India Auto Parts Aftermarket Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Auto Parts Aftermarket Overview:

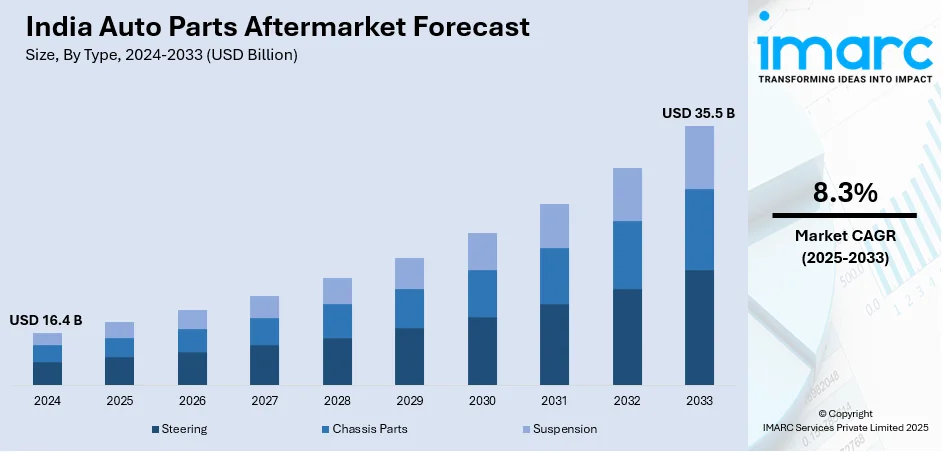

The India auto parts aftermarket size reached USD 16.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.5 Billion by 2033, exhibiting a growth rate (CAGR) of 8.3% during 2025-2033. The market is growing as a result of aging vehicles, increasing e-commerce adoption, and boosted demand for sustainable components. Consumers are keeping their vehicles for longer periods, driving replacement part sales, while online platforms make a broad array of products easily accessible. Environmental sustainability is also accelerating the demand for ecofriendly parts. These integrated trends are poised to have a strong impact on future demand and contribute positively to the India auto parts aftermarket share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.4 Billion |

| Market Forecast in 2033 | USD 35.5 Billion |

| Market Growth Rate 2025-2033 | 8.3% |

India Auto Parts Aftermarket Trends:

Increasing Demand for Replacement Parts

India's automotive aftermarket industry is seeing healthy growth driven mostly by the expanding average age of vehicles in service. The longer vehicles stay in service, the greater becomes the demand for replacement parts. The consumer keeps vehicles longer as a result of growing new-car costs, thereby boosting demand for repair and replacement parts. For instance, in June 2024, Assurance Intl has prolonged its licensing agreement with Goodyear to introduce wiper blades, spark plugs, additives, and accessories in India and Asia by October 2024 for strengthening market presence. Moreover, parts like brake pads, filters, and suspension items are in great demand, particularly for older vehicles that need to be serviced more often. This is likely to boost in the future, adding significantly to the India auto parts aftermarket growth. With a majority of the vehicle population getting older, demand for quality, inexpensive replacement parts are accelerating. This change is making the market more competitive, with suppliers concentrating on low-cost solutions that prolong the life of older vehicles. The accelerating demand for these components highlights a bright future for the sector.

To get more information on this market, Request Sample

E-Commerce Growth in Auto Parts

The expansion of e-commerce is redefining India's auto parts aftermarket. Increased internet penetration and smartphone adoption have led consumers to shift towards online channels to buy auto parts, lured by convenience and product variety. Online channels allow customers to compare prices, read product reviews, and access a comprehensive variety of aftermarket products, and the process thus becomes more convenient and transparent. The growth in e-commerce is redefining distribution channels, offering both small and big suppliers a chance to reach more consumers. This change is driving the India auto parts aftermarket share growth, as online sales are expected to represent a major part of the market in the future. The convenience of doorstep delivery and cost-effectiveness renders online shopping more attractive, particularly to price-conscious consumers. As digitalization prevails, e-commerce is likely to be the driving force in determining the future of India's auto parts industry.

