India Artificial Turf Market Size, Share, Trends and Forecast by Material, Application and Region, 2025-2033

India Artificial Turf Market Overview:

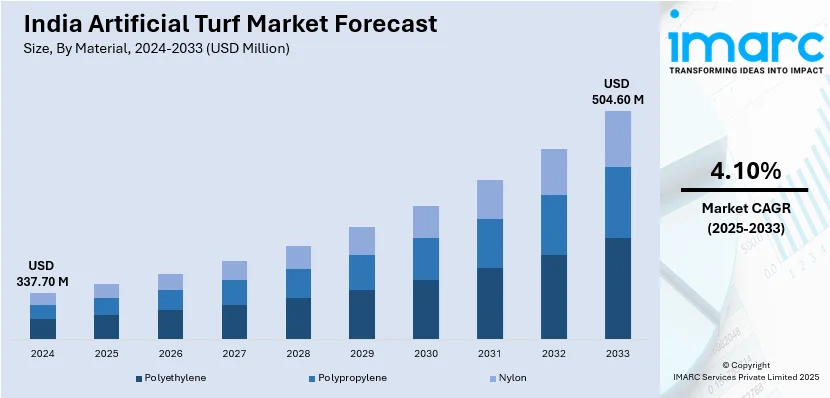

The India artificial turf market size reached USD 337.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 504.60 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The India artificial turf market share is propelled by the increasing demand for low-maintenance, heavy-duty grass surrogates across sports complexes, landscaping, and residential applications. Urbanization, rising disposable income, and awareness about the use of sustainable and water-efficient measures also escalates the use of artificial turf across the nation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 337.70 Million |

| Market Forecast in 2033 | USD 504.60 Million |

| Market Growth Rate 2025-2033 | 4.10% |

India Artificial Turf Market Trends:

Adoption of Artificial Turf in Sports and Recreational Facilities

One of the most significant trends influencing the India artificial turf market outlook is its increasing use in sports centers and recreational spaces. As sports such as football, cricket, and hockey gain popularity, there is increased demand for high-quality, long-lasting playing fields. For instance, the Government of India has adopted a proactive approach to reforming India’s sports policy: The initiative ‘Khelo India’ was created by merging the previous programs of Rajiv Gandhi Khel Abhiyan (RGKA), Urban Sports Infrastructure Scheme (USIS), and National Sports Talent Scheme (NSTS). Khelo India Scheme is the premier Central Sector Initiative of the Ministry of Youth Affairs & Sports, aimed at utilizing sports to attain a robust soft power status through a blend of 12 areas, including talent identification and nurturing, state-level Khelo India hubs, play area enhancement, sports for women, and sports for peace and progress. Artificial turf offers a uniform, all-weather surface that can absorb heavy usage, making it suitable for professional and amateur sports alike. The cost of maintaining and water needs of natural grass can be an expensive worry, particularly in water-scarce regions. Artificial grass provides an eco-friendly, low-maintenance solution. In addition, various cutting-edge sports facilities and schools are more and more placing synthetic grass in order to generate improved playing conditions on a year-round basis. With government support in the form of investments and initiatives for developing sports infrastructure, the demand for artificial turf is poised to continue increasing, making it a favorite in India's fast-evolving sports industry.

To get more information on this market, Request Sample

Increasing Use of Artificial Turf in Landscaping and Urban Spaces

Another trend contributing to the India artificial turf market growth is its expanding application for landscaping and urban areas. As cities grow larger and open areas shrink, artificial turf is increasingly being used in residential, business, and urban landscaping applications. Homeowners and companies are turning to synthetic turf for lawns, gardens, rooftop gardens, and even balcony areas to build green, pleasant spaces with minimal upkeep. Artificial grass does not need to be mowed, watered, or fertilized and is thus both cost-saving and eco-friendly, particularly in dry areas. On top of this, the beautiful look of continuous green landscapes all year round without the hassle of natural grass ensures it is highly desirable for city developments, urban parks, and business properties. With urbanization and the growing need for green solutions, artificial turf will see greater incorporation in landscape designs and will further contribute to the development of green urban spaces in India.

India Artificial Turf Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on material, and application.

Material Insights:

- Polyethylene

- Polypropylene

- Nylon

The report has provided a detailed breakup and analysis of the market based on the material. This includes polyethylene, polypropylene, and nylon.

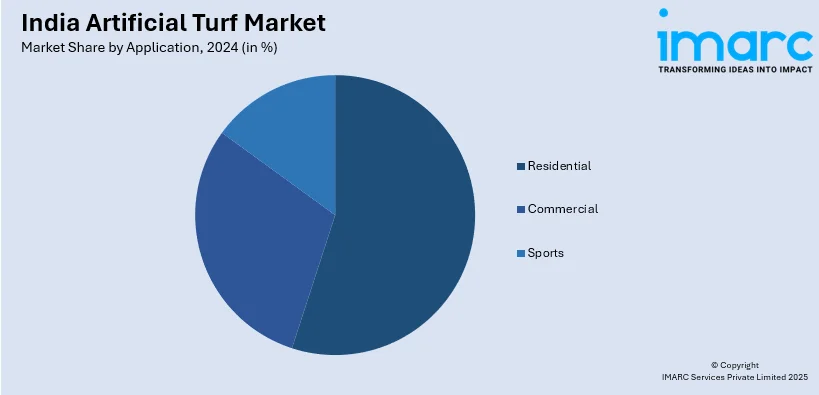

Application Insights:

- Residential

- Commercial

- Sports

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and sports.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Artificial Turf Market News:

- In December 2024, Shaw Industries Group, Inc. (Shaw) revealed that the Shaw Sports Turf brand will again officially serve as synthetic turf provider of the College Football Playoff (CFP) for the second consecutive year.

India Artificial Turf Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Polyethylene, Polypropylene, Nylon |

| Applications Covered | Residential, Commercial, Sports |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India artificial turf market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India artificial turf market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India artificial turf industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India artificial turf market was valued at USD 337.70 Million in 2024.

The India artificial turf market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a value of USD 504.60 Million by 2033.

The India artificial turf market is being driven by rapid urbanization, rising demand for recreational spaces, and growing interest in low-maintenance landscaping solutions. Sports infrastructure development, government-backed stadium and school upgrades, and water scarcity concerns also boost adoption, making synthetic turf an attractive, durable alternative to natural grass across diverse applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)