India API Market Size, Share, Trends and Forecast by Type, Functionality and Purpose, Industry Vertical, and Region, 2026-2034

India API Market Summary:

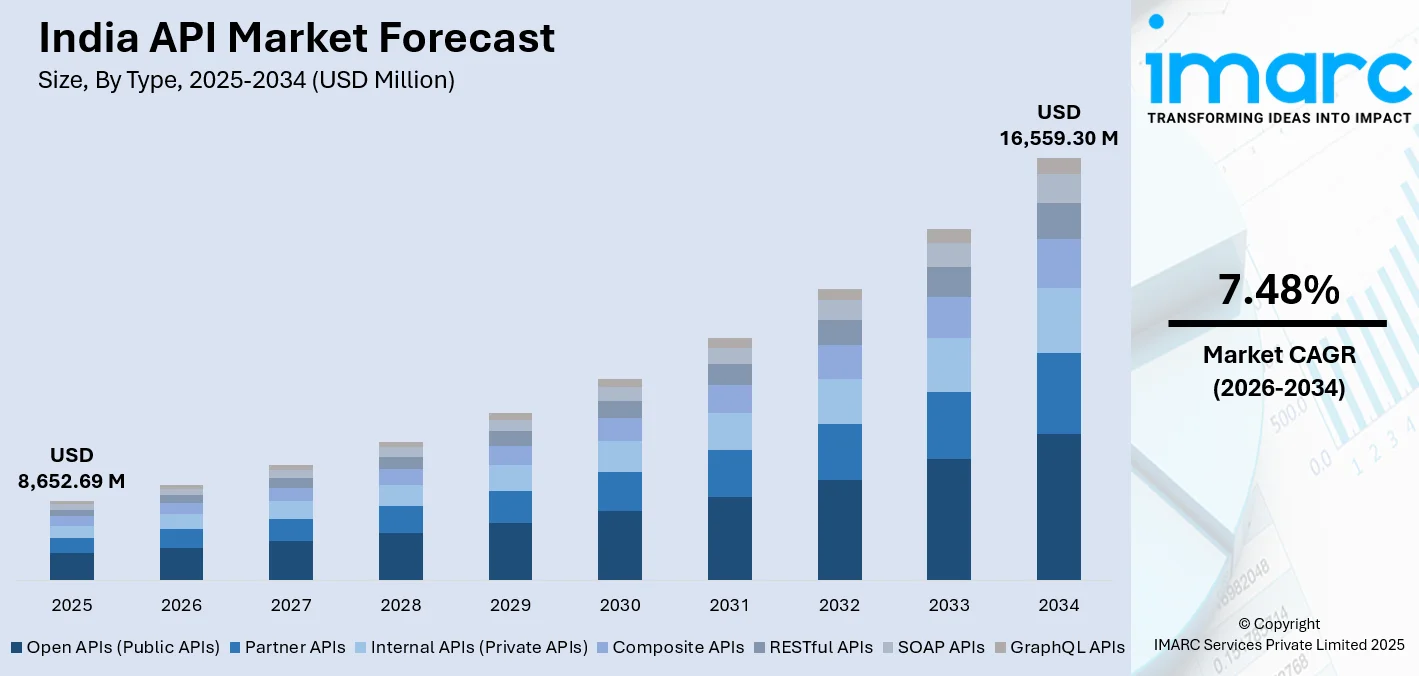

The India API market size was valued at USD 8,652.69 Million in 2025 and is projected to reach USD 16,559.30 Million by 2034, growing at a compound annual growth rate of 7.48% from 2026-2034.

India's API ecosystem is experiencing robust growth as digital transformation accelerates across sectors, with enterprises leveraging APIs to enable seamless integration, enhance customer experiences, and unlock new revenue streams through platform-based business models. The market is driven by government initiatives promoting digital public infrastructure, widespread smartphone adoption creating demand for mobile-first API architectures, and the burgeoning fintech sector that relies extensively on secure, scalable API frameworks, thereby expanding the India API market share.

Key Takeaways and Insights:

- By Type: Open APIs (public APIs) dominate the market with a share of 26% in 2025, enabling widespread third-party integration and fostering innovation through accessible interfaces that democratize data access.

