India Animal Vaccine Market Size, Share, Trends, and Forecast by Animal Type, Technology, Disease, Route of Administration, Distribution Channel, and Region, 2025-2033

India Animal Vaccine Market Overview:

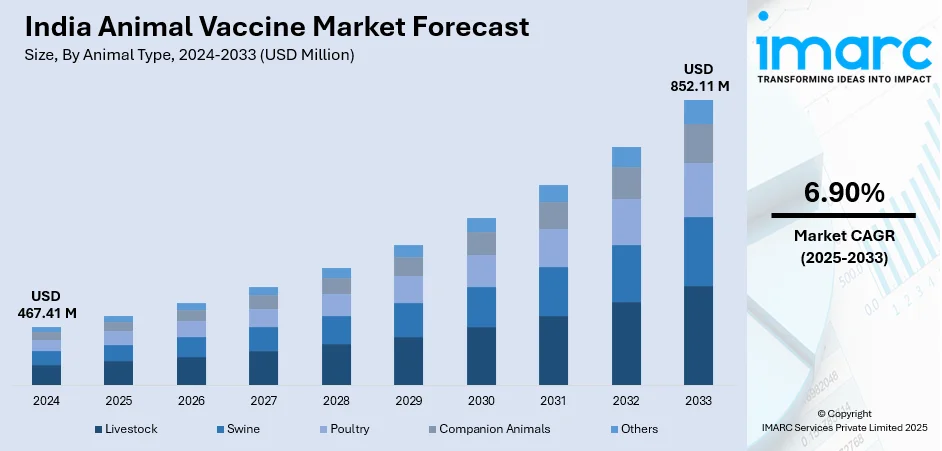

The India animal vaccine market size reached USD 467.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 852.11 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is driven by rising livestock population, increasing awareness about animal health, government vaccination programs, and growing demand for dairy and meat products. Technological advancements and increased investments in veterinary healthcare also contribute to the India animal vaccine market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 467.41 Million |

| Market Forecast in 2033 | USD 852.11 Million |

| Market Growth Rate 2025-2033 | 6.90% |

India Animal Vaccine Market Trends:

Rising Livestock Population and Livestock-Based Economy

India has one of the world’s largest livestock populations such as poultry, cattle, sheep, and goats. The extensive population contributes significantly to the agrarian economy of the country through milk production and animal supply of meat and eggs while supplying labor for agriculture. The prevention of disease outbreaks, as well as steady productivity, requires farmers to administer regular vaccinations to their animals. Livestock producers, together with farmers, actively use vaccines to protect both their livestock health and productivity. With growing dairy and meat demands, protecting animal health has become a priority, leading to greater vaccine usage and investment in veterinary services across rural and semi-urban regions, thereby fueling the India animal vaccine market share. This growing demand is also encouraging innovation and product development in the veterinary vaccine space. For instance, in November 2024, Boehringer Ingelheim announced the launch of a next-generation poultry vaccine in India targeting Marek’s disease. Recommended for in-ovo vaccination of embryonated eggs and day-old chicks, the innovative vaccine offers improved safety and efficacy against virulent strains. Experts emphasize its importance for poultry farmers, aiming to reduce disease outbreaks, enhance flock health, and ensure food security amid rising demand for quality poultry products.

To get more information on this market, Request Sample

Government Initiatives and Vaccination Programs

The Government of India actively supports animal health through national vaccination drives and disease eradication programs, such as the National Animal Disease Control Programme (NADCP). These initiatives aim to control and eliminate diseases like Foot-and-Mouth Disease (FMD) and Brucellosis, which impact livestock productivity and farmer income. Government funding, policy support, and collaboration with private companies have led to the widespread distribution of vaccines, especially in rural and underserved areas, creating a positive India animal vaccine market outlook. Subsidized vaccine distribution and awareness campaigns have improved immunization rates, boosting the demand and enabling deeper market penetration across the country’s livestock sector. These efforts are also driving breakthroughs in advanced vaccine development and disease-specific solutions. For instance, in February 2025, Biovet, a Bharat Biotech group firm, received CDSCO approval for Biolumpivaxin, the world’s first DIVA marker vaccine for lumpy skin disease (LSD) in cattle and buffaloes. Developed in collaboration with ICAR, the vaccine ensures high safety and efficacy while allowing differentiation between infected and vaccinated animals. Production capacity is set at 500 million doses annually, addressing LSD's impact on India's dairy industry.

