India Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, Distribution Channel, and Region, 2026-2034

India Animal Health Market Summary:

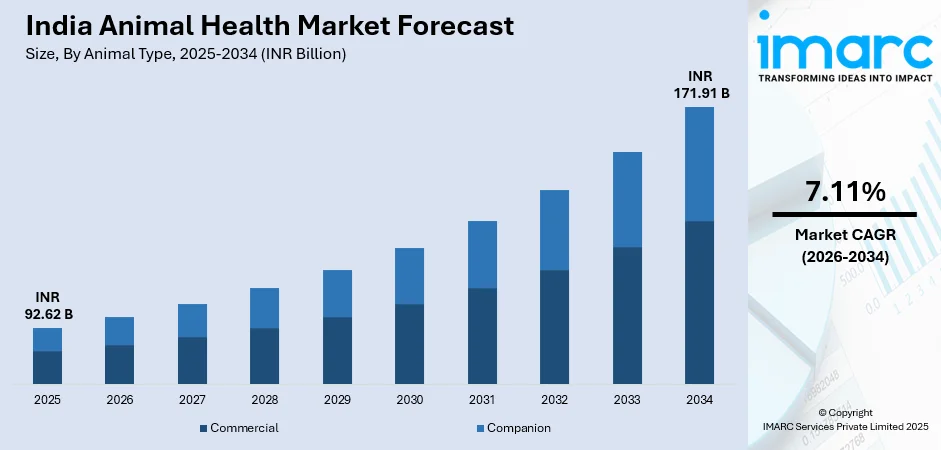

The India animal health market size was valued at INR 92.62 Billion in 2025 and is projected to reach INR 171.91 Billion by 2034, growing at a compound annual growth rate of 7.11% from 2026-2034.

The India animal health market is experiencing robust expansion driven by escalating demand for animal-derived products, growing awareness regarding zoonotic disease prevention, and substantial government investments in veterinary infrastructure. Rising pet ownership among urban populations, increasing adoption of preventive healthcare practices among livestock farmers, and technological advancements in veterinary diagnostics and therapeutics are reshaping the industry landscape. Strategic initiatives by both domestic and multinational pharmaceutical companies to expand production capabilities and distribution networks are strengthening India animal health market share.

Key Takeaways and Insights:

- By Animal Type: Commercial dominates the market with a share of 71% in 2025, driven by the country's extensive livestock population supporting dairy, poultry, and meat production industries requiring comprehensive health management solutions.

- By Product Type: Vaccines lead the market with a share of 20% in 2025, supported by government-mandated immunization programs targeting foot-and-mouth disease, brucellosis, and other economically significant livestock diseases.

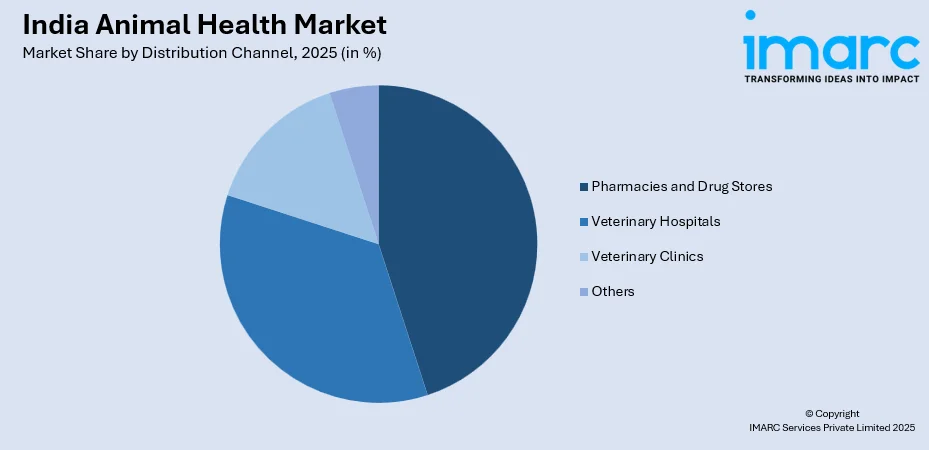

- By Distribution Channel: Pharmacies and drug stores represent the largest segment with a market share of 45% in 2025, offering convenient access to veterinary pharmaceuticals, over-the-counter medications, and healthcare supplies for animal owners.

