India Anti-Obesity Drugs Market Size, Share, Trends and Forecast by Drug Class, Drug Type, Distribution Channel, and Region, 2025-2033

India Anti-Obesity Drugs Market Overview:

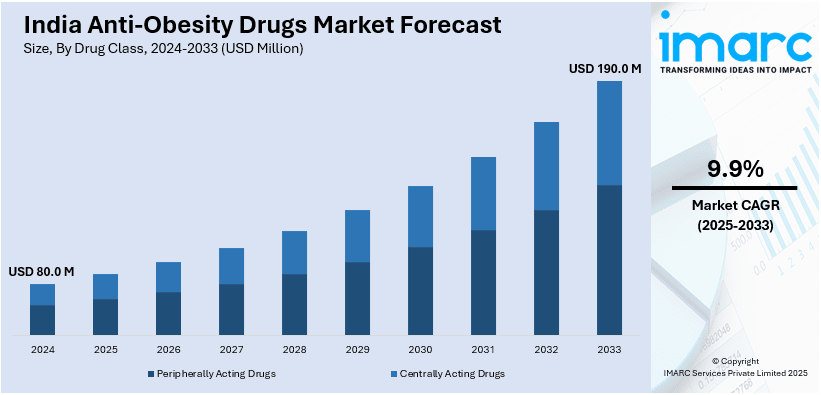

The India anti-obesity drugs market size reached USD 80.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 190.0 Million by 2033, exhibiting a growth rate (CAGR) of 9.9% during 2025-2033. The market share is propelled by increasing rates of obesity, rising health awareness related to excessive weight, and expanding healthcare access. Urbanization, inactive lifestyle, unbalanced diet, and government programs and healthcare reforms are causing obesity impelling the India anti-obesity drugs market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.0 Million |

| Market Forecast in 2033 | USD 190.0 Million |

| Market Growth Rate 2025-2033 | 9.9% |

India Anti-Obesity Drugs Market Trends:

Increasing Demand for Prescription Weight Loss Medications

The India anti-obesity drugs market outlook has been experiencing consistent growth as medical professionals are aware of the increasing obesity pandemic. Obesity is on the rise due to unhealthy eating habits, lack of physical activity, and urbanization. With increased awareness about the long-term health consequences of obesity, including diabetes, cardiovascular disease, and hypertension, more individuals are turning to medical treatment. Prescription weight loss drugs, such as medications that act on appetite suppression and fat absorption, are gaining popularity because they work efficiently when used with diet and exercise. With the approval of Orlistat and newer drugs like GLP-1 receptor agonists, patients now enjoy a broader range of therapeutic alternatives. In July 2024, Eli Lilly and Co., the pharmaceutical firm, has obtained the initial approvals for the importation and distribution of a weight-loss drug in India, outpacing Olympic producer Novo Nordisk AS. Eli Lilly intends to sell it under the brand names Zepbound and Mountjaro, both of which are chemically referred to as tirzepatide. These were originally created to manage type 2 diabetes, although they can also be administered for weight loss. This trend is likely to persist as the Indian healthcare system continues to emphasize obesity control, particularly in individuals who cannot attain sustainable weight loss through lifestyle modifications alone.

To get more information on this market, Request Sample

Growing Popularity of Over-the-Counter (OTC) Weight Loss Supplements

In addition to prescription drugs, the Indian market for over-the-counter (OTC) weight loss supplements and anti-obesity medicines is growing fast. According to Goldman Sachs Research, the anti-obesity medication market might hit $100 billion by 2030 due to significant interest. OTC products are being increasingly adopted by consumers as a part of their weight control regimens, who are now health-conscious and opting for OTC products. Most of these supplements contain natural extracts, herbs, and vitamins, which promise to enhance fat loss, suppress appetite, or boost metabolism. With increasing awareness regarding obesity and related risks, OTC products have become a quick fix for several people as an easy substitute to prescription drugs. The growth in digital health websites and online platforms has increased availability, adding further momentum to this trend. Firms are increasingly investing in creating OTC products that address other dimensions of weight loss, ranging from control of appetite to the metabolism of fat, to meet the diverse tastes of the Indian consumer. This is indicative of the larger trend toward preventative healthcare and wellness.

India Anti-Obesity Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on drug class, drug type, and distribution channel.

Drug Class Insights:

- Peripherally Acting Drugs

- Centrally Acting Drugs

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes peripherally acting drugs and centrally acting drugs.

Drug Type Insights:

- Prescription Drugs

- OTC Drugs

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes prescription drugs and OTC drugs.

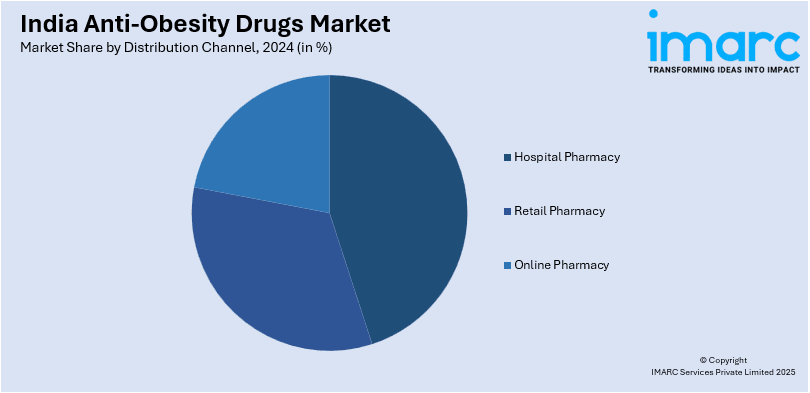

Distribution Channel Insights:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacy, retail pharmacy, and online pharmacy.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Anti-Obesity Drugs Market News:

- In March 2025, Sun Pharmaceutical, India's leading revenue-generating drugmaker, plans to introduce its experimental drug for anti-obesity and type 2 diabetes within the next four to five years.

India Anti-Obesity Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Peripherally Acting Drugs, Centrally Acting Drugs |

| Drug Types Covered | Prescription Drugs, OTC Drugs |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India anti-obesity drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India anti-obesity drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India anti-obesity drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India anti-obesity drugs market was valued at USD 80.0 Million in 2024.

The India anti-obesity drugs market is projected to exhibit a CAGR of 9.9% during 2025-2033, reaching a value of USD 190.0 Million by 2033.

The India anti-obesity drugs market is driven by rising obesity prevalence, increasing lifestyle-related health awareness, and growing acceptance of pharmacological interventions. Expanding healthcare infrastructure, greater access to specialty clinics, and supportive government campaigns further boost demand. Urbanization, elevated disposable incomes, and medical tourism also propel market growth nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)