India Arthroscopy Devices Market Size, Share, Trends and Forecast by Device Type, Arthroscopy Type, End-User, and Region, 2026-2034

India Arthroscopy Devices Market Summary:

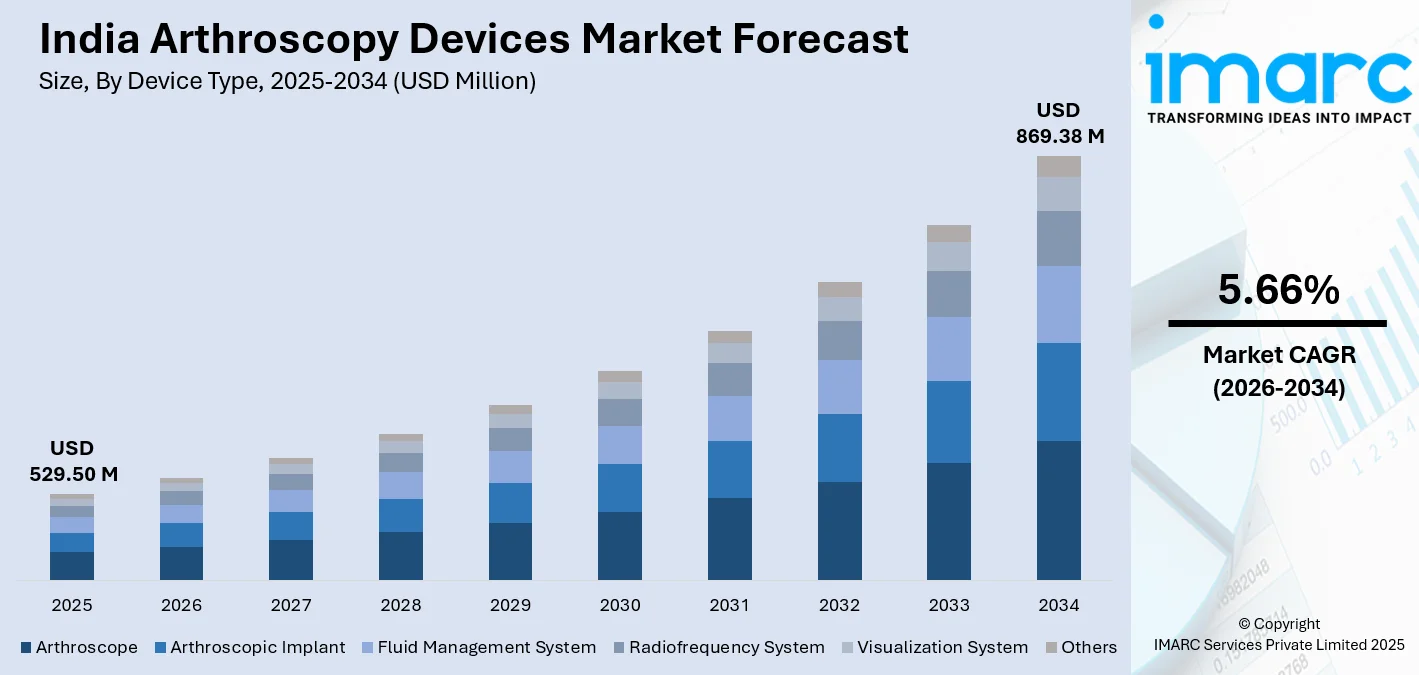

The India arthroscopy devices market size was valued at USD 529.50 Million in 2025 and is projected to reach USD 869.38 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034.

The market is experiencing steady growth driven by rising sports injuries, increasing geriatric population with joint disorders, and growing preference for minimally invasive surgical procedures. The market benefits from improving healthcare infrastructure, expanding medical tourism, and greater awareness about advanced orthopedic treatment options across urban and semi-urban centers. Moreover, technological convergence with digital health, enabling better surgical outcomes and patient monitoring capabilities is expanding the India arthroscopy devices market share.