- By Region: Uttar Pradesh dominates the market with a share of 14% in 2025, due to its large livestock population, extensive dairy and poultry farming, and well-established veterinary infrastructure supporting high demand for animal healthcare products.

- Key Players: The India animal health market exhibits moderate competitive intensity, with both multinational and domestic manufacturers actively competing across a wide range of therapeutic segments, offering vaccines, pharmaceuticals, and healthcare solutions for livestock and companion animals. Some of the major companies include Bayer CropScience Limited, Boehringer Ingelheim Animal Health, Cargill India Pvt. Ltd., Merck, Ceva Sante Animale, Elanco India Private Limited, and Virbac Animal Health India Pvt Ltd.

To get more information on this market Request Sample

The India animal health market is advancing as stakeholders across the livestock and companion animal sectors increasingly prioritize disease prevention, productivity enhancement, and animal welfare. Government initiatives such as the National Animal Disease Control Programme targeting foot-and-mouth disease eradication by 2030 are catalyzing widespread vaccine adoption. For instance, in March 2025, the Union Cabinet approved a revised Livestock Health and Disease Control Programme with an outlay of INR 3,880 crore for 2024-2026, incorporating the new Pashu Aushadhi component to distribute affordable veterinary medicines through PM-Kisan Samriddhi Kendras and cooperatives. Expanding veterinary infrastructure, rising disposable incomes, and growing pet humanization trends among urban households are collectively driving India animal health market growth.

India Animal Health Market Trends:

Digital Transformation and IoT Integration in Veterinary Care

The integration of digital health technologies and Internet of Things solutions is revolutionizing animal health management across India. Smart sensors and wearable devices are being deployed to continuously monitor vital parameters including body temperature, heart rate, and movement patterns in livestock. In March 2024, the Government of India launched the Bharat Pashudhan Data Stack, enabling real-time tracking of over 15.5 crore animal records through unique identification numbers, integrating vaccination, breeding, and disease reporting data into a unified platform.

Rising Pet Ownership and Companion Animal Healthcare Premiumization

The companion animal segment is undergoing a notable transformation as urban populations increasingly treat pets as family members, boosting demand for premium healthcare services and specialized treatments. This shift has spurred the development of advanced veterinary hospitals offering comprehensive diagnostic services, surgical care, and preventive healthcare protocols. India ranks as the country with the third-largest pet population in the world, with around 32 million pets residing in households. This number is projected to grow significantly, reaching approximately 51 million by 2028, reflecting the increasing adoption of companion animals and rising awareness of pet care across urban and semi-urban regions. Growing awareness among pet owners about wellness, nutrition, and disease prevention is driving the adoption of veterinary products and services, contributing to the sustained expansion of the animal health market across India.

Emergence of Indigenous Vaccine Development and Innovation

Domestic pharmaceutical companies are increasingly focusing on research and development to create innovative vaccines targeting region-specific animal diseases. These advancements enhance the security of supply, reduce reliance on imports, and contribute to positioning India as a growing hub for veterinary biologicals. By developing novel and effective vaccines, manufacturers are supporting improved livestock health, disease prevention, and overall growth of the animal health sector, while meeting the evolving needs of farmers and the broader veterinary market.

Market Outlook 2026-2034:

India’s animal health market is set for steady growth, driven by strong government support, expanding veterinary infrastructure, and rising awareness of preventive healthcare among livestock farmers and pet owners. Technological advancements in diagnostics, combined with a growing startup ecosystem and strategic investments from leading industry players, are enhancing the quality and accessibility of veterinary care. These developments are improving disease management, boosting livestock productivity, and expanding services for companion animals, ultimately transforming animal healthcare delivery across both urban and rural regions and reinforcing the market’s long-term growth potential. The market generated a revenue of INR 92.62 Billion in 2025 and is projected to reach a revenue of INR 171.91 Billion by 2034, growing at a compound annual growth rate of 7.11% from 2026-2034.