- By Functionality and Purpose: Machine learning and AI APIs lead the market with a share of 25% in 2025, driven by enterprises embedding intelligent capabilities into applications for predictive analytics and automation.

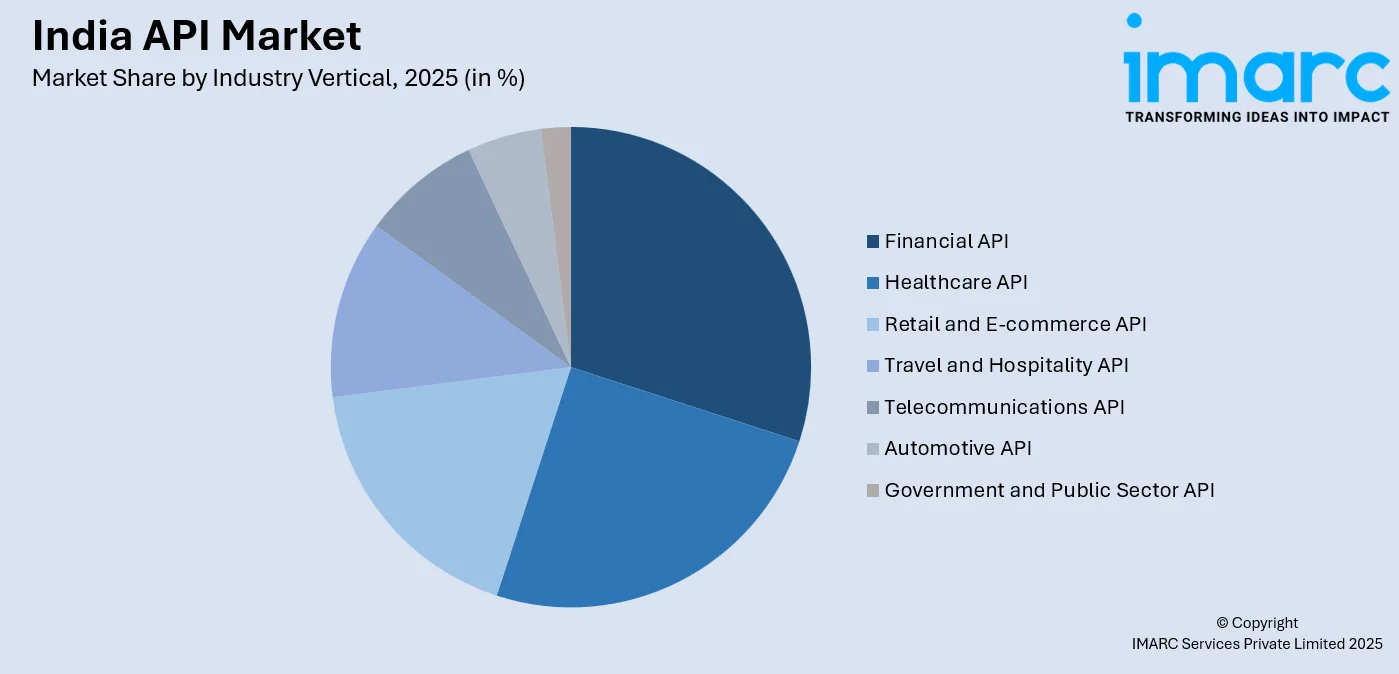

- By Industry Vertical: Financial APIs represent the largest segment with a market share of 29% in 2025, reflecting the sector's aggressive digital banking initiatives and fintech ecosystem development.

- By Region: North India exhibits a clear dominance with a 30% share in 2025, concentrated around the National Capital Region's technology hubs and corporate headquarters demanding sophisticated API infrastructure.

- Key Players: The India API market demonstrates high competitive intensity with global cloud platform providers, specialized API management vendors, and domestic technology enterprises competing across enterprise and SME segments, alongside emerging startups offering niche API solutions.

