India All-Terrain Vehicle Market Size, Share, Trends and Forecast by Engine Type, Application, and Region, 2025-2033

India All-Terrain Vehicle Market Overview:

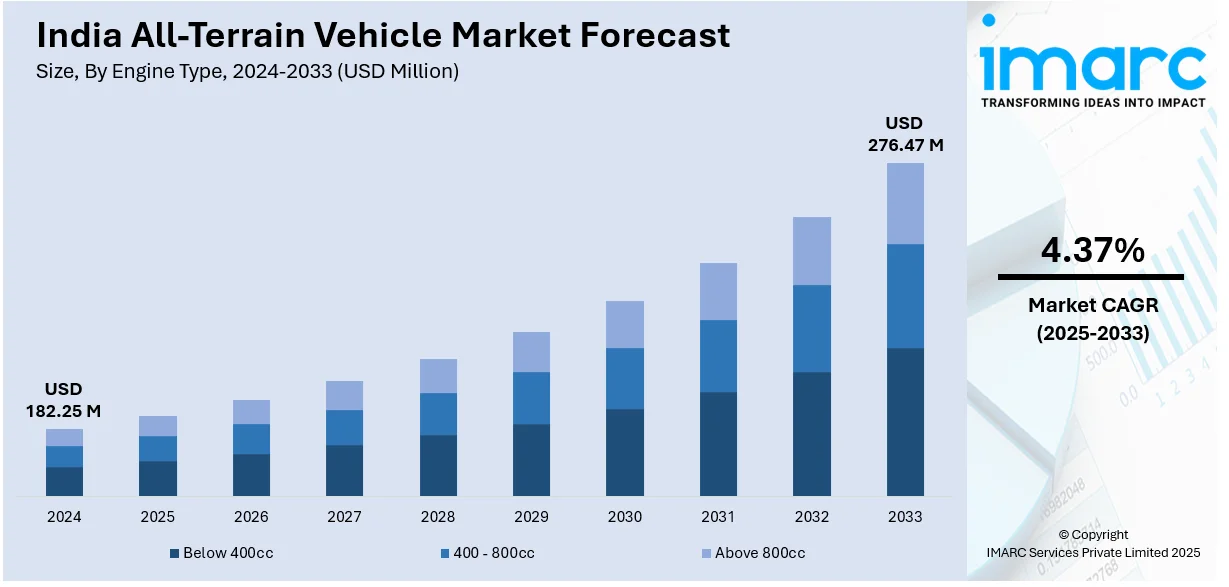

The India all-terrain vehicle market size reached USD 182.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 276.47 Million by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The growing use in the agriculture sector, increasing demand for eco-friendly alternatives, and rising adoption by corporate, government, and military sectors for operational tasks, with innovations in electric vehicles (EVs) and institutional applications are some of the factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 182.25 Million |

| Market Forecast in 2033 | USD 276.47 Million |

| Market Growth Rate 2025-2033 | 4.37% |

India All-Terrain Vehicle Market Trends:

Growing Use in Agriculture Sector

The increasing utilization of all-terrain vehicles (ATVs) in agriculture is a major factor contributing to market expansion, as these machines offer farmers effective and economical ways to traverse difficult landscapes. ATVs provide improved mobility across fields, facilitating quicker transport of materials, tools, and crops. They also help with several responsibilities like land assessments, irrigation evaluations, and pest management, decreasing dependence on conventional farming techniques. As the demand for mechanization in agriculture rises to enhance productivity and satisfy increasing food requirements, ATVs are becoming vital instruments for evolving farming methods. In 2024, A-Thon, in collaboration with IISc's AI and Robotics Technology Park (Artpark), launched India's first home-grown All-Terrain Vehicle (ATV) designed for agricultural applications. The Ashva 4x4, showcased at the International Autoshow 2024, emphasized the growing role of autonomous technology in farming. This initiative aimed to improve farming efficiency, create jobs, and tackle challenges faced by small-scale farmers.

To get more information on this market, Request Sample

Increase in Environmental Awareness and Eco-Friendly Alternatives

The growing concerns about environmental issues is resulting in a higher interest in sustainable options within the ATV industry. Producers are progressively concentrating on creating electric and hybrid off-road vehicles that provide decreased emissions, minimized noise, and enhanced fuel efficiency. This change corresponds with the increasing focus of the country on sustainability and minimizing its carbon footprint. Environmentally aware buyers, especially in younger age groups, are opting for these sustainable alternatives. The shift towards electric ATVs is further supported by the advocacy of the governing body for electric mobility via several incentives and policies. This trend is attracting a new group of purchasers who value eco-friendliness as well as performance, fueling additional growth in the ATV market. In line with this trend, in 2024, Powerland launched India's first road-legal electric 4x4 ATV, the Tachyon, priced at ₹9.5 lakh. The ATV was powered by an 11 kWh battery and offered 50 hp, 800 Nm of torque, with a 100 km range. It featured connected tech, regenerative braking, and was aimed at sectors like defense, firefighting, and agriculture.