India Animal Health Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Animal Type | Commercial | 71% |

| Product Type | Vaccines | 20% |

| Distribution Channel | Pharmacies and Drug Stores | 45% |

| Region | Uttar Pradesh | 14% |

Animal Type Insights:

- Commercial

- Companion

Commercial dominates with a market share of 71% of the total India animal health market in 2025.

Commercial animals such as cattle, buffalo, poultry, swine, and aquaculture species form the backbone of India’s animal health market, supported by the country’s leading position as the world’s largest milk producer and third-largest egg producer. India’s cattle herd exceeds 307.5 million head, including both bovine cattle and Asian domestic water buffalo. The size and diversity of the livestock population continue to drive strong demand for veterinary medicines, vaccines, and preventive healthcare solutions across the country.

Government initiatives further bolster market growth, particularly the National Animal Disease Control Programme, which targets the eradication of foot-and-mouth disease (FMD) by 2030 with an outlay of INR 13,343 crore. Extensive preventive healthcare initiatives are being implemented across the livestock sector, emphasizing the importance of veterinary interventions in maintaining animal health. These efforts play a critical role in controlling diseases, improving livestock productivity, and ensuring the overall well-being of commercial animals, underscoring the strategic significance of structured vaccination and healthcare programs in supporting the growth and sustainability of the animal health market.

Product Type Insights:

- Anti-Bacterial/Antibiotic

- Anti-Chronic Respiratory

- Anticoccidials

- Dewormers/Anthelmintics

- Disinfectants

- Enzymes

- Fly-Binder/Control

- Growth Promoters

- Gut Health (also includes probiotics, prebiotics)

- Liver Tonics

- Nutritional Supplements

- Toxin Binders/Immunomodulators/Mold inhibitors

- Vaccines

- Vitamins/ Minerals/ Amino Acids

- Diagnostics

Vaccines lead the market with a share of 20% of the total India animal health market in 2025.

Vaccines form the backbone of India’s animal health sector, playing a critical role in preventing and controlling infectious diseases that can impact livestock productivity and food security. Government-led immunization initiatives targeting diseases such as foot-and-mouth disease, brucellosis, peste des petits ruminants, and classical swine fever are driving strong demand for veterinary vaccines across the country. These programs ensure widespread coverage and reinforce the importance of preventive healthcare in sustaining the health and productivity of livestock populations.

In addition to government programs, private sector innovations are enhancing vaccine offerings in India. For instance, in November 2024, a next-generation poultry vaccine was launched to combat Marek’s disease, utilizing advanced serotype-1 construct and controlled attenuation technology to provide early and long-lasting immunity. Such developments, along with large-scale production capacities in domestic manufacturing facilities, are supporting both national immunization efforts and the overall growth of the animal health market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Veterinary Hospitals

- Veterinary Clinics

- Pharmacies and Drug Stores

- Others

Pharmacies and drug stores represent the highest revenue share of 45% of the total India animal health market in 2025.

The pharmacies and drug stores act as critical interfaces through which animal keepers have access to veterinary medicines, over-the-counter medications and supplements, and other health products. With the pharmacies and drug stores widely spread and having convenient operational hours, animal keepers can conveniently and effectively access necessary medications for preventive and curative purposes without having to access veterinary services. This has endeared the pharmacies and drug stores to animal keepers, and therefore, they form the backbone of the animal healthcare supply chain in the Indian economy.

Programs initiated to ensure greater accessibility to affordable veterinary health products are improving the distribution chain in the country. Through collaboration with cooperatives, community centers, and service centers, farmers in rural areas are assured of access to vital animal health products. This makes it easier for them to prevent and treat their livestock and adopt veterinary products, thereby improving animal health and productivity. These programs demonstrate the efficiency and effectiveness of animal health care facilities in the country.Top of FormBottom of Form

Regional Insights:

- Uttar Pradesh

- Rajasthan

- Madhya Pradesh

- Bihar

- Andhra Pradesh

- Gujarat

- Others

Uttar Pradesh holds the largest share at 14% of the total India animal health market in 2025.

