India Ampoules Market Size, Share, Trends and Forecast by Material Type, Capacity, Ampoule Type, End-User Industry, and Region, 2025-2033

India Ampoules Market Size and Share:

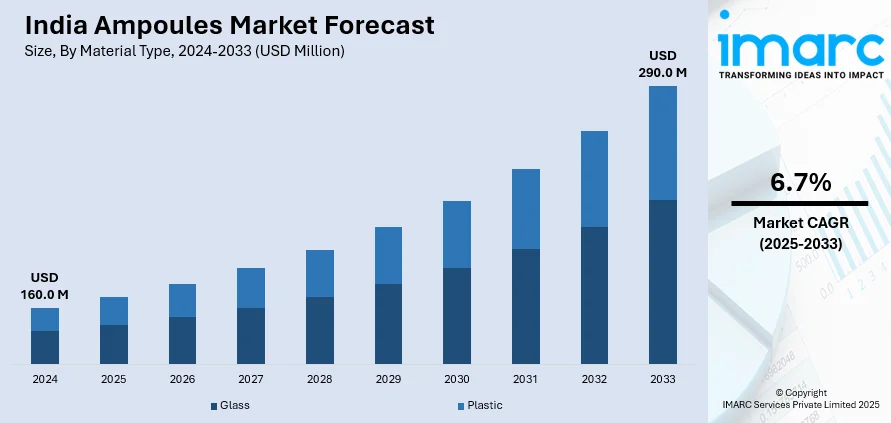

The India ampoules market size reached USD 160.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 290.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.7% during 2025-2033. The market is expanding rapidly, fueled by the rising demand for injectable medications and increasing healthcare infrastructure. Additionally, with advancements in manufacturing technology and stringent quality standards, India is becoming a key player in global ampoule production. The market is expected to continue growing, driven by both domestic and international demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 160.0 Million |

| Market Forecast in 2033 | USD 290.0 Million |

| Market Growth Rate (2025-2033) | 6.7% |

India Ampoules Market Trends:

Rising Demand for Glass Ampoules in Injectable Drug Packaging

The Indian ampoules industry is witnessing continuous growth, influenced by the surge in the demand for glass ampoules in the packaging of drugs, vaccines, and biologics. Manufacturers are focusing on high-quality, contamination-free packaging solutions as injectable drugs, vaccines, and biologics become more mainstream. Glass ampoules ensure superior chemical stability, sterility, and anti-oxidative protection, leading to them becoming a first-choice packaging solution for sensitive drug compounds. Increased instances of chronic diseases, growing vaccination programs, and the transition to the use of biologics have also increased the demand for ampoules in hospitals, clinics, and diagnostic centers. For instance, according to IMARC group, India's biologics market is projected to reach USD 24.6 Billion by 2033, significantly influencing the market dynamics. Indian pharma companies are also investing in automatic filling and sealing machines that guarantee accuracy, efficiency, and regulatory validation. Moreover, increasing emphasis on single-dose drug delivery forms for enhanced patient safety and dose accuracy is driving ampoule adoption. Increased manufacturing capacity of India's pharmaceutical industry for injectable medicines is driving demand from domestic and export markets, solidifying the position of high-performance glass ampoules in injectable drug delivery.

To get more information on this market, Request Sample

Growth in Sustainable and Eco-Friendly Ampoule Manufacturing

The India ampoules market is witnessing a shift toward sustainable packaging solutions, as pharmaceutical manufacturers seek to reduce environmental impact while maintaining product safety and efficacy. With increasing emphasis on green manufacturing, companies are adopting lightweight and recyclable glass ampoules, minimizing raw material usage and carbon emissions. For instance, as per industry reports, ten of India's top 20 pharmaceutical companies have committed to cutting emissions by more than 30% by 2030. Regulatory bodies are also encouraging the use of eco-friendly production processes, prompting ampoule manufacturers to integrate energy-efficient furnaces, water recycling systems, and automated quality control. Additionally, advancements in low-impact coating technologies are enhancing glass ampoule strength and durability, reducing breakage rates while ensuring regulatory compliance. Pharmaceutical companies are also exploring circular economy models, focusing on glass recycling programs and sustainable sourcing of raw materials. Furthermore, with growing consumer and regulatory interest in green packaging solutions, the Indian ampoule market is evolving to support environmentally responsible pharmaceutical production while maintaining stringent quality and safety standards.

