India Application Processor Market Size, Share, Trends and Forecast by Device Type, Core Type, and Region, 2026-2034

Market Overview:

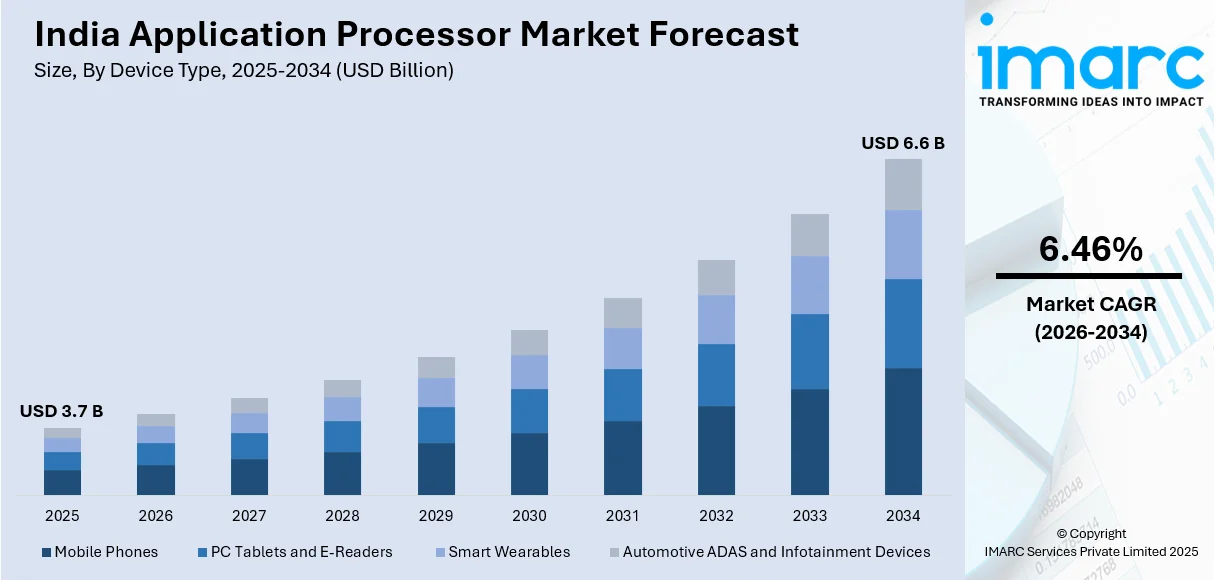

India application processor market size reached USD 3.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.46% during 2026-2034. Collaborations, partnerships, and investments in research and development activities across the semiconductor industry are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.7 Billion |

|

Market Forecast in 2034

|

USD 6.6 Billion |

| Market Growth Rate 2026-2034 | 6.46% |

An application processor, found within a system on a chip (SoC), is tasked with ensuring the efficient operation of applications within a mobile operating system. Its application extends to various electronic devices, encompassing tablets, e-readers, smartphones, netbooks, gaming consoles, and automotive navigation devices. By leveraging an application processor, numerous applications can concurrently operate on diverse operating systems like Android, iOS, Windows CE, or Symbian. This processor also boasts functionalities such as a graphics processing unit, memory controller, and multimedia decoding units. In tandem with the ongoing technological advancements and the increasing emphasis on data-centric capabilities, application processors have evolved from the initial Intel 8086 processor to the current 8th Gen Intel Core i7-8086K processor, boasting a remarkable capacity of up to 5 GHz.

To get more information on this market Request Sample

India Application Processor Market Trends:

The India application processor market is undergoing dynamic growth and transformation as the country embraces the digital era and witnesses a surge in the use of electronic devices across various sectors. Moreover, the widespread adoption of smartphones, tablets, and other smart devices in India has been a significant driver for the application processor market. With the increasing demand for seamless and high-performance mobile experiences, application processors have become indispensable in delivering the necessary computing power and efficiency. Besides this, the expansion of the digital economy, e-commerce, and the increasing reliance on electronic devices for communication and entertainment contribute to the growing demand for advanced application processors. Furthermore, the elevating integration of advanced infotainment systems, navigation devices, and other smart technologies in vehicles is driving the demand for powerful application processors tailored for automotive applications. As technology continues to advance, the India application processor market is witnessing a transition from conventional processors to more sophisticated and powerful solutions. Apart from this, the presence of both domestic and international players, contributing to innovation and competition, is anticipated to fuel the India application processor market over the forecasted period.