To get more information on this market Request Sample

India's market is being propelled by the government's Digital India initiative, which has accelerated API adoption across public services and regulatory frameworks. The Unified Payments Interface (UPI) exemplifies this transformation, processing 16.58 billion transactions in October 2024 through standardized payment APIs that have revolutionized financial accessibility. Financial institutions are rapidly deploying Open Banking APIs following the Account Aggregator framework, enabling customers to consolidate financial data across multiple institutions. Meanwhile, the healthcare sector is implementing the Ayushman Bharat Digital Mission's Health Information Exchange APIs, creating interoperable health records systems. E-commerce platforms are extensively utilizing geolocation and payment APIs to enhance customer experiences, while telecommunications providers are monetizing their networks through IoT and messaging APIs that enable smart city infrastructure and enterprise communication solutions. A compelling example of API-driven innovation is ONDC (Open Network for Digital Commerce), which launched in 2022 with standardized commerce APIs enabling small retailers to participate in digital commerce without depending on proprietary e-commerce platforms. As of 9 December 2025, there are more than 1.16 lakh retail sellers active on the ONDC from over 630 cities and towns throughout India. However, classifications of sellers by metropolitan business districts are not kept.

India API Market Trends:

Rising Adoption of GraphQL APIs for Flexible Data Retrieval

GraphQL APIs are gaining significant traction in India's technology landscape as organizations seek more efficient data querying mechanisms that reduce network overhead and improve application performance. Unlike traditional REST APIs that require multiple endpoint calls, GraphQL enables developers to request precisely the data needed in a single query, dramatically reducing bandwidth consumption and improving mobile application responsiveness. Indian e-commerce giants like Flipkart have implemented GraphQL to optimize their product catalog APIs, enabling faster page load times even on slower 3G networks that still serve millions of tier-2 and tier-3 city users. Moreover, the heightened investment in research and development (R&D) is increasing the use of flexible data retrieval systems. India's Gross Expenditure on Research and Development (GERD) has increased more than twofold in a decade, rising from ₹60,196.75 crore in 2010–11 to ₹1,27,380.96 crore in 2020–21.

Integration of API Security Protocols Driven by Data Protection Regulations

The implementation of India's Digital Personal Data Protection Act has intensified focus on API security, with enterprises implementing OAuth 2.0, API gateways with threat detection, and end-to-end encryption to protect sensitive user information. Financial services organizations are deploying advanced API security frameworks that include tokenization, rate limiting, and behavioral analytics to prevent unauthorized access and data breaches. The Reserve Bank of India's cybersecurity guidelines mandate stringent authentication mechanisms for banking APIs, prompting institutions to adopt multi-factor authentication and biometric verification at the API layer, significantly elevating security standards across the industry. In 2025, India's digital payment landscape is poised for a significant security upgrade as the Reserve Bank of India (RBI) rolls out new authentication protocols, starting April 2026. The updated framework will mandate that banks implement a risk-based approach for transaction verification, an initiative designed to enhance fraud prevention while ensuring a seamless payment experience for users. In the new system, two-factor authentication will still be required, but banks will move away from depending only on one-time passwords (OTPs). They will evaluate transaction risk by utilizing various signals, including device behavior, location, and transaction history.

Emergence of API-First Development Strategies in Product Engineering

Indian software development organizations are increasingly adopting API-first architectures where APIs are designed before application code, ensuring modularity, scalability, and easier integration across diverse platforms. Recently, it has been observed that the Indian SaaS sector has consistently achieved a strong growth rate of around 30% year-over-year. This approach has become particularly prominent in Software-as-a-Service startups, where exposing functionality through well-documented APIs accelerates partner ecosystem development and enables rapid customization for enterprise clients. Companies have built their entire product suite around API-first principles, allowing customers to integrate multiple business applications seamlessly while enabling third-party developers to build complementary solutions that extend platform capabilities and create network effects.

Market Outlook 2026-2034:

India's API market is poised for sustained expansion as 5G network rollout enables low-latency IoT applications requiring real-time API communications, while artificial intelligence integration demands sophisticated machine learning APIs for natural language processing and computer vision applications. The government's push for interoperability across digital public infrastructure is creating standardized API frameworks for identity verification, payments, and data sharing that will facilitate cross-sector innovation. The market generated a revenue of USD 8,652.69 Million in 2025 and is projected to reach a revenue of USD 16,559.30 Million by 2034, growing at a compound annual growth rate of 7.48% from 2026-2034. Enterprise modernization initiatives are driving legacy system integration through middleware APIs that bridge traditional databases with cloud-native applications, enabling gradual digital transformation without disruptive system replacements.

