India Ammonium Nitrate Market Size, Share, Trends and Forecast by Grade, Solids, End Use, and Region, 2025-2033

India Ammonium Nitrate Market Overview:

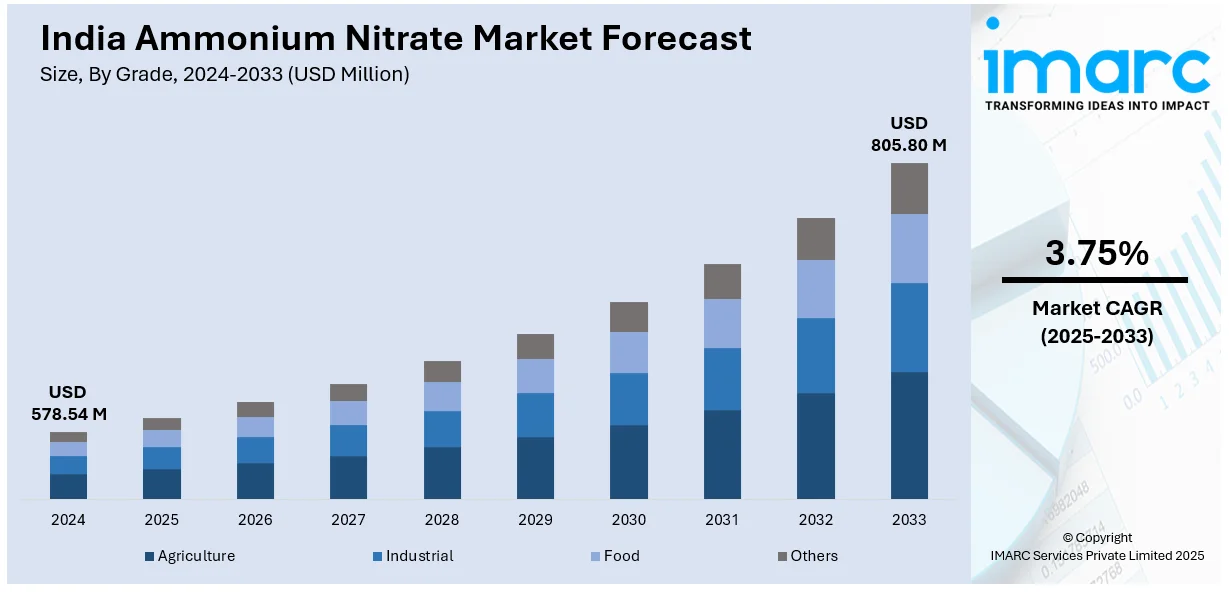

The India ammonium nitrate market size reached USD 578.54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 805.80 Million by 2033, exhibiting a growth rate (CAGR) of 3.75% during 2025-2033. The India ammonium nitrate market is growing due to supportive government policies promoting self-reliance and sustainable agriculture, along with increased production capacity driven by strategic technology partnerships and investments in advanced domestic manufacturing facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 578.54 Million |

| Market Forecast in 2033 | USD 805.80 Million |

| Market Growth Rate 2025-2033 | 3.75% |

India Ammonium Nitrate Market Trends:

Government Policies and Regulatory Support

The increasing number of policies by the governing body are crucial in influencing the ammonium nitrate market, especially via programs that encourage self-sufficiency and enhance local production. For example, in 2024, Coal India Limited (CIL) and Bharat Heavy Electricals Limited (BHEL) signed a joint venture to establish an ammonium nitrate plant in Odisha, using coal gasification technology. The plant was set to produce 2,000 tons of ammonium nitrate daily, utilizing 1.3 million tons of coal from CIL. This project aimed to reduce import dependency and support the government's Atmanirbhar Bharat initiative. By enhancing local production capability, these initiatives reinforce the market for ammonium nitrate in India, ensuring its competitiveness and sustainability over the long term. Furthermore, the emphasis of the government on promoting sustainable farming and industrial development is leading to the implementation of policies that support the use of fertilizers, such as nitrogen-rich options like ammonium nitrate. Financial support and grants for fertilizers enhance the accessibility and affordability of ammonium nitrate for farmers, promoting its use in agricultural methods. Moreover, regulatory structures backing industries like mining and construction are also driving the need for ammonium nitrate, particularly for its application in the production of explosives.

To get more information on this market, Request Sample

Capacity Expansion Through Technology Partnerships

The consistent rise in production capacity achieved through strategic technological partnerships and industrial investments is bolstering the market growth. The nation’s effort to enhance its local fertilizer and chemical manufacturing is motivating public enterprises and private companies to invest in advanced, high-efficiency plants. For instance, in 2023, Casale announced that Rashtriya Chemicals and Fertilizers Ltd. (RCF) in Trombay, India, had selected its NitroPIPE technology for a new 425 MTPD Ammonium Nitrate melt facility. The project was set to be executed on an LSTK basis by Larsen & Toubro (L&T), with Casale providing the license, process design, and proprietary items. This marked a significant expansion of Casale's presence in the Indian nitrate market. This project highlights the increasing focus on incorporating advanced, energy-efficient technologies into Indian manufacturing infrastructure. Casale's participation encompasses licensing, process design, and provision of proprietary equipment, reflecting a wider industry movement towards modernization and localization. These initiatives not only boost operational efficiency but also decrease dependence on imports, improve supply stability, and aid downstream industries such as mining, infrastructure, and defense. With these technology-driven growth, the supply of high-purity and bulk-grade ammonium nitrate is increasing, enhancing the market's capacity to satisfy growing domestic needs in both industrial and agricultural sectors.

