India Artisanal Chocolate Market Size, Share, Trends and Forecast by Product Type, Ingredients, Distribution Channel, Consumer Demographics, Application, and Region, 2025-2033

India Artisanal Chocolate Market Overview:

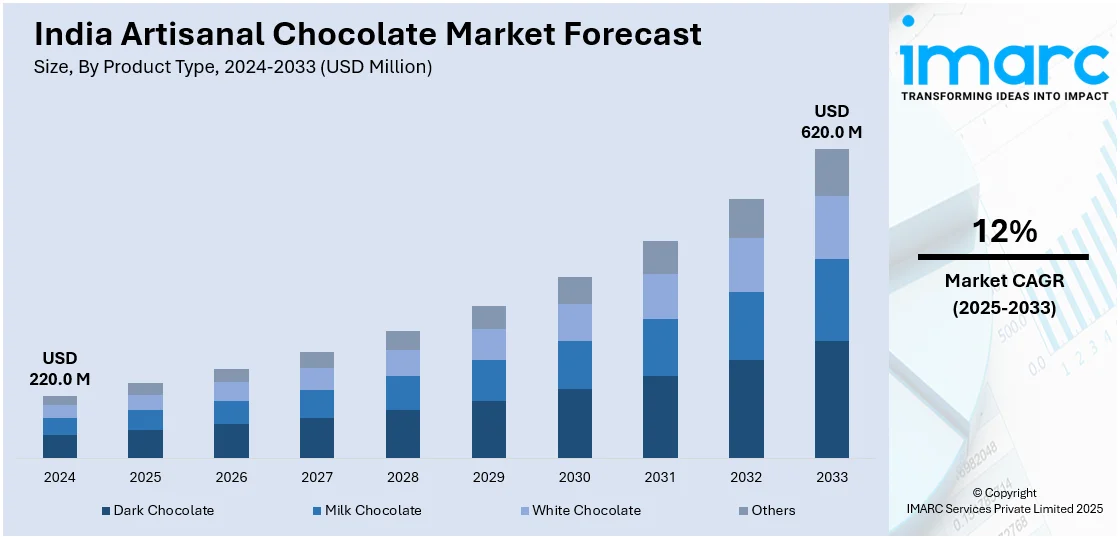

The India artisanal chocolate market size reached USD 220.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 620.0 Million by 2033, exhibiting a growth rate (CAGR) of 12% during 2025-2033. The growing demand for premium, organic, and ethically sourced chocolates is fueled by rising health awareness and disposable incomes. Urbanization, e-commerce growth, and social media influence are expanding accessibility. Consumers also seek unique, personalized experiences, driving innovation in flavors, sustainability, and experiential offerings, further expanding the India artisanal chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.0 Million |

| Market Forecast in 2033 | USD 620.0 Million |

| Market Growth Rate 2025-2033 | 12% |

India Artisanal Chocolate Market Trends:

Rising Demand for Premium and Organic Artisanal Chocolates

The rise in demand for premium and organic products, driven by increasing health consciousness and disposable incomes, is creating a positive India artisanal chocolate market outlook. Consumers are shifting from mass-produced chocolates to handcrafted, high-quality variants made with organic cocoa, natural sweeteners, and ethically sourced ingredients. According to an industry report, organic exports from India are expected to reach INR 20,000 crore (approximately USD 2,500 Million) by 2028 as against the current levels of Rs 5,000-6,000 crore (approximately USD 625 Million to USD 750 Million), a 3-to-3.5-fold jump. The country is a global leader in organic farming, with over 1.7 Million Hectares of organic-certified land and 1.4 Million organic farmers. This organic shift is also influencing the artisanal chocolate market in India. Artisanal chocolatiers are leveraging this trend by offering unique flavors, such as Himalayan pink salt, saffron, and single-origin cocoa, catering to discerning buyers. Additionally, the growing preference for clean-label and vegan chocolates is encouraging brands to innovate with plant-based ingredients, free from artificial additives. Social media and gourmet food platforms have amplified awareness, making artisanal chocolates a popular gifting choice. As urban consumers prioritize wellness and sustainability, the premium segment is expected to grow steadily, with artisanal brands expanding their presence in metro cities and online marketplaces.

To get more information on this market, Request Sample

Fusion of Traditional Indian Flavors with Artisanal Chocolate

Artisanal chocolatiers in India are innovating by infusing traditional Indian flavors into premium chocolate creations. Ingredients such as cardamom, jaggery, paan, and masala chai are blended with high-quality cocoa to create culturally resonant yet sophisticated treats. This fusion appeals to both nostalgia-seeking local consumers and curious international buyers. Seasonal offerings, such as Diwali-themed truffles or mango-infused chocolates in summer, capitalize on festive demand. Brands are also collaborating with regional spice growers and Ayurvedic experts to develop functional chocolates with health benefits, such as turmeric-infused dark chocolate. A research report from the IMARC Group indicates that the market for ayurvedic products in India was valued at INR 875.9 Billion (approximately USD 10.51 Billion) in 2024. It is projected to grow to INR 3,605.0 Billion (approximately USD 43.26 Billion) by 2033, reflecting a compound annual growth rate (CAGR) of 16.17% from 2025 to 2033. The trend reflects a broader movement towards "glocalization," where global artisanal techniques meet indigenous tastes. As consumers seek unique, locally inspired indulgences, this flavor experimentation is driving differentiation and India artisanal chocolate market growth.