Key Takeaways and Insights:

- By Device Type: Arthroscopic implant dominates the market with a share of 43% in 2025, driven by high procedure volumes and recurring demand for tissue fixation solutions.

- By Arthroscopy Type: Knee arthroscopy leads the market with a share of 48% in 2025, reflecting the prevalence of knee-related injuries and degenerative conditions.

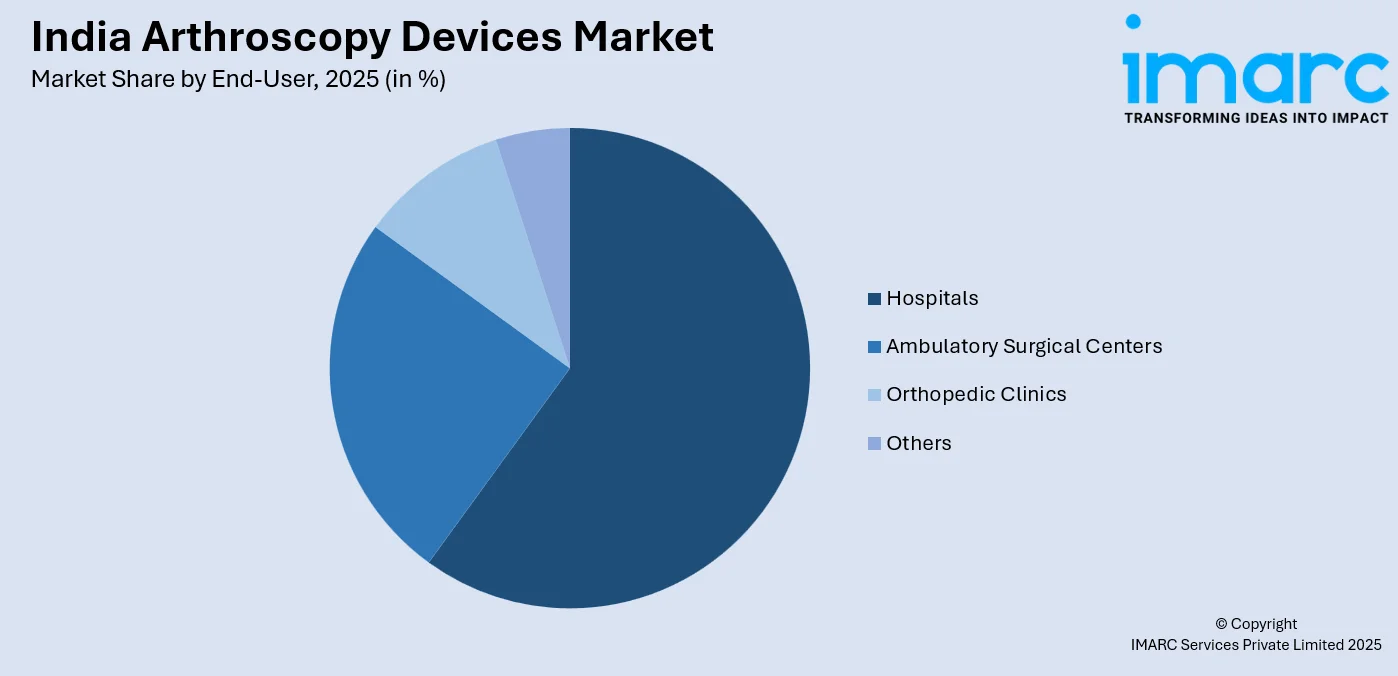

- By End-User: Hospitals represent the largest segment with a market share of 60% in 2025, supported by comprehensive infrastructure and specialist availability.

- By Region: North India exhibits a clear dominance with 32% market share in 2025, benefiting from concentrated healthcare facilities and higher medical spending capacity.

- Key Players: The India arthroscopy devices market demonstrates moderate consolidation with multinational medical device corporations competing alongside domestic manufacturers across various price segments and distribution networks.