Uttar Pradesh leads the market in the India animal health market, mainly due to the large and diverse population of livestock, such as cattle, buffaloes, poultry, and small ruminants. The state is a major hub for dairy and poultry farming, and it contributes significantly to the milk and meat supplies in India. The demand for vaccines, veterinary medicines, and other health-related preventive products will be high because the density of livestock is high, which further increases the chances of diseases. Programs announced by the government aimed at maintaining the health of livestock, controlling diseases, and increasing the productivity of the livestock support the outlook for adoption in commercial and smallholder farms in the state.

The presence of well-established veterinary infrastructure, together with the wide availability of veterinary services, also explains Uttar Pradesh's leading position in the market. Urban and rural combined livestock farming, rising awareness among farmers about preventive care, and growing investment in animal husbandry ensure consistent demand for health products. Established modern technologies, such as diagnostic tools and digital platforms used for the management of livestock, are increasingly employed to further enhance healthcare delivery and reinforce the leadership position of the state in India's animal health sector.

Market Dynamics:

Growth Drivers:

Why is the India Animal Health Market Growing?

Substantial Government Investment in Livestock Healthcare Infrastructure

The Government of India is implementing extensive initiatives to strengthen veterinary healthcare infrastructure and advance disease control across the livestock sector. National programs focus on the prevention and eradication of key livestock diseases, enhancing overall animal health and productivity. Efforts include deploying mobile veterinary units, improving disease surveillance systems, and expanding access to affordable veterinary medicines through targeted distribution programs. These measures aim to provide comprehensive healthcare support for livestock, improve preventive care, and ensure that veterinary services and essential medicines are accessible to farmers across urban, rural, and underserved regions. Over 4,016 mobile veterinary units are now operational across 28 states, providing doorstep veterinary services through the toll-free 1962 helpline.

Growing Demand for Animal-Derived Products Supporting Livestock Intensification

India's expanding population, rising disposable incomes, and changing dietary preferences are driving substantial increases in demand for dairy, eggs, and meat products, necessitating enhanced livestock health management. India holds the top position worldwide in milk production, accounting for a significant share of global output, with total production reaching nearly 248 million tonnes in 2024-25. Rising demand for animal-derived products has created a strong need to maintain healthy and productive livestock populations. This trend is driving increased investment in preventive healthcare, nutritional supplements, and veterinary pharmaceuticals to enhance animal health, improve productivity, and reduce economic losses associated with diseases. Ensuring the well-being of livestock remains a critical focus for farmers and the animal health sector, supporting sustainable growth in production and reinforcing the importance of comprehensive veterinary care and preventive interventions.

Rising Pet Ownership and Companion Animal Healthcare Spending

The companion animal segment is experiencing rapid transformation as pet ownership surges among urban Indian households, driven by changing lifestyles, nuclear family structures, and increasing emotional attachment to pets. India's pet population has grown substantially from 26 million in 2019 to approximately 42 million in 2024, with dogs comprising the majority at over 36.8 million and projected to exceed 51 million by 2028. Pet owners are increasingly willing to invest in quality veterinary care, including routine healthcare services and surgical treatments, reflecting a growing emphasis on ensuring the health and well-being of their animals. For instance, in August 2024, Godrej Consumer Products announced its entry into pet care through subsidiary Godrej Pet Care, planning INR 500 crore investment over five years, reflecting growing corporate interest in this expanding market segment.

Market Restraints:

What Challenges the India Animal Health Market is Facing?

Inadequate Veterinary Infrastructure in Rural and Remote Regions

Despite government efforts, substantial gaps persist in veterinary infrastructure across rural and semi-urban areas where the majority of livestock populations reside. Limited access to qualified veterinary professionals, inadequate diagnostic facilities, and insufficient cold chain networks for vaccine storage constrain effective healthcare delivery. Many livestock farmers face challenges in accessing timely veterinary services, leading to delayed treatment and increased disease transmission risks.

