India Alternative Medicine and Herbal Remedies Market Size, Share, Trends and Forecast by Product Type, Therapeutic Application, Distribution Channel, End User, and Region, 2025-2033

India Alternative Medicine and Herbal Remedies Market Overview:

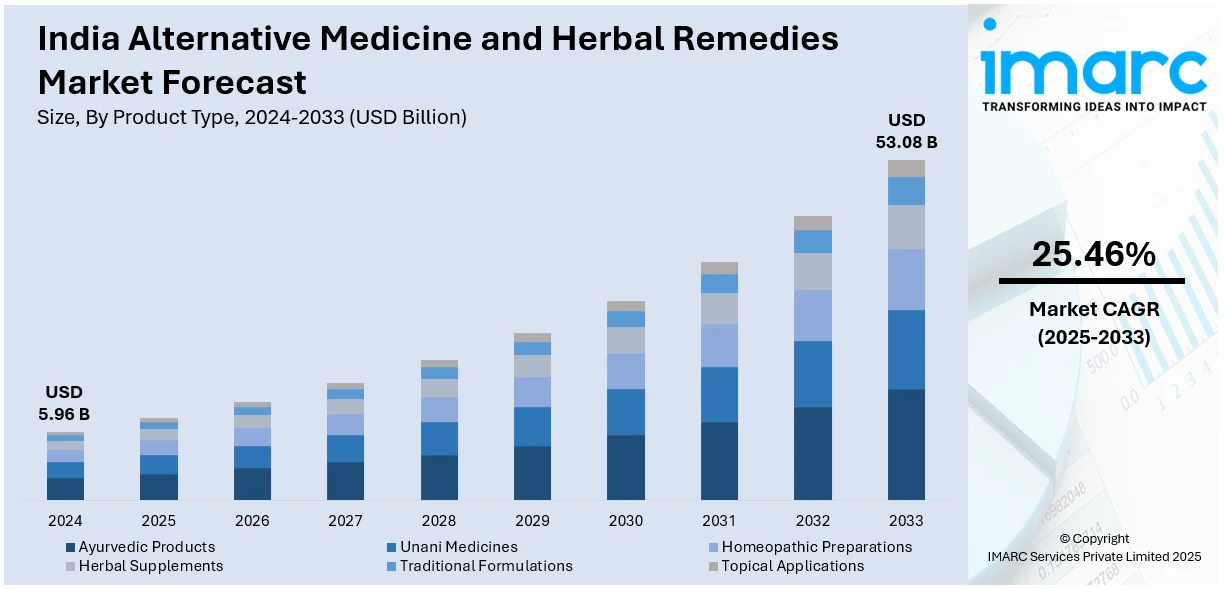

The India alternative medicine and herbal remedies market size reached USD 5.96 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 53.08 Billion by 2033, exhibiting a growth rate (CAGR) of 25.46% during 2025-2033. The market is gaining momentum due to increasing consumer preference for natural, holistic healthcare solutions and rising adoption of traditional systems like Ayurveda, Unani, and Siddha alongside modern wellness trends. Growing awareness, supportive government initiatives, and rising demand for preventive care are significantly shaping the competitive dynamics of the India alternative medicine and herbal remedies market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.96 Billion |

| Market Forecast in 2033 | USD 53.08 Billion |

| Market Growth Rate 2025-2033 | 25.46% |

India Alternative Medicine and Herbal Remedies Market Trends:

Expanding Product Availability Through Modern Retail and E-commerce

Alternative medicine and herbal remedies are now widely available through pharmacies, supermarkets, wellness stores, and digital platforms. E-commerce has played a crucial role in increasing accessibility, especially in tier-2 and tier-3 cities, where physical access to wellness stores may be limited. Online platforms offer a wide range of products—from herbal supplements and teas to oils and skincare—backed by user reviews, detailed descriptions, and influencer marketing. Subscription services, combo packs, and discounts further drive purchases. Modern retail formats have also enhanced visibility of these products with better packaging and shelf space. This improved distribution ecosystem is making it easier for consumers to integrate herbal and alternative remedies into their daily routines, boosting market penetration. For instance, in August 2024, leading Indian company Denzour Nutrition, known for its dedication to natural and potent sports supplements, announced its entry into the fascinating field of organic nutraceuticals. This new product line appeals to both athletes and the public who want to improve their fitness and health by utilizing the best nutrients found in nature.

To get more information on this market, Request Sample

Growing Consumer Preference for Natural and Preventive Healthcare

The India alternative medicine and herbal remedies market growth is also driven by Indian consumers increasingly leaning toward natural, plant-based treatments for managing health conditions and boosting immunity. Concerns over the side effects of synthetic drugs and a shift toward wellness and preventive care have boosted interest in alternative systems like Ayurveda, homeopathy, and herbal supplements. The COVID-19 pandemic further accelerated this trend, with many turning to traditional remedies to strengthen immunity and manage mild symptoms. Consumers now prefer holistic approaches that address root causes rather than just symptoms. This rising preference for organic and chemical-free products is expanding the demand for herbal teas, oils, tonics, and dietary supplements, making natural healthcare a major driving force behind the market’s steady growth.

Increasing Global Recognition and Export Opportunities

India’s rich tradition in Ayurveda and herbal medicine is gaining worldwide acceptance, opening new export opportunities. The demand for natural, chemical-free health and wellness products is growing across Europe, North America, and Southeast Asia. Indian companies are responding by adhering to international quality standards, obtaining global certifications, and innovating in formulations to cater to global tastes. Government-backed export incentives and bilateral agreements under the AYUSH framework are further promoting international trade. This global recognition not only brings foreign revenue but also enhances brand credibility within the domestic market. As Indian brands establish themselves on the world stage, they drive awareness and demand at home, making global acceptance a key market growth driver.