To get more information on this market Request Sample

The India arthroscopy devices market is positioned at a critical juncture where demographic shifts intersect with technological advancement and healthcare accessibility improvements. The country's expanding middle class, coupled with increasing health insurance penetration, which reached approximately 500 million individuals under government like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PMJAY) and private schemes, is enabling greater access to advanced orthopedic procedures. Metropolitan hospitals are adopting cutting-edge arthroscopic technologies including high-definition visualization systems and radiofrequency ablation devices that enhance surgical precision. The government's push toward medical device manufacturing through initiatives like Make in India is encouraging domestic production, with the medical device sector targeting self-reliance in critical categories by 2030. Sports medicine is emerging as a specialized field with dedicated centers opening in major cities, catering to both professional athletes and recreational sports enthusiasts seeking minimally invasive treatment options. The orthopedic device market in India is experiencing transformation driven by digital integration, with telemedicine consultations for post-operative care becoming standard practice at leading facilities, enabling remote monitoring and reducing unnecessary hospital visits while maintaining quality outcomes.

India Arthroscopy Devices Market Trends:

Integration of Artificial Intelligence (AI) in Surgical Planning and Execution

Arthroscopic procedures in India are increasingly incorporating AI algorithms for preoperative planning, intraoperative guidance, and postoperative assessment. Advanced visualization systems now feature AI-powered image enhancement that improves tissue differentiation and pathology identification during procedures. Several tertiary care hospitals in metropolitan areas have begun implementing AI-assisted surgical platforms that provide real-time feedback on instrument positioning and surgical technique. Telangana Governor Jishnu Dev Varma launched the Hyderabad Arthroscopy Conclave-2025 in March 2025, signifying the start of a two-day global conference and live workshop organized by Yashoda Hospitals. The event seeks to examine progress in arthroscopic surgery, robotic support, and the incorporation of artificial intelligence (AI) in minimally invasive orthopaedic techniques.

Rise of Single-Use Arthroscopic Instruments

The Indian market is witnessing growing adoption of disposable arthroscopic instruments as healthcare facilities prioritize infection control and operational efficiency. Single-use devices eliminate sterilization costs, reduce cross-contamination risks, and ensure consistent performance without degradation from repeated processing cycles. This trend has accelerated following heightened infection prevention awareness and regulatory scrutiny of reprocessing protocols. The shift is particularly pronounced in ambulatory surgical centers where streamlined operations and predictable per-procedure costs are essential for financial sustainability. IMARC Group predicts that the India ambulatory surgical centers market is projected to reach USD 8.78 Billion by 2033.

Expansion of Ambulatory Surgical Centers for Arthroscopic Procedures

India is experiencing proliferation of specialized ambulatory surgical centers equipped for same-day arthroscopic procedures, driven by patient preference for convenient outpatient care and cost efficiencies. These facilities offer focused expertise in orthopedic procedures with streamlined workflows that reduce waiting times and hospital-acquired infection risks. The model is particularly gaining traction in tier-2 cities where standalone arthroscopy centers provide quality care without the overhead of full-service hospitals. In 2025, Kauvery Hospital, Vadapalani, inaugurated the Kauvery-SAC (Sports Medicine and Arthroscopy Center), a center focused on transforming joint treatment in Chennai. The center offers advanced minimally invasive methods combined with cartilage regeneration therapies to preserve joint health, particularly in younger individuals.

Market Outlook 2026-2034:

The India arthroscopy devices market is poised for sustained growth as healthcare infrastructure modernization accelerates across both urban centers and emerging tier-2 and tier-3 cities. Increasing medical tourism positioning India as an affordable destination for orthopedic procedures is driving demand for international-standard arthroscopic equipment. The market generated a revenue of USD 529.50 Million in 2025 and is projected to reach a revenue of USD 869.38 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034. Technological advancements including 4K and 8K ultra-high-definition visualization systems, augmented reality surgical navigation, and biodegradable implant materials are being adopted by leading hospitals, setting new standards for surgical precision and patient outcomes.