India API Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Open APIs (Public APIs) |

26% |

|

Functionality and Purpose |

Machine Learning and AI APIs |

25% |

|

Industry Vertical |

Financial API |

29% |

|

Region |

North India |

30% |

Type Insights:

- Open APIs (Public APIs)

- Partner APIs

- Internal APIs (Private APIs)

- Composite APIs

- RESTful APIs

- SOAP APIs

- GraphQL APIs

Open APIs (public APIs) dominate with a market share of 26% of the total India API market in 2025.

Open APIs have emerged as the cornerstone of India's digital ecosystem, enabling third-party developers to build innovative applications that extend platform capabilities and create new value propositions. The accessibility of public APIs has democratized software development, allowing startups and individual developers to leverage enterprise-grade infrastructure without significant capital investment. Government initiatives like the India Stack have made critical public APIs freely available for identity verification (Aadhaar eKYC), payments (UPI), and document verification (DigiLocker), catalyzing fintech innovation and digital service delivery. Major technology platforms expose comprehensive API catalogs covering everything from mapping services to machine learning models, fostering vibrant developer communities.

The revenue-sharing models associated with public APIs have created sustainable business ecosystems where platform providers monetize through transaction fees, premium tier subscriptions, or indirect value from ecosystem expansion. Payment gateway providers like Razorpay and Paytm have built entire businesses around well-designed public APIs that simplify merchant onboarding and transaction processing. Social media platforms provide APIs for authentication, content sharing, and analytics, enabling businesses to integrate social features seamlessly into their applications. The documentation quality, sandbox environments, and developer support infrastructure surrounding public APIs have become critical competitive differentiators, with organizations investing substantially in developer experience to maximize API adoption and ecosystem growth.

Functionality and Purpose Insights:

- Payment APIs

- Geolocation APIs

- Social Media APIs

- Weather APIs

- Machine Learning and AI APIs

- IoT APIs

Machine learning and AI APIs lead with a share of 25% of the total India API market in 2025.

Machine learning and AI APIs are transforming how Indian enterprises embed intelligent capabilities into their applications without requiring deep data science expertise or computational infrastructure. Cloud providers offer pre-trained models accessible through simple API calls for natural language processing, image recognition, speech-to-text conversion, and predictive analytics. E-commerce platforms leverage recommendation APIs to personalize product suggestions based on browsing history and purchase patterns, significantly improving conversion rates. Customer service operations deploy chatbot APIs powered by conversational AI that handle routine inquiries in multiple Indian languages, reducing support costs while maintaining 24/7 availability and improving response times for complex issues requiring human intervention.

The accessibility of AI APIs has leveled the playing field for small and medium enterprises that can now incorporate sophisticated capabilities previously available only to large technology companies with dedicated research teams. Healthcare startups are utilizing medical imaging APIs for preliminary diagnostic screening, while agricultural technology companies employ computer vision APIs to identify crop diseases from smartphone photographs. Financial institutions implement fraud detection APIs that analyze transaction patterns in real-time to flag suspicious activities. The continuous improvement of these models through federated learning and transfer learning techniques ensures that API consumers benefit from enhanced accuracy without managing the underlying infrastructure, creating a compelling value proposition that drives adoption across sectors seeking competitive advantages through intelligent automation.

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Healthcare API

- Financial API

- Retail and E-commerce API

- Travel and Hospitality API

- Telecommunications API

- Automotive API

- Government and Public Sector API

Financial APIs exhibits a clear dominance with a 29% share of the total India API market in 2025.

Financial APIs have become the backbone of India's digital payments revolution and the rapidly expanding fintech ecosystem that is reshaping how consumers and businesses manage money. The Unified Payments Interface, built on standardized APIs, has enabled interoperability across banks and payment providers, processing billions of transactions monthly and establishing India as a global leader in real-time payments. Account Aggregator APIs, implemented under the Reserve Bank of India's framework, allow customers to securely share financial data across institutions, enabling faster loan approvals, better credit assessment, and consolidated wealth management. Banks are exposing APIs for everything from account balance inquiries to fund transfers, enabling third-party applications to offer banking services without customers leaving their preferred interfaces, fundamentally changing the competitive dynamics.