India Alternative Medicine and Herbal Remedies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, therapeutic application, distribution channel, and end user.

Product Type Insights:

- Ayurvedic Products

- Unani Medicines

- Homeopathic Preparations

- Herbal Supplements

- Traditional Formulations

- Topical Applications

- Balms

- Oils

- Creams

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ayurvedic products, Unani medicines, homeopathic preparations, herbal supplements, traditional formulations, and topical applications (balms, oils, and creams).

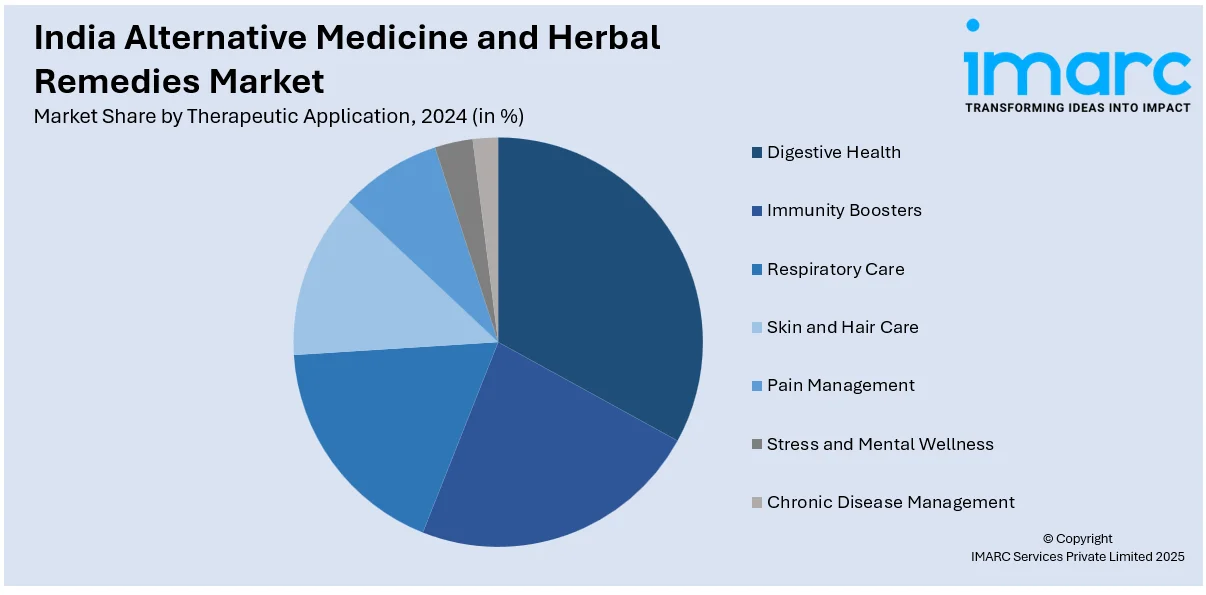

Therapeutic Application Insights:

- Digestive Health

- Immunity Boosters

- Respiratory Care

- Skin and Hair Care

- Pain Management

- Stress and Mental Wellness

- Chronic Disease Management

A detailed breakup and analysis of the market based on the therapeutic application have also been provided in the report. This includes digestive health, immunity boosters, respiratory care, skin and hair care, pain management, stress and mental wellness, and chronic disease management.

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Online Retailers

- Supermarkets and Specialty Stores

- Direct Selling and Clinics

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies and drug stores, online retailers, supermarkets and specialty Stores, and direct selling and clinics.

End User Insights:

- Individual Consumers

- Hospitals and Clinics

- Wellness and Spa Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual consumers, hospitals and clinics, and wellness and spa centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Alternative Medicine and Herbal Remedies Market News:

- In October 2024, Prime Minister Shri Narendra Modi unveiled, inaugurated, and placed the foundation stone for several health sector projects valued at approximately ₹12,850 crore at the All-India Institute of Ayurveda (AIIA), New Delhi, in honor of Dhanvantari Jayanti and the 9th Ayurveda Day. Vaidya Rajesh Kotecha, Secretary Ayush, Dr. Manoj Nesari (Ayush Advisor), Dr. Mansukh Mandaviya, Minister of Labor and Employment & Youth Affairs and Sports, Shri J.P. Nadda, Union Minister for Health and Family Welfare & Chemicals & Fertilizers, and other dignitaries attended the event.

India Alternative Medicine and Herbal Remedies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Therapeutic Applications Covered | Digestive Health, Immunity Boosters, Respiratory Care, Skin and Hair Care, Pain Management, Stress and Mental Wellness, Chronic Disease Management |

| Distribution Channels Covered | Pharmacies and Drug Stores, Online Retailers, Supermarkets and Specialty Stores, Direct Selling and Clinics. |

| End Users Covered | Individual Consumers, Hospitals and Clinics, Wellness and Spa Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India alternative medicine and herbal remedies market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India alternative medicine and herbal remedies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India alternative medicine and herbal remedies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alternative medicine and herbal remedies market in India was valued at USD 5.96 Billion in 2024.

The India alternative medicine and herbal remedies market is projected to exhibit a CAGR of 25.46% during 2025-2033, reaching a value of USD 53.08 Billion by 2033.

The growth of the India alternative medicine and herbal remedies market is driven by rising awareness of natural healthcare solutions and a strong cultural preference for traditional practices like Ayurveda and homeopathy. Greater focus on preventive wellness and immunity-boosting products has increased demand among urban and rural consumers alike. Expanding retail availability and growth of online sales channels are also making herbal products more accessible nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)