India Artisanal Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, ingredients, distribution channel, consumer demographics, and application.

Product Type Insights:

- Dark Chocolate

- Milk Chocolate

- White Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dark chocolate, milk chocolate, white chocolate, and others.

Ingredients Insights:

- Organic and Natural Ingredients

- Conventional Ingredients

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes organic and natural ingredients, and conventional ingredients.

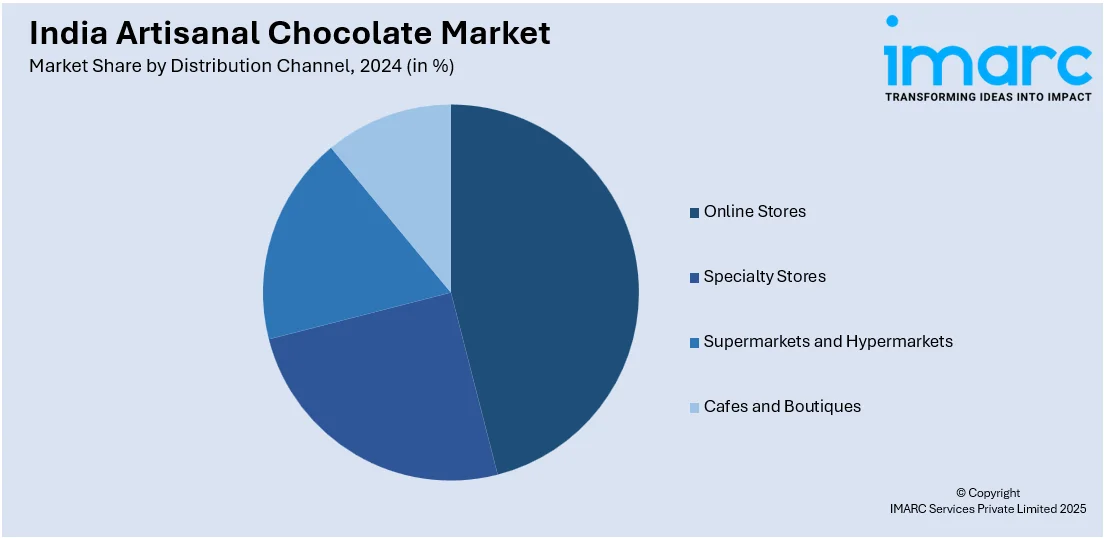

Distribution Channel Insights:

- Online Stores

- Specialty Stores

- Supermarkets and Hypermarkets

- Cafes and Boutiques

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online stores, specialty stores, supermarkets and hypermarkets, and cafes and boutiques.

Consumer Demographics Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the consumer demographics have also been provided in the report. This includes premium and mass.

Application Insights:

- Direct Consumption

- Bakery and Confectionery

- Beverages

The report has provided a detailed breakup and analysis of the market based on the application. This includes direct consumption, bakery and confectionery, and beverages.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Artisanal Chocolate Market News:

- February 27, 2025: Salon Du Chocolat et de la Patisserie, the world’s largest chocolate exhibition, announced making its debut in India at Mumbai’s Jio World Convention Centre in January 2026. The event will curate international chocolatiers, patissiers and cocoa artisans. For India’s premium chocolate industry, this presents a great opportunity to get recognition at a global level.

- December 23, 2024: Diageo India and SMOOR partnered to launch The Dessert Collection, a range of luxurious non-alcoholic artisanal chocolates that will be available across pan India from January 2025. Prices range from INR 295 to INR 1250 (approximately USD 3.54 to USD 15), with chocolate bars, shots, and cakes in flavors including Classic, Creamy Berries, and Sea Salt Caramel in the collection. This collaboration marks the growing need for high-quality chocolate for the artisanal chocolate industry in India.

India Artisanal Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dark Chocolate, Milk Chocolate, White Chocolate, Others |

| Ingredients Covered | Organic and Natural Ingredients, Conventional Ingredients |

| Distribution Channels Covered | Online Stores, Specialty Stores, Supermarkets and Hypermarkets, Cafes and Boutiques |

| Consumer Demographics Covered | Premium, Mass |

| Applications Covered | Direct Consumption, Bakery and Confectionery, Beverages |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India artisanal chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India artisanal chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India artisanal chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The artisanal chocolate market in India was valued at USD 220.0 Million in 2024.

Increasing awareness about unique flavors, single-origin cacao, and ethically sourced ingredients is driving the demand for artisanal chocolates. Urban consumers, especially millennials and Gen Z, are showing strong interest in gourmet products that combine luxury with authenticity. The gifting culture, particularly during festivals and special occasions, has further boosted artisanal chocolate sales.

The India artisanal chocolate market is projected to exhibit a CAGR of 12% during 2025-2033, reaching a value of USD 620.0 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)