India Allergy Relief Products Market Size, Share, Trends and Forecast by Product Type, Allergen Type, Distribution Channel, End User, and Region, 2025-2033

India Allergy Relief Products Market Overview:

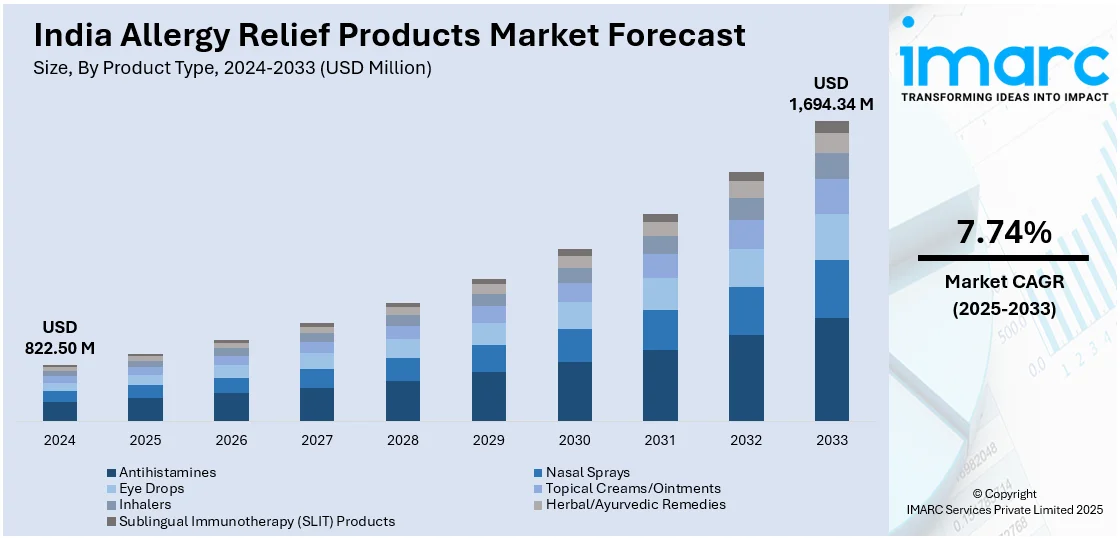

The India allergy relief products market size reached USD 822.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,694.34 Million by 2033, exhibiting a growth rate (CAGR) of 7.74% during 2025-2033. The market is witnessing consistent growth due to rising cases of respiratory and skin allergies caused by pollution, changing weather patterns, and urban lifestyles. Increased consumer awareness and easy access to both prescription and over-the-counter treatments are supporting demand. Pharmaceutical companies introducing innovative and fast-acting solutions to meet evolving needs are also influencing competition and shaping the India allergy relief products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 822.50 Million |

| Market Forecast in 2033 | USD 1,694.34 Million |

| Market Growth Rate 2025-2033 | 7.74% |

India Allergy Relief Products Market Trends:

Rising Prevalence of Allergies Due to Pollution and Urbanization

Air pollution, especially in urban and industrial areas, is a significant contributor to the rising incidence of allergies in India. The rise of respiratory and skin allergies directly correlates with the increasing amounts of dust combined with pollen and emissions from vehicles and industrial pollutants. The high pace of urbanization has intensified contact with allergy-causing substances so that allergic rhinitis, asthma, and eczema have become more prevalent. Furthermore, construction dust and poorly ventilated indoor environments contribute to year-round allergy triggers. As people migrate to cities and face constant exposure to allergens, the demand for effective allergy relief products has grown. This environmental trend is a major driver for the market, influencing both the volume and variety of allergy treatments required by the Indian population.

To get more information on this market, Request Sample

Growing Health Awareness and Self-Care Trends

With the spread of health information through digital media and rising health literacy, Indian consumers are becoming more proactive about managing allergies. There is a noticeable shift toward early detection, prevention, and self-care, with individuals seeking solutions for common allergy symptoms such as sneezing, itching, rashes, and congestion. This growing awareness has boosted demand for over-the-counter antihistamines, nasal sprays, skin creams, and herbal remedies. Consumers are also prioritizing products that offer quick relief with fewer side effects. This self-driven health approach, often without a doctor’s prescription, has widened the customer base for allergy relief products. Consequently, pharmaceutical and wellness brands are expanding their allergy portfolios to meet these self-care demands, making awareness a key growth factor in the market. For instance, in April 2025, Inamdar Multispeciality Hospital opened a dedicated allergy department in a major effort to combat the growing prevalence of allergies. The program represents a significant advancement in patient education, evidence-based treatment, and early diagnosis—essential elements that are frequently absent from standard care. This initiative reflects rising public health awareness and the demand for specialized care.

Innovation in Product Formulations and Delivery Methods

Pharmaceutical and wellness firms are dedicating resources to research and development to produce more efficient, long-lasting, and user-friendly allergy relief solutions. Innovations include non-drowsy antihistamines, fast-acting nasal sprays, herbal and Ayurvedic alternatives, and advanced skin care solutions for allergic reactions. Additionally, improvements in drug delivery, such as extended-release tablets, dissolvable strips, and inhalable formulations, are enhancing treatment experiences and compliance. These innovations cater to consumer preferences for convenience, efficacy, and safety. Local manufacturers are also developing region-specific solutions that address common allergens in different parts of India. As competition increases, brands are differentiating themselves through innovation, further expanding consumer options and stimulating demand in the allergy relief segment. This innovation-centric approach is a vital factor driving the India allergy relief products market growth.

