India Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and Region, 2025-2033

India Alternative Data Market Overview:

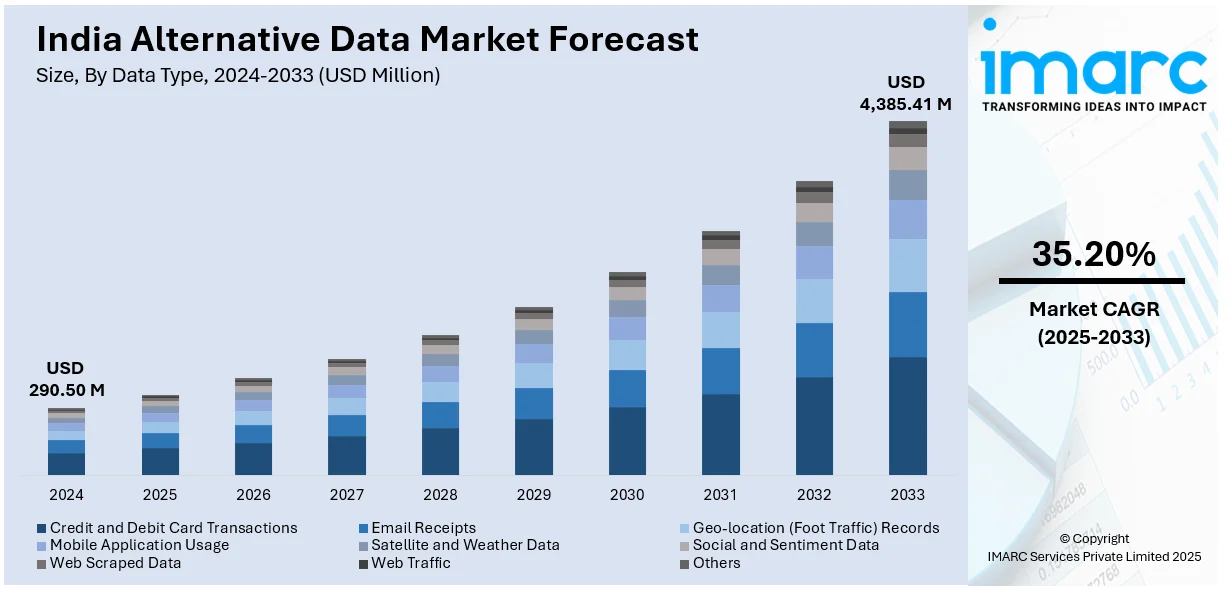

The India alternative data market size reached USD 290.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,385.41 Million by 2033, exhibiting a growth rate (CAGR) of 35.20% during 2025-2033. The market is witnessing significant growth, driven by the increasing adoption of alternative data in financial services and the emergence of sector-specific alternative data use cases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 290.50 Million |

| Market Forecast in 2033 | USD 4,385.41 Million |

| Market Growth Rate 2025-2033 | 35.20% |

India Alternative Data Market Trends:

Increasing Adoption of Alternative Data in Financial Services

The India alternative data market is witnessing a significant increase in adoption within the financial services sector, particularly among asset managers, banks, and fintech firms. With growing demand for real-time, non-traditional data sources to enhance risk assessment, credit scoring, and investment strategies, financial institutions are leveraging data from digital transactions, satellite imagery, mobile usage, and social media activity. This trend is driven by the need to generate differentiated insights in a competitive landscape and improve decision-making beyond traditional financial metrics. In particular, the rise of digital lending and the under-penetration of formal credit systems in India have made alternative data an essential tool for evaluating creditworthiness in the absence of conventional documentation. Financial institutions are also integrating machine learning algorithms to process large volumes of unstructured data, allowing for more granular customer segmentation and predictive analytics. As per industry reports, in June 2024, RBI is leveraging vast computing power and alternative data for deeper analysis, acknowledging the shift from data scarcity to abundance, as noted during the 18th Statistics Day Conference in Mumbai. Regulatory developments, including the account aggregator framework, are facilitating secure and consent-based access to user data, further enabling the use of alternative datasets. As financial inclusion expands and digital footprints grow, the reliance on alternative data is expected to deepen, positioning it as a key component of India’s evolving financial ecosystem.