India Animal Vaccine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on animal type, technology, disease, route of administration, and distribution channel.

Animal Type Insights:

- Livestock

- Swine

- Poultry

- Companion Animals

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes livestock, swine, poultry, companion animals, and others.

Technology Insights:

- Inactive Vaccine

- Live Attenuated Vaccine

- Toxoid Vaccine

- Recombinant Vaccine

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes inactive vaccine, live attenuated vaccine, toxoid vaccine, recombinant vaccine, and others.

Disease Insights:

- Foot and Mouth Disease

- New Castle Disease

- Infectious Bronchitis

- Infectious Bursal Disease

- Fowl pox

- Rabies

- Others

A detailed breakup and analysis of the market based on the disease have also been provided in the report. This includes foot and mouth disease, new castle disease, infectious bronchitis, infectious bursal disease, fowl pox, rabies, and others.

Route of Administration Insights:

- Subcutaneous

- Intramuscular

- Intraocular

- Oral

- Others

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes subcutaneous, intramuscular, intraocular, oral, and others.

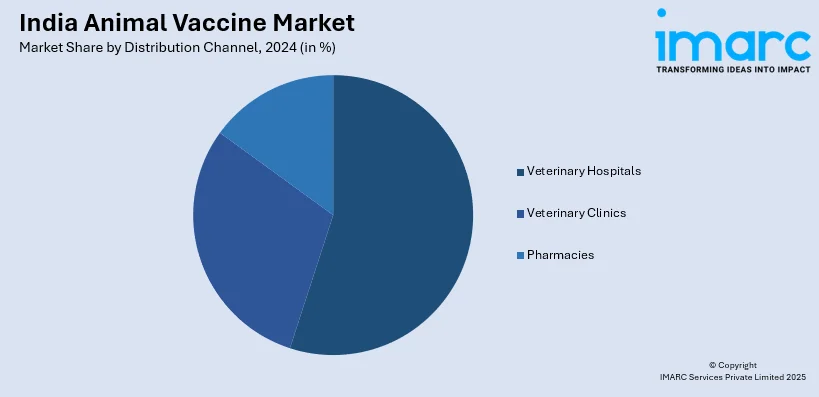

Distribution Channel Insights:

- Veterinary Hospitals

- Veterinary Clinics

- Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes veterinary hospitals, veterinary clinics, and pharmacies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Animal Vaccine Market News:

- In September 2024, Bioveta, a.s. announced its partnership with Vetina Healthcare LLP to introduce the Biocan NOVEL canine vaccine range to the Indian market. This proven vaccine offers essential protection against serious canine infections, including rabies and leptospirosis, enhancing public health by reducing risks to humans. Vetina Healthcare will exclusively distribute Biocan NOVEL to veterinarians, ensuring reliable solutions for pet owners across India

India Animal Vaccine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Livestock, Swine, Poultry, Companion Animals, Others |

| Technologies Covered | Inactive Vaccine, Live Attenuated Vaccine, Toxoid Vaccine, Recombinant Vaccine, Others |

| Diseases Covered | Foot and Mouth Disease, New Castle Disease, Infectious Bronchitis, Infectious Bursal Disease, Fowl pox, Rabies, Others |

| Route of Administrations Covered | Subcutaneous, Intramuscular, Intraocular, Oral, Others |

| Distribution Channels Covered | Veterinary Hospitals, Veterinary Clinics, Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India animal vaccine market performed so far and how will it perform in the coming years?

- What is the breakup of the India animal vaccine market on the basis of animal type?

- What is the breakup of the India animal vaccine market on the basis of technology?

- What is the breakup of the India animal vaccine market on the basis of disease?

- What is the breakup of the India animal vaccine market on the basis of the route of administration?

- What is the breakup of the India animal vaccine market on the basis of distribution channel?

- What is the breakup of the India animal vaccine market on the basis of region?

- What are the various stages in the value chain of the India animal vaccine market?

- What are the key driving factors and challenges in the India animal vaccine market?

- What is the structure of the India animal vaccine market and who are the key players?

- What is the degree of competition in the India animal vaccine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India animal vaccine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India animal vaccine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India animal vaccine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)