India Aluminium-Extruded Products Market Size, Share, Trends and Forecast by Product Type, End Use Industry, Alloy Type, and Region, 2025-2033

India Aluminium-Extruded Products Market Overview:

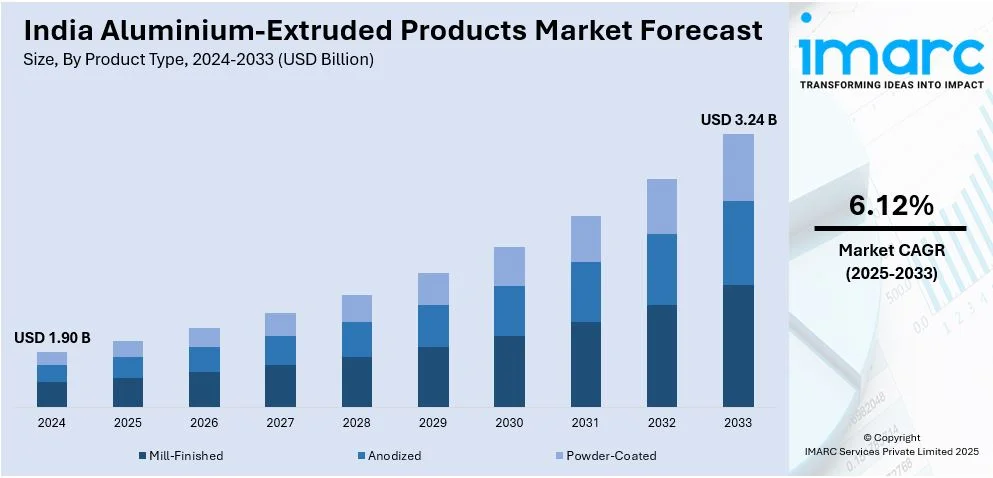

The India aluminium-extruded products market size reached USD 1.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.24 Billion by 2033, exhibiting a growth rate (CAGR) of 6.12% during 2025-2033. The growing demand in construction, automotive, and electrical industries, increasing adoption of lightweight materials, rising infrastructure projects, government initiatives promoting sustainable development, advancements in extrusion technology, which is enhancing product efficiency and application diversity are some of the major factors augmenting India aluminium-extruded products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.90 Billion |

| Market Forecast in 2033 | USD 3.24 Billion |

| Market Growth Rate 2025-2033 | 6.12% |

India Aluminium-Extruded Products Market Trends:

Growing Demand from the Construction and Infrastructure Sector

The India aluminium-extruded products market growth is driven by the expanding construction and infrastructure sector. Aluminium extrusions are widely used in building facades, doors, windows, roofing systems, and structural frameworks due to their lightweight nature, corrosion resistance, and durability. According to an industry report, the Ministry of Housing & Urban Affairs announced on December 18, 2024, that the Smart Cities Mission had invested INR 1,47,704 Crore (about USD 17 274 Million) and completed 7,380 of 8,075 projects, or 91% of the total. With rapid urbanization and favorable government initiatives such as Smart Cities and Housing for All, the demand for high-performance construction materials is increasing. Additionally, aluminium's recyclability aligns with the growing emphasis on sustainable building materials. The shift toward energy-efficient and green buildings has further propelled the adoption of aluminium extrusions in modern architectural designs. Rising investments in commercial and residential projects, coupled with increased focus on high-rise buildings and prefabricated structures, are boosting market growth. Furthermore, the growing demand for aesthetically appealing and structurally strong materials in urban infrastructure projects is expected to fuel the aluminium-extruded products market, making it a preferred choice in the construction sector.

To get more information on this market, Request Sample

Expanding Automotive and Transportation Applications

The automotive and transportation sector is emerging as a key driver of India's aluminium-extruded products market, fueled by the growing demand for lightweight and fuel-efficient vehicles. Aluminium extrusions are extensively used in manufacturing vehicle components such as frames, panels, bumpers, and structural reinforcements due to their high strength-to-weight ratio. With the rising adoption of electric vehicles (EVs), the need for lightweight materials to enhance battery efficiency and overall vehicle performance has increased, which in turn is positively impacting India aluminium extruded products market outlook. Notably, according to an article published on March 21, 2025, the government's incentives and subsidies for clean mobility are helping to propel the electric vehicle (EV) industry in India to exponential growth. The PM E-Drive plan, which has been allocated INR 3,679 Crore (about USD 431 Million), is expected further to encourage the use of electric two- and three-wheelers. India's growing demand for EVs is also propelled by improvements in domestic manufacturing, more product offerings, and increasing public awareness. This surge in EV adoption is also creating a significant opportunity for the aluminium extruded products market in India. Additionally, stringent emission norms and fuel efficiency regulations have prompted automakers to replace traditional steel components with aluminium alternatives. The expansion of railway networks and metro projects across major cities has also contributed to the increasing demand for aluminium extrusions in rail car manufacturing. As India strengthens its focus on sustainable mobility and energy-efficient transportation solutions, the aluminium-extruded products market is poised for sustained growth in the automotive and transportation industries.

