India Automated Assembly Line Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Automated Assembly Line Market Overview:

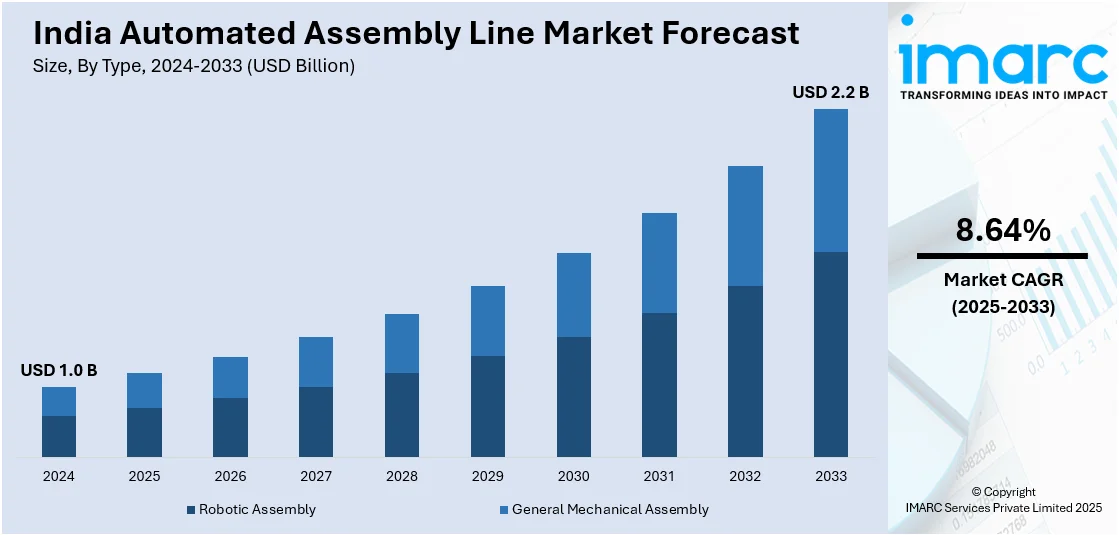

The India automated assembly line market size reached USD 1.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 8.64% during 2025-2033. The market is driven by rising labor costs, demand for precision manufacturing, and government initiatives including "Make in India." Industry 4.0 adoption, increasing FDI in manufacturing, and the need for flexible, scalable automation solutions further propel growth. Sectors such as automotive, electronics, and pharmaceuticals are further expanding the India automated assembly line market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.0 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Market Growth Rate 2025-2033 | 8.64% |

India Automated Assembly Line Market Trends:

Increasing Adoption of Industry 4.0 Technologies

The adoption of Industry 4.0 technologies like internet of things (IoT), artificial intelligence (AI), and robotics is significantly contributing to the India automated assembly line market growth. As per a report from the industry, India's manufacturing industry is rapidly adopting Industry 4.0 technologies, with AI and ML likely to account for 40% of overall manufacturing expenditure by 2025 compared to 20% in 2021. Hence, the need for automated assembly lines will increase in proportion to the dominance of smart factories since they enable automated machinery to achieve efficiency as much as accuracy. Companies are implementing smart automation technologies to improve efficiency, reduce downtime, and enhance the quality of products. The automotive, electronics, and pharma sectors are investing in advanced manufacturing technologies, such as automated assembly lines featuring real-time monitoring and predictive maintenance capabilities under the Government of India program 'Make in India.' These technologies enable data communication flexibility between machines, which essentially automates and simplifies your production streams. The advent of smart factories is also enabling companies to incorporate collaborative robots (cobots) and automated guided vehicles (AGVs) into their operations to enhance flexibility and scalability. With increasing labor costs and demands for precision, automation has become essential, making India an emerging hotspot for smart manufacturing in the Asia-Pacific region.

To get more information on this market, Request Sample

Growing Demand for Customized and Flexible Automation Solutions

The rising demand for customized and flexible automation solutions is creating a positive India automated assembly line market outlook. Manufacturers are moving away from traditional, rigid assembly lines and toward modular systems that can quickly be reconfigured to produce different product versions. Small production cycles and continuous design shifts demand flexible automation of consumer electronics, automotive components, FMCG, etc. This is driven by innovations in programmable logic controllers (PLCs) and human-machine interface (HMI) technologies that make assembly line reprogramming easier. Furthermore, seeking energy-efficient and low-cost automation also fuels the interplay between robots and human interventions in a hybrid system. With small and medium enterprises (SMEs) moving towards more automation, vendors are providing scalable solutions within budgetary limits, further fueling market growth. According to an industry report, the micro, small, and medium enterprises (MSME) sector in India, comprising over 63 Million firms, will witness a compound annual growth rate (CAGR) of 2.5%. This includes automated assembly lines, where small and medium enterprises (SMEs) are leading the way in innovation and growth. Under the MSME umbrella, the government has budgeted INR. 22,138 Crore (about USD 2.65 Billion) in the 2024 budget to help MSMEs with digital transformation and access to funds. Moreover, the increase in digital payments, which now account for 72% of all payments, is benefitting MSMEs engaged in automation and manufacturing as well. Moreover, the focus on agility and customization ensures that India's automated assembly line market remains dynamic and competitive.

