The market generated a revenue of USD 141.96 Million in 2025 and is projected to reach a revenue of USD 209.97 Million by 2034, growing at a compound annual growth rate of 4.44% from 2026-2034.

India Aliphatic Hydrocarbons Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Unsaturated | 55% |

| Application | Paints and Coatings | 32% |

Product Insights:

- Saturated

- Unsaturated

The unsaturated dominates with a market share of 55% of the total India aliphatic hydrocarbons market in 2025.

Unsaturated aliphatic hydrocarbons account for the largest share of the India aliphatic hydrocarbons market, driven by their higher reactivity and suitability for specialized chemical synthesis. These compounds play a vital role in producing intermediates for coatings, adhesives, plasticizers, and specialty chemicals that require tailored performance characteristics. Their ability to enable controlled reactions and support formulation flexibility enhances their demand across fast growing industrial segments.

Growing adoption of high purity, low odor, and environmentally aligned grades is further strengthening the market position of unsaturated hydrocarbons. Industries increasingly prefer these materials for applications where precision, compatibility, and consistent solvency are essential. Rising investments in advanced manufacturing, expanding downstream chemical production, and the shift toward performance based formulations continue to reinforce the dominance of unsaturated hydrocarbons in the market.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Paints and Coatings

- Adhesives and Sealant

- Polymer and Rubber

- Surfactant

- Dyes

- Others

The paints and coatings lead with a share of 32% of the total India aliphatic hydrocarbons market in 2025.

Paints and coatings represent the largest application segment in the India aliphatic hydrocarbons market, supported by rising construction activity, infrastructure expansion, and demand for automotive refinishing solutions. Aliphatic hydrocarbons are widely used as solvents that offer controlled evaporation, stable solvency power, and smooth application characteristics, enabling high performance coating formulations. Their compatibility with diverse resin systems also enhances overall finish quality and durability.

The segment is further benefiting from the shift toward cleaner, low odor, and high purity solvents that align with evolving industry performance requirements. As adoption of protective, decorative, and industrial coatings continues to grow, manufacturers rely on aliphatic hydrocarbons to optimize formulation efficiency and meet application specific needs. Their role in improving flow, film formation, and application consistency ensures sustained demand in the paints and coatings segment.

Regional Insights:

- North India

- South India

- East India

- West India

North India shows steady demand for aliphatic hydrocarbons driven by expanding construction, industrial activity, and growing use of coatings and adhesives. Increasing automotive maintenance needs and rising manufacturing investments further support regional consumption across diverse downstream applications.

South India experiences consistent uptake of aliphatic hydrocarbons due to strong presence of automotive, electronics, and textile industries. Expanding industrial clusters and rising adoption of high-performance coatings, adhesives, and rubber processing solutions contribute to the region’s sustained market demand.

East India demonstrates growing consumption of aliphatic hydrocarbons supported by infrastructure development, rising industrialization, and increasing use across paints, coatings, and polymer processing. Expansion of small and medium manufacturing units continues to create steady demand for solvent-based applications.

West India maintains robust demand for aliphatic hydrocarbons, driven by strong chemical, automotive, and packaging industries. Significant presence of refineries and manufacturing hubs supports widespread usage in coatings, adhesives, rubber processing, and specialty chemical formulations.

Market Dynamics:

Growth Drivers:

Why is the India Aliphatic Hydrocarbons Market Growing?

Growing Use in Paints, Coatings, and Adhesives

The India aliphatic hydrocarbons market is significantly supported by rising consumption of paints, coatings, and adhesives across construction, automotive, packaging, and industrial sectors. The India adhesives market size reached USD 2.40 Billion in 2024, and is projected to reach USD 4.30 Billion by 2033, further strengthening solvent demand. Aliphatic hydrocarbons offer controlled evaporation, stable solvency, and predictable performance, making them essential for achieving smooth application and uniform finishes. As demand for protective and decorative coatings increases, manufacturers rely on these solvents to enhance formulation quality, efficiency, and alignment with evolving performance requirements.