India Arthroscopy Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Device Type | Arthroscopic Implant | 43% |

| Arthroscopy Type | Knee Arthroscopy | 48% |

| End-User | Hospitals | 60% |

| Region | North India | 32% |

Device Type Insights:

- Arthroscope

- Arthroscopic Implant

- Fluid Management System

- Radiofrequency System

- Visualization System

- Others

Arthroscopic implant dominates with a market share of 43% of the total India arthroscopy devices market in 2025.

Arthroscopic implants represent the cornerstone of reconstructive joint procedures, encompassing anchors, screws, tacks, and interference devices used for soft tissue fixation and ligament reconstruction. The segment's dominance stems from the high volume of anterior cruciate ligament reconstructions, rotator cuff repairs, and labral repairs performed across India's healthcare facilities. These procedures require multiple implants per case, with surgeons often using five to eight anchors for complex rotator cuff repairs or multiple interference screws for ACL reconstruction, creating recurring demand patterns.

The arthroscopic implant market benefits from continuous material innovation, with bioabsorbable implants gaining preference over traditional metallic options for eliminating hardware removal procedures and reducing imaging artifacts. Manufacturing advancements have introduced knotless anchor systems that simplify surgical technique and reduce operative time, appealing to both experienced surgeons and those building arthroscopic competency. The segment also sees strong growth from revision procedures where previous repairs have failed, requiring specialized implant solutions with enhanced fixation strength and bone integration properties for compromised tissue.

Arthroscopy Type Insights:

- Knee Arthroscopy

- Hip Arthroscopy

- Spine Arthroscopy

- Shoulder and Elbow Arthroscopy

- Foot and Ankle Arthroscopy

- Others

Knee arthroscopy leads with a share of 48% of the total India arthroscopy devices market in 2025.

Knee arthroscopy dominates India's arthroscopic procedure landscape due to the joint's vulnerability to both traumatic sports injuries and degenerative conditions affecting millions of Indians. The procedure addresses meniscal tears, cruciate ligament injuries, cartilage damage, and inflammatory conditions through minimally invasive techniques that typically allow same-day discharge and rapid return to function. Cricket, football, and badminton, along with other sports with massive participation across India, generate consistent volumes of acute knee injuries requiring arthroscopic intervention, while the aging population presents with osteoarthritis and meniscal degeneration necessitating surgical treatment.

The segment's growth is further amplified by evolving surgical capabilities, with procedures advancing beyond simple diagnostic arthroscopy to complex reconstructive interventions including cartilage restoration techniques and partial knee replacements performed arthroscopically. Orthopedic surgeons across India have developed significant expertise in knee arthroscopy, making it the most commonly performed arthroscopic procedure in both metropolitan hospitals and smaller orthopedic centers. The procedure's favorable reimbursement profile under various insurance schemes and relatively standardized protocols contribute to its sustained market leadership.

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic Clinics

- Others

Hospitals exhibit a clear dominance with a 60% share of the total India arthroscopy devices market in 2025.

Hospitals maintain commanding market share through their comprehensive infrastructure supporting complex arthroscopic procedures requiring advanced imaging, anesthesiology support, and potential overnight observation capabilities. Multi-specialty hospitals in urban centers house dedicated orthopedic departments with fellowship-trained arthroscopic surgeons, high-definition visualization systems, and complete device inventories enabling treatment of diverse joint pathologies. These institutions handle complicated cases including revision surgeries, multi-ligament knee reconstructions, and procedures on patients with comorbidities requiring specialized perioperative management unavailable in smaller facilities.

