India Autocatalyst Market Size, Share, Trends and Forecast by Material, Catalyst Type, Distribution Channel, Vehicle Type, Fuel Type, and Region, 2025-2033

Market Overview:

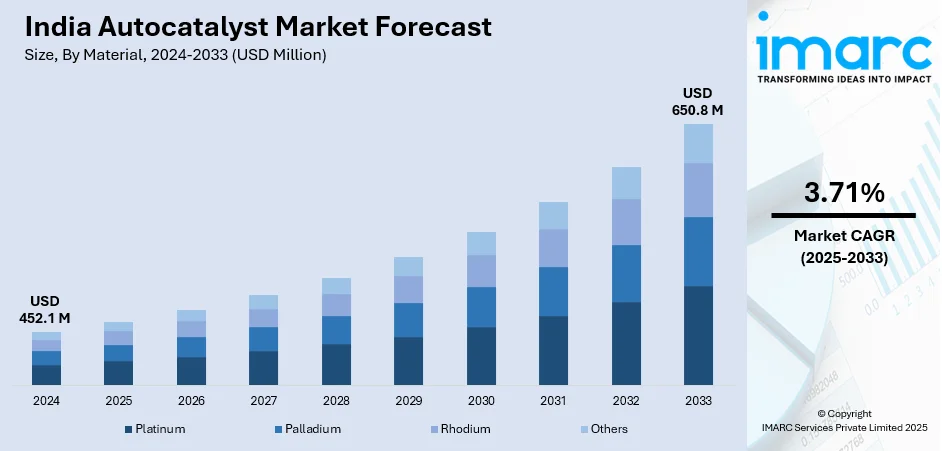

India autocatalyst market size reached USD 452.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 650.8 Million by 2033, exhibiting a growth rate (CAGR) of 3.71% during 2025-2033. The widespread adoption of recycling methods and sustainable manufacturing processes is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 452.1 Million |

| Market Forecast in 2033 | USD 650.8 Million |

| Market Growth Rate (2025-2033) | 3.71% |

An autocatalyst is created through the transformation of ceramics or metals into a finely structured honeycomb, which is then coated with a solution containing platinum, rhodium, and palladium. Typically integrated into the exhaust system of vehicles, its primary function is to facilitate the conversion of harmful substances such as hydrocarbons, nitrogen oxide, and carbon monoxide into benign elements like nitrogen, water, and carbon dioxide. In contemporary applications, three-way catalysts are gaining prominence as advanced emission treatment systems for gasoline vehicles. These catalysts feature ultra-thin and high-cell substrates designed to operate at lower temperatures, ensuring efficient removal of toxic substances during the vehicle's ignition process.

To get more information on this market, Request Sample

India Autocatalyst Market Trends:

The India autocatalyst market has witnessed significant growth in response to the increasing focus on environmental sustainability and stringent emission norms for vehicles in the country. These devices are typically crafted by transforming ceramics or metals into a finely structured honeycomb, coated with a solution containing platinum, rhodium, and palladium. Moreover, as India intensifies its efforts to combat air pollution and promote cleaner technologies, autocatalyst have become integral components in the automotive sector. Besides this, the market is witnessing a shift towards advanced autocatalyst systems, with three-way catalysts gaining traction. Additionally, these catalysts feature ultra-thin and high-cell substrates designed to operate efficiently at lower temperatures, ensuring optimal emission treatment for gasoline vehicles. The adoption of three-way catalysts aligns with the evolving regulatory landscape and the need for more sophisticated emission control technologies. Furthermore, as India continues to advance its automotive industry and address environmental concerns, the autocatalyst market is expected to play a crucial role. Manufacturers are likely to focus on innovative solutions that not only comply with regulatory standards but also contribute to sustainable and eco-friendly transportation. Apart from this, technological innovations, regulatory compliance, and environmental stewardship, reflecting the industry's commitment to cleaner and greener mobility solutions, are expected to fuel the market growth over the forecasted period.

India Autocatalyst Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on material, catalyst type, distribution channel, vehicle type, and fuel type.

Material Insights:

- Platinum

- Palladium

- Rhodium

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes platinum, palladium, rhodium, and others.

Catalyst Type Insights:

- Two-way

- Three-way

- Four-way

A detailed breakup and analysis of the market based on the catalyst type have also been provided in the report. This includes two-way, three way, and four-way.

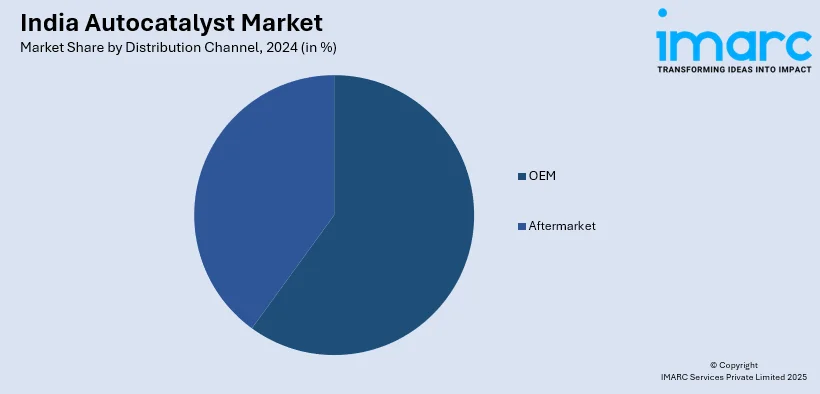

Distribution Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEM and aftermarket.

Vehicle Type Insights:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger car, light commercial vehicle, heavy commercial vehicle, and others.

Fuel Type Insights:

- Gasoline

- Diesel

- Hybrid Fuels

- Hydrogen Fuel Cell

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, diesel, hybrid fuels, and hydrogen fuel cell.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Autocatalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Platinum, Palladium, Rhodium, Others |

| Catalyst Types Covered | Two-way, Three-way, Four-way |

| Distribution Channels Covered | OEM, Aftermarket |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle, Others |

| Fuel Types Covered | Gasoline, Diesel, Hybrid Fuels, Hydrogen Fuel Cell |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India autocatalyst market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India autocatalyst market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India autocatalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The autocatalyst market in India was valued at USD 452.1 Million in 2024.

The India autocatalyst market is projected to exhibit a CAGR of 3.71% during 2025-2033, reaching a value of USD 650.8 Million by 2033.

The India autocatalyst market is driven by stringent emission regulations, growing vehicle production, and rising demand for fuel-efficient and eco-friendly vehicles. Additionally, increasing adoption of advanced catalytic technologies, government incentives for cleaner transportation, and awareness of environmental sustainability are boosting market growth across passenger and commercial vehicle segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)