India Antibody Drug Conjugates Market Size, Share, Trends and Forecast by Application, Technology, and Region, 2025-2033

India Antibody Drug Conjugates Market Overview:

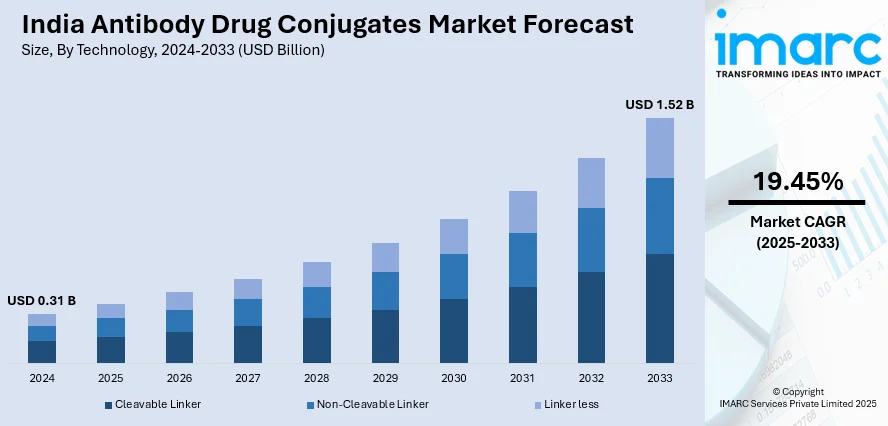

The India antibody drug conjugates market size reached USD 0.31 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.52 Billion by 2033, exhibiting a growth rate (CAGR) of 19.45% during 2025-2033. The market is driven by rising cancer prevalence, escalating demand for targeted therapies, increasing biomarker-based diagnostics, expanding clinical research infrastructures, and supportive government initiatives aimed at strengthening domestic biologics manufacturing and precision medicine capabilities, fostering both adoption and innovation in next-generation oncology treatments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.31 Billion |

| Market Forecast in 2033 | USD 1.52 Billion |

| Market Growth Rate 2025-2033 | 19.45% |

India Antibody Drug Conjugates Market Trends:

Rising Burden of Cancer and Increasing Demand for Targeted Therapies

India is experiencing an escalating surge in the incidences of cancer, which is becoming an alarming public health issue. According to reports, India is projected to record 2.7 million cancer cases annually by 2050. Traditional chemotherapy, although in common use, does not always yield the best results because of its non-selectivity, systemic toxicity, and related side-effects. This situation has generated an urgent demand for more targeted and less toxic therapies—exactly where Antibody Drug Conjugates (ADCs) are filling the gap. ADCs are a groundbreaking class of biopharmaceuticals that harness the specificity of monoclonal antibodies with the cytotoxic potential of chemotherapeutic agents. These targeted agents selectively kill cancer cells without harming healthy tissue, minimizing collateral damage and enhancing patient quality of life. With growing awareness about targeted therapies among oncologists and patients, India is witnessing greater acceptance and clinical adoption of ADCs. Cancer care centers and hospitals are extensively using these therapies as first- or second-line treatment options for many malignancies, such as breast, lung, and hematological cancers.

To get more information on this market, Request Sample

Expansion of Domestic Biopharmaceutical Manufacturing and Research Capabilities

Another important driver of the Indian ADC market is the strong build-out of indigenous biopharmaceutical R&D and manufacturing facilities. During the last decade, India has transformed quickly from a market dominated by generics to an innovation-permitting environment that can produce sophisticated biologics and next-generation drugs. The policies like the "Make in India" campaign, combined with regulatory reforms to enable biotech investments, have immensely supported indigenous capability in the development of biologic drugs—such as ADCs. A number of Indian biotech companies and big pharma players are now investing heavily in ADC R&D, clinical trials, and manufacturing platforms. Dr. Reddy's, Biocon, and Piramal Pharma have initiated or planned to increase their ADC pipeline through alliances with overseas companies or indigenous R&D initiatives. These companies are also establishing world-class facilities for conjugation chemistry, bio-analytics, and clinical-scale manufacturing, allowing local production of high-value biotherapeutics. Also, India presents a cost-effective advantage in manufacturing biopharmaceuticals. Lower operational expenditures, a huge talent pool of scientists, and a growing network of clinical trials render India highly appealing to the world's ADC development collaborations.

India Antibody Drug Conjugates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application and technology.

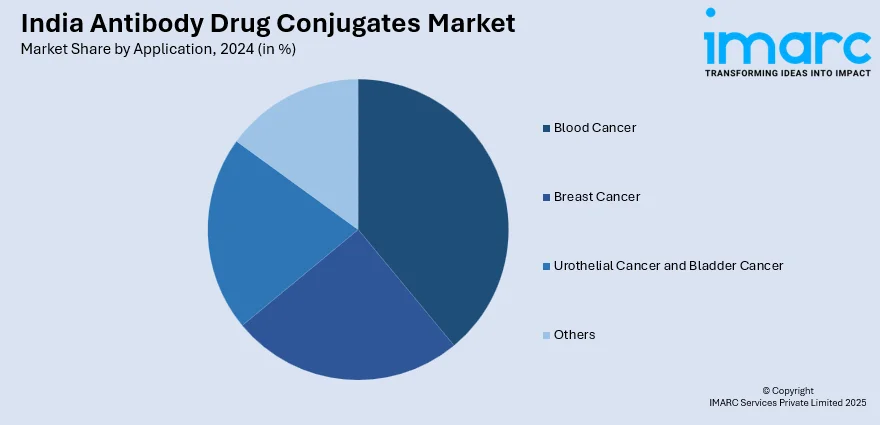

Application Insights:

- Blood Cancer

- Leukemia

- Lymphoma

- Multiple Myeloma

- Breast Cancer

- Urothelial Cancer and Bladder Cancer

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes blood cancer (leukemia, lymphoma, and multiple myeloma), breast cancer, urothelial cancer and bladder cancer, and others.

Technology Insights:

- Cleavable Linker

- Non-Cleavable Linker

- Linker less

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes cleavable linker, non-cleavable linker, and linker less.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Antibody Drug Conjugates Market News:

- June 2024: Dr. Reddy's and Zydus Lifesciences announced that they would co-market a Pertuzumab biosimilar in India, expanding access to HER2 positive breast cancer treatment. Zydus developed the biosimilar and will market it as Sigrima, while Dr. Reddy's will market it as Womab. Zydus also launched Ujvira, an antibody-drug conjugate biosimilar of trastuzumab emtansine.

- February 2024: Suven Pharmaceuticals merged with Cohance Lifesciences to enhance its contract development and manufacturing services, notably incorporating Cohance's antibody-drug conjugate (ADC) platform.

India Antibody Drug Conjugates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered |

|

| Technologies Covered | Cleavable Linker, Non-Cleavable Linker, Linker Less |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India antibody drug conjugates market performed so far and how will it perform in the coming years?

- What is the breakup of the India antibody drug conjugates market on the basis of application?

- What is the breakup of the India antibody drug conjugates market on the basis of technology?

- What are the various stages in the value chain of the India antibody drug conjugates market?

- What are the key driving factors and challenges in the India antibody drug conjugates market?

- What is the structure of the India antibody drug conjugates market and who are the key players?

- What is the degree of competition in the India antibody drug conjugates market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India antibody drug conjugates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India antibody drug conjugates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India antibody drug conjugates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)