India Antihyperlipidemic Drugs Market Size, Share, Trends and Forecast by Drug Class, Route of Administration, Distribution Channel, and Region, 2025-2033

India Antihyperlipidemic Drugs Market Size and Share:

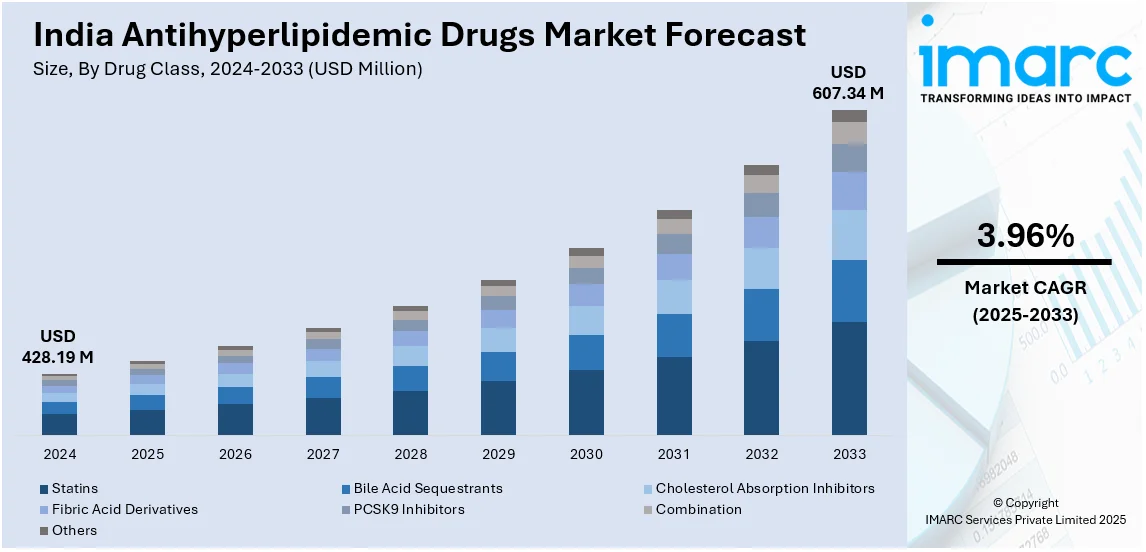

The India antihyperlipidemic drugs market size reached USD 428.19 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 607.34 Million by 2033, exhibiting a growth rate (CAGR) of 3.96% during 2025-2033. The India antihyperlipidemic drugs market share is expanding, driven by the rising aging population, which requires effective treatment to manage lipid levels, along with the increasing availability of modern diagnostic tools that enable faster and more accurate cholesterol screening.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 428.19 Million |

| Market Forecast in 2033 | USD 607.34 Million |

| Market Growth Rate (2025-2033) | 3.96% |

India Antihyperlipidemic Drugs Market Trends:

Growing aging population

The rising geriatric population is offering a favorable India antihyperlipidemic drugs market outlook. The United Nations Population Fund (UNFPA) anticipated that the elderly population in India will reach 158 Million individuals by 2025. By the year 2050, the senior demographic is set to increase to 319 Million, equating to 19.5% of the overall population. As individuals grow older, their bodies become less effective at managing cholesterol levels, resulting in an increased risk of conditions such as hyperlipidemia. The senior population is also more susceptible to inactive lifestyles, unhealthy eating patterns, and decreased physical activity, all of which leads to high lipid levels. The elderly population needs efficient care to control cholesterol levels and reduce the likelihood of heart attacks, strokes, and various complications. Consequently, the requirement for antihyperlipidemic medications like statins, fibrates, and cholesterol absorption blockers is increasing. Moreover, healthcare professionals emphasize preventive care for older adults, promoting routine cholesterol checks and timely treatment. Enhanced access to medications enables elderly patients to control their cholesterol levels more effectively, thereby fueling the market growth. With the growth of India's elderly population, the demand for efficient lipid-lowering treatments is high.

To get more information on this market, Request Sample

Expanding healthcare infrastructure

The expanding healthcare infrastructure is impelling the India antihyperlipidemic drugs market growth. As hospitals, clinics, and diagnostic centers broaden across urban and rural areas, more people undergo regular health check-ups, leading to early detection of high cholesterol and related conditions. With improved facilities, healthcare providers can better manage cardiovascular risks by prescribing antihyperlipidemic drugs, such as cholesterol absorption inhibitors, statins, and fibrates. The availability of modern diagnostic tools enables faster and more accurate cholesterol screening, offering timely intervention. Additionally, telemedicine platforms and digital health services make consultations and medication management more convenient, especially in remote regions. Expanding pharmacy networks further ensure widespread access to lipid-lowering drugs, improving patient adherence to treatment. Government initiatives supporting affordable healthcare services, advanced infrastructure, and insurance coverage also encourage more individuals to seek medical support for cholesterol management. The Government of India designated INR 90,958 Crore in the FY2024-25 budget for the nation's healthcare sector, reflecting a 2% increase from INR 89,155 Crore in FY2023-24. Out of which, approximately INR 87,656 Crore was assigned to the Department of Health and Family Welfare to enhance healthcare infrastructure and to reinforce the execution of centrally sponsored schemes. As healthcare infrastructure is broadening, better access to medical advice, screening, and treatment are catalyzing the demand for antihyperlipidemic medications in India.