The hospital segment's dominance is reinforced by patient referral patterns, insurance network preferences, and medical tourism infrastructure concentrated in hospital settings. Teaching hospitals affiliated with medical colleges perform high volumes of arthroscopic procedures for training purposes while simultaneously serving large patient populations seeking subsidized care. Corporate hospital chains have invested substantially in arthroscopy programs, marketing specialized sports medicine centers within their facilities and attracting both domestic patients and international medical tourists seeking quality orthopedic care at competitive pricing compared to Western markets.

Regional Insights:

- North India

- South India

- East India

- West India

North India leads with a share of 32% of the total India arthroscopy devices market in 2025.

North India commands the largest share of the arthroscopy devices market, driven by the concentration of premier healthcare institutions, higher per capita income, and robust medical infrastructure in the National Capital Region and surrounding states. The region houses numerous multi-specialty hospitals, dedicated orthopedic centers, and sports medicine facilities that perform high volumes of arthroscopic procedures. Delhi, Gurugram, Noida, and Chandigarh serve as major healthcare hubs attracting patients not only from North India but also from neighboring countries seeking quality orthopedic care. The region benefits from established medical tourism infrastructure with international patient facilitation services, interpreters, and streamlined visa processes that support the influx of patients from Afghanistan, Bangladesh, and Central Asian nations.

The presence of premier medical institutions creates a competitive environment that drives adoption of advanced arthroscopic technologies and attracts fellowship-trained surgeons specializing in sports medicine and joint preservation. North India's sports culture, particularly cricket, hockey, and emerging interest in football and basketball, generates consistent volumes of sports-related injuries requiring arthroscopic intervention. The region also demonstrates higher health insurance penetration compared to other parts of India, facilitating access to elective arthroscopic procedures for middle-class populations. Government medical colleges across Uttar Pradesh, Punjab, Haryana, and Rajasthan are increasingly establishing arthroscopy training programs, expanding the pool of skilled surgeons and improving procedure accessibility beyond metropolitan areas into tier-2 cities throughout the region.

Market Dynamics:

Growth Drivers:

Why is the India Arthroscopy Devices Market Growing?

Rising Incidence of Sports-Related Injuries and Active Lifestyle Adoption

India is witnessing unprecedented growth in sports participation across age groups, from professional athletics to recreational fitness activities, generating substantial volumes of musculoskeletal injuries requiring arthroscopic intervention. The proliferation of fitness centers, running clubs, cycling groups, and organized sports leagues has exposed millions of Indians to injury risks previously confined to professional athletes. Young professionals increasingly engage in high-impact activities including CrossFit, marathon running, and adventure sports without adequate conditioning or technique guidance, resulting in ligament tears, meniscal damage, and cartilage injuries. In 2025, the sports medicine department at King George's Medical University begun utilizing a new kind of advanced implant to treat patients suffering from ACL (anterior cruciate ligament) tears, a frequent knee injury. Doctors stated that this is the first instance in UP where a modern implant has been utilized for ACL repair in any government hospital. The operation was carried out on Anurag Kumar, a football athlete from Moradabad who works in the UP Police and is presently stationed in Agra. He incurred a ligament injury to his left knee while competing for his department's squad.

Expanding Geriatric Population with Degenerative Joint Conditions

India's demographic transition toward an aging society is fundamentally reshaping orthopedic care demand, with the senior citizen population projected to reach approximately 230 million by 2036. This geriatric cohort experiences high prevalence of osteoarthritis, rotator cuff degeneration, meniscal tears, and cartilage deterioration requiring surgical intervention when conservative management fails. The increasing life expectancy combined with desire among older Indians to maintain active, independent lifestyles drives demand for joint-preserving arthroscopic interventions including cartilage repair, partial meniscectomy, and synovectomy that alleviate symptoms while delaying or avoiding total joint replacement.

