India Asphalt Market Size, Share, Trends, and Forecast by Product, Asphalt Type, Application, End-Use Sector, and Region, 2025-2033

India Asphalt Market Overview:

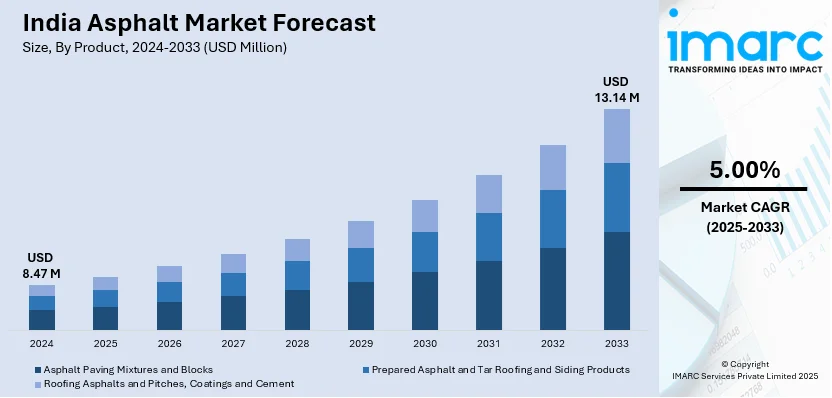

The India asphalt market size reached USD 8.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13.14 Million by 2033, exhibiting a growth rate (CAGR) of 5.00% during 2025-2033. The market is experiencing steady growth, driven by expanding infrastructure projects, particularly in road construction and urban development. Additionally, government initiatives, such as the National Infrastructure Pipeline (NIP), along with the rising demand for durable road surfaces, are fueling the widespread adoption of asphalt products in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.47 Million |

| Market Forecast in 2033 | USD 13.14 Million |

| Market Growth Rate 2025-2033 | 5.00% |

India Asphalt Market Trends:

Growing Demand Driven by Infrastructure Expansion

India’s asphalt market is experiencing steady growth due to large-scale infrastructure projects aimed at enhancing transportation networks. Government-led initiatives such as Smart Cities Mission are fueling the demand for high-quality asphalt in road construction, highways, and expressways. For instance, as of December 2024, India’s Smart Cities Mission (SCM) achieved 91% project completion, with a total investment of ₹1.47 lakh crore. The development of logistics corridors and upgrading of city roads are other critical drivers fueling market growth. With India planning to enhance city-rural connectivity, the demand for long-lasting road surfaces with greater load-carrying capacity is on the rise. Airports and seaports are also being significantly upgraded, demanding asphalt solutions that provide better performance under heavy traffic loads. Also, the growth in urbanization is creating demand for commercial and residential infrastructure, increasing demand for high-performance asphalt products. As more investments are being made in industrial corridors and metro rail networks, the market is witnessing increased use of modified asphalt for better durability and resistance to harsh weather conditions. With government accelerating infrastructural development, demand for quality asphalt products is likely to further increase, opening up prospects for producers to innovate and respond to changing construction needs.

To get more information on this market, Request Sample

Sustainability and Eco-Friendly Asphalt Solutions

Sustainability is becoming a major focus in the India asphalt market as regulatory policies and environmental concerns push for greener construction practices. The rising adoption of recycled asphalt pavement (RAP) is helping reduce reliance on virgin materials while cutting down waste and emissions. For instance, as per recent study, incorporating RAP can decrease asphalt production emissions by up to 20%. In line with this, RAP allows old asphalt to be reprocessed and reused in new pavement, making road construction more cost-effective and sustainable. Low-carbon bitumen technologies are also gaining attention, with manufacturers developing bio-based and sulfur-enhanced bitumen that offers improved durability while lowering environmental impact. For instance, according to industry reports, lignin-based bio-bitumen may cut greenhouse gas emissions by 70%. Additionally, warm mix asphalt (WMA) is being promoted as an eco-friendly alternative, reducing energy consumption during production and lowering greenhouse gas emissions. The push for green infrastructure development, particularly under initiatives like Smart Cities, is accelerating the adoption of sustainable asphalt solutions. Furthermore, as India continues its transition towards eco-conscious construction, demand for innovative, low-emission asphalt products is expected to rise, shaping the future of road infrastructure with environmentally responsible materials.

India Asphalt Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, asphalt type, application, and end-use sector.

Product Insights:

- Asphalt Paving Mixtures and Blocks

- Prepared Asphalt and Tar Roofing and Siding Products

- Roofing Asphalts and Pitches, Coatings and Cement

The report has provided a detailed breakup and analysis of the market based on the product. This includes asphalt paving mixtures and blocks, prepared asphalt and tar roofing and siding products, roofing asphalts and pitches, and coatings and cement.

Asphalt Type Insights:

- Hot Mix Asphalt

- Warm Mix Asphalt

- Cold Mix Asphalt

A detailed breakup and analysis of the market based on the asphalt type have also been provided in the report. This includes hot mix asphalt, warm mix asphalt, and cold mix asphalt.

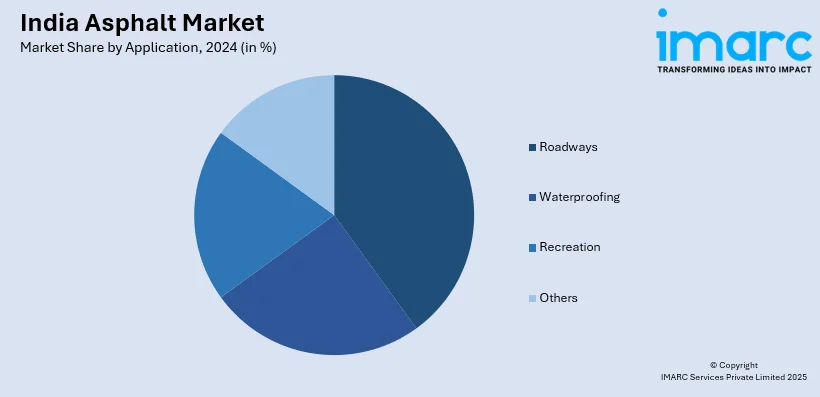

Application Insights:

- Roadways

- Waterproofing

- Recreation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes roadways, waterproofing, recreation, and others.

End-Use Sector Insights:

- Non-Residential

- Residential

- Others

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes non-residential, residential, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Asphalt Market News:

- In December 2023, Ammann Group announced an acquisition with Volvo CE’s global ABG asphalt paver business, including facilities in India. This acquisition strengthens Ammann’s product range, while Volvo CE focuses on sustainable solutions and future technologies.

India Asphalt Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Asphalt Paving Mixtures and Blocks, Prepared Asphalt and Tar Roofing and Siding Products, Roofing Asphalts and Pitches, Coatings and Cement |

| Asphalt Types Covered | Hot Mix Asphalt, Warm Mix Asphalt, Cold Mix Asphalt |

| Applications Covered | Roadways, Waterproofing, Recreation, Others |

| End-Use Sectors Covered | Non-Residential, Residential, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India asphalt market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India asphalt market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India asphalt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The asphalt market in India was valued at USD 8.47 Million in 2024.

The India asphalt market is projected to exhibit a CAGR of 5.00% during 2025-2033, reaching a value of USD 13.14 Million by 2033.

Urbanization, expanding road networks, and government focus on infrastructure projects is driving the asphalt market in India. Growing road construction, maintenance projects, and rural connectivity schemes add to demand. Government spending on industrial corridors, airports, and logistics hubs further increases asphalt usage, with rising awareness encouraging adoption of eco-friendly, high-performance asphalt mixes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)