The regulatory push toward Open Banking is accelerating API adoption as financial institutions recognize that collaboration through well-designed interfaces creates more value than proprietary closed systems. Payment gateway APIs process millions of daily transactions for e-commerce merchants, subscription services, and utility bill payments, creating seamless checkout experiences that reduce cart abandonment. Investment platforms utilize market data APIs to provide real-time stock quotes, portfolio analytics, and algorithmic trading capabilities to retail investors. Insurance companies are deploying APIs that enable instant policy issuance, claims processing, and risk assessment by integrating with vehicle telematics, health records, and property databases. The security requirements for financial APIs have driven innovation in authentication protocols, encryption standards, and fraud detection mechanisms that are now being adopted across other sectors, establishing finance as a bellwether for API best practices.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India leads with a share of 30% of the total India API market in 2025.

North India's API market leadership stems from the concentration of technology enterprises, corporate headquarters, and government institutions in the National Capital Region (Delhi-NCR) and surrounding cities. Gurgaon and Noida host major multinational technology companies, IT service providers, and product startups that collectively generate substantial demand for API management platforms, integration services, and custom API development. The presence of government ministries and regulatory bodies in Delhi has created a unique ecosystem where public sector digital transformation initiatives drive API standardization for citizen services, procurement systems, and inter-departmental data sharing. Financial institutions headquartered in the region are among the earliest adopters of Open Banking APIs, while e-commerce giants based in Gurgaon have built sophisticated API infrastructures supporting millions of daily transactions and third-party marketplace integrations.

The region's educational institutions and technical talent pool support a vibrant developer community that rapidly adopts new API technologies and architectural patterns. Cities like Chandigarh are emerging as secondary technology hubs with growing API consumption driven by SME digitalization and startup ecosystem development. The availability of advanced telecommunications infrastructure, including early 5G deployment, enables sophisticated API applications requiring low latency and high bandwidth. Government initiatives like the Smart Cities Mission in multiple North Indian cities are creating demand for IoT APIs that manage urban infrastructure, traffic systems, and environmental monitoring. The concentration of banking, insurance, and financial services companies continues to drive innovation in financial APIs, while the presence of major automotive manufacturers in the NCR region is spurring development of connected vehicle APIs and automotive commerce platforms.

Market Dynamics:

Growth Drivers:

Why is the India API Market Growing?

Proliferation of Cloud-Native Application Architectures and Microservices Adoption

Indian enterprises are increasingly migrating from monolithic application architectures to cloud-native microservices designs that inherently rely on APIs for inter-service communication and external system integration. This architectural shift enables organizations to develop, deploy, and scale application components independently, reducing time-to-market for new features and improving system resilience through fault isolation. Banking institutions are decomposing legacy core banking systems into microservices that expose specific functionalities like account management, transaction processing, and customer authentication through dedicated APIs, enabling agile development cycles and facilitating selective modernization without complete system replacement. Manufacturing companies are building cloud-native supply chain management systems where inventory tracking, order fulfillment, and vendor management modules communicate through internal APIs, enabling real-time visibility and rapid adaptation to demand fluctuations. India cloud computing market will reach USD 266.90 Billion by 2034, as per IMARC Group.

Surge in Mobile Commerce and Smartphone Penetration Driving Mobile-First API Design

India's smartphone user base exceeding 700 million users has created enormous demand for mobile-optimized APIs that deliver responsive performance over variable network conditions and bandwidth constraints prevalent across urban and rural geographies. E-commerce platforms are redesigning their API architectures specifically for mobile consumption patterns, implementing progressive data loading, aggressive caching strategies, and compressed response formats that minimize data transfer while maintaining rich user experiences. Food delivery aggregators process millions of daily orders through mobile apps that rely on location APIs for real-time tracking, payment APIs for seamless transactions, and notification APIs for order status updates, requiring ultra-low latency and high availability infrastructure.

