India Anti-Counterfeit Packaging Market Report by Technology (Barcodes, RFID (Radio-Frequency Identification), Holograms, Taggants, and Others), Feature Type (Overt Features, Covert Features), End Use Industry (Food and Beverage, Healthcare, Automotive, Consumer Electronics, and Others), and Region 2025-2033

Market Overview:

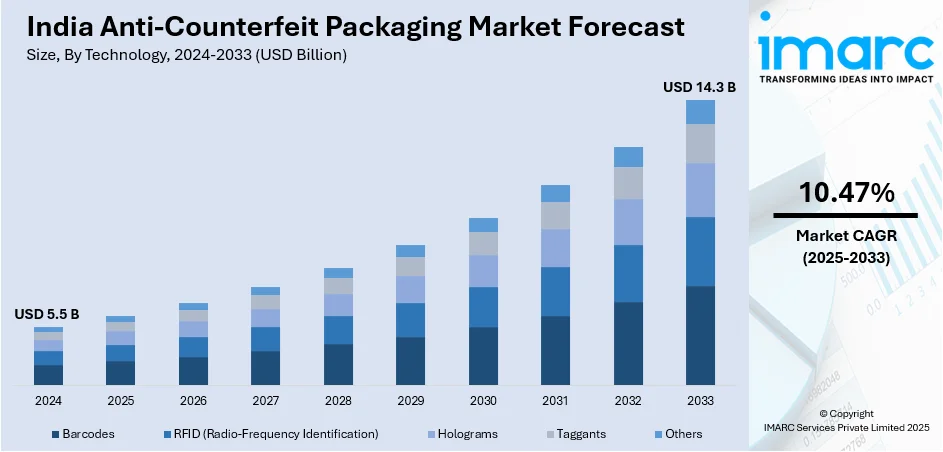

India anti-counterfeit packaging market size reached USD 5.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.47% during 2025-2033. The increasing proliferation of counterfeit products across various industries, such as pharmaceuticals, food and beverages, electronics, and luxury goods, which has fueled the need for advanced anti-counterfeit measures, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 14.3 Billion |

| Market Growth Rate (2025-2033) | 10.47% |

Anti-counterfeit packaging refers to the integration of advanced technologies and security features into product packaging to safeguard against unauthorized replication and distribution. This specialized packaging aims to protect consumers, brand reputation, and revenue by preventing the production and sale of counterfeit goods. Various technologies, such as holograms, QR codes, RFID tags, and tamper-evident seals, are employed to enable authentication and traceability. Additionally, covert features like invisible inks and microprinting enhance security. Anti-counterfeit packaging not only acts as a deterrent to counterfeiters but also provides consumers with the assurance of purchasing genuine products. As counterfeiting poses significant economic and health risks, industries such as pharmaceuticals, electronics, and luxury goods increasingly adopt anti-counterfeit packaging measures to ensure product integrity and consumer safety.

To get more information on this market, Request Sample

India Anti-Counterfeit Packaging Market Trends:

The anti-counterfeit packaging market in India is witnessing robust growth, propelled by several key drivers. Firstly, the increasing regional awareness of the economic and health risks associated with counterfeit products has stimulated demand for advanced anti-counterfeit packaging solutions. Moreover, as supply chains become more complex, the need for robust authentication measures has intensified. Consequently, manufacturers are adopting innovative packaging technologies to protect their brand integrity and ensure consumer safety. In addition to this, stringent government regulations mandating the implementation of anti-counterfeit measures further contribute to the market's expansion. These regulations, often aimed at safeguarding public health and intellectual property, drive companies to invest in sophisticated packaging solutions that deter counterfeiting. Simultaneously, the rise of e-commerce has exposed products to a wider range of potential threats, making anti-counterfeit packaging imperative for online retailers and consumers alike. Furthermore, technological advancements, such as the integration of track-and-trace systems, holograms, and QR codes, bolster the anti-counterfeit packaging market. These innovations enhance transparency across the supply chain, enabling quick detection of counterfeit products. As a result, the regional market is poised for sustained growth as stakeholders increasingly prioritize the implementation of comprehensive anti-counterfeit strategies to protect both their brands and consumers.

India Anti-Counterfeit Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, feature type, and end use industry.

Technology Insights:

- Barcodes

- RFID (Radio-Frequency Identification)

- Holograms

- Taggants

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes barcodes, RFID (radio-frequency identification), holograms, taggants, and others.

Feature Type Insights:

- Overt Features

- Covert Features

A detailed breakup and analysis of the market based on the feature type have also been provided in the report. This includes overt features and covert features.

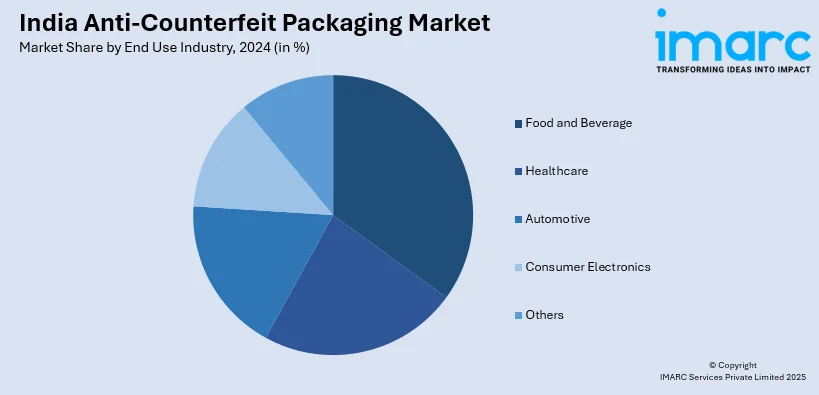

End Use Industry Insights:

- Food and Beverage

- Healthcare

- Automotive

- Consumer Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes food and beverage, healthcare, automotive, consumer electronics, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Anti-Counterfeit Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Barcodes, RFID (Radio-Frequency Identification), Holograms, Taggants, Others |

| Feature Types Covered | Overt Features, Covert Features |

| End Use Industries Covered | Food and Beverage, Healthcare, Automotive, Consumer Electronics, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India anti-counterfeit packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India anti-counterfeit packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India anti-counterfeit packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti-counterfeit packaging market in India was valued at USD 5.5 Billion in 2024.

The anti-counterfeit packaging market in India is projected to exhibit a CAGR of 10.47% during 2025-2033, reaching a value of USD 14.3 Billion by 2033.

The India anti-counterfeit packaging market is driven by growing concerns over counterfeit goods across sectors like pharmaceuticals, electronics, and food. Increasing regulatory mandates, technological innovations such as RFID and holograms, and expanding e-commerce channels are further fueling market growth and adoption of secure packaging.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)