India Ampoules Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material type, capacity, ampoule type, and end-user industry.

Material Type Insights:

- Glass

- Plastic

The report has provided a detailed breakup and analysis of the market based on the material type. This includes glass and plastic.

Capacity Insights:

- Less than 2 ml

- 3 to 5 ml

- 6 to 8 ml

- Above 8 ml

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes less than 2 ml, 3 to 5 ml, 6 to 8 ml, and above 8 ml.

Ampoule Type Insights:

- Straight Stem

- Open Funnel

- Closed Funnel

- Others

The report has provided a detailed breakup and analysis of the market based on the ampoule type. This includes straight stem, open funnel, closed funnel, and others.

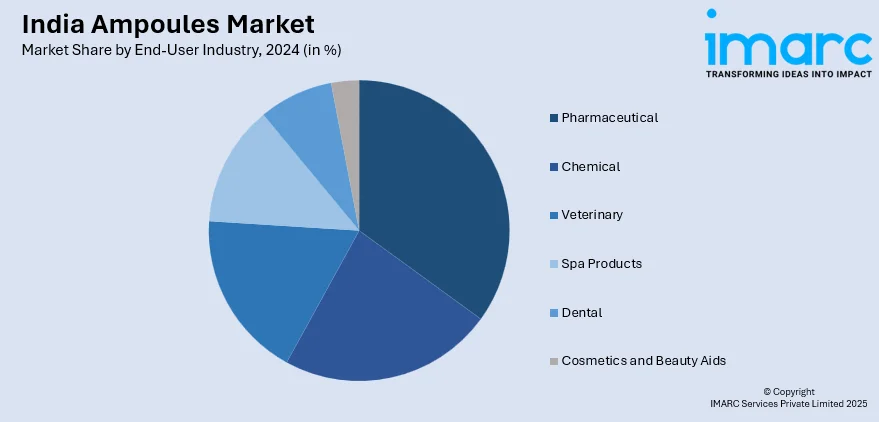

End-User Industry Insights:

- Pharmaceutical

- Chemical

- Veterinary

- Spa Products

- Dental

- Cosmetics and Beauty Aids

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes pharmaceutical, chemical, veterinary, spa products, dental, and cosmetics and beauty aids.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ampoules Market News:

- In April 2024, Windlas Biotech announced the commissioning of its advanced injectable facility for Small Volume Parenteral products, meeting international cGMP standards. The facility, licensed by the Drug Controlling & Licensing Authority of Uttarakhand, will produce ampoules, liquid vials, and lyophilized vials, supporting its CDMO, generics, and export operations.

India Ampoules Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Glass, Plastic |

| Capacities Covered | Less than 2 ml, 3 to 5 ml, 6 to 8 ml, Above 8 ml |

| Ampoule Types Covered | Straight Stem, Open Funnel, Closed Funnel, Others |

| End-User Industries Covered | Pharmaceutical, Chemical, Veterinary, Spa Products, Dental, Cosmetics and Beauty Aids |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ampoules market performed so far and how will it perform in the coming years?

- What is the breakup of the India ampoules market on the basis of material type?

- What is the breakup of the India ampoules market on the basis of capacity?

- What is the breakup of the India ampoules market on the basis of ampoule type?

- What is the breakup of the India ampoules market on the basis of end-user industry?

- What is the breakup of the India ampoules market on the basis of region?

- What are the various stages in the value chain of the India ampoules market?

- What are the key driving factors and challenges in the India ampoules market?

- What is the structure of the India ampoules market and who are the key players?

- What is the degree of competition in the India ampoules market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ampoules market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ampoules market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ampoules industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)