Government Healthcare Initiatives and Insurance Coverage Expansion

The Indian government's healthcare initiatives including Ayushman Bharat and state-specific health insurance schemes have dramatically improved access to surgical care for economically disadvantaged populations previously unable to afford arthroscopic procedures. These programs currently cover over 500 million beneficiaries, providing treatment at empaneled hospitals and removing financial barriers that historically restricted advanced orthopedic care to affluent patients paying out-of-pocket. In October 2024, the Indian government announced the Production Linked Incentive (PLI) Scheme for Encouraging Domestic Manufacturing of Medical Devices seeks to enhance domestic manufacturing of medical devices by drawing significant investments to build local manufacturing capacity and rewarding domestic production. The roster of premium medical equipment being produced domestically under the program is provided in the Annexure. These medical devices are approximately 10% to 30% less expensive than imported items, thus contributing to lower domestic healthcare expenses

Market Restraints:

What Challenges the India Arthroscopy Devices Market is Facing?

High Equipment and Procedural Costs Limiting Accessibility

Arthroscopic procedures require substantial capital investment in high-definition camera systems, fluid management equipment, radiofrequency devices, and specialized instruments, creating financial barriers for smaller hospitals and clinics. The recurring costs of implants, disposables, and equipment maintenance compound accessibility challenges, particularly in tier-2 and tier-3 cities where patient volumes may not justify expensive infrastructure investments.

Limited Trained Arthroscopic Surgeons and Skill Disparity

India faces a shortage of fellowship-trained arthroscopic surgeons capable of performing complex reconstructive procedures, with expertise concentrated in metropolitan areas. The learning curve for advanced arthroscopy is steep, requiring extensive training and mentorship that many orthopedic residency programs cannot provide adequately. This skills gap results in variable surgical outcomes and limits market growth in underserved regions.

Regulatory and Reimbursement Complexities

The medical device regulatory landscape in India remains complex with evolving quality standards, import regulations, and pricing controls that create uncertainty for manufacturers and distributors. Inconsistent reimbursement policies across government schemes and private insurers lead to variation in procedure coverage and patient out-of-pocket expenses, affecting demand predictability and market planning.

Competitive Landscape:

The India arthroscopy devices market exhibits a moderately competitive structure with multinational medical device corporations maintaining significant market share through established distribution networks and brand recognition among orthopedic surgeons. These global players leverage technological superiority, comprehensive product portfolios spanning all device categories, and strong relationships with key opinion leaders in sports medicine and orthopedic surgery. Domestic manufacturers are gaining traction by offering cost-competitive alternatives to imported devices, capitalizing on government procurement preferences for locally manufactured products and developing solutions tailored to Indian healthcare economics. The market also features specialized distributors and importers who partner with international brands to provide regional coverage and technical support. Competition centers on product innovation, clinical evidence demonstrating superior outcomes, surgeon training programs, and after-sales service capabilities that ensure equipment uptime and technical support accessibility across India's diverse geographic landscape.

India Arthroscopy Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Arthroscope, Arthroscopic Implant, Fluid Management System, Radiofrequency System, Visualization System, Others |

| Arthroscopy Types Covered | Knee Arthroscopy, Hip Arthroscopy, Spine Arthroscopy, Shoulder and Elbow Arthroscopy, Foot and Ankle Arthroscopy, Others |

| End-Users Covered | Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India arthroscopy devices market size was valued at USD 529.50 Million in 2025.

The India arthroscopy devices market is expected to grow at a compound annual growth rate of 5.66% from 2026-2034 to reach USD 869.38 Million by 2034.

Arthroscopic implant dominated the market with a 43% share in 2025, driven by their essential role in reconstructive procedures and the high volume of ligament repairs, rotator cuff surgeries, and labral reconstructions performed across Indian healthcare facilities.

Key factors driving the India arthroscopy devices market include rising sports participation and injury incidence, expanding geriatric population with degenerative joint conditions, improving healthcare insurance coverage, and increasing preference for minimally invasive surgical techniques.

Major challenges include high equipment and procedural costs limiting adoption in smaller facilities, shortage of fellowship-trained arthroscopic surgeons particularly in tier-2 and tier-3 cities, and complex regulatory environment with inconsistent reimbursement policies across different insurance schemes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)