Growing Investments in Infrastructure and Construction

Expanding infrastructure development and large-scale construction activity continue to strengthen demand for aliphatic hydrocarbons used in coatings, sealants, waterproofing agents, and construction chemicals. India's National Infrastructure Pipeline (NIP) expanded from 6,835 to 9,142 projects, with USD 1.9 Trillion invested. Railways earned USD 30.58 Billion, loading over 1.61 Billion Tonnes. The logistics market is projected to grow from USD 317.26 Billion in 2024 to USD 484.43 Billion by 2029, with a CAGR of 8.8%. These solvents play a key role in improving application consistency and material durability. With increasing emphasis on urban development, industrial projects, and housing expansion, the consumption of solvent-based products is rising steadily, creating sustained need for high quality aliphatic hydrocarbons across diverse construction related applications.

Increasing Application in Rubber and Polymer Processing

The rapid growth of the automotive and industrial manufacturing sectors is boosting consumption of aliphatic hydrocarbons in rubber and polymer processing. The India rubber processing chemicals market size reached USD 387.95 Million in 2024 and is projected to reach USD 566.68 Million by 2033, reflecting strong downstream demand. Aliphatic hydrocarbons are increasingly used as processing aids, cleaning agents, and formulation components that support smooth compounding, efficient blending, and improved material performance. As the requirement for tires, industrial rubber goods, and engineered polymers rises, manufacturers depend more on these solvents to maintain production efficiency and consistently meet evolving quality standards.

Market Restraints:

What Challenges the India Aliphatic Hydrocarbons Market is Facing?

Volatility in Crude Oil and Feedstock Prices

Price fluctuations in crude oil and related feedstocks create uncertainty in the cost structure of aliphatic hydrocarbons, affecting both manufacturers and end users. This volatility complicates budgeting, disrupts procurement planning, and impacts overall production economics, especially for industries dependent on consistent and predictable solvent pricing.

Stringent Environmental and Safety Regulations

Increasingly strict regulations on emissions, VOC content, and solvent handling are raising compliance burdens for industries using aliphatic hydrocarbons. These requirements necessitate additional monitoring, improved workplace safety measures, and potential formulation adjustments, prompting some users to reconsider solvent choices to align with environmental and regulatory expectations.

Availability of Substitute Solvents

Growing interest in water based, bio based, and low VOC alternatives is creating competitive pressure on traditional aliphatic hydrocarbons. These substitutes appeal to industries seeking safer and more sustainable options, reducing reliance on conventional solvents and gradually reshaping demand patterns across several application segments.

Competitive Landscape:

The competitive landscape of the aliphatic hydrocarbons market is characterized by a mix of established producers and emerging suppliers focusing on cost efficiency, product purity, and reliable supply capabilities. Companies compete through advancements in refining technologies, improved distribution networks, and tailored product grades for industries such as paints, adhesives, and pharmaceuticals. Market participants are also prioritizing sustainability by optimizing energy consumption and reducing emissions during production. Growing interest in low VOC formulations is encouraging manufacturers to innovate and diversify their portfolios. Overall, competition is intensifying as players balance price pressures, regulatory compliance, and evolving customer expectations.

Recent Developments:

- In March 2025, Russia surpassed the UAE as India's top naphtha supplier for 2024-25, providing over half of India's 3 million tonnes import. With Russian naphtha priced USD 14-USD 15 per tonne cheaper than Middle Eastern alternatives, refiners are keen to capitalize on lower costs amidst rising domestic petrochemical demands.

India Aliphatic Hydrocarbons Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Saturated, Unsaturated |

| Applications Covered | Paints & Coatings, Adhesives & Sealant, Polymer & Rubber, Surfactant, Dyes, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India aliphatic hydrocarbons market size was valued at USD 141.96 Million in 2025.

The India aliphatic hydrocarbons market is expected to grow at a compound annual growth rate of 4.44% from 2026-2034 to reach USD 209.97 Million by 2034.

The unsaturated segment held the largest share of the India aliphatic hydrocarbons market, supported by its growing use in coatings, adhesives, polymers, and specialty chemical formulations that require efficient solvency, controlled evaporation, and consistent performance across diverse industrial applications.

Key factors driving the India aliphatic hydrocarbons market include rising demand from paints, coatings, adhesives, and rubber processing, expanding manufacturing activity, infrastructure development, and increasing preference for high purity, low odor, and regulatory compliant solvent grades.

The market faces challenges such as crude oil price volatility, tightening environmental and VOC related regulations, and growing competition from water based, bio based, and low emission solvent alternatives that are gaining traction in sensitive applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)