India Animal Feed Supplements Market Size, Share, Trends and Forecast by Source, Product Type, Livestock Type, Form, Application, and Region, 2025-2033

India Animal Feed Supplements Market Overview:

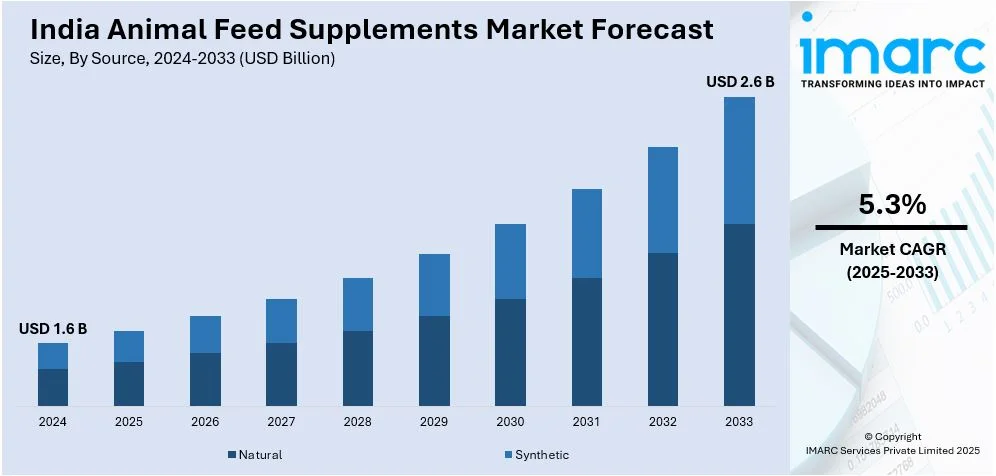

The India animal feed supplements market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033. The market in India for animal feed supplements is growing rapidly, driven by increasing awareness of animal nutrition, demand for specialized products, and sustainability trends. Along with this, farmers are seeking solutions to improve livestock health, productivity, and quality, boosting the market for eco-friendly, customized feed supplements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Market Growth Rate (2025-2033) | 5.3% |

India Animal Feed Supplements Market Trends:

Increasing Demand for Nutritional Supplements

The market in India is experiencing significant growth in demand as there is increased awareness among livestock farmers regarding the necessity of good animal nutrition. As concerns are being raised regarding animal health and productivity, farmers are now examining supplements to meet the specific nutritional deficiencies in the diets of their animals. The demand for vitamins, minerals, and proteins to enhance livestock growth, immunity, and reproduction is on the rise. As livestock production increases, particularly in the case of dairy and poultry farming, the importance of feed supplements for preserving ideal health and productivity becomes even more vital. Furthermore, trends in recent spans indicate that the market is transforming with more products tailored to meet the demands arising from India's varied climatic environments. For instance, supplements to assist livestock in battling heat stress during summer months, such as "Cool Da Cow," are becoming increasingly popular. Besides, there is also a growing emphasis on supplements that enhance milk yield and quality, including "Milkk O Rich," which increases fat content and milk output in cattle. Since India is still one of the world's largest livestock markets, such demand for specific animal feed supplements is propelling the market growth, with more companies providing customized solutions to meet local farm requirements.

To get more information on this market, Request Sample

Sustainability and Eco-Friendly Solutions

Sustainability is a key momentum in the Indian market, with consumers and farmers increasingly emphasizing eco-friendly and ethical practices. As concern for climate change and environmental degradation increases, farmers are looking for products that encourage sustainable livestock farming practices. Most new feed supplements are being formulated with the aim of minimizing waste, improving the efficiency of feed conversion, and reducing the ecological impact. Moreover, the increase in regenerative farming practices is yet another major trend fueling this change. Firms are providing supplements that not only work well to enhance livestock health but are also produced with environmentally friendly processes. For instance, some supplements are now produced from organic farming practices that prioritize soil health and biodiversity. Moreover, the popularity of plant and natural ingredients is growing as farmers seek alternatives to synthetic additives and chemicals. Government policies promoting sustainable agriculture and the growing use of labels such as Regenerative Organic Certified (ROC) support the trend. As sustainability is increasingly becoming a deciding factor for farmers and consumers alike, the market for environmentally friendly animal feed supplements will likely grow, with firms concentrating on creating products that meet these changing values.

India Animal Feed Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on source, product type, livestock type, form, and application.

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

Product Type Insights:

- Vitamins and Minerals

- Amino Acids

- Enzymes

- Antibiotics

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamins and minerals, amino acids, enzymes, antibiotics, and others.

Livestock Type Insights:

- Poultry

- Ruminants

- Swine

- Aquaculture

- Others

A detailed breakup and analysis of the market based on the livestock type have also been provided in the report. This includes poultry, ruminants, swine, aquaculture, and others.

Form Insights:

- Liquid

- Dry

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and dry.

Application Insights:

.webp)

- Growth and Weight Management

- Health and Wellness

- Digestive Health

- Reproductive Health

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes growth and weight management, health and wellness, digestive health, reproductive health and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major comspanies have been provided.

India Animal Feed Supplements Market News:

- March 2025: R.G.S. Vet Nutraceuticals in Tamil Nadu celebrated 17 years of success by developing specialized animal feed supplements tailored to Indian farmers. With products like "Cool Da Cow" and "Milkk O Rich," they address specific livestock concerns, impelling growth and innovation in India’s animal feed supplements segment.

- November 2024: UPL partnered with CH4 Global to launch a methane-reducing cattle feed supplement, Methane Tamer, made from Asparagopsis seaweed. Targeting India, this collaboration aims to reduce methane emissions by up to 90%, driving growth in the animal feed supplements industry by offering sustainable solutions for livestock.

India Animal Feed Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Natural, Synthetic |

| Product Types Covered | Vitamins and Minerals, Amino Acids, Enzymes, Antibiotics, Others |

| Livestock Types Covered | Poultry, Ruminants, Swine, Aquaculture, Others |

| Forms Covered | Liquid, Dry |

| Applications Covered | Growth and Weight Management, Health and Wellness, Digestive Health, Reproductive Health, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India animal feed supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the India animal feed supplements market on the basis of source?

- What is the breakup of the India animal feed supplements market on the basis of product type?

- What is the breakup of the India animal feed supplements market on the basis of livestock type?

- What is the breakup of the India animal feed supplements market on the basis of form?

- What is the breakup of the India animal feed supplements market on the basis of application?

- What are the various stages in the value chain of the India animal feed supplements market?

- What are the key driving factors and challenges in the India animal feed supplements?

- What is the structure of the India animal feed supplements market and who are the key players?

- What is the degree of competition in the India animal feed supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India animal feed supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India animal feed supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India animal feed supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)