India Application Processor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on device type and core type.

Device Type Insights:

- Mobile Phones

- PC Tablets and E-Readers

- Smart Wearables

- Automotive ADAS and Infotainment Devices

The report has provided a detailed breakup and analysis of the market based on the device type. This includes mobile phones, PC tablets and E-readers, smart wearables, and automotive ADAS and infotainment devices.

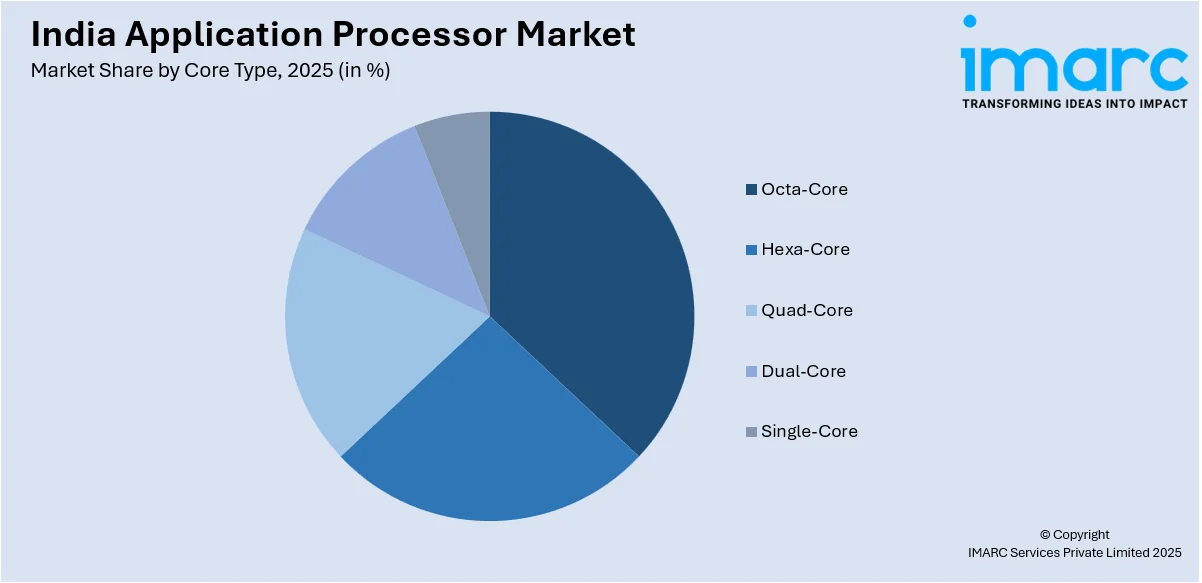

Core Type Insights:

Access the comprehensive market breakdown Request Sample

- Octa-Core

- Hexa-Core

- Quad-Core

- Dual-Core

- Single-Core

A detailed breakup and analysis of the market based on the core type have also been provided in the report. This includes octa-core, hexa-core, quad-core, dual-core, and single-core.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Application Processor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Mobile Phones, PC Tablets and E-Readers, Smart Wearables, Automotive ADAS and Infotainment Devices |

| Core Types Covered | Octa-Core, Hexa-Core, Quad-Core, Dual-Core, Single-Core |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India application processor market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India application processor market?

- What is the breakup of the India application processor market on the basis of device type?

- What is the breakup of the India application processor market on the basis of core type?

- What are the various stages in the value chain of the India application processor market?

- What are the key driving factors and challenges in the India application processor?

- What is the structure of the India application processor market and who are the key players?

- What is the degree of competition in the India application processor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India application processor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India application processor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India application processor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)