India Automated Assembly Line Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Robotic Assembly

- General Mechanical Assembly

The report has provided a detailed breakup and analysis of the market based on the type. This includes robotic assembly and general mechanical assembly.

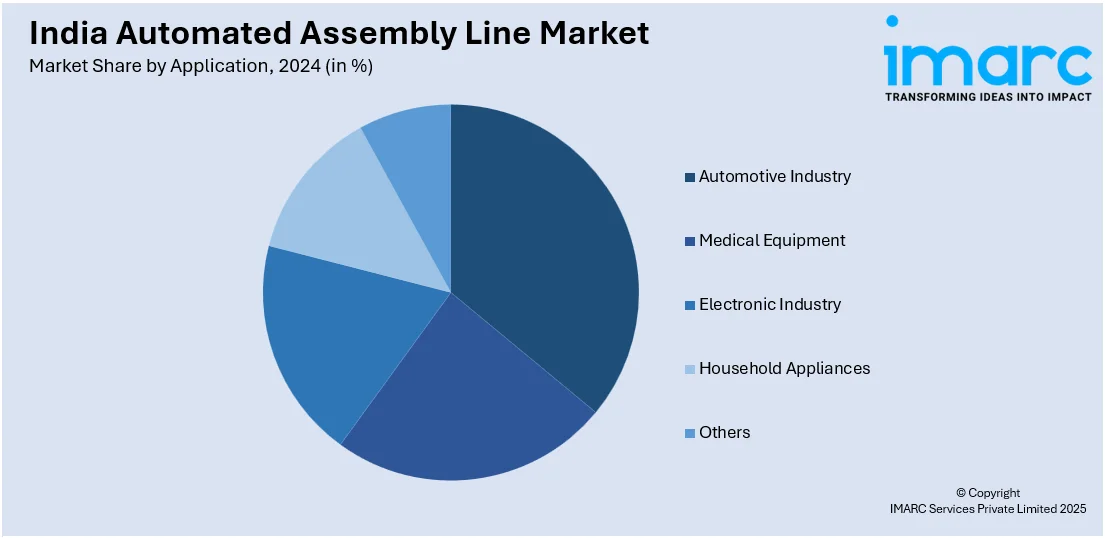

Application Insights:

- Automotive Industry

- Medical Equipment

- Electronic Industry

- Household Appliances

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive industry, medical equipment, electronic industry, household appliances, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automated Assembly Line Market News:

- February 3, 2025: Solex Energy inaugurated India's fastest 800 MW solar manufacturing line with AI and N-Type TOPCon technology. The facility runs at an overall line speed up to 30 percent higher than the existing production lines, thereby greatly improving efficiency and throughput, with the Tapi-R series modules achieving record peak efficiencies of up to 625-watt peak (wp). In line with this, the new project falls under Solex's Vision 2030 to grow by 5 GW in solar cell capacity and 15 GW in module capacity and to fortify its leadership position in automated manufacturing in India as well as clean energy.

- June 26, 2024: Euronics launched India’s biggest manufacturing facility of washroom automation accessories in Gurugram. The plant has an annual production capacity of 200,000 units and an investment of INR100 crore (approximately USD 12 Million). With the world's most advanced Japanese bending and laser cutting equipment, the factory aims to deliver 80% of global needs locally. Euronics, which accounts for 60% of India's washroom industry market share, aims to manufacture all its products in India over the next three years, thus significantly contributing to India with its automated assembly line market.

India Automated Assembly Line Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Robotic Assembly, General Mechanical Assembly |

| Applications Covered | Automotive Industry, Medical Equipment, Electronic Industry, Household Appliances, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automated assembly line market performed so far and how will it perform in the coming years?

- What is the breakup of the India automated assembly line market on the basis of type?

- What is the breakup of the India automated assembly line market on the basis of application?

- What is the breakup of the India automated assembly line market on the basis of region?

- What are the various stages in the value chain of the India automated assembly line market?

- What are the key driving factors and challenges in the India automated assembly line market?

- What is the structure of the India automated assembly line market and who are the key players?

- What is the degree of competition in the India automated assembly line market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automated assembly line market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automated assembly line market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automated assembly line industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)