India Ammonium Nitrate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on grade, solids, and end use.

Grade Insights:

- Agriculture

- Industrial

- Food

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes agriculture, industrial, food, and others.

Solids Insights:

- High Density Ammonium Nitrate

- Low Density Ammonium Nitrate

The report has provided a detailed breakup and analysis of the market based on the solids. This includes high density ammonium nitrate and low density ammonium nitrate.

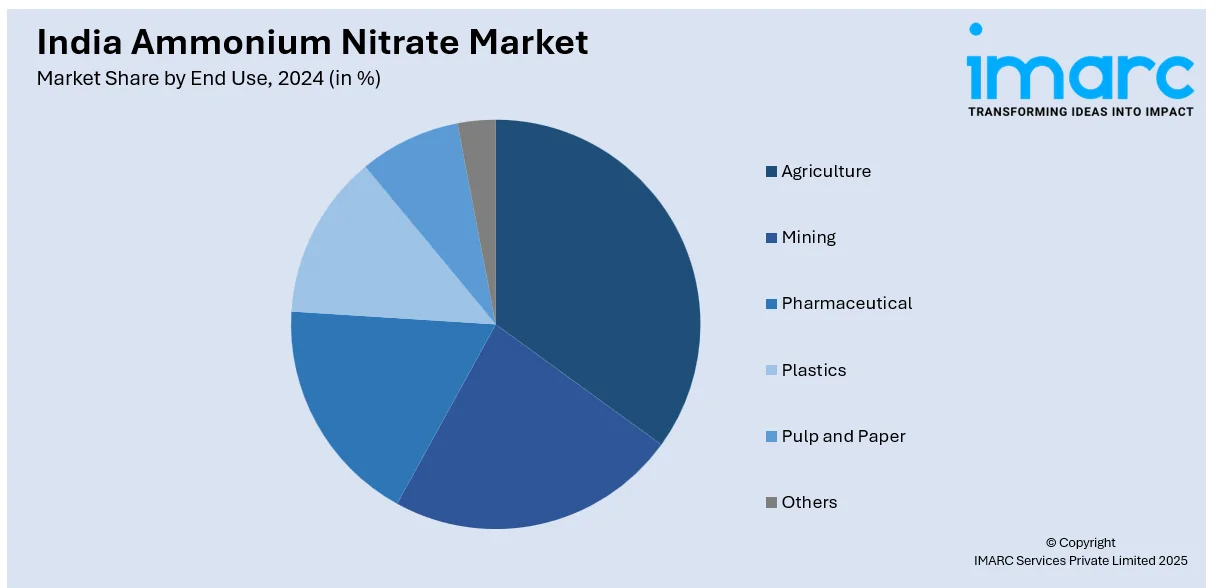

End Use Insights:

- Agriculture

- Mining

- Pharmaceutical

- Plastics

- Pulp and Paper

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes agriculture, mining, pharmaceutical, plastics, pulp and paper, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ammonium Nitrate Market News:

- In January 2025, Chambal Fertilisers revised its contract with Larsen & Toubro for setting up a technical ammonium nitrate (TAN) plant at Gadepan, Rajasthan, increasing the contract price to Rs. 992.71 crore. The contract covers designing, procurement, construction, and commissioning of the plant, with provisions for future expansion. The project completion date is extended to January 19, 2026.

- In August 2024, the Board of Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC) approved an investment to enhance the production capacity of weak nitric acid by 57%, totaling 200,000 MTPA. The company also cleared investments in ammonium nitrate production.

India Ammonium Nitrate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Agriculture, Industrial, Food, Others |

| Solids Covered | High Density Ammonium Nitrate, Low Density Ammonium Nitrate |

| End Users Covered | Agriculture, Mining, Pharmaceutical, Plastics, Pulp and Paper, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ammonium nitrate market performed so far and how will it perform in the coming years?

- What is the breakup of the India ammonium nitrate market on the basis of grade?

- What is the breakup of the India ammonium nitrate market on the basis of solids?

- What is the breakup of the India ammonium nitrate market on the basis of end use?

- What is the breakup of the India ammonium nitrate market on the basis of region?

- What are the various stages in the value chain of the India ammonium nitrate market?

- What are the key driving factors and challenges in the India ammonium nitrate market?

- What is the structure of the India ammonium nitrate market and who are the key players?

- What is the degree of competition in the India ammonium nitrate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ammonium nitrate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ammonium nitrate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ammonium nitrate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)