India Aluminium-Extruded Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, end use industry, and alloy type.

Product Type Insights:

- Mill-Finished

- Anodized

- Powder-Coated

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mill-finished, anodized, and powder-coated.

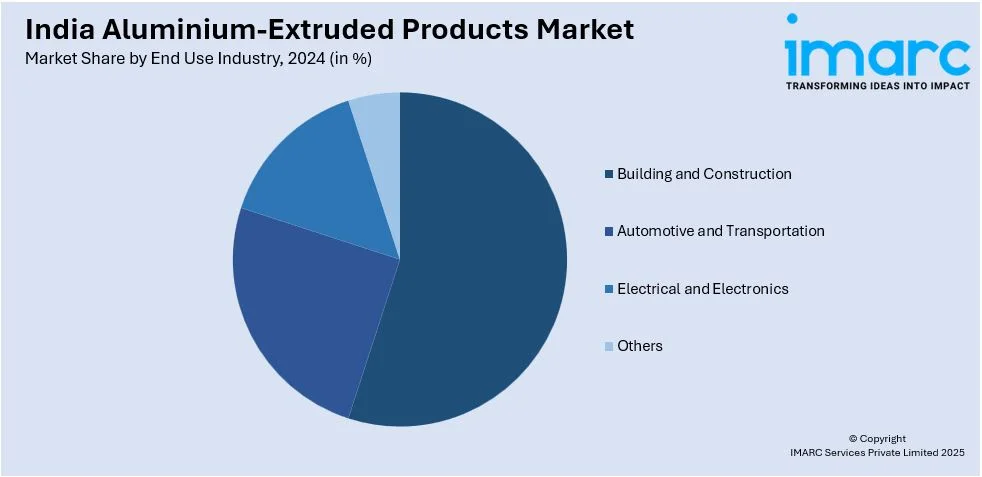

End Use Industry Insights:

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, automotive and transportation, electrical and electronics, and others.

Alloy Type Insights:

- 1000 Series

- 2000 Series

- 3000 Series

- 5000 Series

- 6000 Series

- 7000 Series

A detailed breakup and analysis of the market based on the alloy type have also been provided in the report. This includes 1000 series, 2000 series, 3000 series, 5000 series, 6000 series, and 7000 series.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aluminium-Extruded Products Market News:

- On March 6, 2025, Maan Aluminium stated that it would expand its aluminum extrusion production activities and add value-added services by purchasing 13,117 square meters of leasehold land in Devas Industrial Area, Madhya Pradesh, for INR 8.75 Crore (about USD 1.03 Million), exclusive of stamp duty and other fees. This increase comes after the company's yearly production capacity doubled to 24,000 tons in December 2024 with the start of a new extrusion line that can handle profiles up to 300 mm in all alloy series from 1000 to 7000.

- On November 19, 2024, it was revealed that the 15th ZAK Aluminium Extrusions Expo would take place in Pragati Maidan, New Delhi, from December 5–7, 2024. Advances in die design, surface treatment, and aluminum extrusion technology will be demonstrated at this event, which is being organized by ZAK Exhibitions and Conferences. It will be held alongside the ZAK Doors and Windows Expo and the ZAK Glass Technology Expo, and it is anticipated to draw 350 exhibitors and more than 25,000 people.

India Aluminium-Extruded Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mill-Finished, Anodized, Powder-Coated |

| End Use Industries Covered | Building and Construction, Automotive and Transportation, Electrical and Electronics, Others |

| Alloy Types Covered | 1000 Series, 2000 Series, 3000 Series, 5000 Series, 6000 Series, 7000 Series |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aluminium-extruded products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aluminium-extruded products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aluminium-extruded products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminium-extruded products market in India was valued at USD 1.90 Billion in 2024.

The India aluminium-extruded products market is projected to exhibit a CAGR of 6.12% during 2025-2033, reaching a value of USD 3.24 Billion by 2033.

The India aluminium-extruded products market is driven by the growing demand from sectors like construction, automotive, and electrical. The expansion of infrastructure projects and government initiatives, along with technological advancements in extrusion processes, are contributing to increased adoption of aluminium for its lightweight and durable properties.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)