Expansion of Corporate and Institutional Uses

Various corporate sectors, government agencies, and military organizations are increasingly using ATVs for operational tasks that demand high mobility in difficult terrains. These vehicles are used for tasks like monitoring, transportation, security patrols, and mapping land. Sectors such as mining, construction, and forestry depend on ATVs for off-road activities, including site evaluations and moving materials through challenging terrains. The increasing need for ATVs in these areas is fueled by the requirement for economical and effective ways to traverse challenging landscapes. This trend is broadening the use of ATVs beyond leisure activities and encouraging businesses to allocate resources for research to improve vehicle capabilities. In 2023, BAE Systems and Larsen & Toubro (L&T) partnered to bring the BvS10, an advanced articulated all-terrain vehicle, to the Indian defence market under the 'Make in India' initiative. L&T was the prime bidder, with support from BAE Systems Hagglunds, and the vehicle was upgraded as the 'BvS10-Sindhu' to meet the Indian Army's needs. This collaboration aimed to deliver high-mobility vehicles for extreme conditions and integrate logistic support.

India All-Terrain Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on engine type and application.

Engine Type Insights:

- Below 400cc

- 400 - 800cc

- Above 800cc

The report has provided a detailed breakup and analysis of the market based on the engine type. This includes below 400cc, 400 - 800cc, and above 800cc.

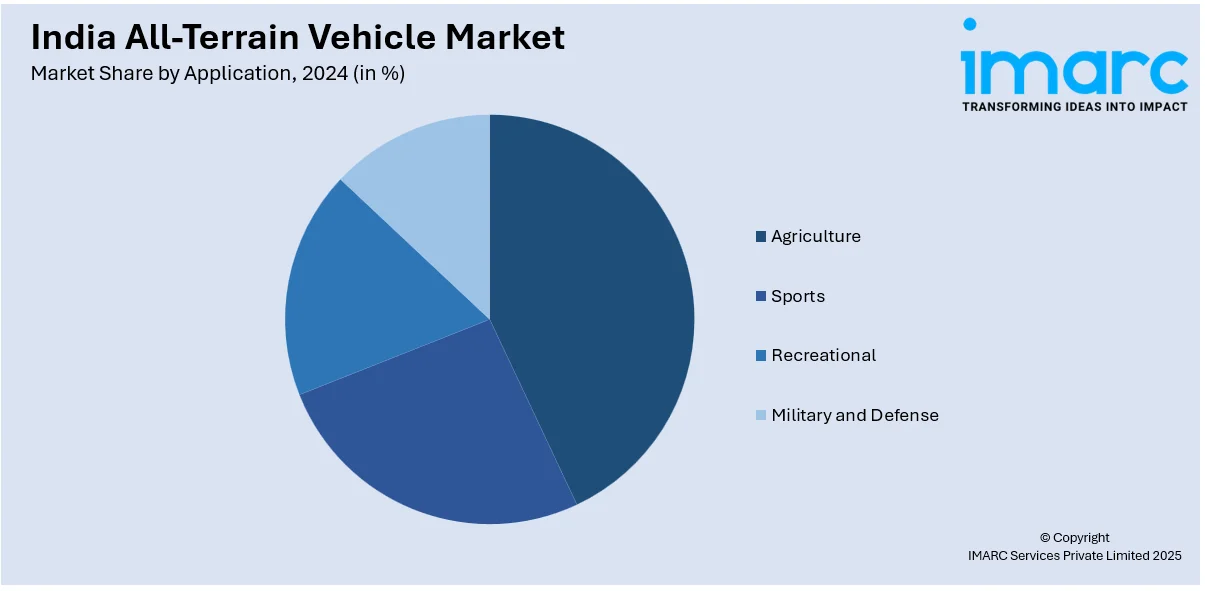

Application Insights:

- Agriculture

- Sports

- Recreational

- Military and Defense

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agriculture, sports, recreational, and military and defense.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India All-Terrain Vehicle Market News:

- In December 2024, the Indian Army deployed advanced All-Terrain Vehicles (ATVs) in Ladakh to enhance operational readiness in challenging winter conditions. The ATVs, including the Polaris Sportsman and JSW-Gecko ATOR, were designed for high mobility across icy landscapes and difficult terrain. This strategic deployment strengthened the Army's presence along the Line of Actual Control (LAC) in the region.

- In May 2024, Bengaluru-based All Terrain Private Limited (A-THON) developed all-terrain vehicles (ATVs) with potential military applications. The company created the ASHVA, ARAV, and ADBHUT models, which could meet the Indian Army’s operational needs, reducing reliance on imported vehicles. Initially targeting the agricultural sector, these ATVs were designed for patrol, reconnaissance, and transport in challenging terrains.

India All-Terrain Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Engine Types Covered | Below 400cc, 400 - 800cc, Above 800cc |

| Applications Covered | Agriculture, Sports, Recreational, Military and Defense |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India all-terrain vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India all-terrain vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India all-terrain vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The all-terrain vehicle market in India was valued at USD 182.25 Million in 2024.

The India all-terrain vehicle market is projected to exhibit a CAGR of 4.37% during 2025-2033, reaching a value of USD 276.47 Million by 2033.

The India all-terrain vehicle market is driven by rising use in agriculture for field operations, growing interest in adventure sports and recreational activities, and increased deployment by defense and security forces. Technological advancements and the introduction of electric ATVs are further accelerating market expansion across diverse applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)