Prevalence of Counterfeit and Substandard Veterinary Products

The presence of counterfeit and substandard veterinary medicines in distribution channels poses significant challenges to animal health outcomes and market integrity. Unregulated products may lack therapeutic efficacy, potentially causing adverse reactions or treatment failures that undermine farmers' confidence in veterinary interventions. Strengthening regulatory enforcement and improving product traceability remain priorities for ensuring quality standards across supply chains.

Limited Awareness and Adoption of Preventive Healthcare Practices

Many small-scale livestock farmers and rural pet owners demonstrate limited awareness regarding preventive healthcare benefits, vaccination schedules, and disease management protocols. Traditional practices and cost considerations often delay veterinary consultations until animals exhibit severe symptoms, reducing treatment effectiveness. Educational initiatives and awareness campaigns remain essential for improving adoption of proactive animal health management approaches.

Competitive Landscape:

The India animal health market exhibits moderate competitive intensity, with established multinational corporations operating alongside capable domestic manufacturers that focus on affordable solutions for region-specific disease challenges. Global and local players compete through diversified product portfolios, research and development capabilities, and extensive distribution networks. Domestic manufacturers play a critical role in vaccine production and tailored healthcare solutions for livestock and companion animals. Strategic collaborations, mergers, and partnerships are increasingly shaping the market landscape, driving innovation, enhancing operational efficiency, and strengthening the ability of companies to meet the growing demand for comprehensive animal health products across diverse therapeutic segments.

Some of the key players in the market include:

- Bayer CropScience Limited

- Boehringer Ingelheim Animal Health

- Cargill India Pvt. Ltd.

- Merck

- Ceva Sante Animale

- Elanco India Private Limited

- Virbac Animal Health India Pvt Ltd.

Recent Developments:

- August 2025: The Ministry of Fisheries, Animal Husbandry and Dairying issued India's first-ever national guidelines and standard operating procedures for animal blood transfusion and veterinary blood banks, mandating state-regulated facilities with donor screening, blood typing, and biosafety protocols while establishing a roadmap for the National Veterinary Blood Bank Network.

- February 2025: Biovet, a Bharat Biotech Group company, received regulatory approval from India's Central Drug Standard Control Organization for BIOLUMPIVAXIN, the world's first DIVA marker vaccine for lumpy skin disease in cattle and buffaloes, marking a significant advancement in indigenous vaccine development.

India Animal Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Anti-Bacterial/Antibiotic, Anti-Chronic Respiratory, Anticoccidials, Dewormers/Anthelmintics, Disinfectants, Enzymes, Fly-Binder/Control, Growth Promoters, Gut Health (Also Includes Probiotics, Prebiotics), Liver Tonics, Nutritional Supplements, Toxin Binders/Immunomodulators/Mold Inhibitors, Vaccines, Vitamins/ Minerals/ Amino Acids, Diagnostics |

| Distribution Channels Covered | Veterinary Hospitals, Veterinary Clinics, Pharmacies and Drug Stores, Others |

| Regions Covered | Uttar Pradesh, Rajasthan, Madhya Pradesh, Bihar, Andhra Pradesh, Gujarat, Others |

| Companies Covered | Bayer CropScience Limited, Boehringer Ingelheim Animal Health, Cargill India Pvt. Ltd., Merck, Ceva Sante Animale, Elanco India Private Limited, Virbac Animal Health India Pvt Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India animal health market size was valued at INR 92.62 Billion in 2025.

The India animal health market is expected to grow at a compound annual growth rate of 7.11% from 2026-2034 to reach INR 171.91 Billion by 2034.

Commercial animals, representing the largest share of 71% in 2025, dominate the India animal health market driven by the country's extensive livestock population supporting dairy, poultry, and meat production industries requiring comprehensive health management and disease prevention solutions.

Key factors driving the India animal health market include substantial government investments in livestock healthcare infrastructure, rising demand for animal-derived products, growing pet ownership among urban populations, increasing awareness of zoonotic disease prevention, and technological advancements in veterinary diagnostics.

Major challenges include inadequate veterinary infrastructure in rural regions, prevalence of counterfeit veterinary products, limited awareness of preventive healthcare practices among small-scale farmers, cold chain constraints for vaccine distribution, and price sensitivity among economically constrained livestock owners.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)