India Allergy Relief Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, allergen type, distribution channel, and end user.

Product Type Insights:

- Antihistamines

- Nasal Sprays

- Eye Drops

- Topical Creams/Ointments

- Inhalers

- Herbal/Ayurvedic Remedies

- Sublingual Immunotherapy (SLIT) Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes antihistamines, nasal sprays, eye drops, topical creams/ointments, inhalers, herbal/ayurvedic remedies, and sublingual immunotherapy (SLIT) products.

Allergen Type Insights:

- Respiratory Allergens

- Skin Allergens

- Food Allergens

- Drug Allergens

- Insect Sting Allergens

A detailed breakup and analysis of the market based on the allergen type have also been provided in the report. This includes respiratory allergens, skin allergens, food allergens, drug allergens, and insect sting allergens.

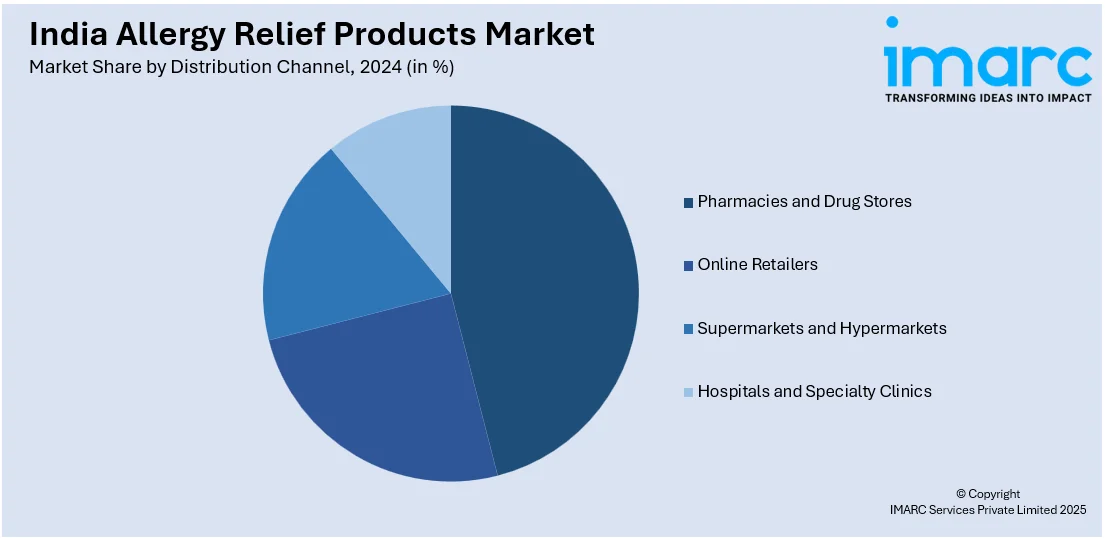

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Online Retailers

- Supermarkets and Hypermarkets

- Hospitals and Specialty Clinics

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies and drug stores, online retailers, supermarkets and hypermarkets, and hospitals and specialty clinics.

End User Insights:

- Adults

- Children

- Elderly

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes adults, children, and elderly.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Allergy Relief Products Market News:

- In March 2024, a brand-new probiotic was introduced by Entod Pharmaceuticals to treat nasal allergies. Probiotics' involvement in reducing allergy reactions, especially in the nose, has been clinically investigated and reported in international publications for years, despite their traditional usage to support the maintenance of a healthy intestinal flora that may improve immunity and general wellness.

- In November 2024, Marksans Pharma Ltd announced that the US health agency had given its generic Loratadine tablets, which are used to treat allergic rhinitis, final approval. In a regulatory filing, Marksans Pharma stated that the US Food and Drug Administration (USFDA) had approved the company's abbreviated new drug application (ANDA) for 10 mg Loratadine tablets.

India Allergy Relief Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Antihistamines, Nasal Sprays, Eye Drops, Topical Creams/Ointments, Inhalers, Herbal/Ayurvedic Remedies, Sublingual Immunotherapy (SLIT) Products |

| Allergen Types Covered | Respiratory Allergens, Skin Allergens, Food Allergens, Drug Allergens, Insect Sting Allergens |

| Distribution Channels Covered | Pharmacies and Drug Stores, Online Retailers, Supermarkets and Hypermarkets, Hospitals and Specialty Clinics |

| End Users Covered | Adults, Children, Elderly |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India allergy relief products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India allergy relief products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India allergy relief products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The allergy relief products market in India was valued at USD 822.50 Million in 2024.

The India allergy relief products market is projected to exhibit a CAGR of 7.74% during 2025-2033, reaching a value of USD 1,694.34 Million by 2033.

Growing awareness of allergic conditions and increasing prevalence of respiratory and skin allergies in India drive the allergy relief products market. Rising urban pollution, lifestyle changes, and seasonal allergens contribute to demand. Enhanced access to healthcare, self-care products, and over-the-counter solutions, along with product innovation and convenience-focused offerings, further support market growth and consumer adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)