Move Towards Sustainable Auto Parts

Sustainability is gradually emerging as an area of core importance within India's automobile aftermarket, supported both by governmental decrees and public demand for sustainable products. For example, in January 2025, ZF Aftermarket increased its TRW brake pad coverage to 90% of the vehicle market in India by introducing 50 new part numbers, enhancing availability of parts throughout the country in 2024. Furthermore, while the focus on environmental conservation strengthens, efforts for energy-conserving and recoverable automobile parts intensify. Evidence of the amplifying trend appears through the widespread appeal for low-emission exhaust pipes, recovered body parts, and energy-efficient illuminating technologies. The pressure for more environmentally friendly alternatives is also a reaction to tighter emissions controls and growing consumer awareness of the environment. This is likely to shape the India auto parts aftermarket expansion highly as more companies bring on board sustainable products to cater to this need. The government's emphasis on lowering carbon emissions also pushes the use of environmentally friendly components. Since both consumers and enterprises are giving higher importance to sustainability, the call for eco-friendly parts will only grow, which will provide additional scope for innovation in the Indian automotive aftermarket market.

India Auto Parts Aftermarket Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Steering

- Chassis Parts

- Suspension

The report has provided a detailed breakup and analysis of the market based on the type. This includes steering, chassis parts, and suspension.

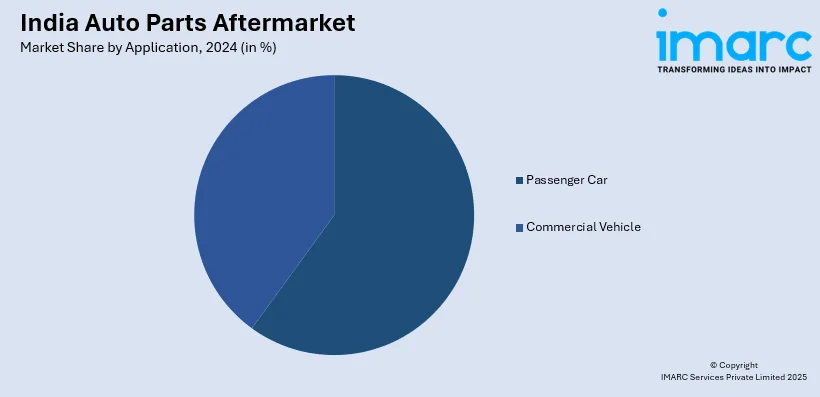

Application Insights:

- Passenger Car

- Commercial Vehicle

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes passenger car and commercial vehicle.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Auto Parts Aftermarket News:

- In February 2025, Carlyle Group made a significant foray into India's auto parts aftermarket by investing $400 million to buy a controlling interest in a platform created by consolidating Highway Industries and Roop Automotives, with the aim of consolidating operations and enhancing capabilities in powertrain and steering components manufacturing.

- In February 2024, South Korea's Daewoo re-entered the Indian market, courtesy of a strategic alliance with Gurugram-based Kelwon Electronics. The company will deal in aftermarket products such as batteries, lubricants, and e-bikes, with the aim of having a network of 150 distributors and reaching 4,000-5,000 retail outlets by mid-2024.

India Auto Parts Aftermarket Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steering, Chassis Parts, Suspension |

| Applications Covered | Passenger Car, Commercial Vehicle |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India auto parts aftermarket from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India auto parts aftermarket.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India auto parts aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The auto parts aftermarket market in India was valued at USD 16.4 Billion in 2024.

The India auto parts aftermarket market is projected to exhibit a CAGR of 8.3% during 2025-2033, reaching a value of USD 35.5 Billion by 2033.

The major drivers for the India auto parts aftermarket are the increasing average vehicle age, growing vehicle parc, and elevated demand for low-cost repair alternatives. Organized retail growth, digital platforms, and e-commerce channels also fuel increased access. Increasing consumer inclination towards preventive maintenance and access to low-cost aftermarket components further fuel steady market growth in urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)