Expanding Internet of Things (IoT) Ecosystem Creating Massive Device Connectivity Requirements

The rapid deployment of IoT devices across smart cities, industrial automation, connected vehicles, and smart home applications is generating unprecedented demand for APIs that enable device provisioning, data ingestion, remote control, and firmware updates at massive scale. Smart metering initiatives in electricity distribution are connecting millions of meters through cellular IoT networks, with each device communicating consumption data, receiving tariff updates, and enabling remote disconnection through standardized APIs that ensure interoperability across manufacturers and utility providers. Agricultural IoT solutions deploy soil moisture sensors, weather stations, and automated irrigation controllers that communicate through APIs with decision support systems, enabling precision farming techniques that optimize water usage and crop yields based on real-time environmental conditions. On Monday (December 9, 2024), Google revealed that developers worldwide, including India, will have free access to the Google Maps Platform starting in March 2025. The complimentary availability of products comprises Maps, Routes, Places, and Environment APIs and SDKs, but is capped at a monthly limit. Google thinks this will assist developers in creating improved solutions.

Market Restraints:

What Challenges the India API Market is Facing?

Security Vulnerabilities and Data Privacy Concerns Limiting Adoption

Organizations remain cautious about exposing critical systems through APIs due to concerns about unauthorized access, data breaches, and compliance with evolving data protection regulations. The complexity of implementing robust authentication, authorization, and encryption mechanisms creates implementation barriers, particularly for small and medium enterprises with limited cybersecurity expertise and resources.

Lack of Standardization Across Industry-Specific API Implementations

The absence of universally accepted API standards within specific sectors creates integration challenges as organizations must customize implementations for each partner's unique interface specifications. This fragmentation increases development costs, extends integration timelines, and complicates maintenance as businesses must manage multiple API versions and protocol variations across their ecosystem partnerships.

Limited Technical Expertise for API Design and Governance

Many organizations lack experienced professionals who understand API architecture best practices, versioning strategies, and lifecycle management, resulting in poorly designed interfaces that become difficult to maintain and scale. The shortage of API product managers who can balance technical requirements with business objectives leads to APIs that fail to meet developer needs or adequately support evolving use cases.

Competitive Landscape:

The India API market exhibits a dynamic competitive structure with global cloud platform providers offering comprehensive API management solutions alongside specialized vendors focused exclusively on API gateway and lifecycle management capabilities. Domestic technology enterprises provide API development and integration services while also building proprietary API platforms for specific industry verticals. The ecosystem includes emerging Indian startups offering innovative API security solutions, monetization platforms, and developer experience tools tailored to local market requirements. Financial technology companies have developed robust API infrastructures that set industry benchmarks for performance, security, and developer experience. The market demonstrates increasing collaboration between traditional IT service providers and niche API specialists who partner to deliver end-to-end solutions encompassing strategy, architecture, implementation, and ongoing management for enterprise clients undertaking comprehensive API programs.

India API Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open APIs (Public APIs), Partner APIs, Internal APIs (Private APIs), Composite APIs, RESTful APIs, SOAP APIs, GraphQL APIs |

| Functionality and Purposes Covered | Payment APIs, Geolocation APIs, Social Media APIs, Weather APIs, Machine Learning and AI APIs, IoT APIs |

| Industry Verticals Covered | Healthcare API, Financial API, Retail and E-commerce API, Travel and Hospitality API, Telecommunications API, Automotive API, Government and Public Sector API |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India API market size was valued at USD 8,652.69 Million in 2025.

The India API market is expected to grow at a compound annual growth rate of 7.48% from 2026-2034 to reach USD 16,559.30 Million by 2034.

Open APIs (public APIs) dominate the India API market with a 26% share in 2025, driven by government initiatives like India Stack that provide free access to critical identity, payment, and data-sharing interfaces, along with technology platforms exposing comprehensive developer-friendly APIs that foster innovation ecosystems and enable third-party application development at scale.

Key factors driving the India API market include government-led digital infrastructure standardization through frameworks like India Stack and Account Aggregator, enterprise digital transformation initiatives requiring legacy system modernization, and the expanding developer ecosystem with API-first startup culture enabling platform-based business models and rapid scaling through ecosystem partnerships.

Major challenges include security vulnerabilities and data privacy concerns that limit enterprise willingness to expose critical systems, lack of industry-specific API standardization creating integration complexity and increased development costs, limited technical expertise in API design and governance resulting in poorly architected interfaces, and the complexity of implementing robust authentication and encryption mechanisms particularly for resource-constrained small and medium enterprises.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)