To get more information on this market, Request Sample

Emergence of Sector-Specific Alternative Data Use Cases

The alternative data market in India is evolving with the emergence of sector-specific applications across industries such as agriculture, retail, logistics, and real estate. Organizations are increasingly recognizing the value of integrating unconventional data sources—ranging from geospatial imagery and weather data to foot traffic and consumer sentiment—to gain a competitive edge. In agriculture, for example, satellite-based crop monitoring and soil health data are used for yield forecasting and supply chain planning. Retail businesses are leveraging location intelligence, online reviews, and mobile app usage to refine store placement strategies and inventory management. In logistics, companies adopt alternative data for route optimization, predictive maintenance, and real-time tracking. Real estate developers and investors are analyzing social media trends, construction activity, and local infrastructure data to assess property value and market demand. This sector-specific shift is supported by increased investment in analytics platforms and a growing ecosystem of data providers offering tailored solutions. For instance, in March 2024, Blackstone, with Sattva Group and Panchshil Realty, are advancing plans to launch a commercial REIT in FY25, targeting over 40 million sq. ft., making it South Asia’s second-largest after Embassy REIT. As businesses seek more precise, actionable intelligence, the demand for curated, high-frequency alternative datasets will continue to rise. This trend underscores a broader transformation in enterprise decision-making, where data-driven strategies are increasingly anchored in non-traditional, real-world signals.

India Alternative Data Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on data type, industry, and end user.

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

The report has provided a detailed breakup and analysis of the market based on the data type. This includes credit and debit card transactions, email receipts, geo-location (foot traffic) records, mobile application usage, satellite and weather data, social and sentiment data, web scraped data, web traffic, and others.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, BFSI, energy, industrial, IT and telecommunications, media and entertainment, real estate and construction, retail, transportation and logistics, and others.

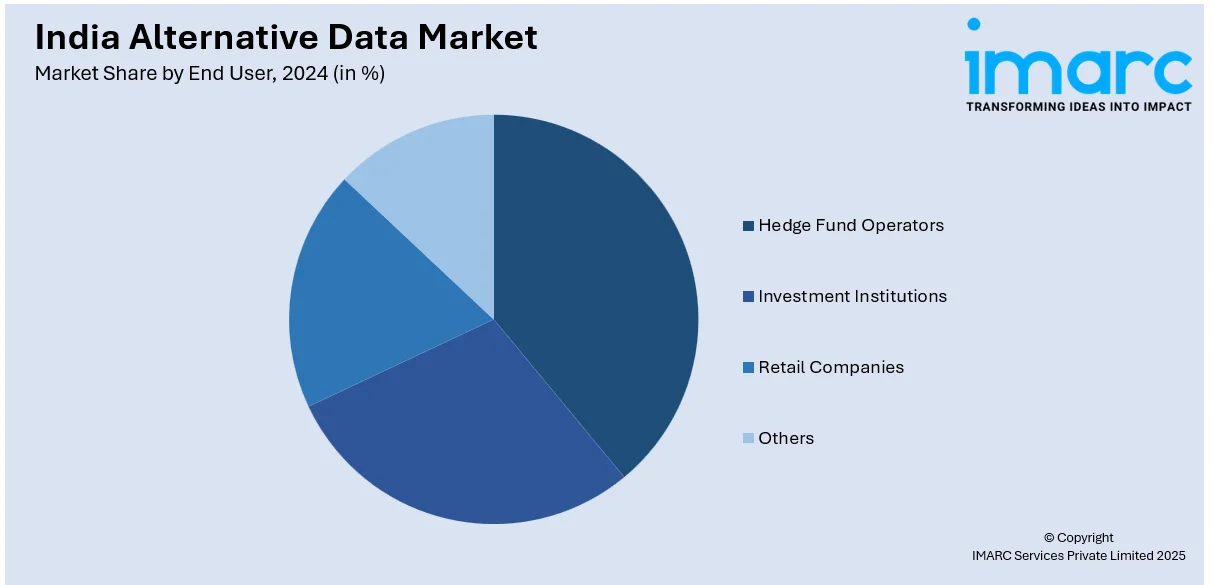

End User Insights:

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hedge fund operators, investment institutions, retail companies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Alternative Data Market News:

- In March 2025, MoSPI hosted a brainstorming session in New Delhi to explore integrating non-conventional data—such as satellite imagery, telecom records, and social media insights—with traditional statistics. These big data sources present new opportunities to enhance official data systems and support more informed, data-driven policy decisions.

India Alternative Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India alternative data market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India alternative data market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India alternative data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alternative data market in India was valued at USD 290.50 Million in 2024.

The India alternative data market is projected to exhibit a CAGR of 35.20% during 2025-2033, reaching a value of USD 4,385.41 Million by 2033.

Growing demand for data-driven decision-making, rise in fintech and digital lending platforms, and increasing reliance on non-traditional data sources for credit scoring and investment analysis are key drivers. Technological advancements and expanding internet penetration further support the growth of alternative data usage in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)