India Antihyperlipidemic Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on drug class, route of administration, and distribution channel.

Drug Class Insights:

- Statins

- Bile Acid Sequestrants

- Cholesterol Absorption Inhibitors

- Fibric Acid Derivatives

- PCSK9 Inhibitors

- Combination

- Others

The report has provided a detailed breakup and analysis of the market based on the drug classes. This includes statins, bile acid sequestrants, cholesterol absorption inhibitors, fibric acid derivatives, PCSK9 inhibitors, combination, and others.

Route of Administration Insights:

- Oral

- Intravenous

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral and intravenous.

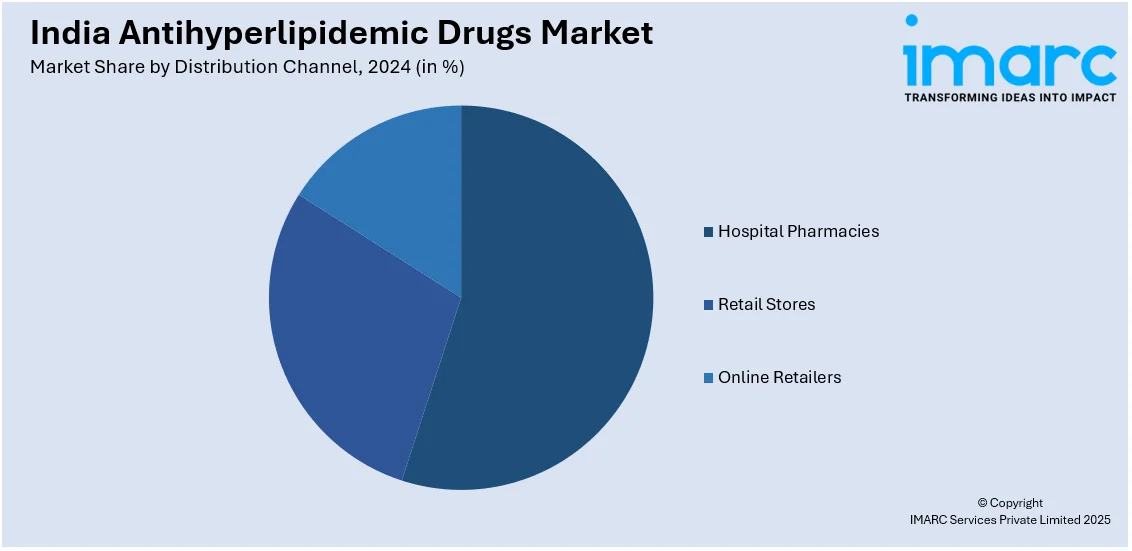

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Stores

- Online Retailers

The report has provided a detailed breakup and analysis of the market based on the distribution channels. This includes hospital pharmacies, retail stores, and online retailers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Antihyperlipidemic Drugs Market News:

- In July 2024, the Cardiological Society of India (CSI) introduced groundbreaking guidelines for managing dyslipidemia. Dr. S. Ramakrishnan, a Cardiology professor at AIIMS in New Delhi, emphasized treatment methods that included statins, non-statin medications, and injectable lipid-lowering therapies like PCSK9 inhibitors or Inclisiran. The goal was to enable healthcare providers in India to control cholesterol levels efficiently, fight heart disease, and enhance overall health.

- In January 2024, Novartis India, a well-known pharmaceutical company, revealed plans to introduce ‘Inclisiran’, a drug utilized to treat primary hypercholesterolemia or mixed dyslipidemia, in India. It could lower blood lipids and aimed to significantly decrease levels of bad cholesterol, called low-density lipoprotein cholesterol (LDL-C), in the bloodstream.

India Antihyperlipidemic Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Statins, Bile Acid Sequestrants, Cholesterol Absorption Inhibitors, Fibric Acid Derivatives, PCSK9 Inhibitors, Combination, Others |

| Routes of Administration Covered | Oral, Intravenous |

| Distribution Channels Covered | Hospital Pharmacies, Retail Stores, Online Retailers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India antihyperlipidemic drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the India antihyperlipidemic drugs market on the basis of drug class?

- What is the breakup of the India antihyperlipidemic drugs market on the basis of route of administration?

- What is the breakup of the India antihyperlipidemic drugs market on the basis of distribution channel?

- What are the various stages in the value chain of the India antihyperlipidemic drugs market?

- What are the key driving factors and challenges in the India antihyperlipidemic drugs market?

- What is the structure of the India antihyperlipidemic drugs market and who are the key players?

- What is the degree of competition in the India antihyperlipidemic drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India antihyperlipidemic drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India antihyperlipidemic drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India antihyperlipidemic drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)